MBA Mortgage Applications Increase 2 Straight Weeks

MBA Mortgage Applications - Weak Construction Spending Growth

Before getting into MBA Mortgage Applications, let's review construction spending growth. Construction spending growth missed estimates and decelerated sharply on a year over year basis. Private residential spending growth fell sharply.

On a month over month basis, construction spending fell 0.1%. That missed estimates for 0.3% growth and was on top of a 0.1% decline. This caused year over year growth to fall from 7.2% to 4.9%.

Spending on new single-family housing was down 0.5% month over month and 2.4% year over year. Spending on home improvement fell 0.9% monthly and rose 0.4% yearly.

Generally, home improvement spending falls when home prices fall. I’m not saying prices are falling. I’m countering the faulty belief that home improvement spending goes up when home prices fall. People want to fix up their home instead of buying a new one.

Spending on multi-family housing was up 1% monthly and 3.2% yearly. Private non-residential spending fell 0.3% monthly, but it was up 6.4% yearly.

MBA Mortgage Applications - Commercial office building spending was up 16.3% yearly.

Those worried about business investment growth slowing should be comforted by this growth. Commercial subcomponent growth was the weakest in this category as it was only up 0.6%. Public construction spending was strong as the educational building was up 2.6% monthly and highway and street spending was down 0.1%.

As you can see from the chart below, private residential construction spending was only up 1.8% year over year as housing is weakening.

Truth is there needs to be a greater supply of entry-level housing in America. The most common age in America is 28. All these young millennials need new houses to move into.

Housing isn’t affordable. Lower prices and lower rates help, but more houses need to be built. Housing starts this cycle peaked at a rate closer to the average trough in past cycles than the average peak.

(Click on image to enlarge)

MBA Mortgage Applications - Strong Redbook Sales

The previous Redbook year over year sales growth of 7.9% hit a 12 year high. It was important because it included Black Friday. Now let’s see if retail sales can run up the scoreboard because there’s an extra week between Thanksgiving and Christmas this year.

Year over year same-store sales growth in the weak of December 1st fell to 7%. That’s still an amazing growth rate. I’m focused on the November retail sales report which will be released on December 14th. October saw 0.3% month over month sales growth from the control group. I’m looking for a seasonally adjusted acceleration in growth.

MBA Mortgage Applications - Solid Light Vehicle Sales

The November motor vehicle sales report signaled lightweight vehicle sales. They stayed in the range they have been in for the past few years as you can see from the chart below.

Total vehicle sales were 17.4 million which fell from 17.5 million in October. The November result beat estimates for 17.2 million. Domestic sales fell from 13.6 million to 13.5 million. Since motor vehicles are about 20% of retail sales, the retail sales report on December 14th should be solid.

(Click on image to enlarge)

MBA Mortgage Applications - Another Week Of Growth For MBA Applications

The MBA mortgage applications report is the most recent data on housing. For the past 2 weeks, the composite has been increasing as interest rates have fallen.

It would be interesting if the main reason housing has been weak this year is because of rising interest rates like 2013. Other possible causes of weakness are a lack of affordable housing and declining Chinese investments in U.S. real estate.

My thesis has been that this weakness catalyzed by a lack of affordability and rising rates will eventually switch to being caused by a weakening labor market. However, I could be wrong.

The Fed could pull back on rate hikes and extend the cycle while long bond yields fall which push down mortgage rates.

MBA Mortgage Applications - Lower mortgage rates and a continued strong labor market in 2019 would support the housing market.

Housing stocks have recently been rallying which supports this possibility. The ITB homebuilder index is up 7.35% since October 24th.

Specifically, in the week of November 30th the MBA applications index was up 2% week over week after increasing 5.5% in the prior week. Purchase index was up 1% after increasing 9%. Refinance index was up 6% on top of 1% growth. It’s important to recognize the data in the week of Thanksgiving had a large seasonal adjustment.

Interestingly, purchase applications were up 36% from last week, but just 0.2% year over year. That’s down from the previous week’s growth of 2%. Refinance’s share of mortgage activity was up 2.5% to 40.4%.

The average interest rate on 30-year conforming mortgages fell 4 basis points to 5.08%. The average loan size for purchase applications fell from $313,000 to $298,000. That's the lowest level since December 2017.

MBA Mortgage Applications - Job Challenger & Jobless Claims Report Show Improvement

To be clear, I’m expecting labor market weakness to start in the 2nd half of 2019. The improvements in the job challenger and claims reports don’t change my opinion.

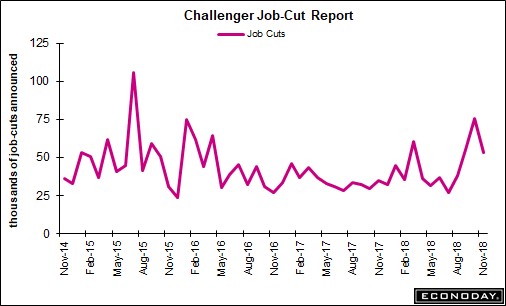

As you can see from the chart below, the November job cuts fell from 75,644 to 53,073. General Motors has been catalyzing the high number of cuts in the past 3 months. In November, auto layoffs were 14,040, healthcare layoffs were 4,300, and retail layoffs were 3,769.

(Click on image to enlarge)

Jobless claims in the previous week were revised from 234,000 to 235,000. Initial claims in the week of December 1st were 231,000 which was a 4,000 decline but was 6,000 higher than estimates. The 4-week average increased from 223,750 to 228,000 which is 15,000 higher than last month.

On the positive side, continuing claims in the week of November 24th were down 74,000 to 1.631 million. The 4-week average was steady at 1.667 million and the unemployment rate for insured workers fell 0.1% to 1.1%. Jobless claims report is starting to show weakness.

But it’s still far away from signifying the labor market is anything but strong.

Personally, I need to see the 4-week moving average move above 250,000 before I use it as a strong reason to sell stocks. Now, it’s just a potential reason. The November BLS report should be solid.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial ...

more