Markets: Steady As She Goes

Avoid sudden change – good advice for sailors and traders today. That is the lesson for the day as the summer lull continues to bring out the bulls. Risk on, Dollar off. The rally up in China shares notable along with CNY relative stability. Even Turkey got some relief. Central banks and trade remain front and center today –

- RBA on hold noting China weakness and US trade uncertainty. The central bank hinted that CPI would be lower leaving the SOMP Friday in play along with tomorrow’s RBA Lowe speech.

- New Zealand shadow RBNZ board says rates should stay on hold as there is no urgency despite longer term seeing globally higher rates and inflation.AUD/NZD shot higher through 1.10 resistance.

- BOJ still focus after Reuters article says plan to raise rates this year was scuttled by market turbulence and lower CPI.

- Turkey sees TRY bounces 1.5% early to 5.1720 from 5.4222 record lows, off 4.7% yesterday, with relief trade following after a Turkish CNN broadcaster said that a "delegation of Turkish officials are to go to the U.S. in 2 days" after the Two nations "reached pre-agreement on certain issues," citing diplomatic sources.

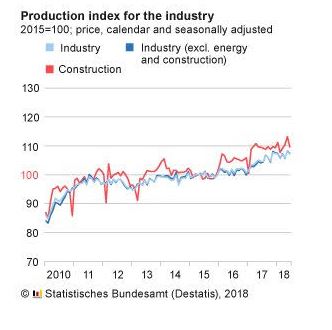

The economic news remained negative for Europe with German industrial production missing and adding to fears of a slowdown there, but the EUR is bid. For trading this market – many are back to watching the USD as the overall risk barometer.Whether that works or not remains to be seen.

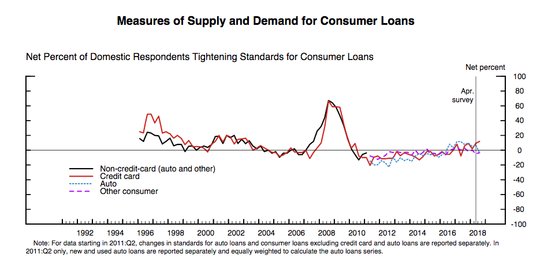

Question for the Day: Does the Fed US Senior Loan Officer Survey matter? The growth of the US economy remains linked to the consumer and to credit. This report was steady as she goes – 5% credit growth continues. FOMC tightening is still seen as gradual normalization and the reports from yesterday suggest good times continue for corporates, but perhaps not for the consumer. Banks have eased standards according to the report yesterday, 17% have cut terms and standards for larger firms and 10% for smaller ones. Consumers see 6.5% tighter standards on credit cards but autos and real estate is unchanged.

What Happened?

- RBA leaves cash rate unchanged at 1.5% - as expected – leaves forecasts economy unchanged, notes global outlook uncertainty due to US trade. The RBA also acknowledged that growth in China has slowed a little. The RBA said inflation is likely to be higher in 2019 and 2020 but lowered outlook for 2018 inflation to 1.75% from "bit above 2%" because of "once-off" declines in some administered prices for 3Q. The RBA maintained the outlook for GDP growth in 2018 and 2019, citing support from non-mining business investment and higher levels of public infrastructure investment.

- China July FX Reserves up $5.82bn to $3.118trn from $3.112trn – better than -$12bn expected. This is the second monthly gain. The reserve gain reflects valuation effects of holding foreign bonds. The USD index was off 0.2% in July. The value of China’s gold reserves fell to $72.324 billion at the end of July, from $74.071 billion at the end of June.

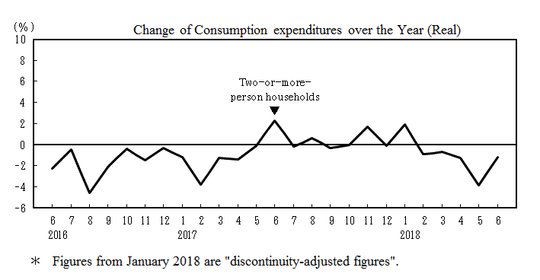

- Japan June household spending-+2.9% m/m, -1.2% y/y after -3.9% y/y – better than -0.2% m/m, -1.5% y/y expected – first monthly rise in 5 months. This supports 2Q GDP estimates for Friday of 0.2% q/q, 1% y/y. However, higher spending on cars and air conditioners failed to make up for a sharp drop in expenditures on package tours. The recent trend is that more people are bypassing travel agencies for domestic leisure and unit costs for overseas tours have dropped as people are choosing closer and cheaper holiday destinations in Asia. The ministry left its assessment on household spending, saying "weakness is seen in consumption." The ministry last downgraded its view for the April data.

