Master Cycle Highs

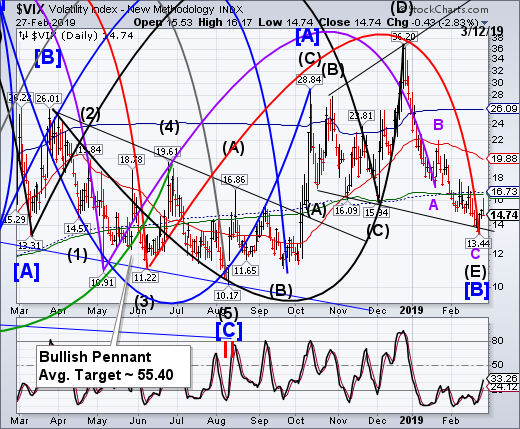

VIX confirmed the second Master Cycle low on February 25 with a Key Reversal. While VIX appears to be calm, a rally above mid-Cycle resistance at 16.73 puts it on a buy signal.

-- The NYSE Hi-Lo Index also put in its Master Cycle high on February 25. A decline into negative territory may spell trouble for equities.

(Bloomberg) The rally thundering across markets has done more than just drive up prices, it’s pushed down volatility.

Markets around the world have started the year on a tear encouraged by easing trade tensions, a more dovish-sounding Federal Reserve and signs that China is bolstering its economy. And volatility gauges have responded. The CBOE Volatility Index touched its lowest level in four months last week, while the Merrill Option Volatility Index, which monitors Treasury options, is near a four-month low. The JPMorgan Global FX Volatility Index ended Tuesday at the lowest reading since April.

“Volatility instruments have all but completely normalized,” Richard Franulovich, head of FX strategy at Westpac Banking Corp., wrote in a report Tuesday, noting that relative levels of equity, bond, currency and high-yield credit volatility all declined significantly from late last year.

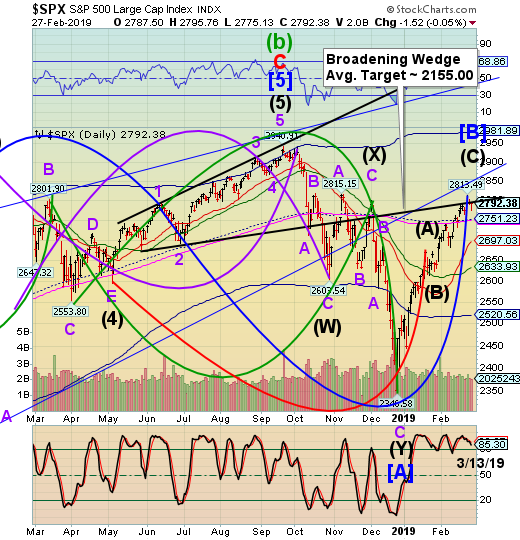

-- The SPX is likely to have made an (inverted) Master Cycle high on Monday above the trendline of its Broadening Wedge Formation. The turn came precisely at the “last chance” .786 Fibonacci retracement level. Today it closed beneath that trendline, suggesting a probable reversal has been made.

(ZeroHedge) Just days after Warren Buffett lamented in his latest annual letter that prices for businesses possessing decent long-term prospects are "sky high", an insider transaction-based model constructed by University of Michigan finance professor Nejat Seyhun predicts that the S&P 500 will be 3.9% lower in one year as a result of a recent surge in insider selling.

Seyhun, one of academia's "leading experts" on insider transactions, and his trading model were profiled in a recent Barron's article. Barron's had previously covered his work back in May 2017. At the time Seyhun's model was bullish and the S&P has, since then, risen by more than 20%. His model also gave the market "the benefit of the doubt" back in October, during a correction. Since then, the market is about 1% higher.

What is more notable, is that Seyhun's model has been found to be statistically significant by peer reviewed research. He claims that insider buying and selling data, when researched properly, "does a better job predicting year-ahead returns than almost all of the better-known indicators that are popular on Wall Street."

