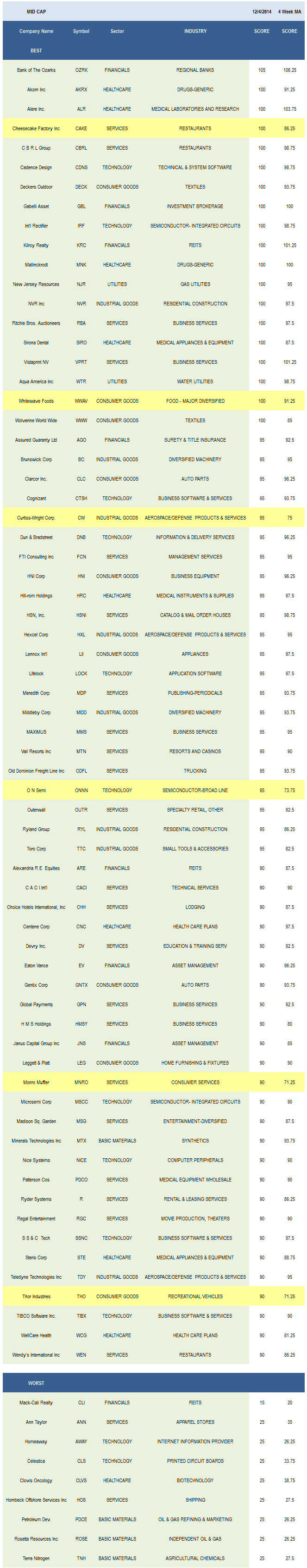

Mid Cap Best & Worst Report - December 3, 2014

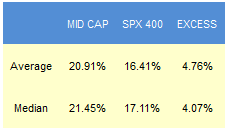

Since 2010, the best scoring names in our weekly mid cap reports have outpaced the S&P 400 by a median 4.07% in the following year. The best performers from our list from 1 year ago are ILMN up 95%, KNX up 88%, LVLT up 65%, AMED up 61%, and ALXN up 59%.

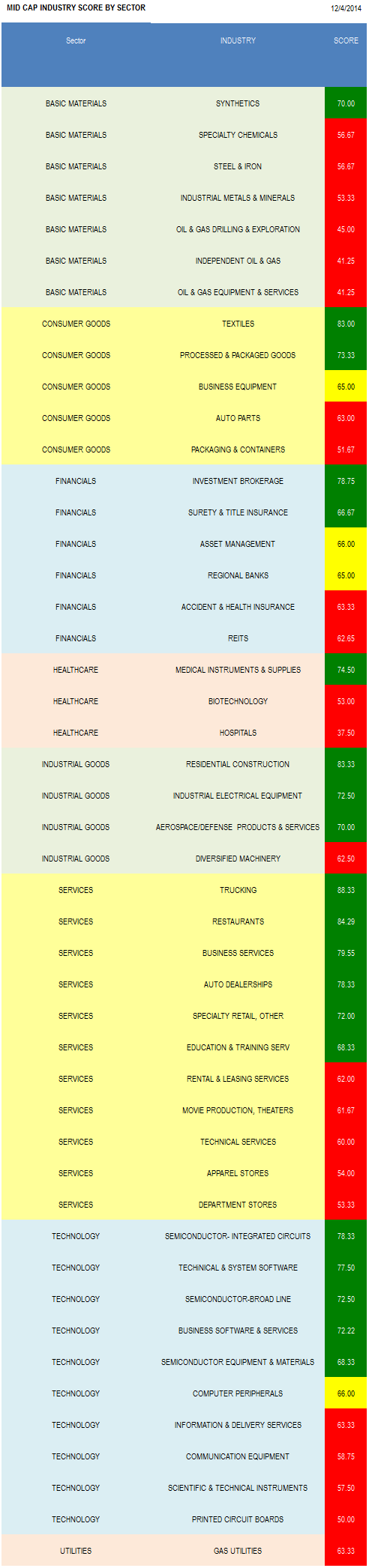

- The best mid cap sector is utilities.

- The top mid cap industry is trucking.

The average mid cap score is 65.15, below the four week moving average score of 65.88. The average mid cap is trading -15.07% below its 52 week high, 1.77% above its 200 dma, has 6.69 days to cover held short, and is expected to grow EPS by 16.69% next year.

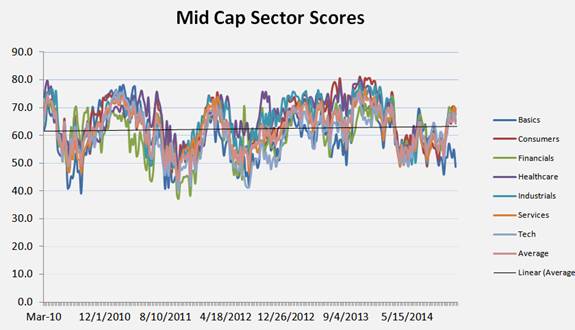

The top scoring mid cap sector is utilities. Consumer goods, services, and healthcare score above the mid cap universe average score. Technology, industrial goods, and financials score in line. Basic materials score below average.

