Markets: Show Me

We all live in Missouri this morning, perhaps not Ohio or Kansas where voters yesterday left tight races. Missouri is the show-me state where you have to prove the facts before you trade them. The summer lull continues with less news continuing to support risk. The take-aways from economic data were 1) China trade isn’t yet hurt by the US tariffs – though imports are likely higher in anticipation of them. 2) Japan economic outlook is weak and BOJ talk of hiking rates seems far-off market. 3) Spanish and French economic data point to slowing growth. The global synchronized growth that start 2018 has become splintered and we live with idiosyncratic markets allowing traders to win but for the noise of central bankers and politicians. Here is the overnight list:

- Italy's Tria was reported to have said that they will go ahead with pension reform and repeats the government is not questioning the EUR. This led to further BTP buying and helped support EUR.

- BOJ Summary of Opinions saw only 1 member support -/+0.25% 10Y JGB yield range. This pushed USD/JPY down but was expected.

- RBA Lowe noted that he expected the next move in the cash rate will be higher, and that he sees no strong case for a near term adjustment. For the market, he expects inflation to be close to 2.5% by 2020, the most recent SOMP, which ran through to June 2020, had CPI at 2.25% at the end of the forecast range. This lifted AUD marginally.

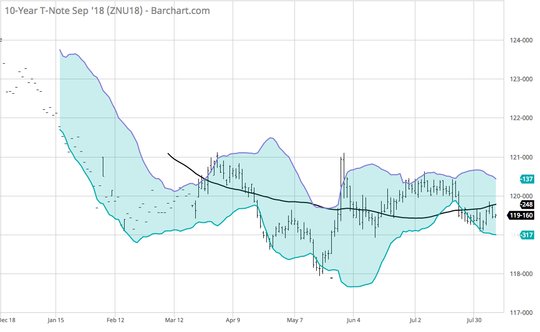

We are now in a “show-me” phase for markets to believe in bad news. The China trade data are not weak enough to give much credibility to the worst-case scenarios prices for a global trade war. However, there are plenty of other fears like inflation and growth out there that remain in play. The UK continues to lead the pain trade for FX with GBP at new yearly lows with 1.2750 in play again while NZD holds the G10 lead into the RBNZ meeting today. For most, the lack of big movements leave open hopes for carry trades, selling volatility and playing with bulls in equities. The only problem is in US rates where 3% 10Y looks vulnerable – particularly given Trump tweets for 5% GDP and the 10Y $26bn sale today. Time to go back to old school bond trading and look at the September futures – the skinny range looks set for a breakout.

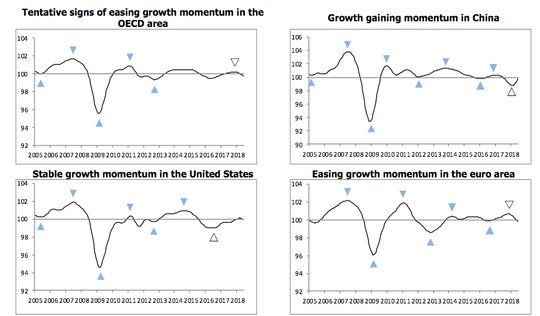

Question for the Day: Do the OECD composite leading indicators matter? The OECD August CLI reports out and it show easing growth momentum in Canada, Europe – with Germany, France and Italy slowing – along with the UK. There is stable growth in the US and Japan. China and India are gaining while Brazil and Russia easing. Does any of this matter to markets today? Probably not but it highlights the risks for Europe into a ECB potential taper and the tantrum that could follow may be troublesome for the world and politics again.

What Happened?