- Japan June average wages rose 3.6% y/y to Y448,919 after up 2.1% y/y. This was mostly due to bonuses up 7.0% y/y after 18.2% y/y in May while base wages rose 1.3% y/y same as May and overtime 3.5% y/y from 2% y/y. "Annual wage hikes may be supporting the growth in base wages but the occasional page of total wage growth is still dependent on special pay." The ministry left its long-held assessment unchanged, saying wages have been increasing "moderately."

- German June industrial production -0.9% m/m after +0.7% m/m – weaker than -0.3% m/m expected. Manufacturing output fell 2.0% after a +2.6% m/m gain in May.Basic goods -0.8% after +3% m/m, consumer goods -1.6% after +6% m/m, capital goods -0.6% after +0.9% m/m, energy +2.9% m/m after +0.9% m/m and construction -3.2% after +2.5% m/m. 2Q industrial output now up 0.4% q/q after 0.1% in 1Q with manufacturing up 0.3% q/q after 0.1%. The 3M industrial output average is unchanged.

- German June trade surplus E19.3bn after revised E20.4bn – less than E20.3bn expected.May revised slightly higher from E20.3bn. The C/A surplus rose to E26.2bn from E13.3bn (NSA). The June trade exports were 0% m/m, up 7.8% y/y to E115.5bn after +1.8% m/m – less than the +0.8% expected.Imports rose 1.2% m/m, 10.2% y/y to E93.7bn

- French June trade deficit E6.2bn after E6.01bn – worse than E5bn expected.Exports up 1% m/m, imports up 1.4% m/m.The French C/A deficit E2.3bn from E2.9bn.

- Sweden June industrial production rose 0.2% m/m, 5.4% y/y after 3.8% m/m, 5.9% y/y – less than 0.6% m/m expected. Manufacturing rose 5.8% y/y from 6%, mining production fell 1% form +2.5%.

Market Recap:

Equities: The US S&P500 futures are up 0.23% after a 0.5% gain yesterday. The Stoxx Europe 600 is up 0.65% after opening up 0.3% while the MSCI Asia Pacific is up 0.7% with focus still on US/China trade.

- Japan Nikkei up 0.69% to 22,662.74

- Korea Kospi up 0.60% to 2,300.16

- Hong Kong Hang Seng up 1.54% to 28,248.88

- China Shanghai Composite up 2.74% to 2,779.30

- Australia ASX off 0.29% to 6,340.80

- India NSE50 up 0.02% to 11,389.45

- UK FTSE so far up 0.75% to 7,721

- German DAX so far up 0.75% to 12,690

- French CAC40 so far up 0.70% to 5,516

- Italian FTSE so far up 1.15% to 21,828

Fixed Income: RBA on hold, Italy budget meetings and weaker growth data leave EU bonds trading lightly. German Bunds sell off across the curve despite weaker industrial production – 2Y up 1bps to -0.598%, 5Y off 1.5bps to -0.168%, 10Y up 1.5bps to 0.4%. French OAT curve also steeper – 10Y up 1bps to 0.72%, 30Y up 1bps to 1.585%. UK Gilts up 1bps to 1.31%. For periphery further relief – Italy off 3bps to 2.88%, Spain off 1bps to 1.39%, Portugal flat at 1.75%, Greece off 1bps to 4.0%.

- US Bonds are lower with focus on belly with 3Y sale today – 5Y up 1bps to 2.813%, 10Y up 1.5bps to 2.947%

- Japan JGBs sold early on Reuter article, weak linker auction, risk-on mood, recover on close.10Y flat at 0.105%. MOF sold Y399.6bn of 10Y inflation linked JGB at -0.309% with 3.122 cover – previously -0.513% with 4.018 cover.

