Markets: Peaks

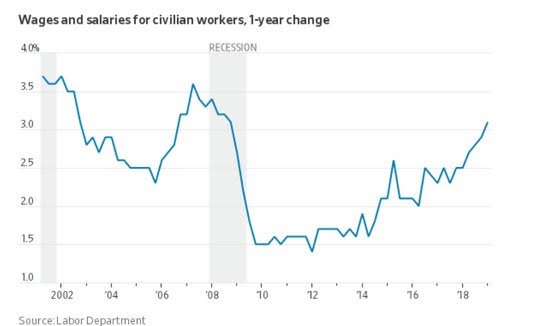

Knowing if you are at the peak starts with checking out to see if there is a ceiling or a taller peak to consider, it ends with looking down as the descent is always harder, if not faster. I spent much of one summer hiking a good part of the Appalachian Trail from Georgia to Maine. You learn about peaks and valleys with your boots as they move from blisters to callouses. The rythem of markets is much the same. The December valley, the January peak – the February confusion – as the trail isn’t so obvious ahead. We are on the razor path between fear and greed as the global slowdown clearly accelerates in January even as trade deal hopes, Fed pauses and China stimulus counter punch. The gloomy global PMI reports are important as they are forward-looking, yet today is more about the backward story of US jobs and the noise around the 5-week government shutdown, cold weather and the ugly politics. Markets are geared up to be stuck as the technical resistance in the S&P500 make any return to the previous peak less obvious. The FOMC outlooks for 2019 and beyond US growth suggest the Trump inspired 3% plus GDP from tax reform and deregulation has peaked. The balancing act of the jobs report rests on the peak in employment against its cost. The availability for new workers and their cost matters to how companies plan the year but the lower CPI from Korea to the flash EU HICP suggest we are also at a peak. The surge in lending in China also appears to be peaking – as usual into the new year holiday – with Reuters reporting that the PBOC told banks to moderate the pace of loans. At the same time, Beijing consumers were given an incentive to buy TVs and refrigerators this week. The lower China PMI and the reversal of the CNY put that back as a key driver for risk post the US jobs report given the Xi/Trump meeting is now the next moment for investors to see if trade fears have truly peaked. The sharp reversal in CNY today merits attention to all that are comfortable with 2800 S&P500 bull targets.

Question for the Day: Do the US payrolls matter or is this all about US/China trade? The rally up in risk in oil and equities in January stands out and the Fed pause, end of the US government shutdown and the prospects for an end or extended truce to US/China trade tariffs drove much of the market even as the global picture on growth peaked. The swing in mood maybe a good place to think about how the non-farm payrolls fits into the picture. There is one big risk today in the wage components as higher labor costs will give the FOMC less patience should financial conditions return to a more steady and easy state. The power of China growth and trade concerns to keep US prices in check seems less obvious and most likely reflected in business investments. The ability to call a peak in Fed hikes rests on the participation rate in the US, the average hourly earnings and the hours worked. As usual, the jobs report looks key to trading even as the uncertainty over the numbers thanks to the government shutdown increases.

What Happened?

- Korea January CPI -0.1% m/m, 0.8% y/y after -0.3% m/m, 1.3% y/y – less than the +0.2% m/m, 1.7% y/y expected. Core (ex food and energy) rose 0.2% m/m and 1% y/y.

- Korea January trade surplus shrinks to $1.34bn from $4.3bn – smallest since Feb 2014 – as exports -5.8% y/y after -1.2% y/y – worse than the +3.3% expected. Imports fell 1.7% after +1.2% y/y – better than the -5.5% y/y expected.