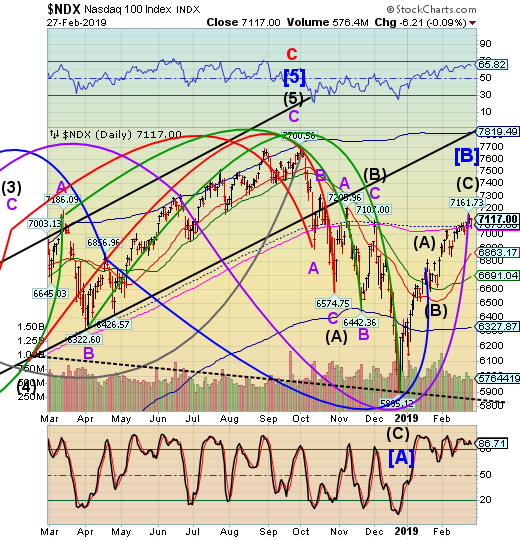

-- NDX also made its Master Cycle high on Monday, retracing 70% of its decline. Today it challenged its 200-day Moving Average at 7063.44, but closed above it. If it continues to decline lower, this may be an ideal “sell the rally” scenario.

(ZeroHedge) President Trump has made no secret of the fact that he believes tech behemoths like Amazon are anti-competitive, job-killing monstrosities that should be broken up or at least see their influence curbed by regulators. And now, after stocking the FTC with critics of big tech, it appears the committee might be taking the first steps toward breaking up the big tech firms - or at least ensuring that they can't get any bigger.

With the committee still prepping what will reportedly be a "record breaking fine" over Facebook's failure to uphold a guarantee to safeguard user data, Bureau of Competition Director Bruce Hoffman and FTC Chairman Joe Simons announced the formation of a new task force that will scrutinize mergers in the tech space - and even review consummated deals.

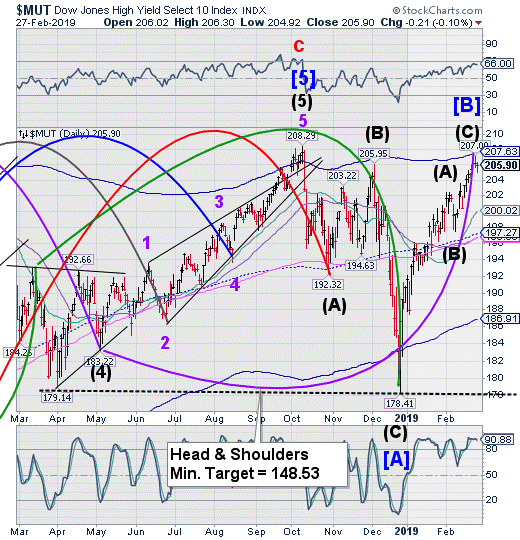

The High Yield Bond Index broke out above the December 4 high briefly yesterday, but made a Key Reversal by the end of the day. A Major low appears to be due in mid-March.

(Bloomberg) The largest junk bond ETF is seeing its biggest cash injection in two years in February as investors jump back into riskier assets after the worst December for high-yield debt since 2015.

The $16.1 billion iShares iBoxx High Yield Corporate Bond ETF, ticker HYG, is on track for its best month of inflows since December 2016, according to data compiled by Bloomberg. The fund is the largest ETF tracking junk debt and has taken in $1.6 billion so far in February.

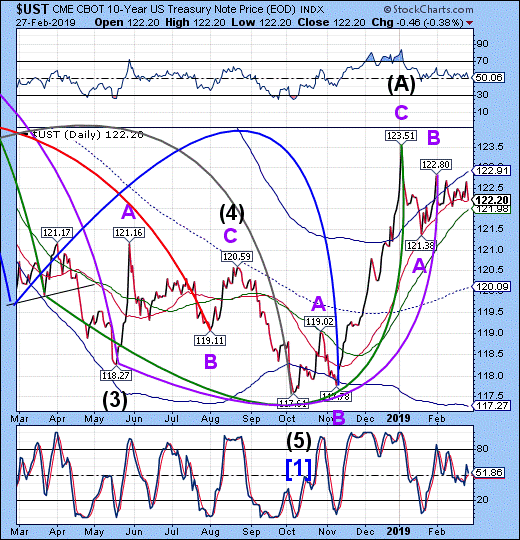

10-Year Treasury Notes remain above the Intermediate-term support at 122.19 and may be ready to plunge through it. The Cycles Model points to a further decline that may test the mid-Cycle support at 120.09 in the next 6-7 weeks.

(CNBC) U.S. government debt yields rose on Wednesday amid Federal Reserve Chairman Jerome Powell’s second day of testimony on Capitol Hill.