- Australian bonds rally tracking US in catch up trade and on hold RBA – 3Y off 4bps to 2.08%, 10Y off 7bps to 2.66%.

- China PBOC skips open market operations, leaves liquidity neutral.Money market rates fell with O/N off 20bps to 1.58%, 7-day off 8bps to 2.25% but 1Y swap rate rose 3bps to 2.65% and 10Y bond yields up 3bps to 3.50%.

Foreign Exchange: The US dollar index is off 0.2% to 95.11 – watching 95.65 for upside against 94.95 and 94.70 base building. In Asia EM FX, USD lower –TWD flat at 30.621, KRW off 0.1% to 1124, INR 68.675 off 0.15%, In EMEA, USD offered- RUB up 0.15% to 63.52, ZAR up 0.7% to 13.343, TRY 5.3120 off 0.5%

- EUR: 1.1590 up 0.3%. Range 1.1551-1.1594 with 1.1530 yesterday’s lows seen as key against 1.1610-80 resistance – rates/risk driving.

- JPY: 111.20 off 0.2%. Range 111.21-111.43 with EUR/JPY 128.95 up 0.2% - focus is on rate spreads, risk-on with 110.50-112.20 key.

- GBP: 1.2965 up 0.2%. Range 1.2938-1.2974 with EUR/GBP .8940 up 0.2% - Brexit talks in Autumn key with 1.30 still pivot for either 1.2750 or 1.32 retest.

- AUD: .7430 up 0.6%. Range .7385-.7438 with NZD .6750 up 0.4%. RBA didn’t shift CPI down enough to match talk, AUD/NZD technical break – RBNZ and milk auction next.

- CAD: 1.2970 off 0.30%. Range 1.2960-1.3010 with focus on US/China trade, US rates and trade hopes still 1.3050 caps for 1.2880 again.

- CHF: .9945 off 0.2%. Range .9940-.9970 with EUR/CHF 1.1530 up 0.2%. Nothing to see here move on?1.00 still caps.

- CNY: 6.8431 fixed 0.12% stronger from 6.8513, CNY gains up 0.35% to 6.8280. CNH up 0.4% to 6.8380.

Commodities: Oil up, Gold up, Copper up 0.8% to $2.7857

- Oil: $69.61 up 0.9%. Range $68.81-$69.69. Oil higher overnight on USD weakness, Saudi production slowing and US inventory speculation – with API key tonight. WTI watching $70.43 July 30 highs than $70.60 July 13 against 100-day base at $67.12. Brent up 1.3% to $74.66, watching $55-day at $75.17 against Friday’s $72.48 lows.

- Gold: $1214 up 0.5%. Range $1207.50-$1215. Gold watching $1220 Friday highs against the $1206.40 lows yesterday. Silver $15.29 - stuck watching Friday’s $15.554 highs against $15.248 lows. Platinum up 1.45% to $837.70, Palladium up 0.6% to $909.40.

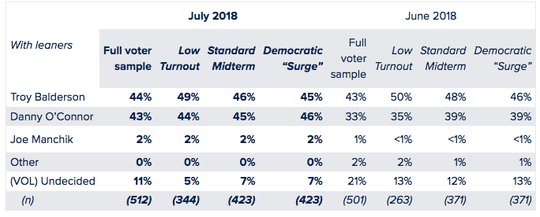

Conclusions: Will today be about the voters? Mid-term elections are going to be a key focus for September but today is about a special election for Ohio’s 12th Congressional District. Many will be watching the result to test the mood for the fall and both parties have spent heavily to win. The Monmouth polls point to a race “too close to call.”

Economic Calendar:

- 1000 am US June JOLTS job openings 6.638mn p 6.9mn e

- 1000 am US Aug IBD/TIPP economic optimism 56.4p 57.2e

- 1000 am Canada July Ivey PMI 63.1p 64.2e

- 1130 am US sells 4-week $70bn bills

- 0100 pm US sells 3Y $34bn notes

- 0200 pm US June consumer credit $24.56bn p $16bn e

- 0430 pm US weekly crude oil inventories 5.59mb p -0.7mb e

- 0500 pm Argentina central bank BCRA rate decision – no change from 40% expected

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.