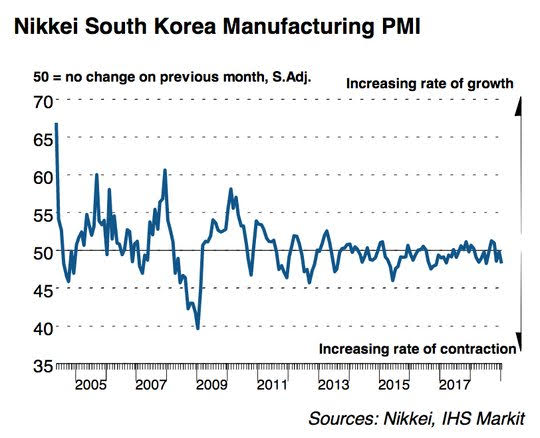

- Korea January manufacturing PMI 48.3 from 49.8 – weaker than 50 expected – sharpest downturn since Nov 2016. Export sales off for 6th month, output and new orders drop faster, confidence near record lows with higher labor costs, weaker domestic demand and trade driving.

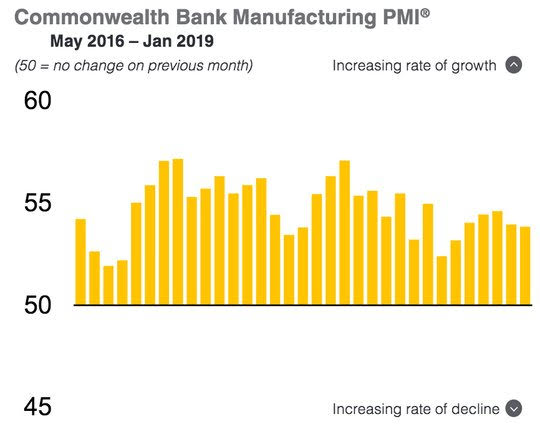

- Australia January final CBA manufacturing PMI 53.9 from 54 – weaker than 54.3 flash – lowest since Aug 2018. The output and orders rose but at a modestly slower rate, confidence rose, but so did inventories.

- Australia January AIG manufacturing PMI 52.5 from 50 revised – better than 51 expected. December revised higher from 49.5. 6 of the 7 activity indexes were higher, with export orders improving.

- Australia 4Q PPI 0.5% q/q, 2% y/y after 0.8% q/q, 2.1% y/y – slightly more than the 0.4% q/q, 1.9% y/y expected. Domestic PPI rose 0.4% q/q while imports rose 0.6% q/q.

- Japan December unemployment rate drops to 2.4% from 2.5% - better than 2.5% expected- 26 year lows. The jobs-to-applicants ratio steady at 1.63. The employment rose 1.7% up 1.14mn y/y while unemployment fell 8.6% off 150,000. Labor forece participation is up 0.9% to 61.4% y/y.

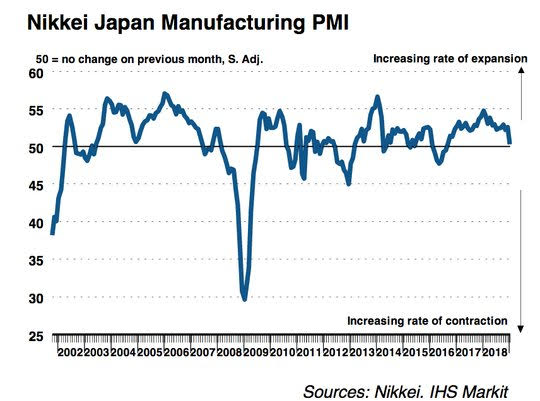

- Japan January final Nikkei manufacturing PMI 50.3 from 52.6 – better than 50 flash – but still 29-month lows. New export orders fell at fastest rate since July 2016. Business confidence drops for 8th month.

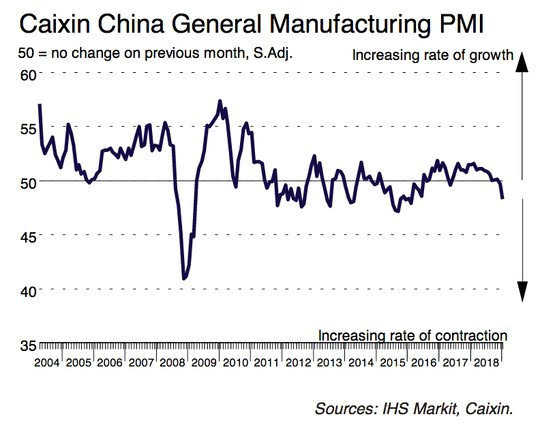

- China January Caixin manufacturing PMI 48.3 from 49.7 – worse than 49.7 expected– with production and new orders slightly lower even with higher export orders, first fall in purchasing in 20-months but optimism was the best since May 2018.

