Markets: Idiosyncratic

A spate of earthquakes around the South China Sea from Indonesia, Taiwan and Philippines puts us on Tsunami alert but nothing happens and its all explained away as aftershocks from this weekend’s tragedy. For markets we see similar warnings, the quakes in TRY, NZD and RUB all look important but are explained away today as idiosyncratic. Those aren’t dominos but they do crash down.

This is the problem with the story – as a flood of currency weakness in the midst of risk-on moves up in equities (US shares are just 1% away from January record highs) puts tail-risk worries back into play. Explaining RUB weakness on US sanctions, TRY at new record lows on dashed hopes from US talks about sanctions and NZD at 2-year lows on a dovish RBNZ outlook is all fine and good enough. The bigger backdrop is that they happen in a larger market and their waves mix with the China/US worries, fears that FOMC hikes will drown the EM funding and geopolitics as Italy, Germany and UK continue with their summer of discontent. It may just be easier to explain today away as just another hot and humid summer day with a few showers but no big changes.

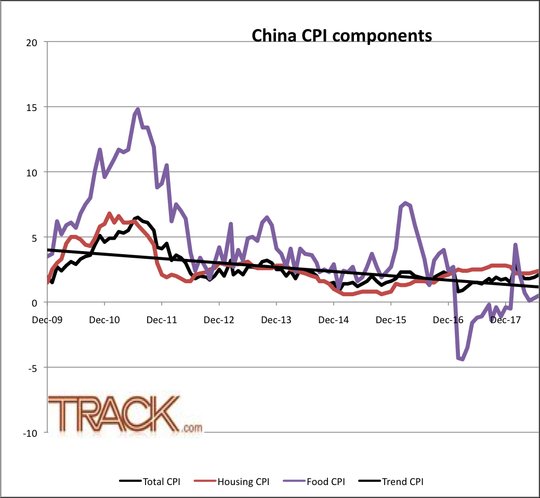

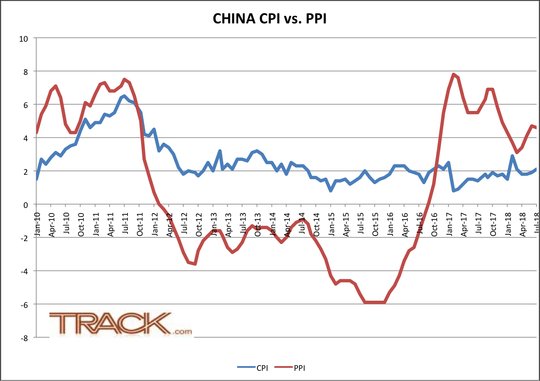

China CPI and PPI both slightly higher but not enough to spur anything different - money market rates did jump 20bps in 2Y there adding to CNY stability below 6.85. The Philippines BSP rate hike of 50bps to 4% was as expected but its still the steepest move in 10 years and with hawk talk following a slightly disappointing 6% 2Q GDP from 6.8% missing the 6.6% forecast - it may highlight the problem in EM – higher rates, weaker FX and missing growth. Throw in the problem of oil – the 3% drop yesterday adds to commodity issues and points back to US sanctions as US oil vanished in the trade data yesterday.

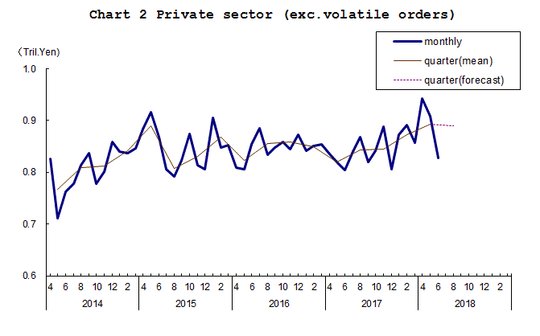

WASDE Friday will be worth watching with rising food inflation watch thanks to weather – EU wheat crop worst in 20-years- and tariff worries in Soybeans/Corn add up. As for growth Japan saw weaker core machinery orders and remains nervous about US trade talks given China outcomes. Running into Europe, moods changed like the weather and risk-off doesn’t seem so idiosyncratic as EM pain bleeds into Europe. This puts focus back to carry unwind risks and logically, JPY as the risk barometer.

