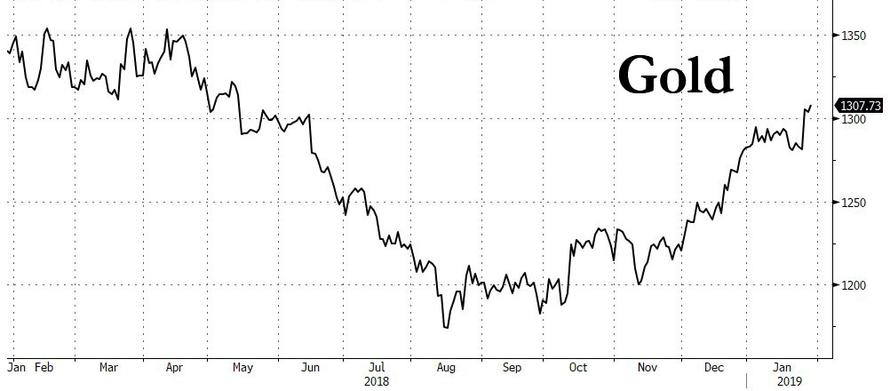

Markets Mixed Ahead Of Barrage Of News As Gold Hits 6 Month High

In a session that has seen global markets drift around ahead of a barrage of key events and gold climb to a seven-month high...

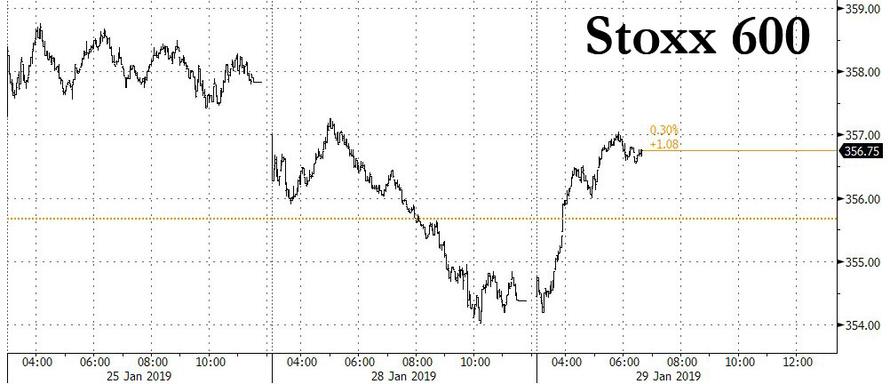

... European stocks reversed modest early losses to trade 0.8% higher, with UK’s FTSE 100 rising 1.4% as cable fluctuated ahead of today's "Plan B" Brexit vote, with S&P futures erasing early losses in Asia to trade flat, some 12 points off sessions low as markets opted for caution before three major macro events and a blizzard of big tech company earnings in the coming days.

Despite the upcoming action - a key Brexit vote in the UK, Wednesday’s Fed decision, Thursday’s conclusion of the latest Sino-U.S. trade talks and Friday's payrolls - European and Asian stocks held up relatively well, however news that the U.S had leveled charges against China’s telecom giant Huawei days before the next round of trade talks between Washington and Beijing knocked sentiment. That, however, was offset by promises of more economic stimulus from China, which had berated Washington on Monday for blocking the appointment of judges for its World Trade Organisation appeal against U.S. tariffs.

As SocGen's Kit Juckes writes overnight, traders are puzzled by various market inconsistencies, with more questions about what's NOT happening in markets than about what is going on, such as: "Why didn't Mario Draghi's admission of downside economic surprises weaken the euro? And why didn't the end of the US government shutdown give Treasury yields a nudge higher?"

In short, markets are in limbo, waiting for new news and with the FOMC and the payroll data due later this week.

“Investors are very cautious with many uncertainties on U.S.-China trade talks and Brexit. Huawei is at the center of dispute, creating very noisy background for the trade talks,” said Margaret Yang, a market analyst at CMC Markets. “All these are making it more difficult for investors to judge the market’s direction. Money is fleeing into assets such as gold, seeking safety.”

