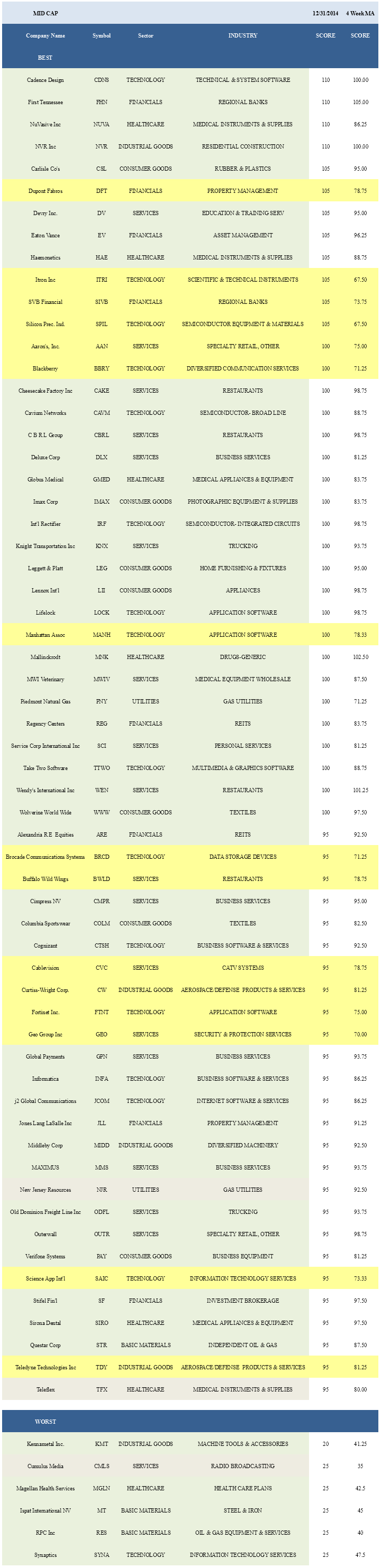

Mid Cap Best & Worst Report - December 31, 2014

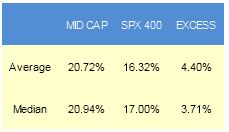

Since 2010, the best scoring names in our weekly mid cap report have outpaced the S&P 400 by a median 371 bps in the following year. The best performers from our list from 1 year ago are TQNT up 236%, SWKS up 174%, and ILMN up 71%.

- The top mid cap sector is utilities.

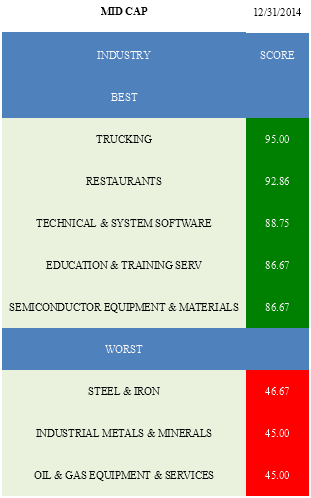

- The best mid cap industry is trucking.

Important: scores have shifted to reflect Q1 seasonality.

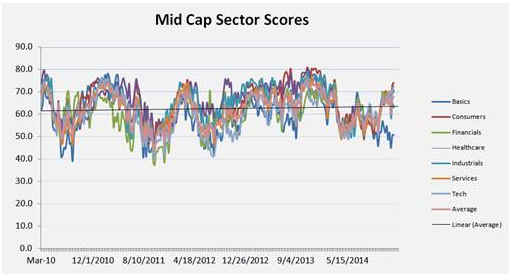

The average mid cap score is 68.96, which is above the four week moving average score of 66.27. The average mid cap stock is trading -13.33% below its 52 week high, 4.23% above its 200 dma, has 7.47 days to cover held short, and is expected to grow EPS by 15.95% next year.