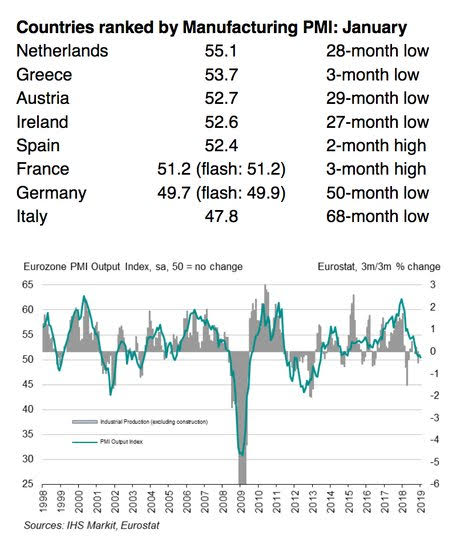

- Eurozone January final manufacturing PMI 50.5 from 51.4 – same as flash. New work drops to April 2013 lows. Growth was sustained from backlogs and inventory building. This was the 6th month of declines overall. Manufacturing is near a recession in Europe.

- Spain manufacturing PMI 52.4 from 51.1 – better than 50.5 expected – optimism at 6-month highs, output and new orders higher.

- Italy manufacturing PMI 47.8 from 49.2 – worse than 48.8 expected – worst since 2013 with new orders and output both weaker

- France final manufacturing PMI 51.2 from 49.7 – same as flash – output fell along with new orders

- German final manufacturing PMI 49.7 from 51.5 – weaker than 49.9 flash – biggest drop in new orders in 6-years, blamed on trade, autos

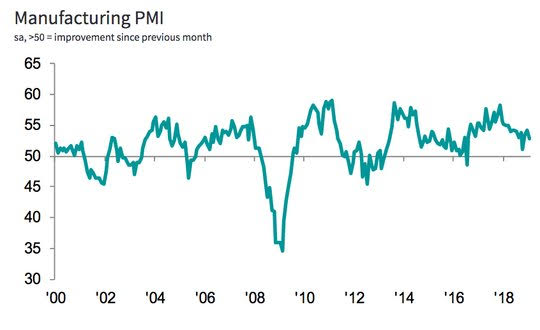

- UK January manufacturing PMI 52.8 from 54.2 – weaker than the 53.5 expected – second worst since July 2016. New order inflows drop and stock-building rose – export orders were near stagnation. Business outlook fell to 30-month lows with Brexit, EU growth and FX cited.

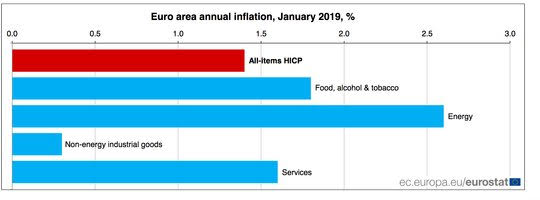

- Eurozone January flash HICP slows to 1.4% y/y after 1.6% y/y – as expected – however, the core HICP rose to 1.1% from 1.0% y/y - more the 1% expected. Energy was up 2.6%, food up 1.8%, services 1.6% and industrial goods just 0.3% y/y.

Market Recap:

Equities: The US S&P 500 futures are off 0.05% after up 0.86%. The Stoxx Europe 600 is up 0.1% and the MSCI Asia Pacific is up 0.1% with China easing hopes.