- BOJ July 30-31 meeting summary of opinions: One favored wider yield range. At the meeting, the BOJ board decided in a 7-to-2 vote to make its long-term interest rate target and asset purchases more "flexible," allowing the nearly flat Japanese government bond yield to steepen slightly in line with firmer growth and inflation. Some of the key points – 1) "The BOJ should introduce forward guidance for policy rates and strengthen its commitment to achieving the price stability target, in order to ensure public confidence in its strong stance toward achieving the target." 2) "In a situation where monetary easing is expected to continue, conducting yield curve control and asset purchases in a more flexible manner should be considered in order to adjust the policy framework so that it can function in a competent manner over the period of easing's duration."

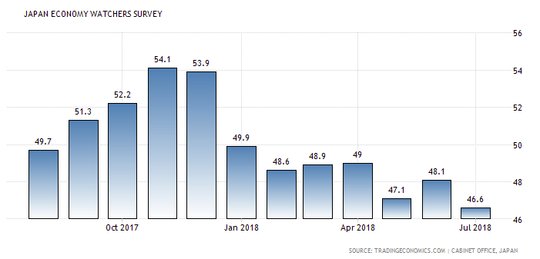

- Japan July Ecowatcher current index drops to 46.6 from 48.1 – weaker than 47.8 expected – 22-month lows. The outlook index fell to 49 from 50 – also weaker than 51 expected. Both fell for the first time in 2 months. The government noted that sentiment was hit by heat waves and rain disasters, while firms remain concerned about rising prices and labor shortages.

- Australia June home loans -1.1% m/m after +1.0% m/m - weaker than +0.1% expected. In trend terms, the number of loans fell 0.5% m/m in June, a small improvement from a 0.7% fall in May and the slowest pace of decline since October last year. In value terms, mortgages for both owner-occupier housing (-1.0% after +0.7%) and investment housing (-2.7% after -0.1%) fell in June. Loans for investment housing fell at a faster pace in June and was down four straight months.