Indeed, as noted above it was a mixed picture across global stock markets on Tuesday, with European shares climbing, U.S. futures trimming a drop and Asian equities slipping as investors juggled concerns about the fallout from America’s trade war with China against hopes for progress in this week’s talks offset by yesterday's criminal charges against Huawei and formally seeking the extradition of its CFO. Personal goods and travel companies were among the biggest gainers in the Stoxx Europe 600 Index as most sectors turned higher following a directionless start.

Meanwhile, in the US, Dow Jones, S&P 500 and Nasdaq futures all showed U.S. stocks were heading for a lackluster open especially after poor guidance by 3M and Pfizer, as focus turned to Apple’s earnings report. PG&E tumbled in pre-market trading after the U.S. utility sought bankruptcy protection with $52 billion in debt.

Markets will have more catalysts this week with over 100 of the S&P500 companies reporting results, including Amazon, Apple and Facebook. Overnight on Wall Street, the Dow and S&P 500 each closed down 0.8 percent and the Nasdaq was off more than 1 percent. The losses came after Caterpillar and Nvidia Corp joined a growing list of companies cautioning about the crippling effects of softening Chinese demand.

In Asia, shares were mixed, with losses for Australia and New Zealand, with their benchmark indices down 0.5 percent and 1.2 percent respectively. Japanese and Chinese stocks both recovered from early wobbles to finish in the green. Technology stocks underperformed after American prosecutors filed criminal charges against Huawei. Worryingly, earnings at China’s industrial firms shrank in December, pointing to more troubles for the country’s vast manufacturing sector, which are already struggling with a decline in orders, job layoffs and factory closures.

China Foreign Ministry expressed serious concern regarding US charges on Huawei and its CFO, whilst strongly urging the US to halt unreasonable suppression of Chinese companies and asked US to withdraw arrest order for Huawei's CFO. China Minister of Industry and Information Technology Miao said China will continue to lower taxes and fees for SMEs, while China will also significantly reduce the investment negative list.

As Bloomberg notes, after a robust start to the year for equities, investors are looking for reasons to chase the rally in a corporate earnings season that’s been mixed so far. Against the backdrop of U.S.-China stress and geopolitical tensions in Venezuela they also need to navigate the Federal Reserve rate decision, developments in the U.K.’s Brexit process and a potential slew of American economic data that was delayed by the government shutdown.

“Even though this has been a good start of the year,’’ investors now “want to be kind of defensive,’’ Ben Emons, managing director of global macro strategy at Medley Global Advisors, said on Bloomberg TV. “Earnings will not grow strongly, and we still deal with leverage in the corporate sector that has not been unwound in any way.’’

Most European government bond yields were little changed. Weaker economic data and unknowns like the trade feuds and Brexit have all boosted expectations that interest rates will stay low. European yields little changed to 2bps higher across core and periphery, 10-year gilt yield 1bp higher, 10-year UST yield 1bp lower.

New debt deals from Greece, Belgium and Austria were also in the pipeline. The slide in rates has also encouraged governments to launch new bond deals. Even Angola, which has just taken IMF aid, said it was eyeing a bond sale.

The U.S.-Sino moves, as well as bets that the U.S. Fed will sound more cautious on Wednesday, kept the dollar near a two-week low and heightened the safe-haven appeal of the Japanese yen and the Swiss franc. The Bloomberg USD index also little changed within a tight range, with NZD leading G-10 gains and GBP lagging, although sterling off its worst session level ahead of key parliamentary Brexit votes after the London close.

Sterling held at $1.3166 and 86.88 pence to the euro before crucial votes later in the day aimed at breaking a deadlock in the UK parliament over Brexit. The pound has rallied 6 percent from Jan. 4 lows, but further gains may be limited unless lawmakers emerge with a big majority on the votes.

