Markets: Monkeys

There is a volatility virus in the present markets as good news and bad news are amplified beyond the expected trading ranges leading to manic depressions. Today and perhaps the entire week is euphoric after the blues from Friday and Monday. The 1995 Terry Gilliam film 12 Monkeys maybe the right way to think about today. We are in a new world traveling back in time to fix the inevitable haunted by our own demise. The film is also intended to be a study of people's declining ability to communicate in modern civilization due to the interference of technology – something to which we can all relate with in 2018. But today is 12/12 – Doble Doceday – where anything is possible if you think beyond the linear progression of time and place. The headlines are a mix of good and bad news with the US/China trade talk hopes ongoing after a Trump interview suggested he may intervene for the Huawei CFO while the UK PM likely faces a leadership challenge and the risk of a new election mixes badly with the rising fear of a no-deal Brexit. The best way to monitor the madness of the moment isn’t in watching the VIX or in tracking the USD but rather looking at the GBP/JPY trend – where JPY reflects rates, trade worries, and global growth and GBP reflects the carry trade, geopolitical fears and the BOE policy risks. This is a market that is going lower and seems even with the 0.85% bounce today to be set up for more pain.

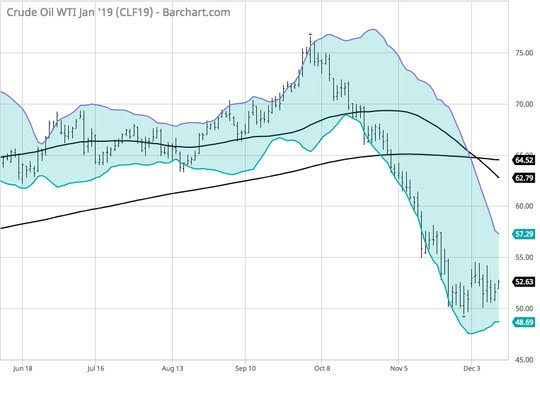

Question for the Day: Is Oil more important for 2019 than rates? What drives the market fears for 2019 is growth and politics, but behind the fears are doubts about policy – as the ECB sets up for a path to normalization. The deflationary effects of lower oil prices matter here – as oil reflects demand and supply. The OPEC monthly released today sheds light on both of these factors. The role of lower prices in October and November will be felt in 2019 and the reaction function of central bankers will follow. Markets are stuck waiting for US CPI today and the ECB tomorrow but they maybe wise to watch the oil market after those events as one of the keys to unlocking value in the new year. Rates reflect the risks of a policy mistake, of US deficits, of US growth doubts and of the fear of geopolitical pressures. Oil may be leading those risks.

What Happened?

- Australia December Westpac consumer confidence rises 0.1% to 104.4– better than 0.3% drop expected. Some of the subindices were more subdued: Finances vs. a year ago fell 1.9% - reversing some of the 4.9% gain in November – while 12M forward outlook fell -0.6% after +3.2%. Consumer outlooks on the economy rose 0.1% but 5Y forward fell 1.5% after 9.7% gain in November. Time to buy a delling fell 3.9% after a 4.2% gain. Unemployment expectations also rose 0.5% after falling 7.8%.

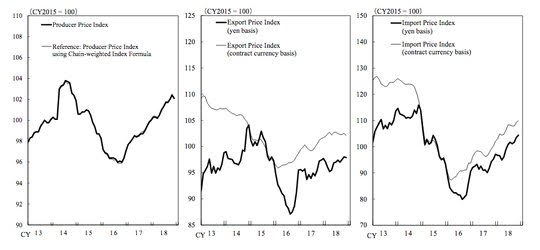

- Japan November corporate PPI -0.3% m/m, 2.3% y/y after +0.4% m/m, 3% y/y – less than the -0.1% m/m, 2.4% y/y expected. Export prices -0.1% m/m, +0.5% y/y while import prices rose 0.9% m/m, 9.5% y/y. Much of the drop was due to oil and coal accounting for -0.31% while electricity, water was up 0.05%.

- Japan October core machinery orders bounce up 7.6% m/m, 4.5% y/y after -18.3% m/m, -7% y/y – weaker than +10.5% m/m, 5.9% y/y expected. Total orders rose 19.5% m/m after revised -17.8%.

