May 2022 Financial Market Update

After a tough April, the first four months of 2022 have not been rewarding for investors. As of the date of this note the S&P 500 Index is down roughly 13% for the year. LPL Research looked at the price return for the index through April, and this decline is the third worst start to a year going back to 1928 as seen in the near table. Encouragingly, returns following a weak start to a year tend to be mostly positive.

The current environment has been more difficult than usual for investors due to the fact bond returns are almost as weak as equity returns. The Bloomberg Aggregate Total Return Bond Index is down nearly 10% through the first four months of this year. This represents the worst performance for this bond index to start a year since it was created in 1986 with backdated history going back to 1976. Longer maturity bonds have performed even worse with the iShares 20+ Year Treasury ETF (TLT) down 19.05% just this year.

The inflationary environment has been one of the primary reasons for the weak market backdrop. Constraints in supply chains continue to be a headwind for some industries, especially with China’s zero-Covid policy and continued large city lockdowns. The unfortunate Russia/Ukraine conflict is negatively impacting commodity markets like fertilizers, natural gas and oil. With the Consumer Price Index running at a near double-digit rate, the Federal Reserve seems determined on reducing inflation pressures. This week the Fed raised interest rates 0.5% after an initial 0.25% increase in March. The Fed also signaled they would start reducing their approximately $9 Trillion bond portfolio and indicated additional 0.5% interest rate increases are possible at the next few meetings. The Fed’s goal in raising rates is to slow the economy which should lead to lower inflation over time and, in fact, the advanced reading on real GDP in the first quarter was -1.4%.

The question top of mind for us and investors is whether all these issues will create a difficult environment for consumers and businesses and ultimately tip the economy into a recession. The risk of recession has increased significantly. At HORAN Capital Advisors, there are variables we track that can provide some insight into whether a recession is near. Some of the data is backward looking, that is, it will not trigger until the economy is in a recession. Many of the variables we follow are giving some indication of at least an economic slowdown. Important components, such as employment, job openings, corporate unit profits and leading economic indicators are not signaling a recessionary environment.

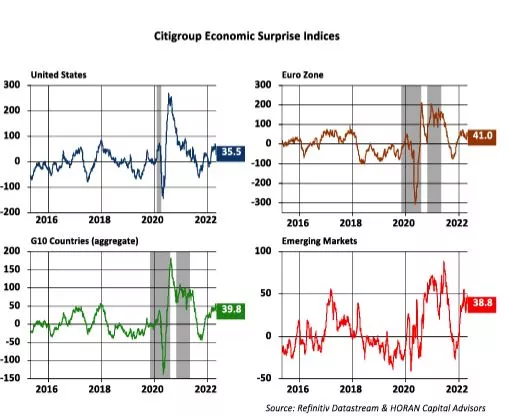

The near chart displays Citigroup’s Economic Surprise Indices for various regions around the world, and all areas are showing economic data being reported better than expected.

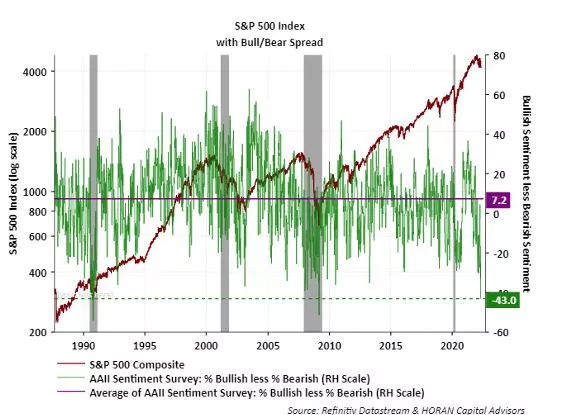

The economic surprise data falls into the sentiment category and economic expectations have been overly cautious. Similarly, bearish sentiment is unfolding with individual investors and their view on stocks. One measure that gets a lot of attention is the American Association of Individual Investors’ Sentiment Survey. The survey started in 1987 and it has always asked the same three simple questions of individual investors – are they bullish, neutral, or bearish in their outlook for stock performance in the next six months.

The percentage of investors indicating they are bullish on stocks is a very low mid-teen percentage. The most recent spread between the bullishness and bearish reading is -43.0%, a level last reached in 1990. This indicates 59.4% of survey participants were bearish and only 16.4% were bullish on stocks. Sentiment measures tend to be contrarian indicators, and a high level of bearishness is viewed as one positive variable for stocks.

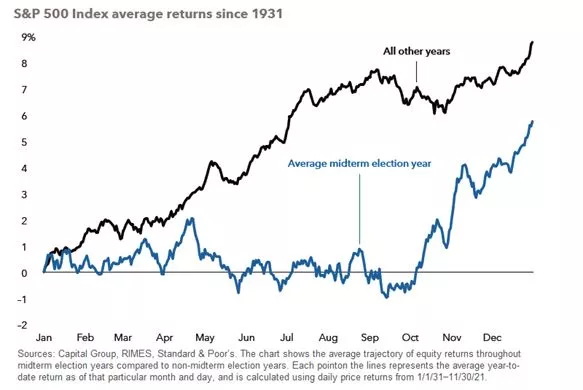

Another contributing factor to sentiment and market weakness may be due to this being a mid-term election year. The S&P 500 Index tends to trade sideways with higher levels of volatility until the uncertainty of the election lessens. As the near chart shows some of the best market returns follow these elections.

As we noted in our quarterly Investor Letter last month, markets are likely to remain volatile over the next several quarters due to all the uncertainties. We are in a transition phase as the Fed and other Central Banks around the world shift from accommodative to tightening monetary policy, and markets are trying to decipher what it ultimately means for the global economy. Most economic indicators still signal the U.S. economy is growing, but the rate of growth has slowed. Despite all the uncertainties, over 80% of companies have reported better than expected results in their latest earnings. We don’t see signs of an imminent recession but are watching the economic and earnings data closely.

Disclaimer: The information and content should not be construed as a recommendation to invest or trade in any type of security. Neither the information nor any opinion expressed constitutes a ...

more