At 11:40 a.m. ET, the yield on the benchmark 10-year Treasury note was up 5 basis points at 2.682 percent, while the yield on the 30-year Treasury bond was up 5 basis points at 3.06 percent. The 10-year yield hit a fresh high of session of 2.684 percent, its highest level since Feb. 25.

Bond yields, which rise as prices fall, moved steadily upward throughout the morning despite what some analysts deemed as dovish commentary from the Fed chief. Tom di Galoma, head of Treasury trading at Seaport Global Holdings, attributed the sharp moves higher in long-term yields to significant corporate issuance in the U.S. as well as a wave of debt selling in Europe.

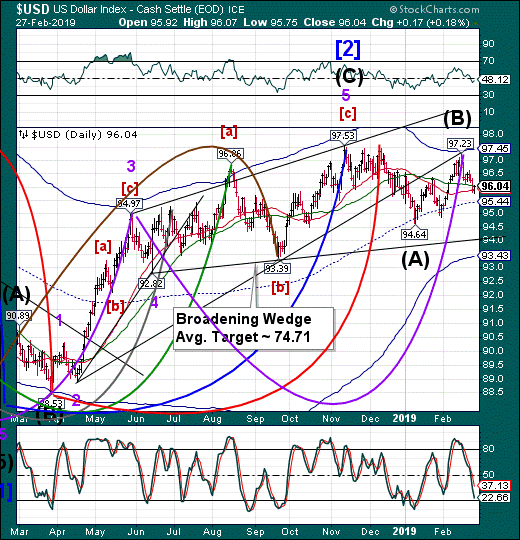

The U.S. Dollar declined through its 50-day Moving Average at 96.02, then bounced back for a retest. It triggers a sell signal on a decline back beneath the 50-day. The Cycles Model suggests a significant low may be made around mid-March.

(CNBC) The U.S. dollar edged higher on Wednesday as investors digested testimonies from the lead U.S. trade negotiator with China and the top ranking Federal Reserve official.

The dollar index against a basket of six major currencies was up 0.16 percent at 96.15.

Fed Chair Jerome Powell finished his second day of testimony on Wednesday in front of the House Financial Services Committee. In his previous day’s testimony before the Senate Committee on Banking, Housing, and Urban Affairs, Powell warned that problems abroad could impact the U.S.; however, he described the economy as “healthy” and said the outlook is “favorable.”

U.S. Trade Representative Robert Lighthizer also spoke Wednesday, hinting to the House Ways and Means Committee that a trade deal was not yet certain because China needs to do more than just purchase more U.S. goods.

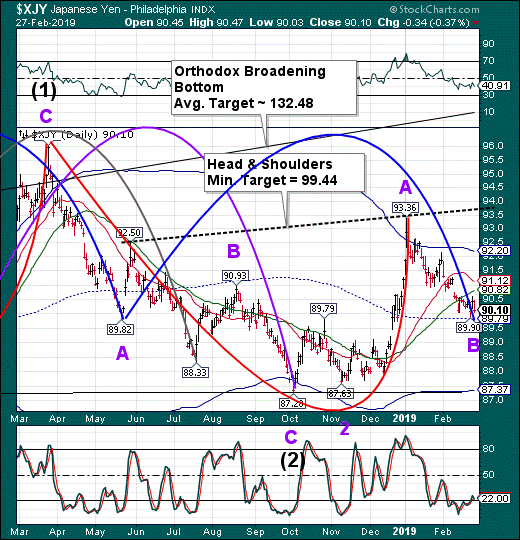

--The Yen appears to have put in an extended Master Cycle low on Monday at its mid-Cycle support. Today it retested support and it held. If the Cycles are correct, there may be an extended rally that could last up to 4 weeks or longer.

(Bloomberg) The Bank of Japan may resort to its least preferred tool to expand stimulus next time the yen jumps: more government bond purchases.

That’s according to Takahide Kiuchi, a former BOJ policy board member who said the central bank’s favored option -- deepening negative interest rates -- would face opposition from Prime Minister Shinzo Abe’s administration because it would be unpopular among the public. Japan’s currency could quickly appreciate past the 100 mark against the dollar from around 110 now if the global economy deteriorates, he warned.

Speculation for BOJ action has grown since Governor Haruhiko Kuroda said last week that he might undertake fresh easing if the yen’s movement hurts the economy and inflation. In an Asahi newspaper interview, Kuroda outlined four options including targeting the monetary base through government bond purchases -- a policy that the BOJ moved away from in 2016.