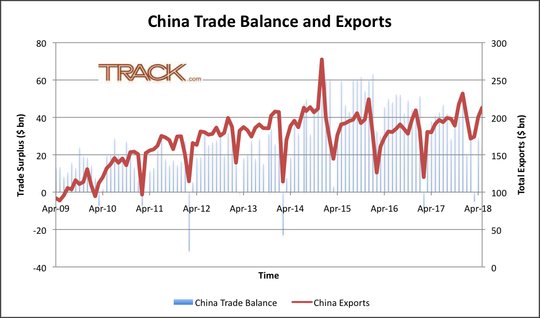

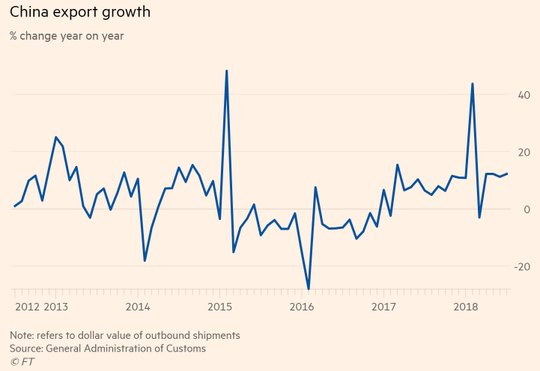

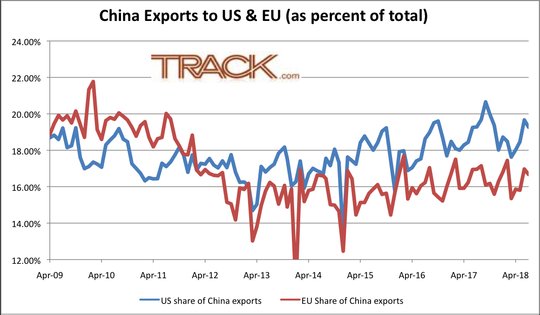

- China July trade surplus $28.05bn after $41.6bn – less than $36bn expected. Exports rose 12.2% to $215.57bn after 11.3% - more than the 10% expected while imports rose 27.3% y/y to $187.52bn after 14.1% y/y – more than the 17% y/y expected. This was the first month since tariffs on consumer goods, including cars, were cut. The s.a. exports were -1.9% m/m, 11.3% y/y after +5.7% m/m, 12.4% y/y while imports were -1.1% m/m, 22.6% y/y after +1% m/m, 23.5% y/y. In CNY terms exports were +6% y/y after 3% y/y while imports 20.9% y/y from 6% y/y. Exports to the U.S., against which China had traded tit-for-tat punitive tariffs, softened to $41.54 billion from the previous month of $42.62 billion. Imports from the EU and Japan both registered faster growth from the previous month - by 20.5% and 13.8% respectively, compared with -14.1% and -6.0%. This suggests that China is diversifying its sources of imports away from the U.S.

- RBA Lowe speech: Sees inflation near 2.5% in 2020. Over the forecast period, we expect inflation to increase further to be close to 2½ per cent in 2020. In the short term, though, we would not be surprised if headline inflation dipped a little, reflecting declines in some administered prices in the September quarter. Electricity prices in some cities have declined recently after earlier large increases, and changes in government policy are likely to result in a decline in child care prices as recorded in the CPI. There have also been changes to some state government programs that are expected to lead to lower measured prices for some services. Together, these changes mean that our forecast for headline inflation for 2018 is now 1¾ per cent.

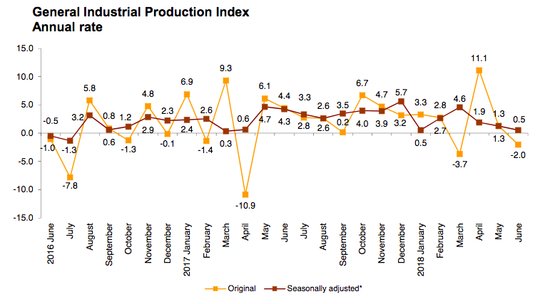

- Spain June industrial production +0.5% y/y after 1.6% y/y – weaker than 2% y/y expected. Energy output fell 8.6% y/y, intermediate goods +4% y/y, capital goods rose 4.1% y/y while consumer goods -0.9% y/y.

- Bank of France 3Q GDP forecast 0.4% q/q after July manufacturing climate index flat at 101,Services drop to 102 from 103, construction drops to 104 from 105. The manufacturing capacity utilization rose to 80.5% from 80.2%.

Market Recap:

Equities: US S&P500 futures are up 0.03% after a 0.3% gain yesterday. The Stoxx Europe 600 is flat at 390.60 after opening down 0.3%. The MSCI Asia Pacific fell 0.1% with China lagging.

- Japan Nikkei off 0.08% to 22,644.31

- Korea Kospi up 0.06% to 2,301.45

- Hong Kong Hang Seng up 0.39% to 28,359.14

- China Shanghai Composite off 1.23% to 2,745.11

- Australia ASX up 0.22% to 6,354.90

- India NSE50 up 0.53% to 11,450.00

- UK FTSE so far up 0.65% to 7,768

- German DAX so far off 0.1% to 12,632

- French CAC40 so far off 0.10% to 5,516

- Italian FTSE so far up 0.4% to 21,937

Fixed Income: Moderation into supply. EU opens bid – Germany sees bull flattening with 2Y yields off 0.5bps to -0.603%, 5Y off 1.5bps to -0.175% and 10Y off 1bps to 0.40%. French curve steeper with 2Y-10Y wider by 2bps to 112, 10Y yields flat at 0.73%. Italy continues to rally back with Tria comments with 10Y off 5bps to 2.82%, 30Y off 3bps to 3.55%. Spain flat at 1.39%, Portugal flat at 1.75% and Greece flat 3.99%. UK gilt curve flattened after supply and post BOE McCafferty talk of 2 more hikes. 10Y yields off 1bps to 1.32% touched 1.335% into sale.