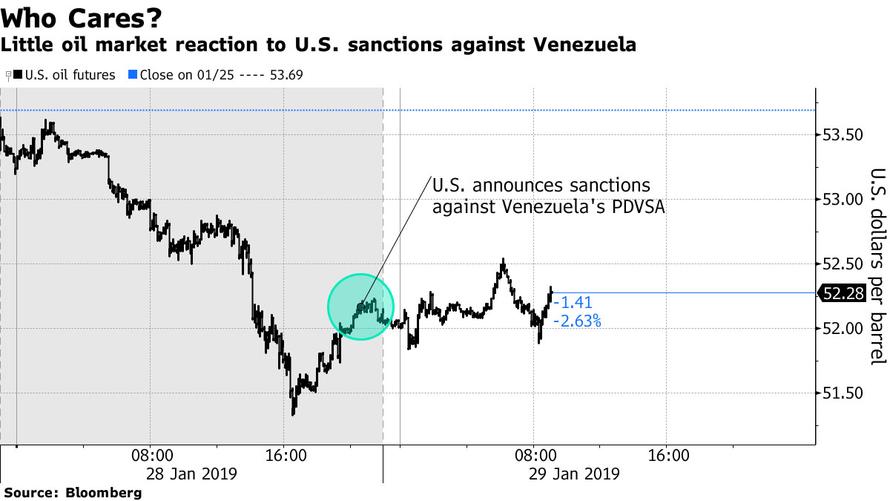

In commodities, WTI and Brent trade 1.1% and 1.3% higher respectively. West Texas crude edged higher as the U.S. slapped a de facto ban on oil from Venezuela. Emerging-market shares and their currencies were steady. Gold rose to highest level since June.

Expected data include Conference Board Consumer Confidence, while the government shutdown will delay some reports yet this week and next. Apple, Danaher, Harley-Davidson, Lockheed, Pfizer, and Verizon are among companies reporting earnings.

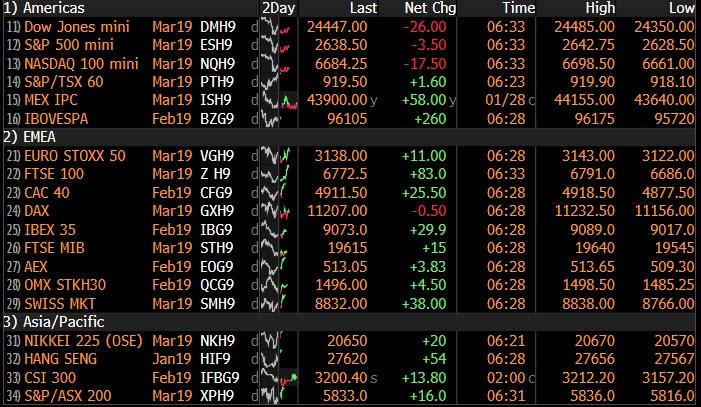

Market Snapshot

- S&P 500 futures little changed at 2,640.75

- STOXX Europe 600 up 0.6% to 356.32

- MXAP down 0.2% to 154.33

- MXAPJ down 0.3% to 503.19

- Nikkei up 0.08% to 20,664.64

- Topix up 0.1% to 1,557.09

- Hang Seng Index down 0.2% to 27,531.68

- Shanghai Composite down 0.1% to 2,594.25

- Sensex down 0.3% to 35,538.29

- Australia S&P/ASX 200 down 0.5% to 5,874.17

- Kospi up 0.3% to 2,183.36

- German 10Y yield rose 0.5 bps to 0.21%

- Euro up 0.1% to $1.1441

- Italian 10Y yield rose 1.5 bps to 2.308%

- Spanish 10Y yield rose 0.9 bps to 1.229%

- Brent futures up 1% to $60.55/bbl

- Gold spot up 0.4% to $1,308.19

- U.S. Dollar Index down 0.1% to 95.67

Top Overnight News

- PG&E Corp., California’s biggest power company, filed for Chapter 11 bankruptcy in Northern California bankruptcy court as investigators probe whether its equipment ignited the deadliest fire in state history

- PM Theresa May is backing a plan to ditch the most contentious part of her Brexit deal as she scrambles for a compromise all sides can support, with time running out before the U.K. leaves the European Union. Some EU states are said to weigh conditions for Brexit extension

- The Trump administration will press China to prove it can keep promises in talks this week aimed at ending the trade war, Treasury Secretary Steven Mnuchin said. China will offer to buy more U.S farm products, according to WSJ

- The U.S. Treasury Department indicated that the government’s borrowing needs are rising faster than previous estimates as the Trump administration finances a widening budget deficit

- Australian firms suffered the worst slump in conditions since the 2008 global financial crisis as evidence mounts that the economy slowed in the latter part of last year

