Markets: Neutral

Not doing anything isn’t the same as actively trying to make things better. The spin on markets today is that neutral is enough but for many the uncertainties over geopolitics and policies supporting growth gnaw away at the latest joy from the FOMC turnabout from normalization to neutral. It’s not a surprise that the Fed pauses and shows patience after 9 hikes. The confirmation of the FOMC moving from tightening to neutral bias was sufficient for a risk-on rally in the US to 2-month equity highs, it continued in Asia bringing further relief to shares from Japan and China but it stalls in Europe. The significant data overnight explains some of the divergences. Korea and Japan both saw lower industrial production, the BOJ meeting summary highlights the doubts from US/China trade disruptions and how its hitting the consumer. The drop in inflation in Europe makes clear that the ECB isn’t going to get to target in 2020 and it begs the question of them doing enough. The China NBS PMI was good enough to squash the worst fears about imminent economic slowing but make clear that its more about US/China trade deals still. Further deregulation of foreign investment rules (combining QFII schemes) may help, but better Alibaba profits maybe more important than either amidst a host of warnings on earnings from other Chinese companies. The German retail sales collapse, the as expected 0.2% q/q Eurozone GDP crawling at 4-year lows and confirmation that Italy is in a technical recession – all these economic data points make clear that neutral in the US maybe less than needed elsewhere. Throw in the pesky political stories from populist politics to Brexit and you get the sense that the USD dip from yesterday maybe more consolidation in trend and that the bulls for the EUR will just have to wait it out further. Spain’s far-right Vox party surges in the latest polls even as the socialist remain in the lead. UK gets a EU counter offer on Irish backstops contingent on a permanent customs union. The French, UK, and German set up a non-USD trade mechanism with Iran. These aren’t the stories to inspire confidence that Europe will attract new growth and investment over and above the usual noises of month end. The EUR is the bellwether to watch today with any failure at the 1.1535 resistance essential to the view that neutral FOMC is more important than a confused ECB.

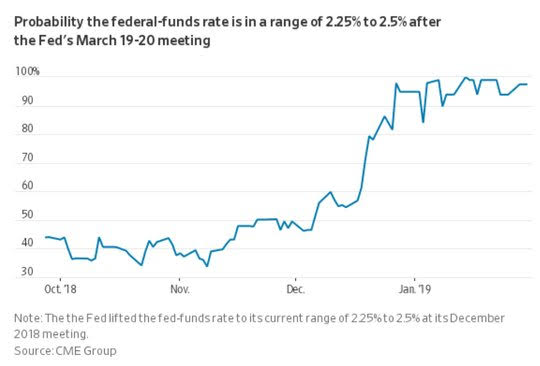

Question for the Day: Is the FOMC neutral bias sufficient to keep the risk-on rally intact? The probability of the FOMC doing nothing in 2019 is prices. Markets have led the FOMC thinking as shown. Many would suggest that the fears of a recession in late 2019 or early 2020 have changed accordingly. This leaves the feedback loop of policy and expectations in play with the ECB talking about the potential need for more stimulus, with the PBOC doing perpetual bond swaps and with the BOJ and others continuing their plans to buy bonds – we are still in a world of easy money.

The issue for investors rests on the growth outlook for the US post this FOMC shift in bias. There is every reason to believe that the overshoot in selling risk in December has been corrected in January. This leaves less room for error in economic and earnings forecasts going forward. The Fed downgraded its assessment like the street – we have moved from “strong” to “solid.” What hasn’t happened is that uncertainty over data may drive volatility higher even as risk on positioning returns. As the FOMC warned – “The timing and size of future adjustments to the target range for the federal-funds rate" will be determined by economic data, the statement said.

What Happened?

- Korea December industrial production -1.6 m/m, +1.6% y/y after -1.6% m/m, +1.1% y/y – worse than the -0.2% m/m, 1.7% y/y expected – linked to export sector as semiconductors were down 4.5% m/m, autos off 5.9% mm. Trend industrial production was -0.6% m/m, +0.3% y/y. Production in service sector fell 0.3% m/m dues to information and communication. The manufacturing production was -1.8% m/m, +2% y/y after 1.3% y/y.

