Markets: Silk Purses

Markets are making a silk purse out of a sow’s ear. The FX market is watching the year of the Pig approach and wonders if the present risk-on mood will see a change. GPB and CNY are not yet flashing the yellow signals that many assume would follow the headlines – where bad news bears down on prices. I

n the UK, the biggest defeat in Commons history has become a victory for the embattled prime minister with GBP higher even as the path to Brexit becomes harder. The hope is that there is a delay and/or a referendum. The odds for such are prices at nearly 40%. This leads to UK May more likely to remain in office until June, with those odds over 50%. In China, the lack of progress on structural issues hangs over hopes for a bigger trade deal with the US. The upcoming new year celebrations distort the economy there and squeeze money.

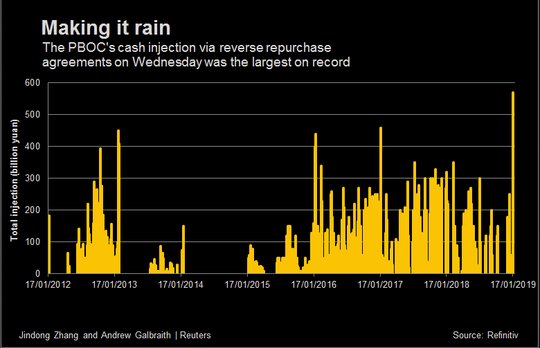

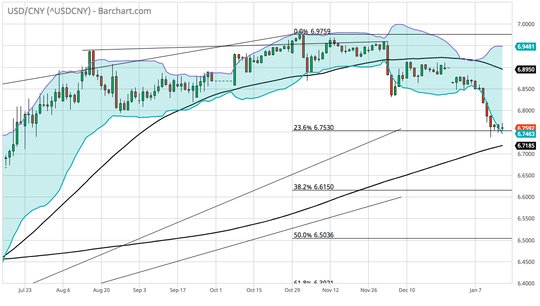

China PBOC adds a record $83bn via reverse repos today – trying to offset the new year squeeze and add to liquidity even after the RRR cuts have put another $116bn estimated into the system, and still this isn’t enough. Further, China is seeing the easing of credit lead to the flows into less productive price gains – witness the house price jump in the big cities with overall up 9.7% y/y. For the rest of the world, weaker Japan machinery orders, lower PPI, lower CPI in Europe and in the UK – all suggest that the disinflationary impulses from US/China trade, lower oil prices, lower global trade orders – all are in the works for 1Q and leave central bankers looking a bit overdone on their quest for normalization. ECB Draghi made that clear yesterday, Carney seems likely to say the same today and many of the Fed – including the hawkish Kansas City Fed President George yesterday pushed for a pause. We are in a world that is waiting for good news but can bear bad news until it overwhelms. Watch the USD/CNY as that barometer as the capital inflows that helped support it are clearly slowing and 6.71-6.73 holds.

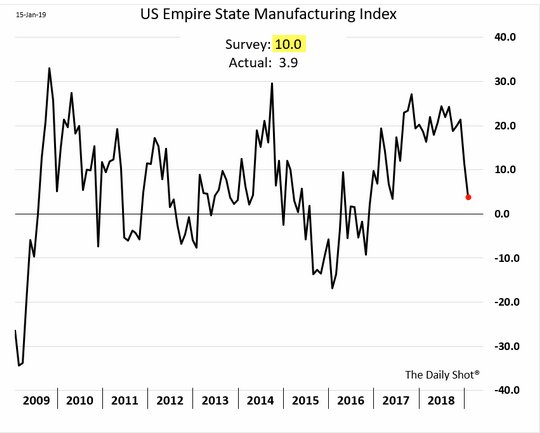

Question for the Day: Is the US government shutdown hurting growth expectations? The effect of the historic partial government shutdown on markets has been modest but now its beginning to hit at economic data releases and the information used by the FOMC to make its decisions. The feedback of private and their own surveys continue to show some economic strength for the consumer but the manufacturing sector – as shown from the NY Empire Fed yesterday is getting worse.

