Markets: Indigenous

Columbus Day holiday in the US, Thanksgiving in Canada, Sports Day in Japan and Indigenous Peoples day throughout the Americas. US stocks are open, US bonds are closed and FX remains the 24/7 focus. There is a bittersweet reflection in the discovery of the Americas by Columbus as many see him as the start of the downfall of the native peoples that populated North and South America. He is a turning point in history with the populations of the Americas subjugated and enslaved by Europe for its benefit. The rise of Portugal and Spain was the end of the Aztec, Inca and Mayan empires. The irony was that Columbus was searching for China and India and found something else. The onslaught of Spanish silver and gold that followed changed the value of money in Europe, brought a wave of inflation and innovation and along with it the outperformance of the region to that of the more advanced India and China. The economic advancement of Europe and eventually the Americas at the expense of India and China is the stuff of history but in that is the rhyming echoes of the present circumstance. Many will suggest the rise of culture and the march of history is out of the control of anyone person, others will see history written only by the victors and made by a handful of men. For markets, there are winners and losers daily and the battle for indigenous profits against speculation becomes a full-time job. This is the story overnight as investors try to understand the China catch-up to the rest of the world’s pain from last week. The China PBOC cut in the RRR by 1% - the fourth such action in 2018 – isn’t a surprise but does confirm the economic slowdown. The drop of China FX reserves reflects more valuation than capital flight as the CNY was mostly stable in September, whether that holds in October remains the key question. The Finance Ministry is promising to support the economy with tax cuts, more infrastructure projects, and aid for trade war effected companies. For even more irony, the Italian born Columbus would be sorely confused by the collapse in the Italian Banking Sector today – as Unicredit sees its shares halted along with UBI and Mediobanca. 2Y BTP yields have shot up to 1.62% from 1.33% in the early trading after Deputy PM Salvini refuels the political drama with EU as he noted “no day passes without Europe attacking Italy.” Italian BTPs are at 4-year lows again. Stocks are sharply lower across Europe tracking lower China shares and moods are negative again with doubts about EM rising and global growth falling. For many, the FX markets are back to watching CNY as the barometer of risk (off 0.8% against the USD today), particularly in Asia, with the fear of a 7.0 breakout driving.

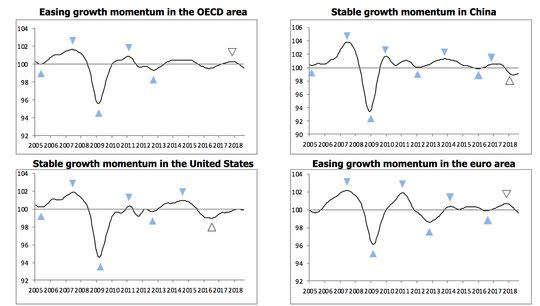

Question for the Day: Does the OECD capture the risks to growth in 4Q? Economic statistics are not reflecting today’s mood. The better China Services PMI and OECD China CLI suggest stability whereas markets price mayhem. The China RRR cut and Fiscal Stimulus underscore that Beijing doesn’t believe them either. The OECD composite leading indicators for October were released today and show that in the US and Japan, stable growth, with emerging signs of the same for Canada. The contrast is that Europe sees easing of growth in Italy, France and the UK while Germany is stabilizing. The emerging markets show Russia growing, China manufacturing stabilizing but easing growth in Brazil and continued growth in India. By the numbers the US is up 0.31% y/y while the Eurozone is off 0.98% y/y. China is off 1.13%. This may better reflect the coincident nature of markets and the lack of confidence in a global recovery amidst a US/China trade war.

What Happened?

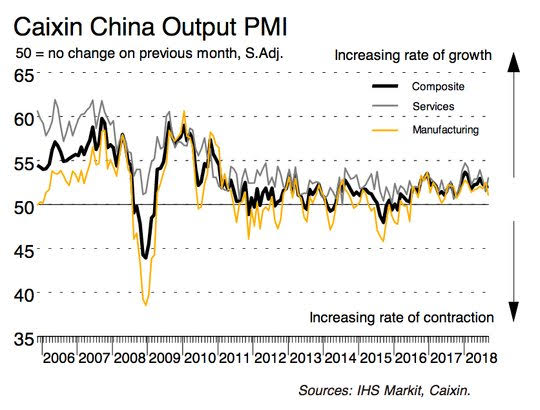

- China September Caixin Services PMI 52.1 from 51.5 – better than 52 expected. The Composite PMI was flat at 52 unchanged from August – weaker than 52.5 expected. The weaker manufacturing growth was offset by stronger services with a rise in new orders. Both sectors saw employment drop – for Services the first drop in 2 years. Input costs rose, with Services seeing prices up the second most since May 2012 – blamed on staffing costs – with output prices unchanged. Chinese companies are generally optimistic but are at 9-month lows in manufacturing, off slightly in Services, and expectations are lower for both at 10-month lows.

- China September FX Reserves drop $22.7bn to $3.09trn after -$8.23bn in August – lowest since July 2017. This was the biggest drop since February. SAFE said the lower valuation of China's FX reserve was due to valuation effects and lower bond prices across major countries. The regulator warned the country is facing uncertainties from the external environment. But the domestic economy is resilient and able to resist

risks, as the strong economic fundamentals help forex stability. "The forex reserves are expected to remain stable amid volatility," SAFE said. - Swiss September unemployment rates improved to 2.5% from 2.6% - as expected. The job vacancies -0.3% m/m, but up 191.3% y/y while unemployment fell 1.2% m/m, -20% y/y.