- Japan December industrial production -0.1% m/m, -1.9% y/y after -1% m/m, +1.5% y/y – weaker than -0.4% m/m, +3% y/y expected. The drop was led by production machinery, chemicals and electric parts while general machinery, autos, and information rose. Inventories rose 1% m/m, 1.3% y/y while shipments rose 0.3% m/m, -2.8% putting ratios up 2.2% m/m, 4.6% y/y.

- Japan BOJ summary of opinions from 22-23 January: Notes uncertainties from US/China trade, consumer sentiment drop. Amid the heightening uncertainties concerning the global economy and the scheduled consumption tax hike in Japan consumption of nondurable goods has not moved off its bottom. It also is concerning that indicators of consumer sentiment have weakened somewhat.

- BOJ Amamiya: Sees economy expanding moderately with virtuous cycle for corporates and households. The corporate sector sees exports and production increasing despite hit from natural disasters in 3Q. This drives household sector improvement with labor market tightness eventually leading to better wages.

- Australia December private sector credit 0.2% m/m, 4.3% y/y after 0.3% m/m, 4.4% y/y - - less than 0.3% m/m, 4.5% y/y expected. The housing credit growth was up 0.3% m/m same as November, while personal -0.4% m/m after -0.3% m/m, and business slowed to +0.3% m/m after 0.5% m/m.

- China January NBS manufacturing PMI 49.5 after 49.4 – better than the 49.3 expected – 4-month highs. New orders expanded the most since September (51.0 vs 50.4 in December), while softer declines were recorded in both new export orders (49.5 vs 49.0) and employment (48.6 vs 48.5). In terms of prices, input cost inflation rose to a three-month high (52.0 vs 50.1), while output charges continued to fall (49.8 vs 47.6). Looking ahead, business sentiment eased (59.6 vs 60.8). The services PMI rose to 54.7 from 53.8 – also better than the 53.9 expected.

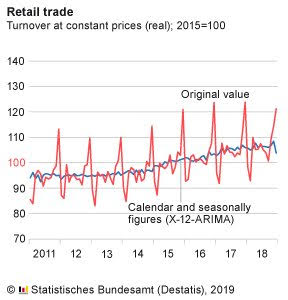

- German December retail sales -4.3% m/m, -2.1% y/y after revised +1.6% m/m, +1.9% y/y – worse than the -0.7% m/m expected. This was the first drop since September and the worst fall since May 2007.

- German January unemployment falls -2,000 after-14,000 – worse than the -10,000 expected. The unemployment rate was unchanged at 5% with 2.26mn.

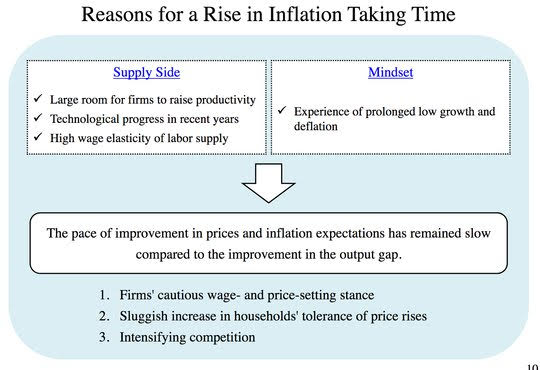

- French January flash CPI -0.5% m/m, 1.2% y/y after 0% m/m, 1.6% y/y – lower than the -0.2% m/m, 1.4% y/y expected. The flash HICP drops to 1.4% y/y from 1.9% y/y – as expected.

- Spain January flash CPI -1.3% m/m, 1% y/y after -0.4% m/m, 1.2% y/y – less than the -1.2% m/m, 1.1% y/y expected. The flash HICP fell -1.7% m/m, 1.0% y/y after 1.2% y/y.

