Markets: Mourning

The US remembers its 41st President today and markets are closed for a day of mourning, while the rest of the world reacts to yesterday’s US reversal of risk-mood and seeks understanding. There are five steps to grief – denial, anger, depression, bargaining and acceptance.The markets are somewhere in the anger and depression stages. Blame for the reversal rests on Trump’s tariff man tweet and the further inversion of the US 2-5Y curve, throw in ongoing equity market rotations from growth to value along with increased volatility and you see a market in mourning. The undoing of the Trump/Xi euphoria isn’t a surprise, but it is a disappointment – this is the slap of reality that the goldilocks narrative of benign central bankers and steady growth truly is a fairy tale.

If you can’t have a bed-time tale, then there is always the newspapers. But, markets want to read the sports page first to celebrate the victorious and leave the front-page disasters for later. So today depends are what you read – where OPEC works on a deal to cut output by 1.3mb a day, but still needs Russia to have it work; where China is “confident” of a trade deal with the US; where Italy expects to get new budget numbers next week; where any twist on the UK Brexit leads to someone losing, either through messy politics or messy trade. The UK maybe the best place to focus on for lessons about grief as they have had two years to mourn the vote to divorce from the EU and yet no acceptance yet.

The GBP looks noisy as the worst outcome for UK May increasing the hope for remaining in the EU and reversing the entire mess – many analysts are moving the odds for another referendum and new elections higher. All of which makes the GBP 1.2650 or 1.2850 levels look more important than usual in the context of trading risk into the weekend and next Monday’s vote.

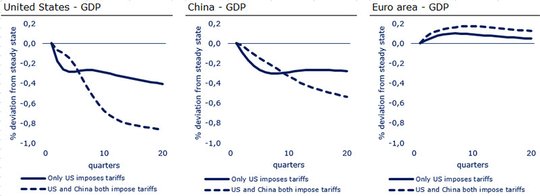

Question for the Day: Does the US/China trade war hurt Europe? The trade war truce and the talks that follow from the US Trump and China Xi G20 dinner are still the main focus for trading markets. The ability to have any edge over outcomes seems limited given the opaque nature of the discussions. The latest research on the effects of trade wars and global economies is filled with gloom and this is part of the story behind risk-on and off market movements. The one new twist on trade analysis came from the Dutch Central Bank last month– its worth considering – here is their point - A trade war between the United States and China is set to cause serious damage to both countries. The euro area may be able to benefit temporarily, provided it does not get involved.

The figure above illustrates the macroeconomic impact of a trade war between the United States and China. We first assume that only the United States imposes a 10% tariff on all US imports from China (solid lines). In a second scenario, we assume that China retaliates by imposing an equal tariff on all Chinese imports from the United States, i.e. on all US exports to China with a three-month delay (dotted lines). Figure 1 shows the impact on gross domestic product (GDP) in each of the regions.

What Happened?

- Australia November Services PMI 55.1 from 51.1 – better than 51 expected – 5-month highs. There was expansion of 5 of the 9 sectors. Communication services rose 1.6 to 55.8, but property services moderated despite customer demand off 1.3 to 51.8, other drops were in Insurance -2.2 to 46.9, wholesale trade -1.7to 48.3, health/education off 1.3 to 56.9 while strongest sector, hospitality, rose 2.1 to 62.6. Notable also that employment fell 4.4 to 52.9 and input prices fell 3.4 to 59.4 while selling prices rose 2 but are still contracting at 47.8. Sales rose 8.8 to 54.5 and new orders rose 9.4 to 56.8.

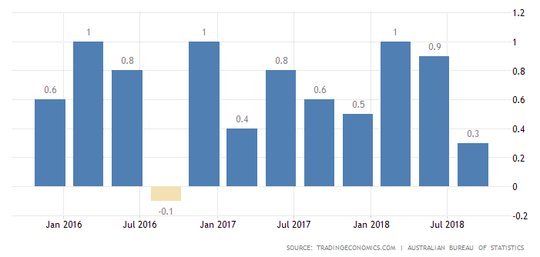

- Australia 3Q GDP rose 0.3% q/q, 2.8% y/y after 0.9% q/q, 3.1% y/y – weaker than 0.6% q/q, 3.3% y/y expected – worst in 2-years. Final household consumption +0.3% q/q, 3.1% y/y – this added 0.2pp to headline – while trade added 0.3pp to growth – mostly due to drop in imports - as terms of trade rose 0.8% q/q, 2.7% y/y. Capex rose just 0.1% q/q, 1.3% y/y – subtracting 0.2pp from growth. Inventories subtracted 0.3pp from growth.