The Nikkei rallied through Tuesday, making a belated Master Cycle high. The strength of this Cycle has been diminished, if not already gone. The Cycles Model calls for a potential decline lasting up to two months.

(CNBC) Japan’s Nikkei closed up on Wednesday as investors bought into defensive stocks such as pharmaceutical and real estate firms, and took some money off the table from machinery shares that had rallied on progress in U.S.-China trade talks.

The Nikkei share average gained 0.5 percent to 21,556.51, not far from its more than 10-week high reached during Tuesday’s session.

The broader Topix added 0.2 percent to 1,620.42, with advancing issues outnumbering declining ones 1,153 to 893.

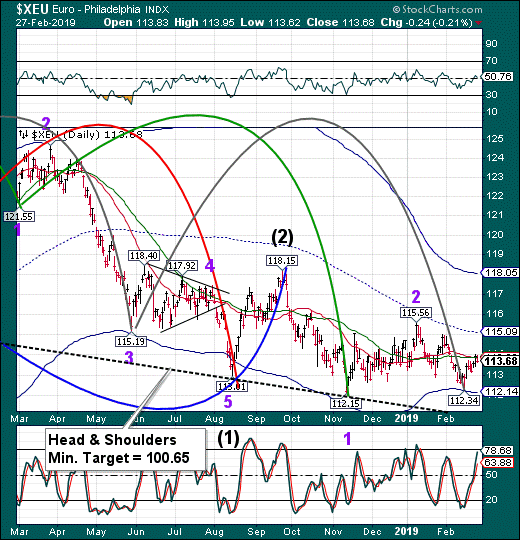

The Euro challenged its dual Intermediate-term and 50-day resistance at 113.87 to no avail. The failure at resistance suggests the bounce may be over. The Euro is on a sell signal, so be wary of a breakdown beneath the Cycle Bottom.

(Reuters) - Eurozone economic sentiment dipped for an eighth consecutive month to a new two-year low in February as managers in the industry became more downbeat about inventories, order books and production expectations.

Eurozone economic sentiment slipped to 106.1 points in February from an upwardly revised 106.3 in January, the European Commission said on Wednesday, marking the lowest level since November 2016.

The survey adds to evidence that economic prospects of the 19-member eurozone for the start of 2019 are muted after only modest growth of 0.2 percent quarter-on-quarter in the third and fourth quarters of 2018.

The EuroStoxx 50 Index rally challenged mid-Cycle resistance at 3284.15, making a 48% retracement of its 7-month decline. The Cycles Model now calls a decline though mid-March.

(CNBC) European stocks traded in the red during Wednesday’s session, as investors digested the latest political and economic news from around the world.

The pan-European Stoxx 600 closed provisionally down 0.38 percent by the late afternoon with all but three sectors in negative territory.

Air France-KLM tumbled 10 percent Wednesday following news that the Dutch government is seeking a higher stake of the company. There are fears that as a result the company’s decision-making process will be slower.

Furthermore, the British bank Metro fell to the bottom of the index, down by more than 26 percent. This was after revealing plans for a £350 million ($463 million) shareholder cash call.

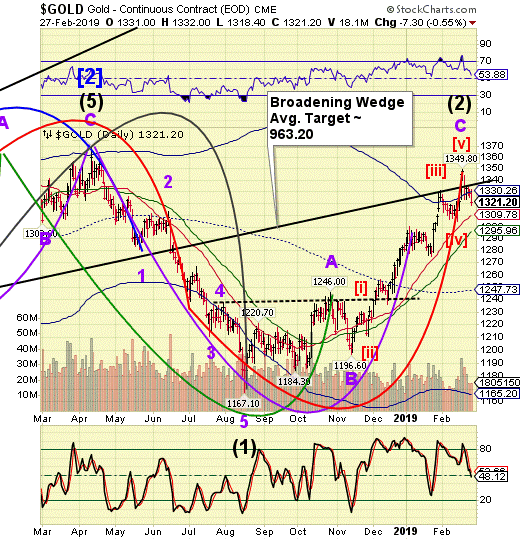

-- Gold dropped beneath its Cycle Top support at 1330.26 and is on a sell signal. The resulting decline may last up to 3 weeks to the next significant low.

(MarketWatch) Gold prices on Wednesday finished lower for a third consecutive session, giving up its month-to-date gain, even as uncertainty hung over financial markets, putting pressure on stocks.

