Markets: Immoral

Markets are amoral. Prices aren’t right or wrong but for your position and your profits. The mix of church and state has been the battle for centuries across all parts of the world. Governments can’t legislate morality either. The blasting of the US indictment of Huawei and the extradition of its CFO led to a Chinese official to call the US actions “unfair and immoral.” The CFO’s lawyer characterizes her as a “hostage.” This is an interesting clash to watch as it sets the tone for US/China talks this week with the March 1 deadline looming and with the focus on China growth not going away. Asia shares slipped while EU has bounced. The Yellow Vests in France suffered an electoral set back as their campaign director quit due to internal squabbling with 10 candidates pushing for seats in the upcoming May EU elections. The French consumer confidence was also better today – suggesting the movement's effect on the broader economy maybe petering out. Overall, the worries about Asia still dominate the picture into US earnings, the FOMC decision, and ongoing US political storms. The risk mood up in Europe, down in Asia leaves the US stuck waiting for Apple earnings, the UK Brexit vote and more from Trump. It’s the nature of markets to price risks to reflect the worst possible outcome for the largest positions and that makes the GBP and its fate today important. GBP/JPY maybe the more exciting barometer for those that want to mix the worst fears about global trade, US/China and Europe together. Unlike the GBP/USD which points to a breakout with 1.35 risks still, the GBP/JPY warns of a bear-market rally at risk of fizzling out into significant resistance at 146 and 147. How the UK manages today, how the US markets absorb more tech earnings stories, how Trump plays his Huawei card in China talks – all that is in play and there isn’t much about principles or morality that will shift traders and investors from waiting this one out.

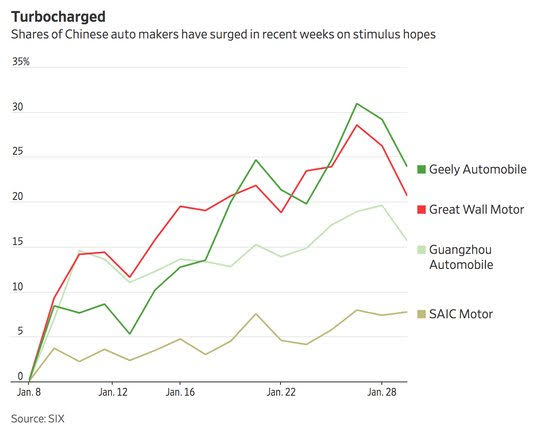

Question for the Day: Is the US/China talks the issue or China growth? The stimulus plans from China in 2019 helped markets last week but not so far this week. Some put the blame on the headlines into the talks this week, while others see the doubts about the Chinese consumer rising. The WSJ highlights this point on the auto sector – reporting on the “nothing burger” announcements today. “Local governments with adequate resources” will be able to offer subsidies to rural car buyers trading in their old vehicles. Central government support seems likely to be limited, with no mention of a cut in the tax on vehicle purchases, a tool Beijing has often used in the past to boost auto sales. Chinese auto stocks slumped by as much as 4%, after what Bernstein autos analyst Robin Zhu termed this “nothing burger” of an announcement. They had rallied almost 20% in the past three weeks after a senior government official suggested stimulus was on the way,

What Happened?

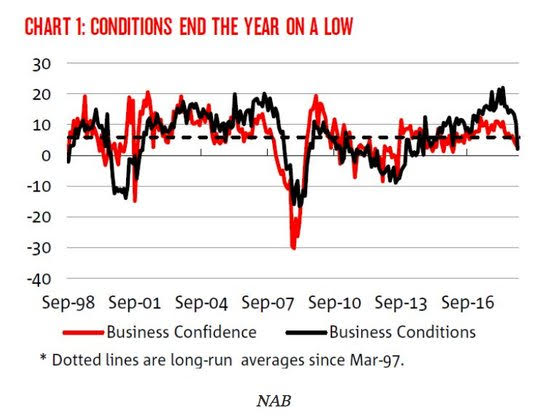

- Australia December NAB business confidence flat at 3 – better than 2 expected – but business conditions fell to 2 from 11 – weakest since Sep 2014. This was the biggest drop since 2008. NAB noted the drop was broad-based with declines in trading, profits and employment across industries and regions.

- French January consumer confidence bounces to 91 from revised 86 – better than 89 expected. The December revised lower from 87 and the long-term average at 100 tempers the result. Price outlooks continue to drop while unemployment fears are rising.

- Spanish 4Q unemployment rate 14.45% after 14.6% - as expected. It remained the lowest jobless rate since the fourth quarter of 2008. Among regions, the lowest rates were recorded in País Vasco (9.6 percent), Cantabria (9.7 percent) and Comunidad Foral de Navarra (10 percent) and the highest in Extremadura (23.1 percent), Andalucía (21.3 percent) and Canarias (20 percent). In Catalonia, jobless rate was 11.8 percent and in Madrid 11.5 percent.

Market Recap:

Equities: The S&P 500 futures -0.05% after falling 0.78% yesterday. The Stoxx Europe 600 is up 0.7% gaining from a flat open while the MSCI Asia Pacific fell 0.1% - Japan rallied sharply to finish up 0.1%after the TOPIX was off 0.9%.