- Japan November Services PMI fell to 52.3 from 52.4 – down from 6-month highs. Business confidence rose to 10-month highs with elevated demand helping. The Composite PMI fell to 52.4 from 52.5 – still near 5 ½ year highs.

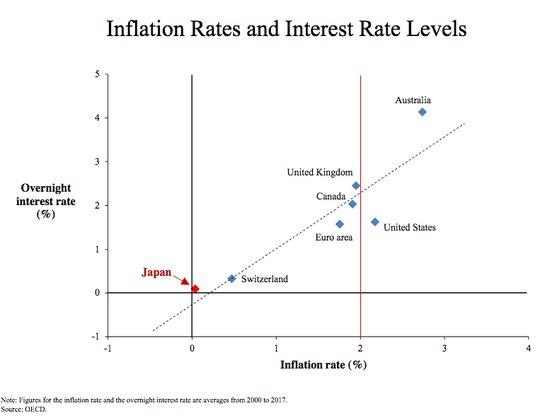

- BOJ Wakatabe: Inflation just halfway to target. "In a case where downward pressure is exerted on the economy again, it may revert to deflation," he warned. "The bank will encourage a rise in the inflation rate to the level that is appropriate for the economy by continuing large-scale monetary easing with the aim of achieving 2 percent inflation." In doing so, the effectiveness of the policy on inflation and the impact on the financial markets and system should be examined closely.

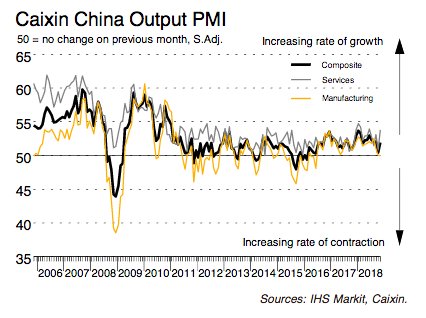

- China November Caixin Services PMI jumps to 53.8 from 50.8 – better than 50.7 expected – best in 5-months. The Composite PMI rose to 51.9 from 50.5 – better than 50.5 expected – signaling modest expansion. Services saw export sales rise, new orders rose for 2nd month but outstanding business fell for 3rd month. Input costs rose, output prices were unchanged. Confidence for Services was weakests since July – with many citing concern over future demand and competition.

- India RBI leaves rates unchanged at 6.5%- as expected. The central bank repeated its target of 4% inflation target to support growth. They noted slowing global economic forces, based on weaker trade and lower demand. The drop in oil also noted, and rally back in INR. RBI noted strong domestic demand in India and strong business confidence.

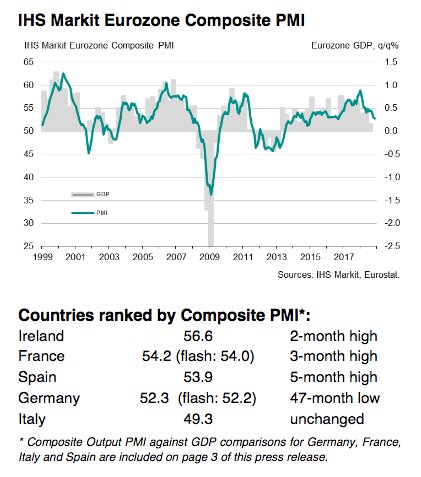

Eurozone November final Composite PMI 52.7 from 53.1 – better than 52.4 flash. The Services PMI 53.4 from 53.7 – also better than 53.1 flash – but still the lowest in over 2-years. Weakness was centered in Germany while France saw gains, Spain was steady and Italy rose slightly. Energy continued to add to input prices, but output prices also rose. Increased volumes helped further job creation but its at six-month lows. Business confidence fell to Aug 2016 lows.

