Markets: It Is Not Enough

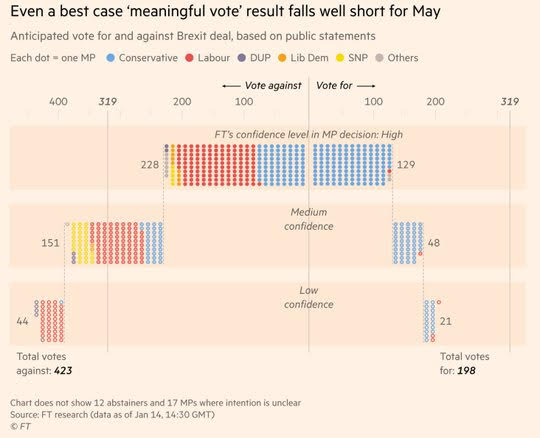

Today is about logically insufficient conditions as investors are likely to see that the tape alone is not enough to support an extended rally up is risky assets. UK PM May faces her Brexit plan not having enough votes to pass and her government not having enough support to stand.

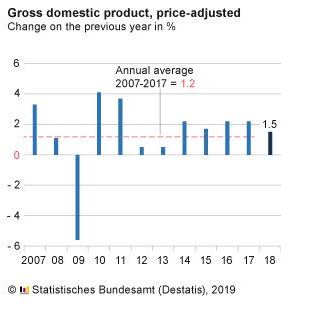

China faces growth issues as the PBOC easing is not enough to support the economy and the government’s fiscal plans aren’t enough to help either. Though the rally back in risk today extends Beijing the courtesy of a bounce but with plenty of confusing signals. ECB Draghi faces the grim reality that negative rates and rolling over the bonds bought is insufficient to support the flagging economy and fight disinflation from lower oil prices. German GDP for 2018 was sharply lower than the previous 5 years even with better trade and a weaker EUR to support it. Still, the nation has probably avoided a technical recession in 2H2018 with domestic demand key.

If the problems in Europe’s strongest economy continue in 2019 its going to be harder for ECB action given the Draghi exit and plans for normalization. In the background, today is about doubt even as the tape bounces on China hopes and the usual squeeze back from a blue Monday. GBP is the center of attention but the actual votes seems a long time away for traders and its result likely already priced with a hard Brexit or another referendum the likely outcomes after the dust settles. Given that no one wants the PM job in the Tory Party – UK May is likely to lead until another election is forced where another hung Parliament produces more of the same. The GBP seems stuck in a bigger 1.26-1.31 range for the short-term and that maybe the foreshadowing for equities as the bounce up over the last 2 weeks seems not enough to break out for a larger rally.

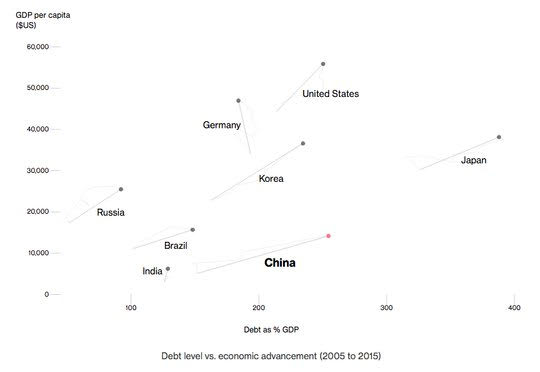

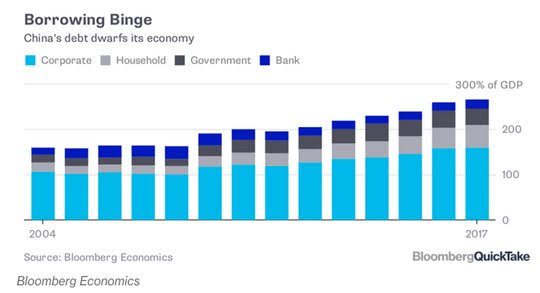

Question for the Day:Is the China effort to spur growth sufficient for 2019? Beijing intends to improve credit availability for smaller companies, accelerate infrastructure investment and cut taxes.Under the plan, Beijing will cut value-added tax rates for some companies, including in manufacturing, and hand tax rebates to others. China also plans to step up fiscal expenditure this year, in what looks like a Keynesian push to help companies. Xu Hongcai, Assistant Minister of Finance, told reporters in Beijing that the government was determined to ease the burden on small enterprises and the manufacturing industry, adding: “The focus is on enhancement and efficiency.” China’s central bank has promised to make monetary policy more forward-looking, flexible and targeted. The People’s Bank of China also vowed to keep liquidity “reasonably ample” - which could calm worries that firms could run short of funds. The country’s state planner has also weighed in. The National Development and Reform Commission (NDRC) said China will strengthen monitoring of its economic situation and improve its “reserve” of economic policies, as it targets “a good start” to 2019.