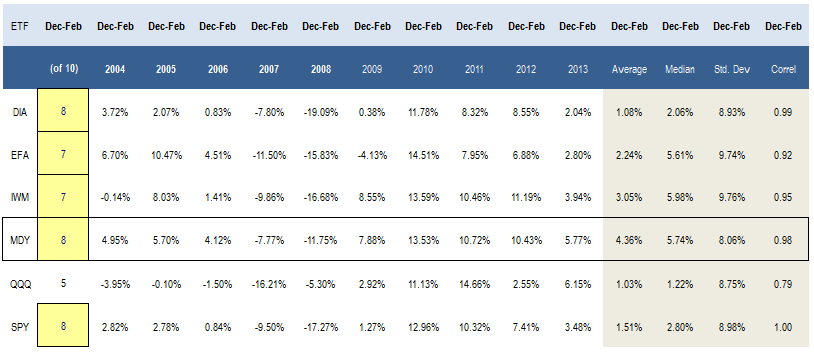

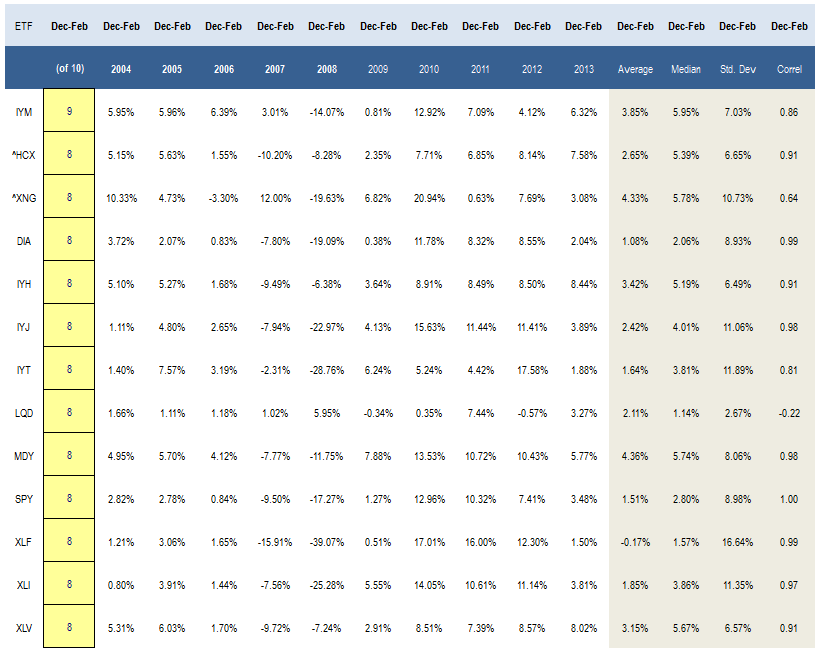

The following table shows major market seasonality for the three month period ending February 28th. The MDY has gained in eight of the past 10 years, producing a median return of 5.74% in the period.

Trucking (ODFL, KNX, HTLD) volume remains bullish for truckload rates. In the most recently reported month of September, the amount of freight moved between the U.S., Canada, and Mexico grew 8.2% year-over-year. Year-to-date, the amount of freight handled between NAFTA countries are up 4.9% from 2013. Foot traffic and average ticket optimism supports restaurants (CBRL, CAKE, WEN, EAT). According to the Nat'l Restaurant Association, 71% of restaurant operators reported a same-store sales gain between October 2013 and October 2014, up from 63% who reported higher sales in August. Residential construction (NVR, RYL) offers opportunity on unit sales growth and pricing. Median home prices reached a record high of $305k in October. Holiday shopping inventory turn supports textiles (WWW, DECK, COLM). Business services (VPRT, RBA, MMS, HMSY, GPN, HPY) also score highly.

In basic materials, only synthetics (MTX, POL) score above average. Textiles and processed & packaged goods (HAIN, FLO) offer upside in consumer goods. Investment brokers (GBL, MKTX) and surety & title (AGO, RDN) are best in financials. Focus on medical instruments (HRC, TFX, PODD, PKI, DXCM) in the healthcare sector. In industrial goods, concentrate on residential construction and industrial electrical equipment (RBC, AOS). The best services groups are trucking, restaurants, and business services. Semi ICs (IRF, MSCC), technical & system software (CDNS, TYL, MENT), and semiconductor-broad line (CAVM) are top scoring in technology.

The following chart breaks out the strongest seasonal baskets for the three months ending February 28th. Over the past 10 years, healthcare, industrials, and financials have been top performers. Basics have also been strong performers, so it will be interesting to see how the group trades from here.

Disclosure: None.