- Japan Nikkei up 0.08% to 20,664.64

- Korea Kospi up 0.28% to 2,183.36

- Hong Kong Hang Seng off 0.16% to 27,531.68

- China Shanghai Composite off 0.10% to 2,594.25

- Australia ASX off 0.53% to 5,939.50

- India NSE50 off 0.09% to 10,652.20

- UK FTSE so far up 1.3% to 6,838

- German DAX so far up 0.1% to 11,223

- French CAC40 so far up 0.6% to 4,918

- Italian FTSE so far up 0.1% to 19,619

Fixed Income: Modest risk-on in EU with little news and focus on Brexit/US FOMC and politics. Nevertheless, weaker economic data and ongoing China growth fears are driving inflation outlooks lower and supporting bonds with the 5Y/5Y breakeven in Europe now 1.5059% - lowest since Oct 2016. German 10-year Bund yields up 1bps to 0.21%, France OATs flat at 0.61%, UK Gilts off 4bps to 1.26% while periphery mixed with Italy up 2bps to 2.65%, Spain flat at 1.22%, Greece off 1bps to 4.05% and Portugal flat at 1.67%.

- Germany sold E5bn of 2Y 0% Schatz at -0.58% same as previously with 1.56 cover.

- US Bonds are in holding pattern, curve steeper, waiting for FOMC, supply, and data – 2Y off 1bps to 2.58%, 5Y off 2bps to 2.57%, 10Y flat at 2.74% and 30Y flat at 3.06%.

- Japan JGBs mixed after 40Y bond sale, equity late rally – 2Y up 1bps to -0.16%, 5Y up 1bps to -0.15%, 10Y off 1bps to 0%, 30Y flat at 0.65% did trade off 1bps to 0.64% back to 2016 Dec lows. The MOF sold Y400bn of 40Y with good demand – cover 3.79 above the average of 3.5 from last 5 sales.

- Australian bonds sold with focus on US/China trade, ignore weaker NAB business conditions – 3Y up 1bps to 1.74%, 10Y up 2bps to 2.24%

- China bonds stuck in holding pattern, focus on talks and Huawei, local government supply – 2Y flat at 2.63%, 5Y flat at 2.96%, 10Y flat at 3.16%. This week local governments are set to issue CNY288.4bn in debt after Xinjiang issued CNY129.6bn – this is 30% of the 2019 quota CNY810 for special bonds (not included in official budgets which have CNY580bn limit). Also, some reports that the spread of these bonds is tighter than 40bps to central government bonds – dropping to 25bps – as part of the stimulus efforts.

Foreign Exchange: The US dollar index off 0.05% to 95.72. In EM, INR off 0.1% t0 71.106, KRW flat at 1117.80, ZAR up 0.2% to 13.632, RUB off 0.15% to 66.298.

- EUR: 1.1440 up 0.15%. Range 1.1420-1.1450 with focus on 1.1380 base for 1.15 again.

- JPY: 109.40 up 0.1%. Range 109.13-109.46 with EUR/JPY 125.15 up 0.2% and focus on US/China talks and equities bouncing.

- GBP: 1.3165 up 0.05%. Range 1.3130-1.3177 with EUR/GBP .8690 up 0.1%. The Brexit vote today key with 1.3050-1.33 consolidation

- AUD: .7170 up 0.05%. Range .7138-.7176 with NZD up 0.3% to .6850 – focus is on commodities and China talks

- CAD: 1.3260 flat. Range 1.3245-1.3278 with data and rates driving 1.32 base building.

- CHF: .9920 up 0.05%. Range .9907-.9927 with EUR/CHF 1.1355 up 0.15% - focus is on Brexit and equities.

- CNY: 6.7340 off 0.15%. Range 6.7270-6.7530 with focus on 6.7150 next – US/China trade talks, stimulus plans, month-end vs. new year push

Commodities: Oil up, Gold up, Copper up 0.4% to $2.7045

- Oil: $52.55 up 1.1%. Range $51.84-$52.60 after losing 3% on global growth fears yesterday, modest recovery. Brent up 1.3% to $60.71 with $59.75 lows and focus on $59-$62 consolidation. The US API inventory key focus today.

- Gold: $1307.60 up 0.35%. Range $1301.70-$1308.40 with futures threatening $1310 break out with room for $1340 next. Silver up 0.85% to $15.90 also breaking out for $16.20 next. Platinum up 0.65% to $819.90 and Palladium up 0.5% to $1296.10.

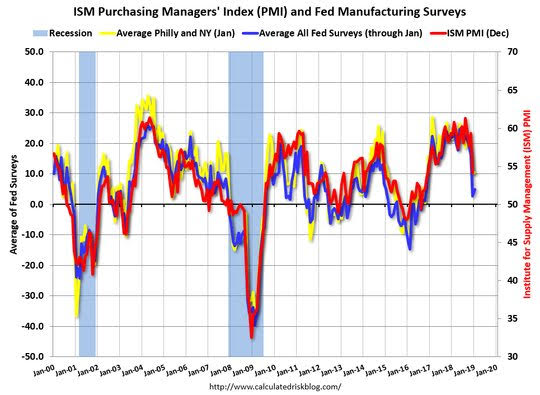

Conclusions: Is the US ISM and PMI report going to show a bigger hit to 1Q growth? The hope for a quick bounce back in the US 1Q growth after the US government shutdown has a larger backdrop with the upcoming PMI and ISM reports later this week. The focus on jobs and the FOMC maybe clouding the picture and yet, the risk rewards are clear that we should be on the lookout for a larger US 1Q drop in growth.

Economic Calendar:

- 0800 am Hungary central bank rate decision - expected -0.15% depo / 0.9% repo unchanged

- 0900 am US Nov S&P/Case-Shill home prices (y/y) 5%p 5%e (m/m) 0%p -0.1%e

- 1000 am US Jan Conference Board consumer confidence 128.1p 124e

- 1130 am US sells 12M bills and $20bn in 2Y FRN

- 0100 pm US sells $32bn 7Y notes

- 0200 pm UK Parliament vote on Brexit PlanB

- 0430 pm US weekly API oil inventories 6.55mb p 2mb e

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.