- U.S. prosecutors filed criminal charges against Huawei Technologies Co., China’s largest technology company, alleging it stole trade secrets from an American rival and committed bank fraud by violating sanctions against doing business with Iran

- Oil held most of its biggest loss in a month as renewed concern over slowing global growth largely outweighed U.S. sanctions against Venezuela’s state oil company

- Acting Attorney General Matthew Whitaker said that Special Counsel Robert Mueller’s Russia investigation is “close to being completed”

- Wall Street has become obsessed with the Federal Reserve’s balance-sheet runoff, as investors debate why it’s suddenly roiling markets more than a year after it began

- Greece will on Tuesday sell bonds for the first time since the end of its international bailout, testing investor interest in the country’s newfound economic independence

Asian equity markets traded lower for most the session as the region followed suit to the negativity on Wall St where sentiment was dampened by corporate updates in which industrial bellwether Caterpillar missed on earnings and Nvidia reduced its guidance with both citing a slowdown in China, while the DoJ announcement of charges against Huawei raised concerns regarding the potential impact this could have on US-China relations. ASX 200 (-0.5%) was negative on return from the extended weekend with the index dragged lower by underperformance in healthcare as Resmed shares tumbled on poor sales figures and with energy names pressured by the recent 3% drop in oil prices, while price action in the Nikkei 225 (Unch.) was at the whim of the JPY-risk dynamic. Elsewhere, Hang Seng (-0.2%) and Shanghai Comp. (-0.1%) weakened after the US announced charges against Huawei including intellectual property theft, as well as bank and wire fraud, although markets gradually rebounded off lows as focus shifted to the upcoming trade discussions. Finally, 10yr JGBs were flat as prices failed to benefit from the weakness across stocks, while a mixed 40yr JGB auction also failed to provide a catalyst for direction.

Top Asian News

- China Life Says Profit May Fall Up to 70% Amid Stock Market Rout

- India Media Giant Rocked by Claims of Ties With Fraud Probe

- Asia’s $1.6 Trillion Stock Rally Is Looking Increasingly Fragile

- Mothers Futures Hit Circuit Breaker After SanBio Trial Fails

Major European equities are modestly in the green [Euro Stoxx 50 +0.5%], outperformance is seen in the FTSE 100 (+1.4%) where index heavyweights British American Tobacco (+4.6%) and Unilever (+1.7%) are in the green after a broker move and purchase of New York based ‘The Laundress’ products business respectively. Sectors are mixed, with outperformance seen in consumer staples, largely due to the aforementioned British American Tobacco and Unilever. Other notable movers include Royal Mail (-10.5%) who are at the bottom of the Stoxx 600 following their earnings, whilst Sartorius (+16.0%) are at the top of the index following a double digit increase to their 2018 sales revenue and earnings. Separately, SAP (-2.0%) are down in spite of the Co.raising their 2020 non-IFRS revenue outlook and confirming their non-IFRS profit outlook.

Top European News

- Swedbank Drags Down Swedish Banks Amid Fee-Income Concerns

- Norwegian Air Falls Most on Record After Emergency Stock Sale

- Chips Lead Tech Slide on Report TSMC Suppliers to Cut Prices

- OMV Says Romanian Strife Casts Doubt on Black Sea Development

In FX, NZD/AUD/EUR - The Kiwi is back in pole position and just outperforming G10 peers like the Euro that is also benefiting from some cross-flows, and a generally soft US Dollar. Nzd/Usd is back up around 0.6850, with some support emanating from NZ trade data overnight alongside ongoing Aud/Nzd selling as the pair delves deeper below 1.0500 (to circa 1.0450 at one stage). Note, Aud/Usd was undermined by a sharp deterioration in NAB business conditions, but subsequently derived some traction to pare losses from 0.7140 to 0.7175 on the back of broadly upbeat comments from RBA’s Harper who reiterated guidance for the next policy move to be a hike based on strength in the Aussie jobs market and the country’s healthy budget situation. Meanwhile, Eur/Usd has inched a bit further above 1.1400 to test its 100 DMA (1.1446) having cleared a 50% Fib (1.1430), but not quite able to breach 1.1450 and challenge the next upside chart resistance at 1.1463 (61.8% Fib). Note also, the single currency may encounter option-related offers ahead of 1 bn expiries at 1.1465-75.