Question for the Day:Has the USD/CNY peaked? Short answer – no. The focus on CNY as the risk barometer for Asia and most of the world equity and bond risks is still in play. The correlation of CNY to Asia shares was very high over the last 2 months. Overnight the rally back in Asia was in part linked to stability in the CNY more than any big reversal. This maybe the summer lull or people seeing value in shares – bear markets end on bargin hunting hopes. The CPI and PPI suggest the economy isn’t dead and that helped spur things on. Rates jumping from O/N to 2-years was another support. But all of these things are not sufficient to over come the FOMC rate hikes, US trade tariff concerns. The biggest part of the puzzle in CNY/USD today versus back in 2015 is that the CNY is trading in synchronicity with EM in general. The moves in RUB and TRY matter today and it makes CNY vulnerable and those that use it to track risk in play.

What Happened?

- New Zealand RBNZ leaves rate unchanged at 1.75%- as expected – but pushes out rate hike forecast. Governor Adrian Orr pushed out RBNZ’s forecast for a hike to the third quarter of 2020, a full year later than it predicted in May, while holding the official cash rate at a record low of 1.75 percent. “The direction of our next OCR move could be up or down,” he said.

- Japan June core machinery orders fell 8.8% m/m after -3.7% m/m – weaker than -1.5% m/m expected. The 3M average drops to -1.1% +0.6% - first drop in 6-months. This puts 3Q orders outlook -0.3% q/q after +2.2% q/q (revised from +7.1%). The Cabinet Office downgraded its assessment for the first time since May 2017, saying, "The picking-up in machinery orders is stalling." Previously, it said, "Machinery orders are picking up." Orders from the manufacturing sector fell 15.9% on month in June, the first drop in three months after +1.3% in May, while orders from the non-manufacturing sector excluding those for power generation and ships also fell 7.0% on month, the first fall in sixth months after +0.2% in May.

- China July CPI up 0.3% m/m, 2.1% y/y after -0.1% m/m, 1.9% y/y – slightly more than 2% y/y expected – highest since February. Food rose 0.1% m/m, 0.5% y/y after -0.8% m/m, +0.3% y/y while non-food rose 0.3% m/m, 2.4% y/y from 0.1% m/m, 2.2% y/y. Notable rise in transport/communication to 3.0% from 2.4% y/y and in recreation 2.3% from 1.8% y/y while health care fell to 4.6% from 5.0% y/y.

- China July PPI up 0.1% m/m, 4.6% y/y after up 0.3% m/m, 4.7% y/y – more than 4.4% y/y expected. Ex-factory price decrease of the following sectors contributed to the PPI m/m slowing: petroleum and natural gas extraction price fell by 3.2%; gasoline, coal and other fuel processing dropped 1.4%; and ferrous metals smelting and flattening lost 0.6%.

- Swiss July unemployment steady at 2.6%- as expected. The unemployment fell 0.5% m/m, -20.8% y/y while job vacancies rose 78% m/m, 145.8% y/y.

Market Recap:

Equities: S&P500 futures are up 0.09% after a The Stoxx Europe 600 is off 0.3% while the MSCI Asia Pacific rose 0.2% led by China.

- Japan Nikkei off 0.20% to 22,598.39

- Korea Kospi up 0.10% to 2,303.71

- Hong Kong Hang Seng up 0.88% to 28,607.30

- China Shanghai Composite up 1.85% to 2,794.71

- Australia ASX up 0.45% o 6,383.60

- India NSE50 up 0.18% to 11,470.70

- UK FTSE so far off 0.75% to 7,720

- German DAX so far off 0.4% to 12,584

- French CAC40 so far off 0.45% to 5,478

- Italian FTSE so faroff 0.6% to 21,664

Fixed Income: Risk on at start and off in at lunch – that was how Europe traded. UK Gilts mixed with 2Y yields up 1bps to 0.75% and 10Y off 1bps to 1.31% - Brexit stories and GBP driving – EU bonds are in tight range back to near open with 2Y German yields up 1bps to -0.61% and 10Y up 1.5bps to 0.395%. The Italian BTPs again key focus given mixed – with 2Y 0.955% and 10Y 2.90%.

