Measuring The Mania

It seems everyone is talking about Bitcoin these days. On ZeroHedge, I’d say easily half the articles are crypto-related. And why not? The equity market has become a bore. How much can you say about a market which basically goes up about half a percent day after day until the end of time? I’ve anchored my life to discussing equity markets, God help me, so having something that actually moves up AND down is exciting and novel after the past eight years.

Of course, daring to predict ANYTHING about cryptos is a fool’s errand. Just a few months ago, a Bitcoin trader and “expert” offered up this prediction for the second half of the year:

So – – basically down to “S3” at about $1200 and then a tremendous rally to $3,000 by about now. Of course, nothing like that took place. As I’m typing this, we’re around $17,000 or so (click here to see the latest chart) and there was never any big dip – – except maybe for the chap who created the aforementioned chart in the first place.

Some predictions – – maybe even wild guesses – – have been closer to the mark. Way back in December 2013, the Winklevoss twins (of Social Network fame) made the lunatic prediction that Bitcoin would rise to $40,000 (it was $1,000 at the time). Surely that seemed to be stark raving mad, and also quite self-serving, since they had bought $11 million of Bitcoin.

And how foolish they must have looked (and felt) when just weeks after their ridiculous prediction, Bitcoin fell 90% – – NINETY PERCENT!! – – which made it look like it was a ruinous choice. I confess, I’d have been the first one laughing. But he who laughs last laughs loudest, and the Winklevii are laughing their assess off now, since their stake is approaching $2 billion. Their $40,000 prediction is, to some, looking conservative.

The now-super-rich WInklevoss twins have updated their crazy prediction with, of course, something even crazier, stating that even with the incredible rise we’ve seen so far, it’s going to go up another twenty-fold. In other words, about $300,000 per Bitcoin (let’s all remember this launched at a value of 1 penny in 2009, so that’s a rise of 30-million-fold in value).

The ascent of cryptos is, of course, unprecedented. People keep talking about tulips. Look, I wrote a book about financial manias, and tulips went up about ten-fold during its mania. Bitcoin has already gone up hundreds-of-thousands-of-fold, so it’s not even close. Instead, let’s compare it to the one mania we experienced in our lifetimes, which was the hottest stocks of the Internet bubble.

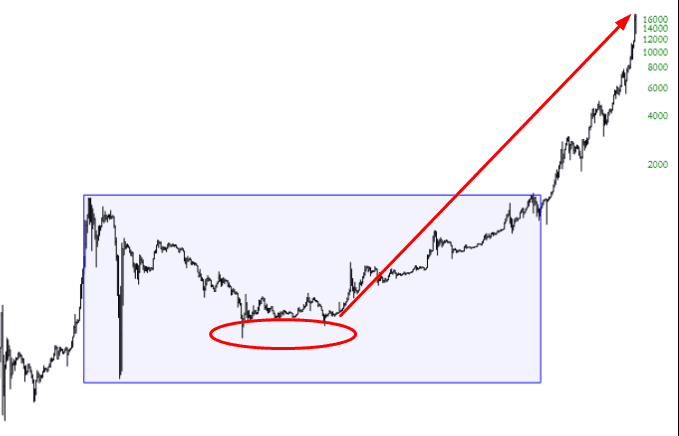

To give us a baseline, let’s try to think of a “base” for Bitcoin. It isn’t a penny. Instead, I like to think of the price where Bitcoin stabilized after its first big crash (see chart above), which is around $160 to $200 (see two arrows pointing out the double bottom). Let’s split the difference and call it $180. So that’ll be our starting point.

There were hundreds of new stocks during the initial Internet era, but the two I want to use for this little thought experiment are Amazon and Yahoo, both of which had breathtaking ascents in price. When people remember the Internet bubble, they might think stocks had insane P/E ratios of 100, 200, or 300. Not so. Yahoo, for instance, had a P/E of nearly 2,200 before the bubble burst. (Of course, Bitcoin has a P/E of infinity, but let’s not get distracted with the fact it actually isn’t a business that could ever produce a profit someday).