- CAD/GBP/CHF/JPY - All narrowly mixed vs the Greenback, as the Loonie draws some solace from relative calm in the oil/commodity complex and recovers towards 1.3250, while Cable is pivoting 1.3150 and awaiting the outcome of UK Parliament’s vote on Brexit Plan B alongside amendments, but the Pound still trading weaker vs the Euro on customary month end factors (Eur/Gbp RHS demand lifting the cross over 0.8700 earlier). Usd/Chf and Usd/Jpy are just off Monday’s lows within narrow ranges of 0.9910-25 and 109.15- 45 respectively, with the Franc not really reacting to Swiss trade data even though the surplus shrank substantially.

- NOK/SEK - Contrasting fortunes for the Scandi Crowns as the Nok also derives comfort from a partial recovery in crude prices vs the Sek acknowledging more Riksbank commentary highlighting no rush to hike rates again (vs the Norges Bank on course to continue its tightening cycle in March). Eur/Nok sub-9.7150, Eur/Sek 10.3500+.

In commodities, Brent (+1.0%) and WTI (+0.9%) prices are higher, and around the USD 60/bbl and USD 52/bbl level respectively, after somewhat pairing back the sessions initial losses; as the risk sentiment has improved from yesterday. US have imposed sanctions on Venezuelan state-owned oil firm PDVSA, aiming to significantly reduce their crude exports to the US; additionally, trying to pressure President Maduro into stepping down. Elsewhere, Nord Stream 2, a new gas export pipeline running from Russia to Europe, continues in discussions to raise EUR 6bln in financing. Separately, Total have announced a significant new discovery in the North Sea, which has an estimated 250mln barrels of oil equivalent of recoverable resources. Gold (+0.3%) is in the green, benefitting from dollar weakness amidst an uneventful overnight session; with the yellow metal towards its session high of USD 1309.4/oz. Following the lifting of sanctions against Rusal, the LME has begun accepting aluminum deliveries from the Co. into their warehouses

US Event Calendar

- 9am: S&P CoreLogic CS 20-City YoY NSA, est. 4.89%, prior 5.03%; 20-City MoM SA, est. 0.4%, prior 0.41%

- 10am: Conf. Board Consumer Confidence, est. 124, prior 128.1; Present Situation, prior 171.6; Expectations, prior 99.1

DB's Jim Reid concludes the overnight wrap

A long opening para today but as the reader, you have the right to skip! Anyway, of all the stories I’ve told in my first para over the years the one that I got most mail back about and the one I still get reminded of most was the one where I woke up one morning to find 40 freshly planted trees had been stolen overnight from our garden. I was apoplectic with rage. 5 years on I’m still not sure I’ve gotten over it. Well, today I report another theft, this time of a more baffling variety. Last week I was listening to Spotify and kept on getting booted out as someone was apparently listening elsewhere. As I was traveling I put this down to my wife. However, when I did get in, new playlists and albums kept on being added that indicated that my wife was going through an experimental stage. Albums by artists called Hoshi, Lil Peep, Maes, Ozel and Polock appeared - most of which seemed to sing in French and none of which I’d ever heard of. Anyway, I meant to grill my wife about it wondering whether she was trying to impress a younger (French) man but I forgot about it.

Last night over dinner I got booted out of the account again and I asked her if she’d added all these new albums. She looked at me with deep confusion and as she was in the room with me I realized it couldn’t be her. After many souls searching and more random music being added to my account while I was trying to play some dinner music myself, the only explanation I could find is that someone had stolen my account. I changed my password and all was fine again. It’s quite creepy knowing someone is on your music account though. Anyway, I’m sure I had some revenge on the thief as over the weekend my daughter wanted a 1970s children’s TV theme song called “Jamie and the magic torch” on about 20 times in a row. She loves it. We introduced her to this as we call one of our twins Jamie (as my family still call me to this day - I reinvented myself as Jim when I went to a new school 34 years ago). This was the song everyone sung at me when I was 5. There will be a small group of readers who will remember it well. Anyway, I can now picture this very cool young French man with big headphones in an arty cafe in Paris thinking he was very clever stealing my account but suddenly being bombarded with 40 year old U.K. children TV soundtracks. However where my trees are 5-plus years later still haunts me.

