Mid Cap Best & Worst Report - August 27, 2014

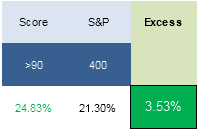

The highest scoring names in mid cap from 1 year ago returned 353 bps more than the S&P 500. The best performers have been TRN up 131%, UA up 96%, ACT up 72%, CW up 72%, OTEX up 65%, and ALXN up 60%.

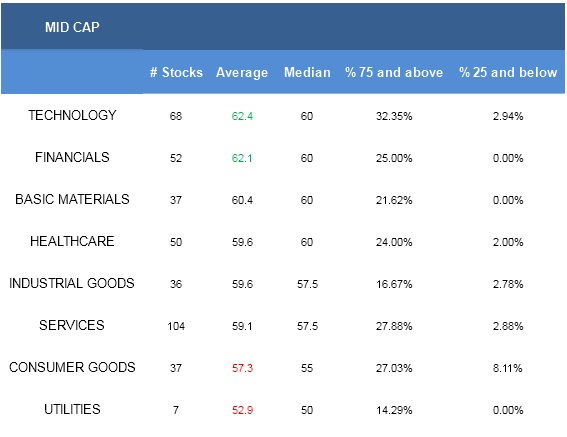

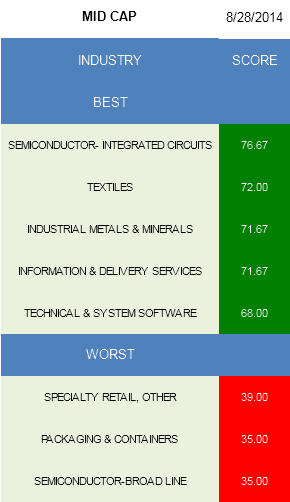

- Technology is the best scoring mid cap sector.

- The top scoring mid cap industry is semi-ICs.

The average mid cap score is 60.02 this week, above the four week moving average score of 56.38. The average mid cap stock is trading -13.19% below its 52 week high, 2.91% above its 200 dma, has 7.79 days to cover held short, and is expected to post EPS growth of 19.11% next year.

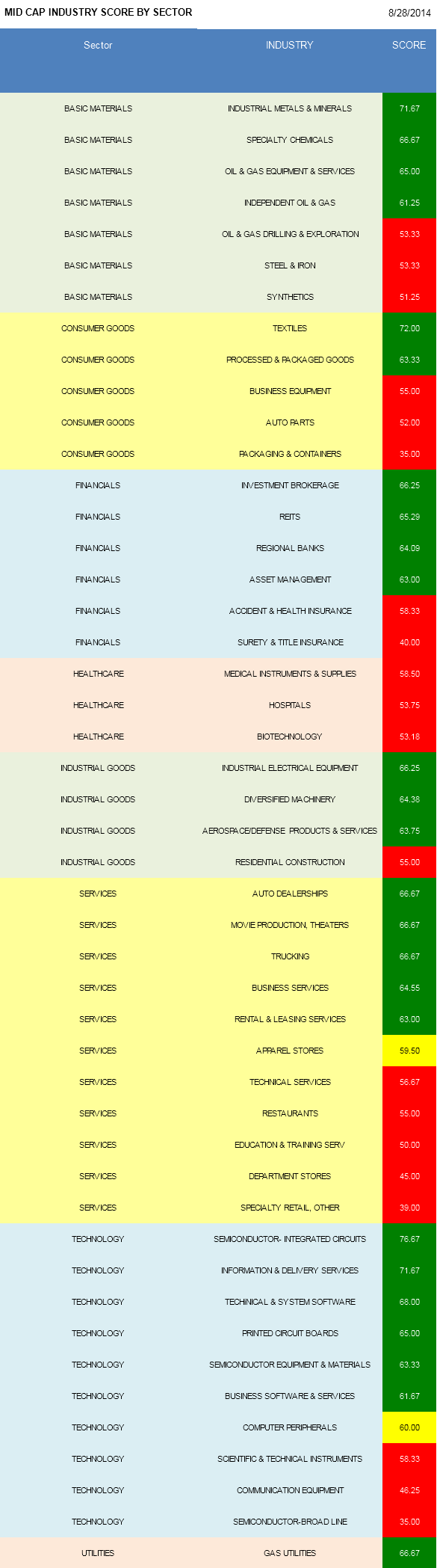

The top scoring mid cap sector is technology. Financials also score above the universe average score. Basics, healthcare, industrial goods, and services score in line with the universe average. Consumer goods and utilities score below average.