- Spain Nov Services PMI 54 unchanged– better than 53.6 expected – with new work best in 6-months and employment stronger.

- Italy Nov Services PMI rose to 50.3 from 49.2 – better than 49.2 expected – but new orders slow to 45-month lows.

- France Nov final Composite PMI rose to 54.2 from 54.1 – better than 54 flash The Services PMI fell to 55.1 from 55.3 – better than 55 flash

- German Nov final Composite PMI 52.3 from 53.4 – better than 52.2 flash – still near 4-year lows. The Services PMI 53.3 from 54.7 – same as flash

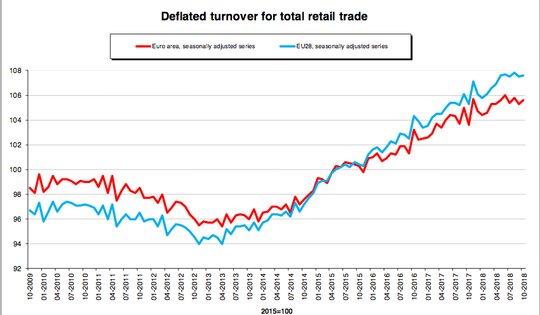

- Eurozone October retail sales rise 0.3% m/m, 1.7% y/y after revised -0.5% m/m, +0.3% y/y – weaker than 0.2% q/q, 2.1% y/y expected. Auto fuels rose 1%, food up 0.6% while non-food products -0.1% m/m. Best gains in Eurozone sales were in Portugal up 2.3% m/, Austria up 1.6% while weakest was Finland -2% m/m. In EU28, Denmark and Sweden both saw -1.2% m/m sales.

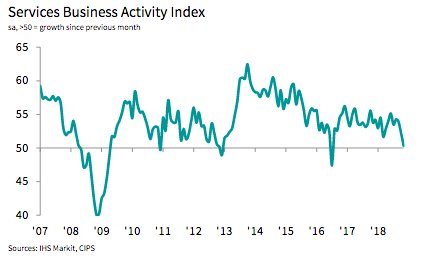

- UK November Services PMI 50.4 from 52.2 – weaker than 52.5 expected – worst since July 2016. Both business activity and incoming new work fell to 2 ½ year lows. Firms noted Brexit uncertainty delaying business decisions. Optimism for 12M forward moderated again to lowest since July 2016 as well. The IHS economist Williamson noted this implies 0.1% q/q growth in 4Q with risks tilted to the downside. The UK composite index also fell to 51 from 52.2 – the worst since July 2016.

Market Recap:

Equities: The US S&P500 futures are off 0.5% after losing 3.24% yesterday. The Stoxx Europe 600 is off 0.8% - worst drop in 2 weeks. The MSCI Asia Pacific fell 1.1% - worst drop in 2 weeks. The MSCI EM fell 1.2% - also the worst drop in 2 weeks.

- Japan Nikkei off 0.53% to 21,919.33

- Korea Kospi off 0.62% to 2,101.31

- Hong Kong Hang Seng off 1.62% to 26,819.68

- China Shanghai Composite off 0.61% to 2,649.81

- Australia ASX off 0.83% to 5,749.10

- India NSE50 off 0.80% to 10,782.90

- UK FTSE so far off 1.15% to 6,943

- German DAX so far off 0.80% to 11,243

- French CAC40 so far off 0.9% to 4,968

- Italian FTSE so far flat at 19,353

Fixed Income: UK Gilts again the focus with Brexit moods driving – 10Y yields are up 5bps to 1.325%, while periphery rallies with Italy budget hopes – Italy off 8.5bps to 3.065%, Spain off 3bps to 1.45%, Portugal off 1.7bps to 1.7% and Greece off 7bps to 4.125%. The core EU bonds are higher on spreads – German Bunds up 0.5bps to 0.265%, French OATs up 0.5bps to 0.67%.

