May 2019 Philly Fed Manufacturing Survey Weakened

The Philly Fed Business Outlook Survey significantly declined and barely remained in expansion. Key elements remained in positive territory.

Analyst Opinion of the Philly Fed Business Outlook Survey

Although the survey index significantly declined, the key element sales declined relatively slightly while unfilled orders improved. Overall, I do not consider this survey much different than last month.

This is a very noisy index which readers should be reminded is sentiment based. The Philly Fed historically is one of the more negative of all the Fed manufacturing surveys but has been more positive than the others recently.

The index moved from +16.6 to +0.3. Positive numbers indicate market expansion, negative numbers indicate contraction. The market expected (from Econoday) 5.8 to 11.0 (consensus +9.3).

Manufacturing conditions in the region weakened this month, according to firms responding to the June Manufacturing Business Outlook Survey. The current activity index declined to a reading just above zero this month. The survey's indexes for new orders, shipments, and employment remained positive but also declined from their May readings. Most of the survey's future activity indexes improved but continue to reflect muted optimism for the remainder of the year.

Current Indicators Suggest Moderating Growth

The diffusion index for current general activity decreased from 16.6 in May to 0.3 this month. This is the lowest reading since February, when the index fell below zero for one month (see Chart 1). The indexes for current shipments and new orders also declined this month: The current new orders index decreased 3 points, while the shipments index fell 11 points.

Econintersect believes the important elements of this survey are new orders and unfilled orders. New orders again declined but remains in expansion whilst unfilled orders modestly improved and is in expansion.

This index has many false recession warnings.

Summary of all Federal Reserve Districts Manufacturing:

Richmond Fed (hyperlink to reports):

Kansas Fed (hyperlink to reports):

Dallas Fed (hyperlink to reports):

New York Fed (hyperlink to reports):

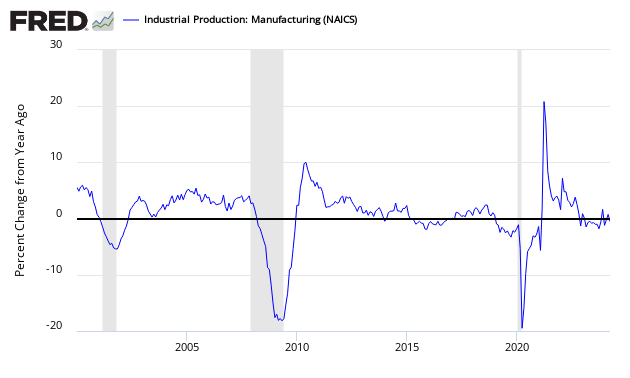

Federal Reserve Industrial Production - Actual Data (hyperlink to report):

Holding this and other survey's Econintersect follows accountable for their predictions, the following graph compares the hard data from Industrial Products manufacturing subindex (dark blue bar) and US Census manufacturing shipments (lighter blue bar) to the Philly Fed survey (yellow bar).

In the above graphic, hard data is the long bars, and surveys are the short bars. The arrows on the left side are the key to growth or contraction.

Caveats on the use of the Philly Fed Business Outlook Survey:

This is a survey, a quantification of opinion - not facts and data. Surveys lead hard data by weeks to months and can provide early insight into changing conditions. Econintersect finds they do not necessarily end up being consistent compared to hard economic data that comes later, and can miss economic turning points.

This survey is very noisy - and recently showed recessionary conditions. And it is understood from 3Q2011 GDP that the economy was expanding even though this index was in contraction territory. On the positive side, it hit the start and finish of the 2007 recession exactly.

No survey is accurate in projecting employment - and the Philly Fed Business Outlook Survey is no exception. Although there are some general correlation in trends, month-to-month movements have not correlated with the BLS Service Sector Employment data.

Over time, there is a general correlation with real business data - but month-to-month conflicts are frequent.

Disclaimer: No content is to be construed as investment advise and all content is provided for informational purposes only.The reader is solely responsible for determining whether any investment, ...

more