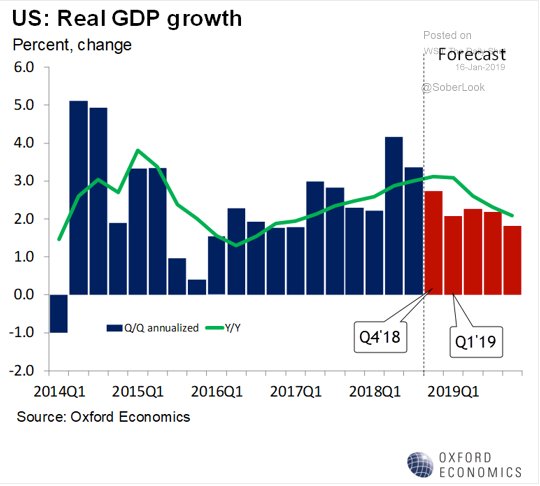

The other effect on GDP for a government shutdown is that the government spending shrinks (although it should bounce back for the workers backpay somewhat). The forecasts for GDP are beginning to get marked down accordingly. 4Q 2019 is consensus below 1.5%.

What Happened?

- Japan November machinery orders 0% m/m, 0.8% y/y after 7.6% m/m, 4.5% y/y – less than the 3.5% m/m expected. The orders from overseas (not reflected in the headline) were up 18.% m/m after 15.5% m/m. Also notable, non-manufacturing core orders were 2.5% m/m after 4.5% m/m.

- Japan December PPI -0.6% m/m, +1.5% y/y after -0.3% m/m, 2.3% y/y – less than the -0.3% m/m, 1.8% y/y expected. Export prices fell 1.1% m/m while import prices fell 3.4% m/m. The PPI drop was led by oil/coal and chemicals while electricity/gas and paper rose.

- China December house prices up 0.8% m/m, +9.7% y/y after 9.3% y/y – more than the 8.5% y/y expected. But the overall market remains under pressure with 59 out of 70 cities up m/m, off from 63 in November. Big cities rebounded leading the gain with Guangzhou up 3% m/m, Beijing up 2.3%, Shangahi up 0.4% m/m.. The smaller tier-2 provincial capitals and tier-3 cities that the official survey tracks posted a slightly smaller monthly price gain of 0.7%.

- German December final HICP unrevised at 0.3% m/m, 1.7% y/y after 0.1% m/m, 2.2% y/y – as expected. The national CPI also unchanged at 1.7% y/y after 2.3% y/y – as expected. For all of 2018, CPI rose 1.9% y/y – almost all because of energy up 4.9% y/y up from 3.1% in 2017.

- Italy December final HICP unrevised at -0.1% m/m, 1.2% y/y after -0.3% m/m, 1.6% y/y – as expected. The national CPI rose 1.1% y/y from 1.6% - also as expected.

- Italian November industrial sales rose 0.1% m/m, 0.6% y/y after 2.0% y/y while orders fell 0.2% m/m, -2% y/y after +1.8% y/y. Domestic orders -1.1% while foreign rose 1.1%.

- UK December CPI up 0.2% m/m, 2.1% y/y after 0.2% m/m, 2.3% y/y – less than the 2.2% y/y expected. The core CPI rose 0.3% m/m, 1.9% y/y after 1.8% y/y – more than the 1.8% y/y expected. The retail price index rose 0.4% m/m, 2.7% y/y after 3.2% y/y - less than the 2.9% y/y expected. The largest drop was from gasoline and airfairs while mobile phone charges, accommodations and food countered some of the weakness.

- UK December output PPI dropped -0.3% m/m, 2.5% y/y after revised 0.1% m/m, 3.0% y/y – less than the 0.1% m/m, 2.9% y/y expected. November revised lower as well from 3.1% y/y. The core PPI output rose 0.2% m/m, 2.5% y/y from 2.4% y/y – more than the 2.4% expected. The input PPI fell -1% m/m, 3.7% y/y after revised 5.3% y/y – more than the 3.5% y/y expected – but November revised down from 5.6% y/y,

0540 am German 30Y Bund sale

Market Recap:

Equities: The US S&P500 futures are up 0.15% after 1.07% gain yesterday. The Stoxx Europe 600 are up 0.2% with focus back on banks. The MSCI Asia Pacific was mixed with Japan and China dragging, up 0.1% overall.