Like Spotify, you can always skip the bits of my research you don’t like and if you’re a bull you may want to do a little bit of skipping today. Monday certainly painted a downcast start to the week ahead of a busy calendar of catalysts: today’s latest Brexit shenanigans, tomorrow’s Federal Reserve meeting conclusion, US/China trade talks starting on the same day, Q4 Euro GDP on Thursday, the US jobs report on Friday, and plenty of potential tape-bombs from the equity world as earnings season reaches a peak. Indeed earnings were the main culprit yesterday as US and European equity markets were all down. The S&P 500 and DOW retreated -0.79% and -0.84%, respectively, as earnings from macro bellwether Caterpillar and a pre-announcement from NVIDIA both disappointed (details below). The S&P 500 machinery index shed -3.33% and the NASDAQ fell -1.11%, as the poor company-level earnings were extrapolated to their parent sectors. Ten-year Treasury yields fell -1.5bps while US HY credit widened +5bps.

Earlier, European stocks had opened lower as well, extending their falls throughout the day, although by the close they had stabilized somewhat, with the STOXX 600 ending -0.97%. Energy stocks led the falls in Europe (-1.86%), as Brent Crude dipped below $60 a barrel for the first time in two weeks before closing at $60.03. Fixed income in Europe struggled to rally though, with 10y Bunds +1.2bp, OATs +1.0bps and BTPs +1.6bps.

As mentioned, the negative tone was set by poor company earnings, with Caterpillar reporting adjusted EPS of $2.55 (vs $2.99 estimated) a 14.6% miss and the biggest margin miss since 2008. The company also said their outlook “assumes a modest sales increase”, below previous expectations. Caterpillar shares fell -9.13%, and the company said lower demand from China was partly responsible for their reduced estimates, with the company expecting sales from the country to be roughly flat in 2019 year-on-year. Nvidia later added to the negative picture, with its shares opening over 18% lower after the company cut its Q4 revenue forecast from $2.7bn to $2.2bn, before paring back losses to close down -13.82%. Nvidia also cited “deteriorating macroeconomic conditions, particularly in China” as a factor affecting its sales, and the company will be releasing Q4 earnings on 14 February. This comes after data last week showed that the Chinese economy grew at its slowest annual rate in 2018 since 1990. Note that the key earnings release today is Apple which is already -33.05% off its 2018 peak, after it warned on its outlook late last year. So earnings and the outlook here will be a key contributor to the macro outlook.

After US markets closed yesterday, the Department of Justice announced two separate indictments covering 23 criminal accusations against Huawei and its executives. The US is formally asking Canada to extradite the company’s CFO Meng Wanzhou to face the charges. The move could complicate trade talks between the US and China which are set to begin later this week, though the offshore renminbi traded flat after the news, perhaps signaling that the news has already been discounted.

Staying in the region, equity markets have fallen in Asia this morning, although are paring back losses, with the Nikkei (-0.17%), up from its lows of the session where it was down over 1%. The Hang Seng (-0.53%), the Shanghai Composite (-0.62%) and the KOSPI (-0.17%) are also lower. Meanwhile, oil has steadied since its declines yesterday, with Brent Crude trading at $60.11 a barrel.

Before we recap more of the last 24 hours let’s move to the exhausting topic of covering Brexit. Today UK MPs will vote on a variety of different amendments on where to go next. Although the specific amendments to be debated will be decided by the Speaker of the House of Commons, two of particular interest are the one by Sir Graham Brady (who chairs the 1922 committee of Conservative backbench MPs) and the cross-party one offered by the Labour MP Yvette Cooper and the Tory MP Nick Boles. The Brady amendment calls for the backstop “to be replaced with alternative arrangements to avoid a hard border”. Supporters of the amendment argue that if a majority of MPs voted in favor, it would demonstrate that changes to the backstop would be sufficient to get the withdrawal agreement through Parliament, and would encourage the EU to modify its position. However, the Irish government have remained uncompromising on the issue, with Simon Coveney, the Irish Deputy Prime Minister, telling The Andrew Marr TV Show on Sunday that “the backstop … is part of a balanced package that isn’t going to change”.

