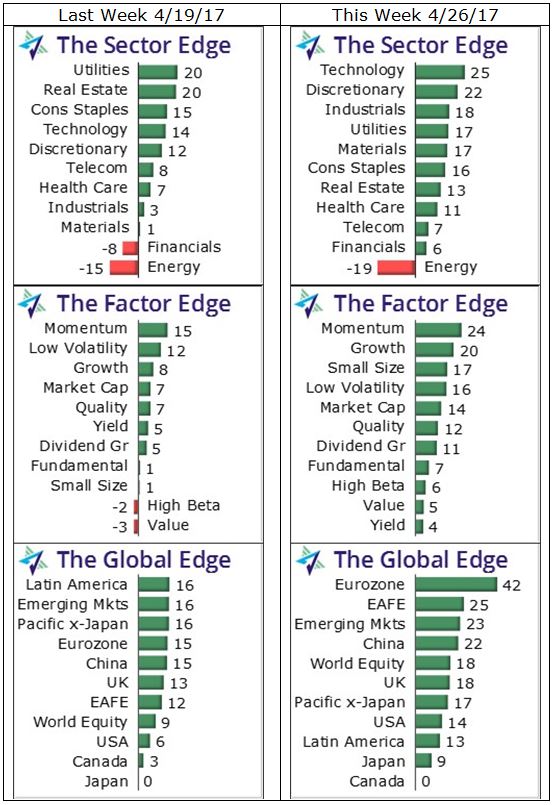

Massive Shifts In ETF Relative Strength

Two weeks ago, we noted that compression in the momentum scores often precedes and precipitates massive shifts in ETF relative strength. This week, we can see these compression-induced changes playing out in the rankings. French election results pushed all of Europe higher, Technology moves to the top of the sector rankings, and Momentum continues to be the strongest factor.

Sectors: The relative-strength rankings have a much different complexion today than a week ago. Four sectors jumped three or more places higher, while four others plunged lower, resulting in a clean slate of new occupants in the top-three positions. Technology moved three spots higher to claim the leadership role, Consumer Discretionary followed in lock step, and Industrials surged five places higher to grab the #3 spot. This new trio at the top suggests a bullish scenario with both consumers and businesses being strong, and technology infrastructure spending ensuring long-term growth. Materials also turned in a good showing by posting the largest momentum improvement among the Sector Benchmark ETFs and zooming into the upper half. The recent reign for the defensive sectors was short-lived, as they posted this week’s largest declines in momentum and relative strength. Utilities gave up its top-ranked spot and fell to fourth, Consumer Staples slipped three places lower, Telecom dropped to ninth, and Health Care eased one spot lower. However, it was Real Estate posting the largest drop as it plunged from a tie for first to seventh place. Down near the bottom, Financials had a good week and flipped back to green, while Energy sunk deeper into the red.

Factors: It was a good week for the Factor Benchmark ETFs as all but one posted a momentum increase. Yield was the odd man out, and its failure to improve resulted in a relative-strength tumble to last place. The Momentum factor has been at the top of the chart for seven consecutive weeks now and shows no sign of relinquishing that spot. Growth moved up a notch to grab the #2 spot, while Small Size vaulted six places higher to third. High Beta and Value were slightly in the red a week ago, but they have now erased those deficits.

Global: There is nothing like an election to change the perception of political risk in the markets. The perceived favorable outcome in round one of the French presidential election on Sunday sent Eurozone markets soaring and brought the rest of the world along for the ride. The iShares MSCI France ETF (EWQ) surged 5.8% on Monday and posted a five-day gain of 8.6%. The iShares MSCI Eurozone ETF (EZU), one of the Global Benchmark ETFs, gained 5.2% on Monday and 7.0% for the week. Some of these outsized advances are attributable to gains in the euro against the U.S. dollar, but the lion’s share of these returns are the result of European stock prices moving higher. The global relative-strength rankings reiterate these results, with the Eurozone climbing three places higher to take the helm. EAFE shot up from seventh place to grab second, and World Equity edged into the upper half. The categories falling in the rankings didn’t lose any value this week, but their mediocre returns paled in comparison to Europe, and therefore they dropped in relative strength. Latin America plunged from first to ninth, Pacific ex-Japan gave up four spots, and Canada dropped to the bottom.

The following Edge Charts are market momentum snapshots. They provide a quick and easy way to help you visually get a handle on the overall state of the market. With these charts, you can assess both the relative strength and absolute strength (momentum) of more than 30 global equity market segments. Please refer to the Edge Chart User’s Guide for further explanation.

Disclosure: more