Mid Cap Best & Worst Report - August 13, 2014

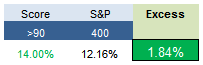

The highest scoring names in mid cap from 1 year ago returned 184 bps more than the S&P 500. The best performers have been UA up 85%, OTEX up 60%, CW up 57%, and STZ up 53%.

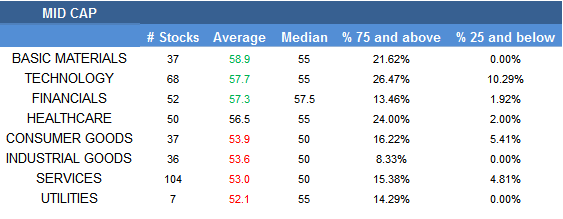

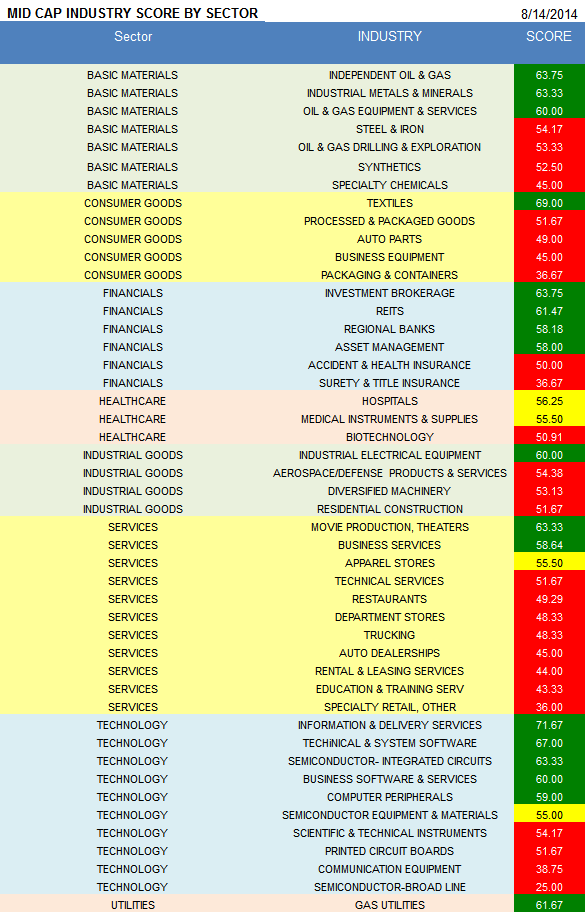

- The top scoring mid cap sector is basic materials.

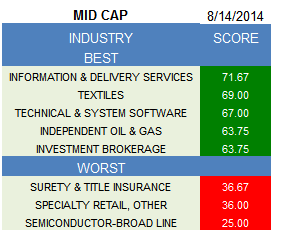

- The best scoring mid cap industry is information & delivery services.

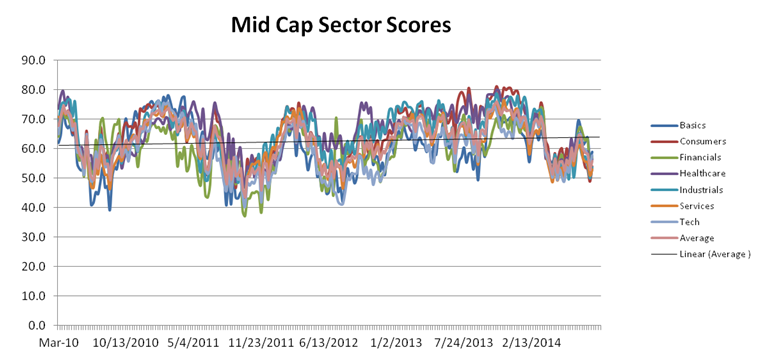

The average mid cap stock score is 55.55 this week, below the four week moving average stock score of 56.11. The average mid cap stock in our universe is trading -16.02% below its 52 week high, -0.61% below its 200 dma, has 7.83 days to cover held short, and is expected to grow its EPS by 19.03% next year.

The top scoring mid cap sector is basic materials. Technology and financials also score above average across our mid cap universe. Healthcare scores in line. Consumer goods, industrial goods, services, and utilities score below average.