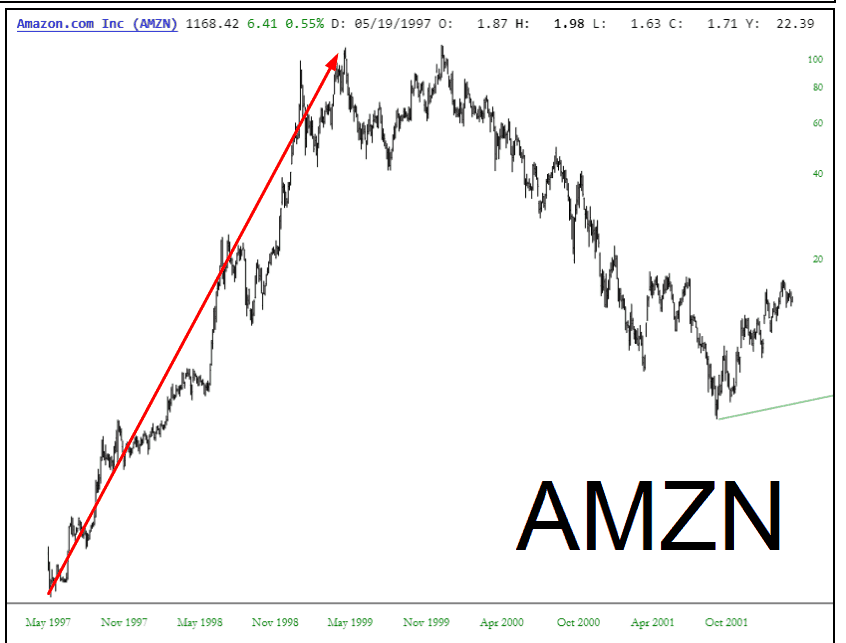

So, starting off with Amazon………….

The red arrow from the late 1990s show its incredible explosion from about $1.31 to $113, a rise of about 90-fold. Using our base of $180, that gives us a target “bubble peak” of $16,200. Well, although Bitcoin does seem to be stalling and struggling at around the $17,000 level, it seems to me we’ve already smashed by this lofty target. In other words, Bitcoin has outperformed Amazon’s 1990s bubble phase.

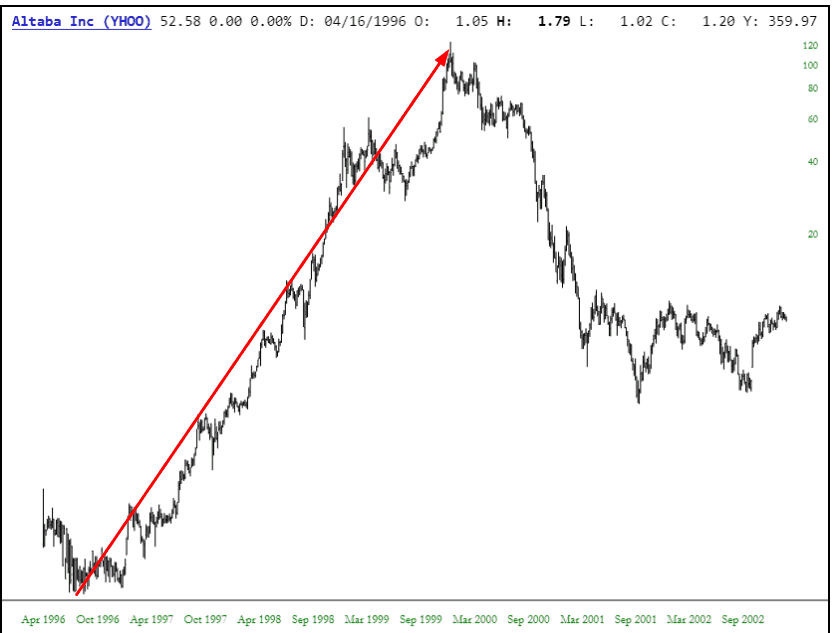

Turning our attention to the late Yahoo (now a funky holding company with the unfortunate moniker of Altaba…….):

Its rise was even crazier, from .70 to 125, which is 180-fold, giving us a target price of about $30,600. And, since one guess is as good as any other, let’s go with that. It’s a mere 1/10th what the Winklevii are calling for, and who knows, they may well be right. But at least loony Yahoo in the late 1990s give us SOME basis for just how high the public might bid up a totally new financial instrument before greed gives way to fear, and it all comes tumbling down to something a little less tethered to stark, raving madness.

Disclaimer: This is not meant to be a recommendation to buy or to sell securities nor an offer to buy or sell securities. Before selling or buying any stock or other investment you should consult ...

more