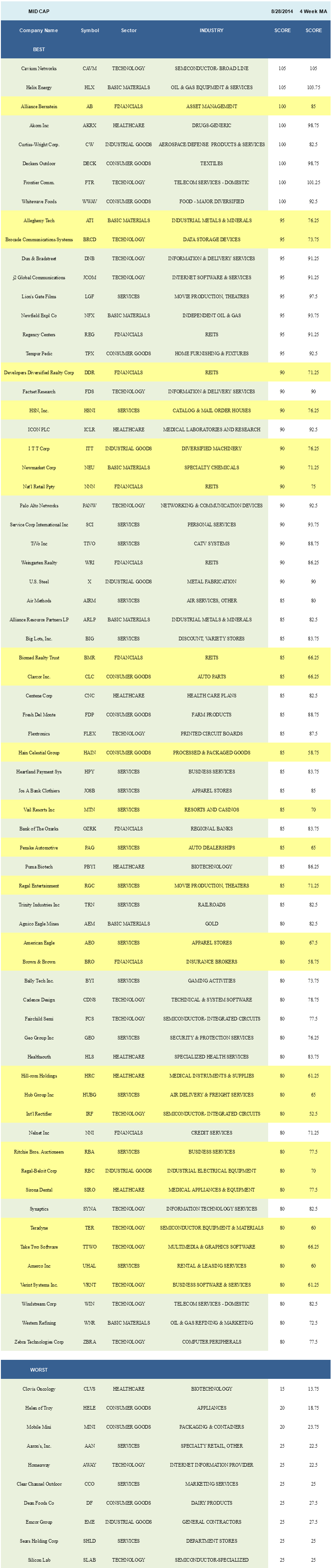

Semi ICs (IRF, FCS) score highest across mid cap industries. Textiles (DECK, SKX, CRI) benefit from back-to-school clothing purchases and improving seasonal tailwinds tied to fourth quarter holiday shopping. Clothing industrial production grew 5% YoY in July (August data to be released on September 15th). Coal miners (ARLP) could see pricing improve given that utility stockpiles have fallen and electricity demand forecasts call for electricity production growth. Information & delivery services (DNB, FDS) and technical & system software (CDNS, MCRS) also score highly.

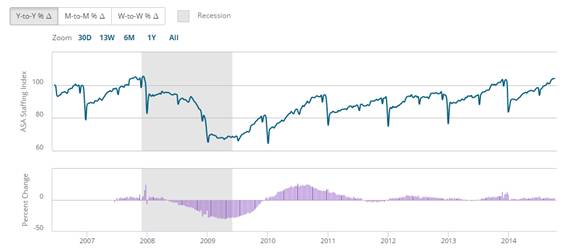

In mid cap basics, buy industrial metals & minerals (ATI), specialty chemicals (NEU), and oil & gas equipment & services (HLX). In consumer goods, focus on textiles and processed & packaged goods (HAIN). The top scoring financials industries include investment brokers (GBL, GHL), REITs (REG, WRI, NNN, DDR, BMR), and regional banks (OZRK, NPBC, CATY, ASBC). No mid cap healthcare industries score above average this week -- trade up in market cap where possible. In industrial goods, the top scoring baskets are industrial electrical equipment (RBC, AOS), diversified machinery (ITT, NDSN, DRC), and aerospace/defense (CW, ESL, TDY, HXL). Auto dealers (PAG, GPI), movies (LGF, RGC), and trucking (HTLD) score highest in services. The DoE expects diesel fuel prices, which averaged $3.92 per gallon in 2013, to fall to $3.89 this year (4 cents below last month's forecast) and drop to $3.87 in 2015. Semi ICs, information & delivery services, and technical & system software score best in technology.

Disclosure: None.