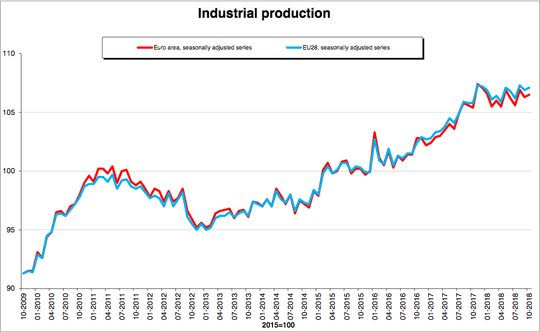

- Eurozone October industrial production rose 0.2% m/m, 1.2% y/y after -0.6% m/m, +0.8% y/y – better than 0.8% y/y expected. Capital goods up 1%, durable consumer goods up 0.4%, intermediate goods up 0.2% and consumer goods flat. Energy fell 1.7%

Market Recap:

Equities: The S&P500 futures are up 0.9% after being flat yesterday. The Stoxx Europe 600 is up 1.3% while the MSCI Asia Pacific rose 1.3%.

- Japan Nikkei up 2.15% to 21,602.75

- Korea Kospi up 1.44% to 2,082.57

- Hong Kong Hang Seng up 1.61% to 26,186.71

- China Shanghai Composite up 0.31% to 2,602.15

- Australia ASX up 1.35% to 5,727.30

- India NSE50 up 1.79% to 10,737.60

- UK FTSE so far up 1.3% to 6,895

- German DAX so far up 1.2% to 10,909

- French CAC40 so far up 1.9% to 4,897

- Italian FTSE so far up 1.7% to 18,903

Fixed Income: Risk-on drives fixed income with US focus – as 5Y belly reverses from inversion. The EU focus is on ECB tomorrow and Italy hopes rising – German 10-year Bund yields up 2bps to 0.25% - crisis level of 0.20% averted again – while French OATs are off 1bps to 0.70% as Macron wins confidence and UK Gilts are up 4bps to 1.23% as risk fears rise over government. Periphery runs higher – Italy off 14bps to 2.98% - 3% break important technical – Spain off 5bps to 1.40%, Portugal off 7bps to 1.70% and Greece flat at 4.25% - the exception to rule with politics key.

- US Bonds are waiting for CPI with curve steeper– 2Y flat at 2.77%, 5Y up 1bps to 2.75%, 10Y up 1bps to 2.90%, 30Y up 1bps to 3.14%.

- Japan JGBs sold with equities ignoring economic blues– 2Y flat at -0.14%, 5Y up 1bps to -0.12%, 10Y up 2bps to 0.06% and 30Y up 1bps to 0.80%.

- Australian bonds are mixed with focus on China still– 3Y up1 bps to 1.96%, 10Y flat at 2.46%.

- China bonds see curve steeper– 2Y off 1bps to 2.78%, 5Y flat at 3.02% 10Y up 1bps to 3.30%.

Foreign Exchange: The US dollar index is off 0.1% to 97.26.

- EUR: 1.1350 up 0.3%- still watching 1.13 but topside 1.1420 now pivot

- JPY: 113.35 flat. Focus is on 114 again for break out.

- GBP: 1.2585 up 0.8%with bounce from lows 1.2474 more important as 1.24 support and barrier plays out with waiting game for politics.

- AUD: .7205 flat. Watching .7180-.7250 still – commodities key. NZD off 0.6% to 0.6830 – with crosses driving.

- CAD: 1.3375 off 0.1%.Oil and data driving with 1.3420-50 cap for 1.33 retest.

- CHF: .9940 up 0.1%.Focus is on .9850-1.000 still with cross driving as Italy fears unwind further.

- CNY: 6.8850 off 0.3%.CNY bid on trade deal hopes with 6.83 next key.

Commodities: Oil up, Gold up, Copper off 0.4% to $2.7905.

- Oil: $52.29 up 1.8%.Range $51.91-$52.80 with $52 the pivot for $55 retests – OPEC monthly and EIA keys for today. Brent up 1.5% to $61.17 with $62 key.

- Gold: $1246 up 0.3%.Range $1245-$1248. USD and rates back in play but bias is for $1236 retest. Silver up 0.7% to $14.62.

Conclusions: Does the CPI help the market today? CPI today was as expected with core up 0.2% m/m, 2.2% y/y up from 2.1% while the headline drops to 2.2% from 2.5% y/y. The risk of a December FOMC hike is higher because of this and the stock market bounce. Hope is that the oil market price drop feeds into an easier inflation story in 1Q and should growth flip down further, the FOMC blinks in 2019. How this plays out will be more important to risk trading.

Economic Calendar:

- 0830 am US Nov CPI (m/m) 0.3%p 0%e (y/y) 2.5%p 2.2%e / core 2.1%p 2.2%e

- 1030 am US weekly EIA oil inventory -7.322mb p +2mb e

- 0100 pm US sells $16bn of 30Y bonds

- 0200 pm US Nov budget statement -$100bn p -$188bn e

- 0300 pm Brazil COPOM interest rate decision – no change from 6.5% expected.

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.