The other amendment of interest put forward is the Cooper-Boles amendment, which is another attempt to avoid a no-deal Brexit. This would require that parliamentary time be made for MPs to debate new legislation, which would require there to be an extension of the Article 50 negotiations if the House of Commons has not approved a deal by February 26. DB’s Oliver Harvey published a preview on Friday of today’s vote (link here ). UK equities fell yesterday along with the rest of Europe, with the FTSE 100 (-0.91%) falling for the fifth consecutive day, while sterling fell back somewhat against the dollar to trade -0.26% weaker at 1.3162.

Ahead of the votes today, leading Brexiter Jacob Rees-Mogg last night said that the influential European Research Group of hard Brexit supporters within the Tory party will not vote in favor of any amendments at this stage. Simultaneously, PM May has endorsed the Brady-backed motion and the government will reportedly whip the party into voting for the amendment. The problem for the government is that without either the ERG or support from other parties, none of their amendments will get a majority. Labour has not yet tipped its hand in either direction, though the party leadership is reportedly leaning toward supporting the Cooper-Boles motion that could potentially lead to a delay to Article 50. Anyway, the votes will begin at 7pm this evening.

Before turning back to yesterday’s action, note that DB’s European equity strategist Sebastian Raedler has lowered his tactical outlook for European equities from positive to neutral, following the 8% rally since late December, as the market has gone from being almost 10% too low on his model (based on Euro area PMIs, the EUR and Euro area real bond yields) to being in line with fair-value. He expects Euro area PMI momentum (i.e. the six- month change in PMIs and a key driver of European equities) to improve from the current seven-year low of -4.5 points to +1.5 points by mid-year. But even this mild PMI improvement implies little further upside for European equities over the coming months, leading him to turn more cautious on the market.

Back to yesterday and staying in Europe, ECB President Draghi appeared before the Economic and Monetary Affairs Committee at the European Parliament yesterday, following last week’s ECB meeting where the Governing Council acknowledged that the risks had “moved to the downside”. The euro rose against the dollar as Draghi spoke, reaching its highest level in nearly two weeks and ultimately closing up +0.19%. Draghi said that if the outlook worsened further, the ECB could still use other tools to combat this, but said that “at this point in time, we don’t see such contingency as likely to materialize, certainly this year”.

Across the Atlantic, the US Congressional Budget Office published its latest Budget and Economic Outlook, including forecasts for the next 10 years. The report makes for stark reading for US policymakers, but at least the outlook is somewhat improved relative to last year’s edition. For the 2018-2028 period, deficits are now forecast to average -4.3% of GDP per year, down from the previous forecast of -4.8% per year. That level of deficit spending has only been hit a handful of times over the last 50 years, and always amid a recession. So to have it every year is incredible. The improvement in forecasts though is driven by lower projections for federal outlays as a percent of GDP, partially helped by lower interest rate projections. Instead of a peak in 10-year treasury yields around 4.1%, the CBO now pencils in 3.7%. Revenues are forecast to be lower as well, with slightly shallower economic growth projections from previously, but this dynamic is outweighed by the outlay side. Overall, these numbers should still worry those who look beyond the immediate path of markets even if there is an interest rate improvement from last year. As a market aside, the projections include around $245bn in reduced deficits for 2020-2021, which could cause the US Treasury to adjust its future issuance plans if the figures are borne out.

Yesterday saw very few data releases, although the Dallas Fed’s Manufacturing index for January came in above estimates at 1.0 (vs -2.7 expected), marking a rebound from the previous month’s two-and-a-half year low. In Europe, M3 money supply growth rose to +4.1% yoy from +3.8%, though M1 growth slowed to 6.6% from 6.7%. The credit impulse turned slightly negative as well.

Turning to the day ahead and as well as the latest Brexit votes in the UK Parliament, we have earnings releases for Apple, Pfizer and SAP. In terms of data, we have French consumer confidence figures for January, Italian PPI inflation for December, and in the US we also have the Conference Board consumer confidence reading and preliminary wholesale inventories for December.