- Japan Nikkei up 0.07% to 20,788.39

- Korea Kospi off 0.06% to 2,203.46

- Hong Kong Hang Seng off 0.04% to 27,930.74

- China Shanghai Composite up 1.30% to 2,618.23

- Australia ASX off 0.03% to 5,935.30

- India NSE50 up 0.58% to 10,893.65

- UK FTSE so far up 0.6% to 7,012

- German DAX so far flat at 11,170

- French CAC40 so far up 0.2% to 5,002

- Italian FTSE so far off 0.3% to 19,665

Fixed Income: The weaker data meets the new month payback. Equities being mixed leave the same for bonds. German 10Y Bund yields are off 2bps at 0.16%, UK Gilts flat at 1.22% and France flat at 0.56%. Periphery mixed with Italy hit on banks up 15bps to 2.75%, Greece up 9bps to 3.97%, Spain up 1bps to 1.22% and Portugal up 1bps to 1.64%.

- US Bonds bid with flatteners into jobs – 2Y flat at 2.46%, 5Y flat at 2.44%, 10Y off 1bps to 2.63% and 30Y off 1bps to 2.99%.

- Japan JGBs are bid with growth doubts driving, curve flattens – 2Y off 1bps to -0.17%, 5Y off 2bps to -0.17%, 10Y off 2bps to -0.01%, 30Y off 5bps to 0.60%.

- Australian bonds bid on China PMI – 3Y flat at 1.76%, 10Y off 3bps to 2.21%.

- China bid with PBOC easing talk, curve steeper – 2Y off 2bps to 2.68%, 5Y off 2bps to 2.91%, 10Y up 2bps to 3.15%.

Foreign Exchange: The US dollar index off 0.1% to 95.52. In emerging markets, USD bid with Asia – INR off 0.45% to 71.27, KRW off 0.15% to 1113.25, led by CNY off 0.5% to 6.7425. In EMEA same – RUB off 0.15% to 65.431, ZAR off 0.1% to 13.263, TRY off 0.6% to 5.195

- EUR: 1.1470 up 0.2%. Range 1.1434-1.1475 with focus on EU PMI and ECB vs US jobs and the FOMC with 1.1420-1.1500 hot spots.

- JPY:108.90 flat. Range 108.72-108.97 EUR/JPY 124.90 up 0.3%

- GBP: 1.3065 off 0.35%. Range 1.3043-1.3115 with 1.30 in play and EUR/GBP .8780 up 0.55%

- AUD: .7260 off 0.15%. Range .7237-.7278 with NZD .6920 up 0.1% - weaker A$ data and China driving with .73 cap

- CAD: 1.3140 up 0.15%. Range 1.3121-1.3158 with GDP weak enough and oil less key market watching jobs and 1.305-1.325 for direction.

- CHF: .9930 off 0.1%. Range .9922-.9958 with EUR/CHF 1.1390 up 0.1%

- CNY: 6.7340 up 0.5%. Range 6.6960-6.7420 with the weaker PMI and less clarity on trade driving with 6.75 pivot.

Commodities: Oil mixed, Gold up , Copper off 0.6% to $2.7565

- Oil: $53.74 off 0.1%. Range $53.37-$54.19 with $55 target tested and still key. Brent $60.94 up 0.2% with $62 key – all about OPEC and Russia output vs. US and global demand

- Gold: $1326.30 up 0.1%. Range $1321.30-$1326.60 with $1315-$1340 keys and USD driving. Silver $16.02 off 0.35%, Platinum $826 up 0.15% and Palladium up 0.8% to $1310.

Economic Calendar:

- 0830 am US Jan non-farm payrolls 312k p 160k e / unemployment rate 3.9%p 3.8%e / hourly earnings 0.4%p 0.3%e / gov jobs 11k p -10k e

- 0930 am Canada Jan RBC manufacturing PMI 53.6p 53.9e

- 0945 am US Jan final manufacturing PMI 53.8p 54.9e

- 1000 am US Jan manufacturing ISM 54.1p 54.1e

- 1000 am US Jan final Univ. Michigan consumer sentiment 98.3p 90.7e

- 0300 pm US Jan total vehicle sales 17.55mn p 17.2mn e

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.