- Bank of France 3Q GDP forecast unchanged at 0.5%. The September manufacturing climate rises to 105 from 103, Services rises to 103 from 102, Construction rises to 105 form 104. The manufacturing capacity use drops to 80% from 81.4%.

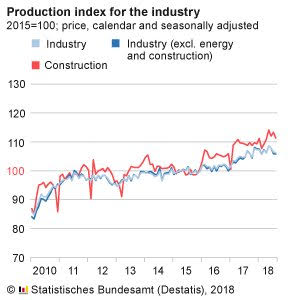

- German August industrial production -0.3% m/m, -0.1% y/y after revised -1.3% m/m - worse than 0.5% m/m expected. July revised lower from -1.1% m/m preliminary. Manufacturing fell 0.2% in August after -1.9% m/m. By sector, consumer goods up 1.4% after -0.7% m/m, capital goods -0.7% after -2.5% m/m, basic goods up 0.1% after -1.6% m/m, construction output -1.8% after +1.2% (revised down from 2.6%) and energy +1.3% after 1.3% m/m (revised up from 0%).

Market Recap:

Equities: S&P500 futures are off 0.2% after the Friday -0.55% drop. The Stoxx Europe 600 is off 0.6% - worst in a month – with Italy leading the losses with focus on banks and energy. The MSCI Asia Pacific fell 1.5% with China in a catch-up trade.

- Japan Nikkei closed for holiday

- Korea Kospi off 0.6% to 2,253.83

- Hong Kong Hang Seng off 1.39% to 26,202.57

- China Shanghai Composite off 3.72% to 2,716.51

- Australia ASX off 1.31% to 6,218.60

- India NSE50 up 0.31% to 10,348.05

- UK FTSE so far off 0.6% to 7,274.53

- German DAX so far off 0.95% to 11,997

- French CAC40 so far off 0.90% to 5,311

- Italian FTSE so far off 2.35% to 19,866

Fixed Income: With US and Japan on holiday, German Bunds key focus on the day with curve flattening as safe-haven demand rises with China and Italian fears driving. The German Bund 10-year yields are off 4.3bps to 0.528% while French OATs are off 2.5bps to 0.875% and UK Gilts off 3bps to 1.687%. The Periphery suffers – Italy up 16bps to 3.575%, Greece up 13.5bps to 4.585% while Spain up 1bps to 1.585% and Portugal up 1.5bps to 1.945%.

- Germany sold E2.435bn of new 6-month April 2019 BuBills at -0.6272% with 1.23 cover – after the Bundesbank holding 1.30 cover.

- US Bonds on Holiday

- Japan JGBs on Holiday

- Australian bonds see sharply steeper curve – tracking US/China, watching supply – AOFM sold A$500 of 10Y 2.75% Nov 2028 #TB152 at 2.7698% with 4.49 cover – previously 2.7069% with 4.245 cover. 3Y up 3.7bps to 2.051%, 10Y up 5.4bps to 2.765%.

- China PBOC skips open market operations, net drains CNY100bn on the day. Money market rates fell with 7-day off 16.5bps to 2.634% and O/N fell 19.5bps to 2.521%. 10-year bond yields were off 2bps to 3.615%.

Foreign Exchange: The US dollar index up 0.3% to 95.91 with 96 highs and 96.40 next key. In EM FX, USD is mixed. EMEA: ZAR up 0.45% to 14.8350 FM resignation rumor noise, TRY off 0.1% to 6.1250, RUB up 0.25% to 66.77; ASIA: TWD off 0.3% to 30.955, KRW off 0.15% to 1132 with 1133.50 highs, INR off 0.4% to 74.07 with 74.10 highs.

- EUR: 1.1480 off 0.4%. Range 1.1465-1.1535 with focus on Italy and 1.1450 stops for 1.14 barrier and 1.1250 target

- JPY: 113.35 off 0.3%. Range 113.25-113.94 with 114 now back as barrier and 112 target – EUR/JPY off 0.65% to 130.10 with 129.93 lows opening 128 retest.

- GBP: 1.3040 off 0.6%. Range 1.3028-1.3134 with EUR/GBP .8805 up 0.3%. Brexit second guessing. 1.30 pivot again with 1.3250 resistance.

- AUD: .7070 up 0.2%. Range .7041-.7073 with copper up and focus on China stimulus vs. crosses and stocks. Key is .70 barrier now with NZD .6450 up 0.15%.

- CAD: 1.2990 up 0.4%. Range 1.2936-1.3010 with focus on oil lower, China, rates and holiday illiquidity.

- CHF: .9330 off 0.1%. Range .99080-.9935 with EUR/CHF 1.1400 off 0.3% - all about Italy and safe-haven demand returning

- CNY: 6.8957 fixed 0.19% weaker from 6.8792 Sunday, traded weaker to 6.9035 from 6.8814 close Sunday and 6.8725 Sep 28. Now off 0.85% to 6.9245 with range 6.8905-6.9290.

Commodities: Oil lower, Gold lower, Copper up 0.3% to $2.8050

- Oil: $73.37 off 1.3%. WTI watching $76.90 the Oct 3 highs against $73.00 Oct 1 lows with $70-$79 wider targets. Brent off 1.4% to $82.97 with $82 next key support.

- Gold: $1194.10 off 0.8%. Gold watching 55-day at $1202 against $1180.90 support (Sep 28 lows). Silver off 1% to $14.49 watching 55-day at $14.72 against $14.18 support (Sep 27 lows) with $14.50 pivot. Platinum off 0.2% to $820.80 and Palladium off 0.35% to $1068.

Economic Calendar: US and Canada holidays

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.