The issue for China is not about stimulus but about debt. It is true that China’s external debt, public and private, is still very low by world standards, reaching only 13% of GDP. But debt issued overseas has grown significantly since the slowdown of China’s credit boom. As central authorities have attempted to regulate credit, enterprises have borrowed abroad. The movement in up debt in China has been led by companies many of which can sell out the assets to cover the loans but only when the markets are bid. This is the key for financial stability and for confidence to hold. There is a socialization of debt in Asia that isn’t well understood in the West (particularly in the US) where failure isn’t a cause for family shame but an incentive for better ideas. The risk/reward for 2019 rests on the believability of the China stimulus (read as renewed growth led by debt).

What Happened?

- Japan December machine tool orders drop 18.3% y/y after -17.0% y/y – back to June 2016 lows. On a monthly basis, preliminary machine tool orders rose by 3.0% following declines of 5.7% and 9.0% seen in November and October respectively. Regardless, when compared to a year ago, the volume of factory orders for both domestic and foreign/overseas orders are weak.

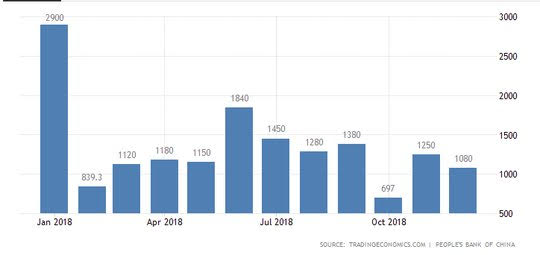

New CNY Loans don't reveal big demand for money

- China December M2 money supply 8.1% y/y from 8% y/y – less than 8.2% y/y expected. The new CNY loans rose 13.5% up 1.08trn from 13.1% or 1.25trn – more than the 13.2% or 800bn expected. For all of 2018, new loans were CNY16.17trn with households 46% of them down from 53% in 2017, but corporate share rose to 51% from 50%. Total social finance was also stronger at CNY1.59trn from CNY1.52trn – better than the CNY1.2trn expected. The People’s Bank of China has revised the way it calculates TSF by adding financial institutions’ asset-backed securities and loan write-offs. It has also added local government special bonds issuance into the TSF calculation from September.

- French December final HICP unrevised at 0.1% m/m, 1.9% y/ y after -0.2% m/m, 2.2% y/y – as expected. The national rate also unchanged at 0.0% m/m, 1.6% y/y after 1.9% y/y.

- Spanish December final HICP unrevised at -0.5% m/m, 1.2% y/y after -0.2% m/m, 1.7%y/y – as expected. The National CPI also unchanged at -0.4% m/m, 1.2% y/y after 1.7% y/y.

- German 2018 GDP 1.5% y/y after 2.2% y/y – as expected. This was the 9th year of expansion but with some lost momentum given the last 2 years were 2.2% each. The 10-year average is 1.2% y/y. Both household consumption up 1% and government spending up 1.1% supported. Capex was up 4.8% compared to 4.5% in 2017. Exports were up but at a slower pace – with trade subtracting 0.2% from the headline GDP. The government budget surplus rises to 1.7% of GDP to E59.2bn a new record after 1% or E34bn in 2017 - more than the 0.6% surplus expected.

- Eurozone trade surplus E19bn after E14.7bn - more than the E13.7bn expected.Exports rose 1.9% y/y to E203bn while imports rose 4.7% y/y to E184bn. Trade within Eurozone rose 1.5% to E170.5bn. The biggest partners were US with total surplus E129bn Jan-Nov with exports up 8.5%; China with total deficit E169.9bn with imports up 5.2%; Switzerland with total surplus E45.2bn with exports up 5.6% and Russia with total deficit E75.6bn with exports up 16.9%.

Market Recap:

Equities: The US S&P500 futures are up 0.45% after losing 0.53% yesterday. The Stoxx Europe 600 is up 0.2% tracking China growth pledges and Italian banks with ECB capital requirements for NPLs hurting. The MSCI Asia Pacific bounces up 1%.