- UK DMO sold GBP2.5bn of 10Y 1.625% Oct 2028 Gilts at 1.458% with 2.25 cover and 0.2bps tail.

- Greece sold E812.5bm of 13-week Nov 9, 2018 T-bills at 0.65% with 1.71 cover– previously 0.65% with 1.54 cover.

- US Bonds flat into 10Y supply– 2Y flat at 2.67%, 5Y off 1bps to 2.83%, 10Y flat at 2.97%, 30Y flat at 3.12%.

- Japan JGBs see modest curve steepening into 30Y sale tomorrow, BOJ summary seen as expected – 10Y yields flat at 0.115%, 40Y touched 1%. BOJ Rinban left 1-10Y buying unchanged and demand cover also steady.

- Australian bonds track US yields, RBA Lowe as expected. 3Y up 1bps to 2.105%, 10Y up 1.5bps to 2.675%.

- China PBOC skips open market operations again, leaves liquidity neutral. Money market rates mixed with O/N off 18bps to 1.404% while 7-day rose 1bps to 2.26%. 10Y bonds up 2bps to 3.52%.

Foreign Exchange: The US dollar index is up 0.2% to 95.20. In Asia, EM FX, USD mixed– KRW off 0.2% to 1120.80, TWD off 0.1% to 30.605 while INR off 0.1% to 68.6450. In EMEA, USD bid– RUB off 1.9% to 64.734, ZAR off 0.6% to 13.414, TRY off 1.5% to 5.3035.

- EUR: 1.1595 flat. Range 1.1581-1.1629. Sideways trading with 1.1550-1.1620 key still. Rates and risk mood driving.

- JPY: 111.00 off 0.3%. Range 110.83-111.48 with EUR/JPY 128.75 off 0.3%. BOJ summary wasn’t scary enough so 111 holding with 110.70 test failed leaves 111.50-80 risk.

- GBP: 1.2865 off 0.5%.Range 1.2860-1.2983 with EUR/GBP .9010 up 0.35%. Brexit politics continues to drive with new yearly low and 1.2750 target.

- AUD: .7410 off 0.1%. Range .7409-.7440. NZD .6740 flat. RBA Lowe speech ignored, China trade better than feared, waiting for RBNZ.

- CAD: 1.3085 up 0.1%.Range 1.3050-1.3087. Reversal from 1.2961 lows opens risk for 1.32 again. Oil/Nafta/Rates.

- CHF: .9960 flat.Range .9930-.9969 with EUR/CHF 1.1550 flat. Nothing to see here.

- CNY: 6.8313 fixed 0.17% strongerfrom 6.8431, trades stronger to 6.8140 from 6.8340 yesterday close but now off 0.1% to 6.8330. CNH off 0.3% to 6.84.

Commodities: Oil up, Gold up, Copper off 0.6% to $2.7655

- Oil: $68.75 off 0.6%.Range $68.70-$69.37. Brent off 0.2% to $74.35. WTI watching $69.92 Monday highs against Friday $67.87 lows and 100-day at $67.29. API reported a larger than expected oil draw but surprise gasoline build. EIA expected to show 2.2mb draw today.

- Gold: $1211.50 up 0.15%.Range $1210.50-$1215.80. Silver up 0.3% to $15.37. Platinum up 0.6% to $831.40, Palladium up 0.1% to 902.90.

Conclusions: Is the US losing out to Europe in the China trade skirmish? The China surge in imports from Japan and Europe was a highlight of the report overnight but the chart that remains at the heart of the Trump strategy is about exports. Here China remains vulnerable and the CNY continues to be in play for 7.00.

Economic Calendar:

- 0830 am Canada June building permits 4.7%p -0.2%e

- 0845 am Richmond Fed Barkin speech

- 1030 am US weekly EIA crude oil inventories 3.803mb p -1.5mb e

- 0100 am US 10Y $26bn note sale

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.

Many thanks Sir for your wonderful information