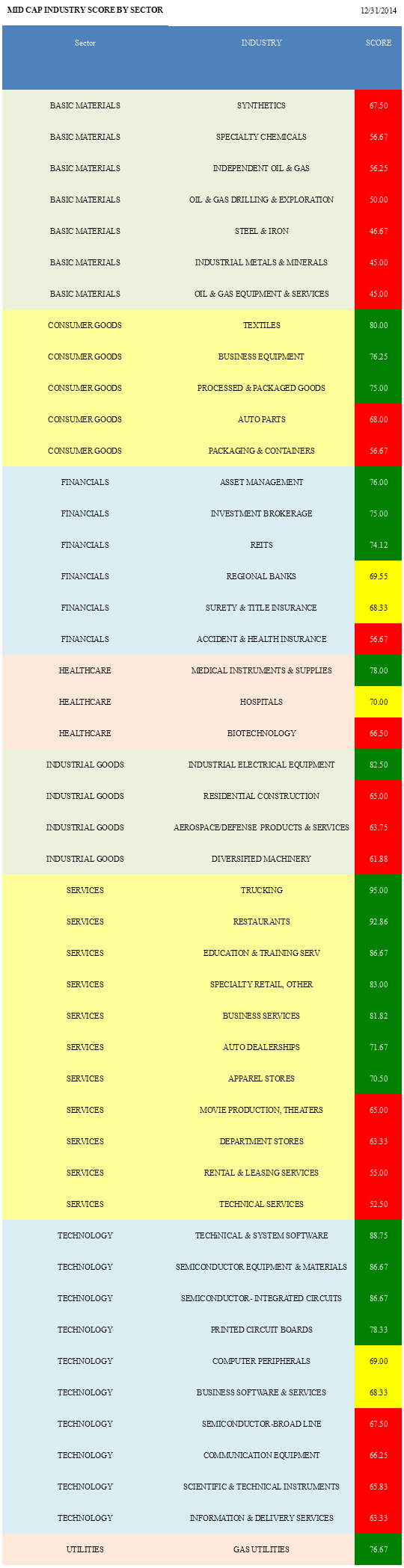

Utilities are the top scoring mid cap sector. Consumer goods, services, technology, and healthcare also score above average. Financials score in line. Industrial goods and basics score below average.

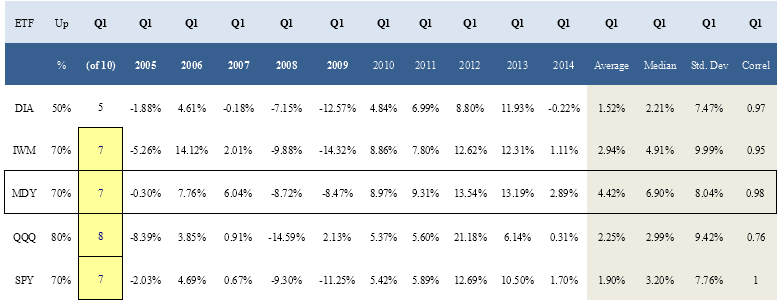

According to the Seasonal Investor database, the SP400 midcap index ETF has climbed in 7 of the past 10 Q1s, returning a median 6.9% in the period.