- Spain sold E1.146bn of 10Y 1.4% 2028 bonds at 1.456% with 1.93 cover – the previous sale was E1.305bn with 1.607% yield and 1.57 cover. Spain sold E1.274bn of 5Y 0.35% 2023 bonds at 0.412% with 1.65 cover – previously 0.565% with 1.95 cover. Spain also sold 3Y 0.05% 2021 bonds at 0.021% with 3.65 cover – previously 0.102% with 2.17 cover.

- US Bonds closed for holiday

- Japan JGBs rally as risk off mood extends, curve steeper– 2Y off 0.8bps to -0.146%, 5Y off 0.7bps to -0.124%, 10Y off 0.5bps to 0.056% and 30Y flat at 0.78%.

- Australian bonds rally with weaker 3Q GDP, risk-mood shift– 3Y off 2bps to 1.96%, 10Y off 3bps to 2.50%.

- China PBOC skips open market operations for 29th day. Bonds continue to rally with PBOC RRR easing expectations – 2Y off 12bps to 2.63%, 5Y off 8bps to 3.035%, 10Y off 11bps to 3.24%.

Foreign Exchange: The US dollar index is off 0.1% to 96.88 with 96.83-97.19 range. USD mixed with EMEA: ZAR up 0.7% to 13.756, TRY up 0.85% to 5.341, RUB up 0.2% to 66.72; ASIA: TWD off 0.35% to 30.79, KRW off 0.75% to 1114, INR flat at 70.467.

- EUR: 1.1355 up 0.1%. Range 1.1317-1.1358 with USD weakness still in play – 1.13-1.14 keys – watching Italy vs UK outcomes.

- JPY: 112.95 up 0.15%. Range 112.65-113.12 with EUR/JPY 128.25 up 0.25% - despite equities – USD bounce in Asia with 112.50 key

- GBP: 1.2770 up 0.4%. Range 1.2672-1.2798 with EUR/GBP .8830 off 0.3% - all about Brexit and 1.2650-1.2825 range consolidation – downtrend intact

- AUD: .7295 off 0.6%. Range .7282-.7356 with GDP driving reversal and .7250 key. NZD off 0.1% to .6925 with .6950 key.

- CAD: 1.3280 up 0.1%.1.3253-1.3295 with oil and BOC the key – market ready for nothing today but January guidance essential.

- CHF: .9975 flat. Range .9970-1.0005 with EUR/CHF 1.1325 up 0.1% - watching Italy and UK then equities with 1.00 pivot.

- CNY: 6.8476 fixed 0.67% stronger– but now off 0.3% to 6.8565 with range 6.8441-6.8726.

Commodities: Oil lower, Gold lower, copper lower -0.3% to $2.8350.

- Oil: $53.17 off 0.2%.Range $52.16-$53.42 with OPEC focus – then USD and equities. Brent off 0.3% to $61.88. Techincals point to $60-$62.50 consolidation.

- Gold: $1237.50 off 0.1%.Range $1235-$1239 with focus on USD and equities as drivers and $1225 base for $1248 test. Silver off 0.3% to $14.48 with $14.50 pivot. Platinum off 0.6% to $799.70 and Palladium up 1.45% to $1250.20.

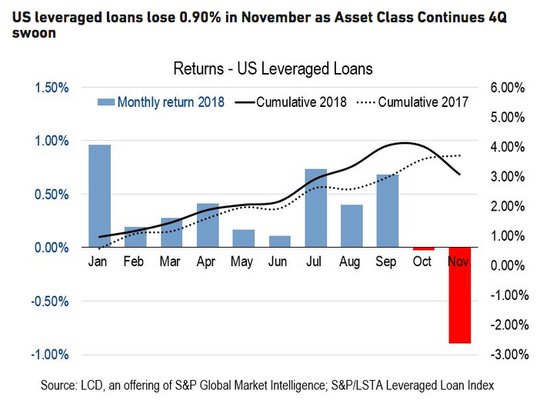

Conclusions: Is the US in a credit crunch? The reversal of forturn in US shares has been linked to trade and yield curve inversions, but the stock market rotations and credit concerns are flashing yellow as well. The leveraged loan losses from November merit some attention. Its worth considering as year-end likely brings another squeeze for debtors.

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.