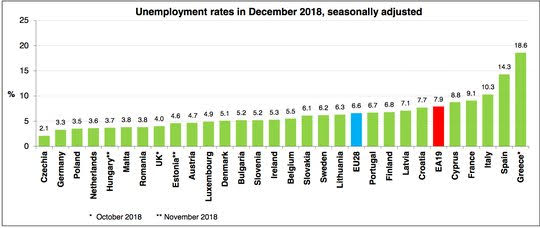

- Eurozone December unemployment rate unchanged at 7.9% - as expected – best since Oct 2008. There were estimated 12.919mn jobless in December, down 75,000 on the month and off 1.174mn for the year. Youth unemployment down to 16.6% to 2.391mn.

- Italy December unemployment rate 10.3% after 10.5% - better than the 10.6% expected. Employment rose 23,000 up 0.1% while jobless fell 44,000 off 1.6% m/m.

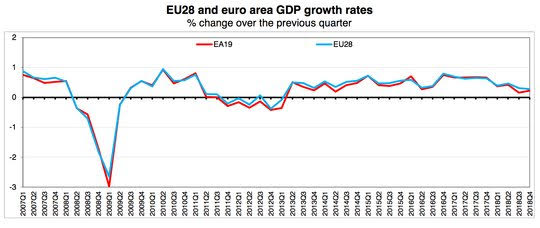

- Eurozone 4Q flash GDP 0.2% q/q, 1.2% y/y after 0.2% q/q, 1.6% y/y – as expected.

- Spain 4Q flash GDP up 0.7% q/q, 2.4% y/y after 0.6% q/q, 2.4% y/y – better than the 0.6% q/q expected. The household consumption slowed to 0.5% from 0.8% while government rose to 1.2% from 0.8%. Gross capital formation -0.2% after +0.8% while trade added with exports +1.9% after -0.9% and imports up 1.1% after -0.2%.

- Italy 4Q flash GDP -0.2% q/q, +0.1% y/y after revised -0.1% q/q, 0.6% y/y – worse than the -0.1% q/q, +0.3% y/y expected. From the demand side, there is a negative contribution by the domestic component (gross of change in inventories) and a positive one by the net export component

Market Recap:

Equities: US S&P500 futures are up 0.1% after at 1.55% FOMC inspired rally. The Stoxx Europe 600 is up 0.1% with big turnaround in DAX and focus early on telecoms. The MSCI Asia Pacific rose 1%.

- Japan Nikkei up 1.06% to 20,773.49

- Korea Kospi off 0.06% to 2,204.85

- Hong Kong Hang Seng up 1.08% to 27,942.47

- China Shanghai Composite up 0.35% to 2,584.57

- Australia ASX off 0.23% to 5,937.30

- India NSE50 up 1.68% to 10,830.95

- UK FTSE so far up 0.55% to 6,980

- German DAX so far up 0.1% to 11,188

- French CAC40 so far up 0.25% to 4,986

- Italian FTSE so far off 0.4% to 19,690

Fixed Income: Post FOMC catch up mixes with data to push EU bond buying. German 10-year Bund yields are off 1bps to 0.18%, French OATs off 1bps to 0.58%, UK Gilts off 2bps to 1.24%. Periphery mixed with Italy flat at 2.6%, Spain off 4bps to 1.23%, Portugal off 3bps to 1.66% and Greece off 4bps to 3.88% - breaking 3.90% looks important.

- US Bonds are bid still with FOMC and data driving – 2Y off 3bps to 2.5%, 5Y off 3bps to 2.47%, 10Y off 3bps to 2.67% and 30Y off 3bps to 3.02%.

- Japan JGBs track US and watch BOJ – 2Y off 1bps to -0.17% - good 2Y sale – 5Y off 1bps to -0.16%, 10Y flat at 0.01% and 30Y off 1bps to 0.66%.

- Australian bonds see modest rally back – 3Y off 1bps to 1.76%, 10Y flat at 2.25%.

- China bonds rally with focus on trade talks/FOMC – 2Y off 2bps to 2.70%, 5Y off 1bps to 2.92% and 10Y off 1bps to 3.13%.

Foreign Exchange: The US dollar index is off 0.05% to 95.30. In EMEA EM – RUB up 0.1% to 65.31 and ZAR up 0.7% to 13.25; ASIA – INR up 0.1% to 71.129, KRW up 0.2% to 1113.

