Markets: Quicksand

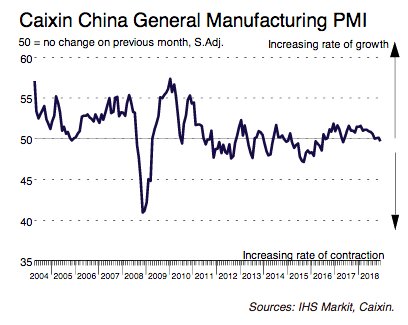

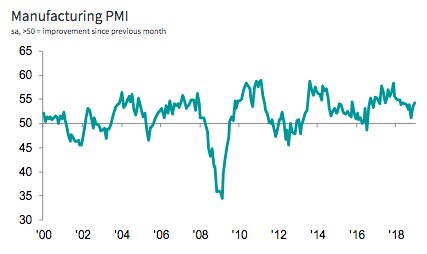

2019 isn’t going to be like 2018. The fear of a recession, the drop in confidence as shown in global PMIs, ongoing political stalemate as shown by the US government shutdown continuing, the threat of a bear market in equities all play out as we start 2019. There is a fear about China growth that permeates the markets today as the PMI there shows more weakness and the usual year-end boom to spend didn’t happen.

There is also a fear about China debt as its growth rate is necessary to support employment and the servicing of corporate leverage. The quicksand fears about debt are rising with the ongoing doubts about the US Fed pausing. Perversely, better US data won’t make any of this better. There is some relief today as many see the ongoing US government closure are hurting real growth and driving the yield curve flatter if not inverting as ugly politics leave little confidence in quick fixes.

Thrashing about in quicksand makes it worse and the US debt story isn’t getting any better either. Growth outlooks are the focus for today and the servicing of debt fears puts any carry trade into reverse. Risk off in Asia followed through to Europe but to a much less panicky start which maybe the best we can get for the moment. Slowing growth makes the soft patch of 4Q seem likely to extend to 1Q but just how much and how bad markets can be remains in the hands of central bankers and politicians. The risk barometer of choice, the JPY/USD is telling us to act slowly to buy any dip and to beware of bulls offering a fast fix to the present quicksand. This makes the holiday there and the absence of the BOJ even more problematic and opens 108.40 then 106.75 into the rest of the week.

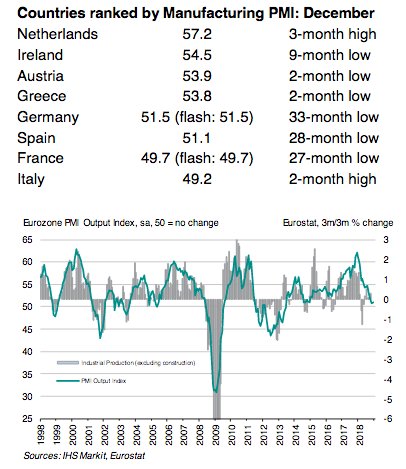

Question for the Day: When does a soft patch become quicksand? Today is about the US and China growth projections into 2019 and the PMI reports behind them. The fear of a European soft-patch leading to an ECB policy mistake continues and spreads to the FOMC and PBOC. There is little hope for a Powell S&P500 put so markets take defensive measures still. The US data this week matters and the ISM will be just the start. Fear of stronger US data making it more difficult maybe something to watch. Soft-patches and quicksand are hard to distinguish.

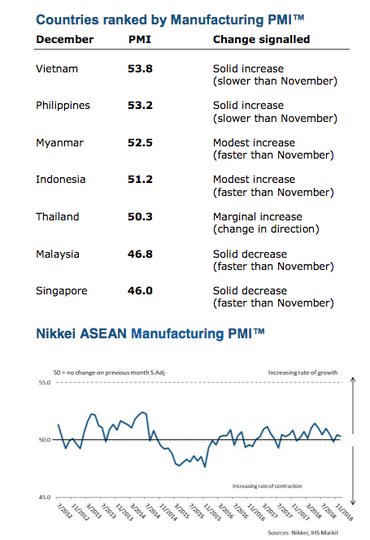

The present outlook for ASEAN PMI is a case in point and one to watch as it maybe a better reflection of real pain from trade and weaker China demand than the China PMI reports. There is a clear differentiation over oil price weakness and lower labor costs in this group and that maybe the take-away for investors into 2019 looking for EM value plays. Markets are afraid of a recession but this report is more about a soft patch.

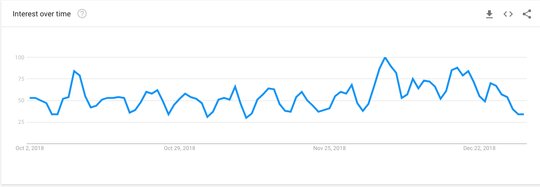

The most interesting chart from Google trends to consider is the one that worries markets the most – recession risks – and that suggests that perhaps the public confidence isn’t quite as bad as that of the market today.

What Happened?

- China December Caixin manufacturing PMI drops to 49.7 from 50.2 – weaker than 50.1 expected – first contraction in 19 months. New orders also fell for the first time in 2 ½ years while new export orders continued to shrink for the 9thmonth. However, production rose slightly. Employment continues to fall with efforts to reduce operating costs. Average input costs fell for the first time in 1 ½ years while output prices fell for the 2ndmonth. Confidence rose to 3 month highs.