- US Bonds mostly flat into 30Y sale - 2Y flat at 2.67%, 5Y flat at 2.835%, 10Y off 1bps to 2.96% and 30Y up 0.5bps to 3.115%.

- Japan JGBs curve flatten after strong auction – 10Y flat at 0.11% while 30Y off 0.5bps to 0.85%. Market sells 10-15Y for 20-30Y. The auction price was 96.35 better than 96.30 expected. The MOF sold Y586.4bn of 30Y bonds at 0.85% with 4.679 cover – previously 0.706% with 5.00 cover.

- Australian bonds bid with NZ move on RBNZ mattering – 10Y New Zealand bonds fell 7bps to 2.70% while Australian 3Y off 3bps to 2.065% and 10Y off 2bps to 2.655%.

- China PBOC skips open market operations, leaves liquidity neutral. Money market rates rose with O/N up 21.5bps to 1.617% and 7-day up 11bps to 2.356%. 10Y bond yields rose 4.5bps to 3.545%.

Foreign Exchange: The US dollar index up 0.2% to 95.23 – wake up if 95.65 breaks else 94.95-95.53. In Asia EM FX, USD mostly weaker – TWD flat at 30.60, KRW up 0.3% to 1116.65, INR off 0.1% to 68.645. In EMEA, USD is bid, RUB off 0.75% to 66.056, ZAR off 0.85% to 13.513, TRY off 1.9% to 5.401 was 5.4480.

- EUR: 1.1590 off 0.2%. Range 1.1573-1.1622. Stuck with 1.1550 base holding. Rates/politics and crosses driving.

- JPY: 111.15 up 0.2%. Range 110.71-111.19 with EUR/JPY 128.80 flat. Rates and trade talks key with 110.70-112 still in play.

- GBP: 1.2885 flat. Range 1.2841-1.2920 with EUR/GBP .8990 off 0.5% but reversed from .9032 highs – with Brexit and Boris in play.

- AUD: .7415 off 0.25%. Range .7383-.7453 with China shares helping but RBNZ hurting. NZD .6650 off 0.8% with .6640 lows.

- CAD: 1.3045 up 0.2%. Range 1.30-1.3120 with NAFTA vs. Saudi dumping in focus and risk of 1.2880 still should Saudi story fizzle.

- CHF: .9935 flat. Range .9917-.9971 with EUR/CHF 1.1515 off 0.15%. Watching BTPs and EU politics.

- CNY: 6.8317 fixed 0.01% weaker from 6.8313, sees CNY gain into London at 6.8295 from 6.8316 closing yesterday. CNH up 0.1% to 6.82.

Commodities: Oil mixed, Gold up, Copper up 2% to $2.8280.

- Oil: $66.91 off 0.05%.Range $66.49-$67.19. Trade worries and supply. WTI watching $67.86 Friday lows for upside against $65.90 Feb uptrend line and then $62.84 the 200-day ma. Brent $72.30 flat with focus on $72 as pivot still.

- Gold: $1214.50 up 0.15%.Range $1214-$1216 – tight ranges with USD bid defied on EM jitters. Silver $15.43 u 0.4% with $15.25 base. Platinum $829.50 up 0.25% and palladium up 1.8% to $888.40.

Economic Calendar:

- 0815 am Canada July housing starts 248.1k p 220ke

- 0830 am Canada July new home prices (m/m) 0%p 0%e

- 0830 am US July PPI (m/m) 0.3%p 0.2%e (y/y) 3.4%p 3.2%e / core 2.8%p 2.8%e

- 0830 am US weekly jobless claims 218k p 217k e

- 1000 am US July wholesale inventories 0%p 0%e

- 1230 pm Chicago Fed Evans press conference

- 0100 pm US 30Y $18bn bond sale

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.

A lot fewer acronyms would make this a lot more intelligible to those of us who are not deep into the jargon pool. It gets as bad as a group of yachtsman drinking after a sailing race. So please have a bit of mercy on those of us who don't do financials for a living.