Source: Seasonal Investor

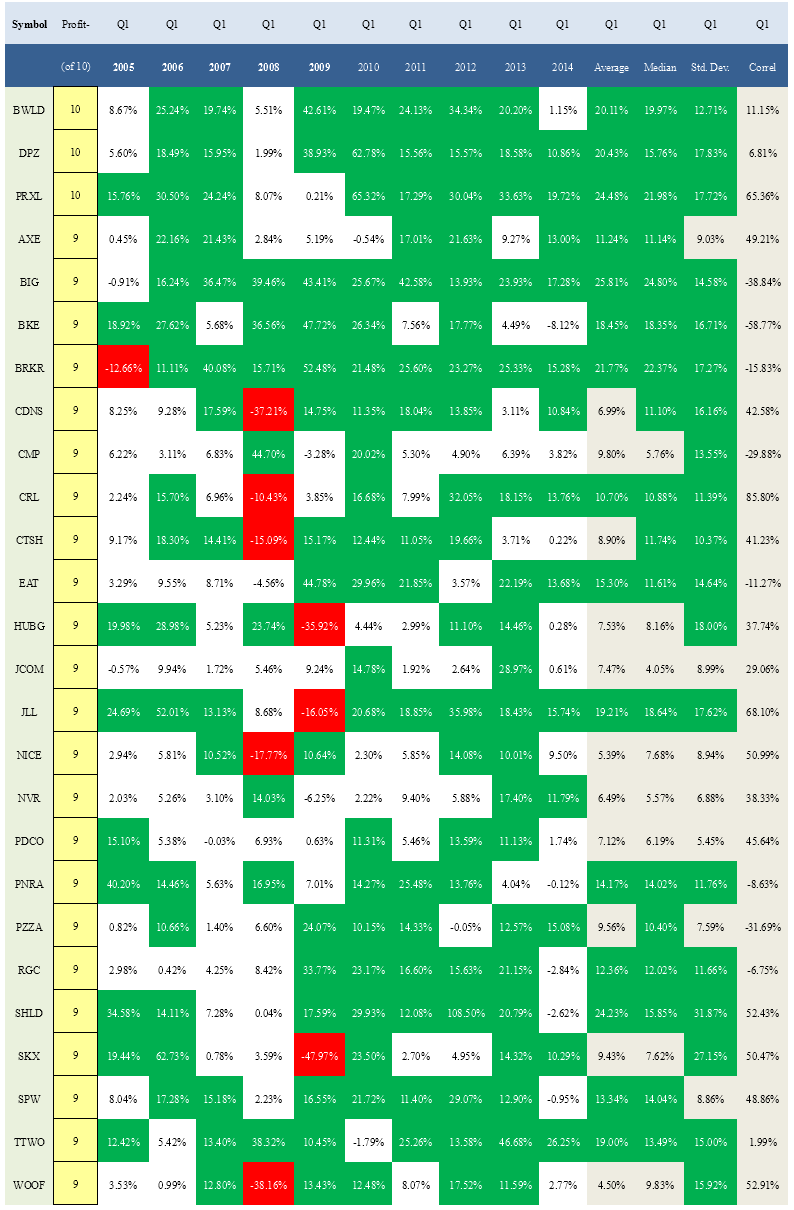

The following mid cap stocks have the best track record of posting gains in the first quarter. Each has gained in at least nine of the past 10 Q1s. Buffalo Wild Wings, Dominos, and Parexel have all gained ground in all 10 of the past 10 years.

Source: Seasonal Investor

The best mid cap industry is trucking (KNX, ODFL, HTLD). NAFTA and port trade traffic continues to support spot rates heading into 2015. Restaurant (WEN, CBRL, CAKE, BWLD, PZZA, EAT) foot traffic and same store sales optimism reflects seasonal strength and offers support through EPS reporting season. IT budget optimism offers upside for technical & system software (CDNS, ACIW, TYL) demand, particularly for process and practice software. Education companies (DV, APOL) benefit from military downsizing and an improving economy, which supports credit availability and reduces default risk. Semi equipment (SPIL, ENTG) demand historically bottoms in fall and picks up through the first half of the following year.

No mid cap basics baskets score above average. In consumer goods, focus on textiles (WWW, COLM, CRI, SKX), business equipment (PAY, HNI), and processed & packaged goods (HAIN, FLO). The best scoring financials groups are asset managers (EV, OZM), investment brokers (SF, MKTX), and REITs (REG, ARE, NNN, DDR). In healthcare, buy medical instruments (NUVA, HAE, TFX, PODD, DXCM, HRC). Industrial electrical equipment (LFUS, BDC) is best in industrial goods. In services, concentrate on trucking, restaurants, and education. Technical & system software, semi equipment, and semi ICs (IRF, MSCC, FCS) score highest across technology.

Disclosure: None.