Eurozone December manufacturing PMI 51.4 from 51.8 – same as flash – weakest since Feb 2016. 4Q average was the worst production since 2Q 2013. New work fell for the third consecutive month while confidence hit new 6-year lows. New export orders led the drop with Germany at 6-year lows. Inventories rose and backlog of work narrowed for the 4th month to Nov 2014 levels. French protests and auto companies dealing with new emission standards were notable issues but Brexit, China trade and politics drive weaker confidence.

- Spain manufacturing PMI 51.1 from 52.6 – weaker than 52.4 expected – worst since Aug 2016

- Italy manufacturing PMI 49.2 from 48.6 – better than 48.7 expected – confidence remains a 6-year lows

- France manufacturing PMI 49.7 from 50.8 – same as 49.7 flash – first contraction in 27-months

- German manufacturing PMI 51.5 from 51.8 – same as 51.5 flash – 33-month lows.

- UK December manufacturing PMI 54.2 from 53.6 – better than 52.5 expected – 6-month highs. However, the 4Q average was the worst since 3Q 2016. New orders drove the December gains – rising to 10-month highs some of which was related to disruption fears. Brexit related concerns also drove up inventories – most since May 2018. Confidence was only marginally above the 27-month lows of November. Input prices ease to 2½ year lows.

Market Recap:

Equities: The US S&P500 futures are off 1.5% after a 0.8% gain Monday. The Stoxx Europe 600 is off 0.8% while the MSCI Asia Pacific is off 1.7% with Japan closed.

- Japan Nikkei closed for holiday

- Korea Kospi off 1.52% to 2,010

- Hong Kong Hang Seng off 2.77% to 25,130.35

- China Shanghai Composite off 1.15% to 2,465.29

- Australia ASX off 1.47% to 5,625.60

- India NSE50 off 1.08% to 10,792.50

- UK FTSE so far off 0.7% to 6,680

- German DAX so far off 0.1% to 10,549

- French CAC40 so far off 1.4% to 4,666

- Italian FTSE so far off 1.3% to 18,092

Fixed Income: Weaker PMI and weaker equities driving bonds with big technical breakouts. German 10-year Bund yields off 9bps to 0.16%, French OATs off 5bps to 0.66%, UK Gilts off 7bps to 1.20% while periphery follows with Italy off 8bps to 2.71%, Spain off 2bps to 1.4%, Portugal off 2bps to 1.71% and Greece flat at 4.38% (despite stronger PMI).

- US Bonds see curve flatter, belly invert again– 2Y off 2bps to 2.49%, 5Y off 5bps to 2.48%, 10Y off 6bps to 2.65% and 30Y off 2bps to 2.99%.

- Japan JGBs closed on holiday– 10Y at 0% key for BOJ

- Australian bonds rally with Asia weakness– 3Y off 6bps to 1.77%, 10Y off 9bps to 2.23%

- China bonds rally sharply with weaker PMI, equities– 2Y off 8bps to 2.81%, 5Y off 5bps to 2.97% and 10Y off 5bps to 3.20%.

Foreign Exchange: The US dollar index is up 0.1% at 96.28

- EUR: 1.1435 off 0.2%. Range 1.1422-1.1497 with 1.15 capping rally still and focus on ECB after weaker PMI reports. 1.13 still base.

- JPY: 109.15 off 0.5%. Range 108.71-109.43 with 108..80 pivotal still and 105 risk in play. Too far too fast fears and BOJ watch.

- GBP: 1.2660 off 0.6%. Range 1.2659-1.2773 with Brexit, EUR driving with PMI ignored. 1.25-1.28 consolidation

- AUD: .7010 off 0.5%. Range .7007-.7045 with China weakness and commodity pain driving .6880 next big target. NZD off 0.1% to .6705

- CAD: 1.3630 off 0.1%. Range 1.3569-1.3639 with focus on rates, oil and BOC reaction function to data ahead.

- CHF: .9845 up 0.1%. Range .9796-.9851 with EUR/CHF 1.1255 off 0.1%.

- CNY: 6.8680 flat. Watching PBOC and PMI against weaker USD in Asia with JPY leading. 6.83 key against 6.92.

Commodities: Oil lower, Gold higher, Copper off 0.5% to $2.6170.

- Oil: $44.96 off 1%. Range $44.41-$46.00. Brent off 0.8% to $53.36 with focus on equities, Russia and US supply with $45 pivot for $43-$46 consolidation in WTI

- Gold: $1288.60 up 0.5%. Range $1280.8-$1291 with equities driving over USD moves. $1300 next key with $1268 base building. Silver flat at $15.51 with $15.20 base. Platinum off 0.5% to $796.70, Palladium off 0.25% to 1194.30.

Economic Calendar:

- 0930 am Canada Dec manufacturing PMI 54.9p 54e

- 0945 am US Dec manufacturing PMI 55.3p 53.9 flash

- 1000 am US Dec manufacturing ISM 59.3p 58e

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.