- EUR: 1.1495 up 0.15%. Range 1.1472-1.1514 with 1.1535 and 1.1550 next resistance and focus on US data, rates.

- JPY: 108.60 off 0.4%. Range 108.52-109.07 with EUR/JPY off 0.3% to 124.85. The focus is on US rates and USD weakness elsewhere but 110 holding means 108 break opens 106.

- GBP: 1.3135 up 0.15%. Range 1.3106-1.3157 with EUR/GBP .8755 with Brexit deal hopes ongoing and 1.3050-1.3250 the keys.

- AUD: .7275 up 0.4%. Range .7242-.7280 with commodities and US rates key. .7350 nest. NZD up 0.4% to .6920 with .6880 base key for .70 barrier.

- CAD: 1.3140 off 0.1%. Range 1.3120-1.3155 with BOC and GDP key today but 1.3050 pivotal base to watch.

- CHF: .9925 off 0.15%. Range .9920-.9942 with EUR/CHF 1.1410 – ECB doing more a risk and bank focus not helping. 1.00 still key.

- CNY: 6.7040 off 0.2%. Range 6.69-6.7110 with 6.70 breaking opening 6.63 next.

Commodities: Oil up, Gold up, Copper up 0.2% to $2.7670

- Oil: $54.29 up 0.1%. Range $53.92-$54.69 with EIA showing less of a build yesterday, weather and equities and USD weakness doing the rest - $55 next key – with Brent $61.85 up 0.5% with $62 still the pivot for $63.50.

- Gold: $1328.60 up 1%. Range $1322.20-$1329.50 with $1310 base and $1340 target – Russia and China buying story with FOMC shift driving. Silver $16.11 up 1.15% with $16 the base to watch. Platinum up 1.1% to $825 and Palladium $1332.70 up 1.25%.

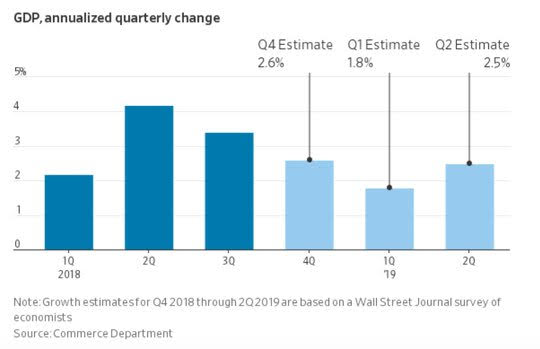

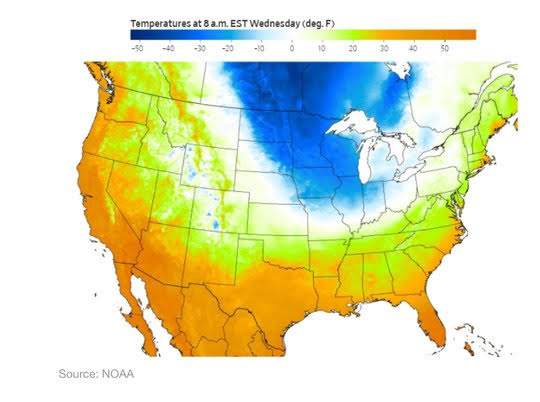

Conclusions: Does the Polar Vortex mean more 1Q troubles? The risk of further noise to 1Q GDP is heating up as the temperatures fall in the US Midwest. The weather forced states of emergency in Wisconsin, Michigan and Illinois, as windchill temperatures plunged to minus 50 degrees Fahrenheit across much of the Chicago area and near minus 70 across parts of the upper Midwest. Thousands of flights and trains were canceled.

Economic Calendar:

- 0830 am Canada Nov GDP (m/m) 0.3%p 0.1%e

- 0830 am Canada Dec PPI (m/m) -0.8%p +0.1%e (y/y) 2.8%p 3%e

- 0830 am US 4Q employment costs 0.8%p 0.8%e

- 0830 am US weekly jobless claims 199k p 211k e

- 0945 am US Jan Chicago PMI 65.4p 62.3e

- 1245 pm Canada BOC Wilkins speech

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.