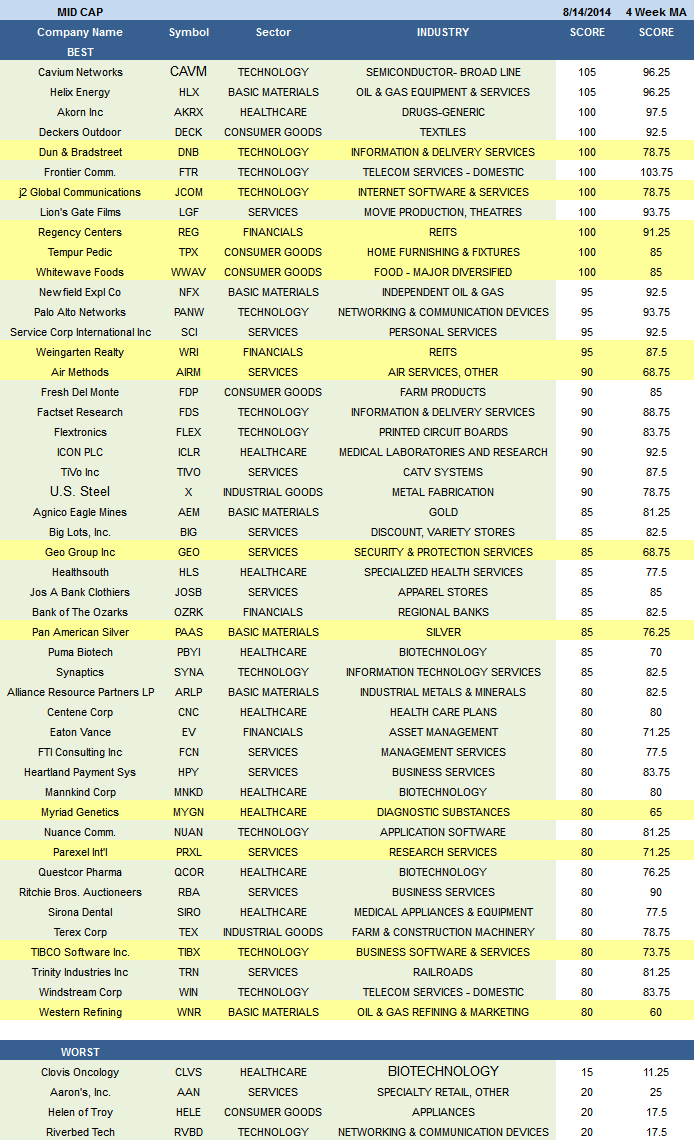

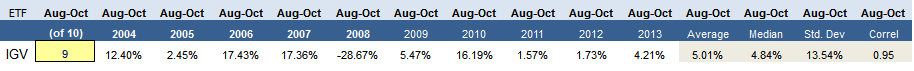

The top scoring mid cap industry is information & delivery services (DNB, FDS). Textiles (DECK, SKX, CRI) score strongly ahead of back-to-school season. Technical & system software (MCRS, CDNS) offer upside opportunity. Seasonal strength supports software stocks heading into fall. The software ETF (IGV) has posted gains in 9 of the past 10 years for the three month period starting August and ending October 31st, returning a median 4.84%. Independent oil & gas (NFX) production growth continues to offer revenue opportunity. Rig activity reached its highest level in two years last week. Investment brokers (GBL) round out this week's best scoring mid cap industry ranking.

The best scoring mid cap basic materials industries include independent oil & gas, industrial metals & minerals (ARLP, ATI), and oil & gas equipment & services (HLX). In mid cap consumer goods, only textiles score above average. In financials, buy investment brokers, REITs (REG, WRI), and regional banks (OZRK, NPBC). None of the mid cap healthcare sectors score above average -- trade up in market cap where possible. In industrial goods, focus on industrial electrical equipment (AOS). In services, buy movies (LGF) and business services (RBA, HPY). Retail faces seasonal headwinds this quarter; however, upward momentum will likely return in the fourth quarter. Information & delivery services, technical & system software, and semi ICs (FCS, MSCC) score best across technology. Gas utilities (PNY) are also high scoring.

Disclosure: None.