“Gold has lost a bit of its allure over the last week, which may be indicative of a trade that’s become a little overcrowded and prone for correction,” said Craig Erlam, senior market analyst at Oanda, in a daily note. “The momentum indicators certainly suggest this may be the case and the recent consolidation off the highs, despite some dollar weakness, also suggests this is a move that’s run out of steam.”

April gold GCJ9, +0.10% fell $7.30, or 0.6%, to settle at $1,321.20 an ounce. It had settled at a 10-month high of $1,347.90 a week earlier, according to FactSet data. Weakness in prices Wednesday prompted the metal to trade about 0.3% lower for the month so far.

West Texas Intermediate Crude bounced back from its Monday decline, but no new high was made. The Master Cycle inversion high was completed last Friday. A decline beneath Intermediate-term support at 53.88 may produce a sell signal.

(OilPrice) Crude oil prices inched higher today after the EIA released its latest Weekly Petroleum Status Report, in which the authority said crude oil inventories had fallen by 8.6 million barrels in the week to February 22, though they are still above the seasonal five-year average.

This compares with an inventory increase of 3.7 million barrels for the previous week.

At the same time, gasoline inventories went down by 1.9 million barrels in the reported period, compared with a decline of 1.5 million barrels a week earlier. Distillate fuel inventories shed 300,000 barrels in the week to February 22 while a week earlier they booked a 1.5-million-barrel draw.

The Shanghai Index challenged Cycle Top resistance at 2960.74, closing beneath it today. The Cycle inversion took two weeks more than expected but may have partially made up for its week-long holiday in February. The Cycles Model indicates weakness may be imminent, lasting through mid-March.

(Bloomberg) Eager to pile into the world’s most-volatile major stock market with 10-to-1 leverage? China’s shadow bankers are happy to help -- and that has the nation’s policymakers worried.

Just hours after China’s CSI 300 Index notched a 6 percent surge on Monday -- its biggest gain in more than three years -- the country’s securities regulator warned of a rise in unregulated margin debt and asked brokerages to increase monitoring for abnormal trades. The China Securities Regulatory Commission’s statement followed a pickup in advertising by margin-finance platforms, which operate with little to no supervision and offer far more leverage than the country’s regulated securities firms.

While margin debt in China is much lower today than when it helped precipitate a market collapse in 2015, investors are boosting leverage quickly as they chase a rally that added more than $1 trillion to stock values since the start of 2019. The worry is that a sudden reversal would force leveraged traders to sell, exacerbating volatility in a market that posted bigger swings than any of its peers over the past 30 days. That prospect may unnerve Chinese policymakers, who have a history of trying to protect the nation’s 147 million individual investors from outsized losses.

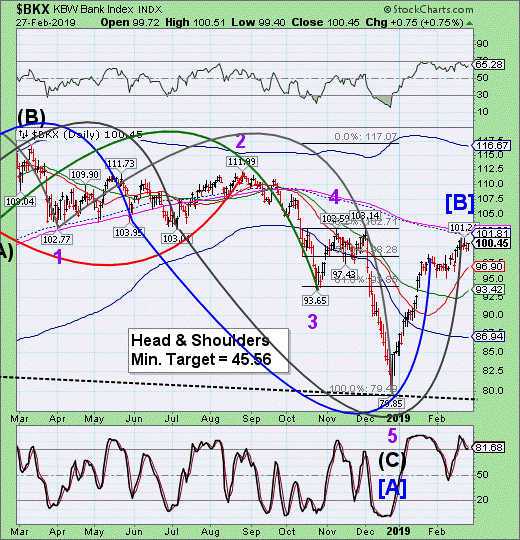

-- BKX peaked on Monday short of its mid-Cycle resistance at 101.81 and the 61.8% Fibonacci retracement at 102.71. The Cycles Model suggests that the turn was about two weeks overdue, but sometimes price targets override the calendar. The next Master Cycle low may be due in late March.

Disclaimer: Nothing in this article should be construed as a personal recommendation to buy, hold or sell short any security. The Practical Investor, LLC (TPI) may provide a status report of ...

more

This arguement linking MMT to socialism is misleading. MMT was also a favorite of capitalist and totalitarian Richard Cheney when he was at war. Remember, it was a Republican who popularized the notion, as Cortez was growing up, that deficits don't matter. So, making it all on the left is just not honest. Cortez is 29. She would have been 14 when Cheney said that in 2002. MMT is wrong, period, on both sides of the aisle.