- Japan Nikkei off 0.55% to 20,442.75

- Korea Kospi up 0.43% to 2,106.10

- Hong Kong Hang Seng up 0.27% to 26,902.10

- China Shanghai Composite flat at 2,570.42

- Australia ASX up 0.37% to 5,893.70

- India NSE50 up 0.03% to 10,890.30

- UK FTSE so far off 0.3% to 6,873

- German DAX so far up 0.2% to 10,915

- French CAC40 so far up 0.4% to 4,803

- Italian FTSE so far up 0.55% to 19,272

Fixed Income: Better risk despite mixed economic and political headlines driving bonds lower. Periphery gains on ECB Draghi – German 10-year Bund yields up 3bps to 0.24%, French OATs up 1bps to 0.64%, UK Gilts up 8bps to 1.34% - all about Brexit. Periphery gains with Italy off 5bps to 2.82%, Spain off 2bps to 1.38%, Portugal off 1bps to 1.64% and Greece off 3bps to 4.24%.

- US Bonds see curve steeper with FOMC pause pricing – 2Y up 3bps to 2.56%, 5Y up 3bps to 2.55%, 10Y up 4bps to 2.74%, 30Y up 4bps to 3.10%.

- Japan JGBs bid up on weaker data, curve flatter– 2Y off 1bps to -0.16%, 5Y off 1bps to -0.15%, 10Y flat at 0.01%, 30Y flat at 0.70%.

- Australian bonds lower on US and equities –3Y up 2bps to 1.81%, 10Y up 2bps to 2.31%.

- China bonds see curve flatten despite PBOC– 2Y flat at 2.69%, 5Y off 2bps to 2.93%, 10Y off 5bps to 3.11%.

Foreign Exchange: The US dollar index is flat at 96.06. In emerging markets, USD mixed – EMEA: RUB up 0.3% to 66.801, ZAR up 0.1% to 13.723, TRY up 1% to 5.39; ASIA: INR off 0.2% to 71.245, KRW flat at 1121.65

- EUR: 1.1400 off 0.1%. Range 1.1391-1.1425 with ECB and data pushing 1.1380 and 1.13 retest risks.

- JPY: 108.80 up 0.1%. Range 108.37-108.81 with USD gains despite weaker Nikkei as weaker Japan data hit. EUR/JPY 123.95 flat.

- GBP: 1.2860 flat. Range 1.2825-1.2896 with EUR/GBP .8865 off 0.1% - all about delay hopes for Brexit and UK May surviving.

- AUD: .7165 off 0.5%. Range .7165-.7212 with focus on commodities, China growth and weaker domestic. NZD off 0.75% to .6765

- CAD: 1.3280 up 0.15%. Range 1.3245-1.3283 with risk for 1.34 again – focus is on data and US rates again.

- CHF: .9885 up 0.1%. Range .9873-.9893 with EUR/CHF 1.1265 flat – all about risk mood still with .9920 resistance.

- CNY: 6.7585 flat. Range 6.7510-6.7790 with PBOC easing, Trade talk hopes moderating – 6.73-6.80 consolidation.

Commodities: Oil lower, Gold up, Copper up 0.2% to $2.68

- Oil: $51.93 off 0.3%.Range $51.71-$52.52. Brent off 0.05% to $60.60 with $61.22 highs – focus is on $52.50 in WTI and $62 in Brent. API report showed less of a drawdown in oil inventories -0.56mb after the previous week’s 6.27mb shock – less than the 3mb draw expected. EIA today will be watched accordingly.

- Gold: $1289.30 up 0.1%.Range $1288-$1292.50 with focus on USD and equities as driver still – stuck with $1285-$1300 consolidation. Silver flat at $15.61 Platinum up 0.4% to $803.20 and Palladium up 1% to $1290.20.

Economic Calendar:

- 0830 am US Dec import prices (m/m) -1.6%p -1.2%e / exports -0.9%p -0.6%e

- 1000 am US Jan NAHB housing index 56p 56e

- 1030 am US weekly EIA oil inventories -1.68mbp

- 0200 pm US Fed Beige Book

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.