- Japan Nikkei up 0.96% to 20,555.29

- Korea Kospi up 1.58% to 2,097.18

- Hong Kong Hang Seng up 2.02% to 26,830.29

- China Shanghai Composite up 1.36% to 2,570.34

- Australia ASX up 0.66% to 5,i71.80

- India NSE50 up 1.39% to 10,886.80

- UK FTSE so far up 0.2% to 6,869

- German DAX so far up 0.1% to 10,863

- French CAC40 so far up 0.2% to 4,772

- Italian FTSE so far off 0.35% to 19,104

Fixed Income: Supply and politics dominate the EU market. Italy issues its first big bond today with E5bn for 2035 seeing E30bn in orders and pricing later this morning. The ECB speech and UK Brexit vote are excuses to hold back even with equities bid on China growth plans. German Bund 10-year yields are up 3bps to 0.21%, UK Gilts off 2bps to 1.28%, French OATs off 1bps to 0.63%. In the periphery, Italy up 1bps to 2.86% on supply while Spain off 3bps to 1.39%, Portugal off 3bps to 1.66% and Greece off 3bps to 4.26%.

- US Bonds are bid – curve flatter - with focus on data, earnings– 2Y off 1bps to 2.52%, 5Y off 2bps to 2.51%, 10Y off 2bps to 2.69% and 30Y off 2bps to 3.04%.

- Japan JGBs mixed with focus on curve– 2Y flat at -0.15%, 5Y up 1bps to -0.14%, 10Y flat at 0.02%, 30Y flat at 0.70%.

- Australian bonds tread water despite China plans, equity bounce– 3Y flat at 1.79%, 10Y flat at 2.27%.

- China bonds slightly lower on tax cuts, growth plans – 2Y up 1bps to 2.68%, 5Y up 1bps to 2.95%, 10Y up 2bps to 3.15%.

Foreign Exchange: The US dollar index is up 0.3% to 95.49 with 95.07-95.53 range. In Emerging Markets USD is bid – EMEA:RUB off 0.15% to 67.102, ZAR off 0.4% to 13.813, TRY off 0.1% to 5.44; ASIA:INR off 0.4% to 71.034 and KRW flat at 1121.20.

- EUR: 1.1430 off 0.35%. Range 1.1423-1.1490 with ECB Draghi and Brexit key drivers today and risk for 1.1350 again.

- JPY: 108.40 up 0.2%. Range 108.13-108.75 with equities up, rates still low, USD bounce modest and worrying 107.80 to 109 keys. EUR/JPY 123.90 off 0.15%.

- GBP: 1.2855 off 0.1%. Range 1.2829-1.2916 with EUR/GBP .8890 off 0.2% - Day of reckoning with more focus and less surprises? 1.26-1.31 big picture.

- AUD: .7195 flat. Range .7191-.7226 with focus on China and hopes for growth, NZD flat at .6820.

- CAD: 1.3265 off 0.15%. Range 1.3244-1.3284 with 1.3250 still base building and risk for 1.34 as rates and growth focus with oil noise.

- CHF: .9860 up 0.5%. Range .9802-.9870 with rebound in $ linked to equities and unwind for safe-haven. EUR/CHF 1.1275 up 0.2%.

- CNY: 6.7590 off 0.1%. Range 6.7380-6.7600 with 6.77 now key resistance for 6.73 and 6.71 tests – watching China growth efforts.

Commodities: Oil up, Gold down, Copper up 0.1% to $2.6675

- Oil: $51.26 up 1.5%.Range $50.64-$51.38 with $51.40 pivotal for $52.50 again – focus is on equities, China growth hopes, US inventories. Brent up 1.5% to $59.90 with $60 the pivotal resistance for $62 target.

- Gold: $1289.40 off 0.15%.Range $1286.50-$1293.50 with focus on $1285 and $1300 still – USD driving. Silver off 0.5% to $15.61 with $15.50 base. Platinum up 0.3% to $805.10 and Palladium up 0.7% to $1291.20.

Economic Calendar:

- 0830 am US Dec PPI (m/m) 0.1%p -0.1%e (y/y) 2.5%p 2.5%e / core PPI 2.7%p 3.0%e

- 0830 am US Jan NY Empire Manufacturing 10.9p 12e

- 1000 am ECB Draghi speech

- 1000 am US Jan IBD/TIPP economic optimism 52.6p 51.8e

- 1130 am Minn Fed Kashkari speech

- 0100 pm Kansas Fed George speech

- 0200 pm UK parliament Brexit vote

- 0430 pm US weekly API oil inventories -6.27mb p

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.