Markets: Ides

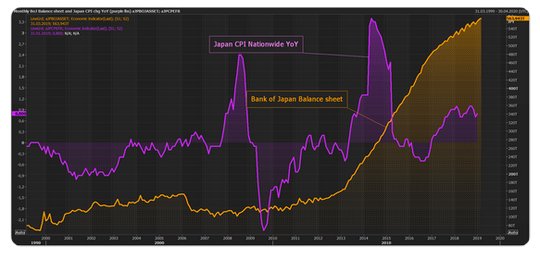

Stuck with Friday, between Pi day and St. Partick’s with many warning to beware because of the witching expiries and the sharp turns in positions that followed them in September and December for risk. Markets are fickle and superstitious. Why the fears of delays yesterday and none today for US/China trade talk or Brexit? Why the insanity of the New Zealand atrocity today? Hate goes a long way. Why does Modern Monetary Theory (MMT) seem so extreme to BOJ Kuroda after 20 years of its in Japan? MMT is worth highlighting as a rising theme for Western democracies after 10-years of QE and ZIRP or NIRP has lifted assets but not voters. The risk-on today seems less about politics and more about the techinical engineering of central bankers to keep finance stable. The long-tail risk of which is MMT. The experiments of "normalization", as opposed to the fears of a liquidity trap, are on play in 2019. This started with the ECB and continues with the BOJ today. There is some sense that monetary policy is great for braking a too-hot economic world but not so good at accelerating it, which requires fiscal stimulus. Hence the MMT discussions. Markets are waiting still for some volatility as the excitement around Brexit and China has been muddled at best because everyone knows its not over and that the delays can become permanent. Being in the middle as in the ides isn't safe, watch your back. This is the same for those that want to believe in long-term value plays. The EUR is probably fair value at 1.25 but the chart is telling us 1.08.

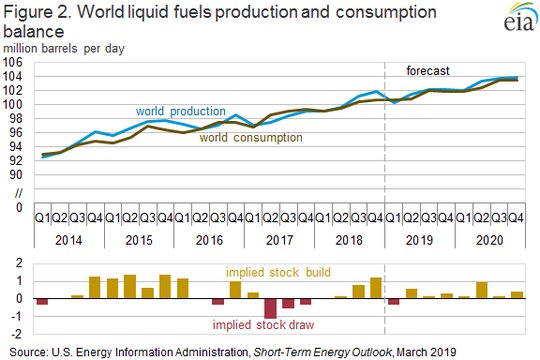

Question for the Day: Why is oil higher if markets are fearing lower global growth? Oil prices along with a number of other markets are used to measure global demand. The anomaly of the last week and a bit of this one is in the rising prices versus the growing fears of a global slowdown. The BOJ/ECB shifting outlooks highlight this point. The oil market is digesting 3 key drivers - the OPEC plan, the Venezuela crisis and the US sanctions on Venezuela and Iran. The price action in oil reflect these stories more than the overall supply/demand dynamic. This means that the signals of higher oil have less correlation to growth hopes than usual, and indirectly help emerging markets less than normal.

The IEA warned in is oil report today of "significant' challenges to the present market should Venezuela outages continue. IEA said Venezuelan output had dropped a further 100,000 b/d in February, to 1.14 million b/d."Much of this spare capacity is composed of crude oil similar in quality to Venezuela's exports. Therefore, in the event of a major loss of supply from Venezuela, the potential means of avoiding serious disruption to the oil market is theoretically at hand," the IEA said. However, it also said OPEC now had a spare production capacity of 2.8 million b/d, partly on the back of intensifying production cuts, which should provide a "cushion."

The OPEC montly report shows crude output fell 221,000 bpd on the month of February to 30.55mbd total - that is less than the 797,000 drop in January bpd - when the OPEC plan of 1.2mbd cuts went into effect. Saudi production fell just 86,000bpd in February to 10.09mbd - that was down from 350,000 in January. Most of the OPEC production drop in February is linked to Venezuela off 142,000 bpd and more due to US oil sanctions and political strife than compliance. Total global oil supply in February fell by 160,000 barrels a day, to average 99.15 million barrels a day, OPEC said. They kept their demand steady at 99.96mbd.

What Happened?

- China February house prices gain 0.5% m/m, 10.4% y/y after 10% y/y – more than the 9.5% expected – best in 21-months. Still, this was the slowest pace of monthly gains since April 2018. Most of the 70 cities saw increases 57 vs. 58 in January. Tier-1 cities rose 0.3% from 0.4% m/m. Tier 2 rose 0.7% m/m flat to January and Tier-3 rose 0.4% from 0.6% m/m. New household loans, mainly mortgages, totaled 919.2 billion yuan ($136.69 billion) in February, accounting for 22.36% of total new loans last month.

- Bank of Japan leaves policy unchanged at-0.1%, 10Y 0% yield and Y80trn QE - as expected – but warns of global slowdown.Vote was 7-2. Despite the shift in outlook, BOJ Kuroda told reporters: “I don’t think there is a need to make any changes to our prices target.” He noted it will take longer and that most of the board see it prudent to be patient. Kuroda added: “It is true Japan’s exports and output are being affected by lean overseas growth. On the other hand, domestic demand continues to grow. We maintain our baseline view that the economy is expanding moderately. “

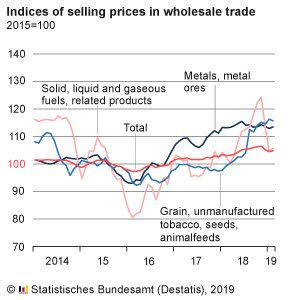

- German February wholesale prices rose 0.3% m/m, 1.6% y/y after -0.7% m/m, 1.1% y/y – more than the 0% m/m, 1% y/y expected.

- Italy January industrial sales rise 3.1% m/m after -3.6% m/m while orders rise 1.8% m/m after -1.4% m/m. The domestic orders were -1.1% while foreign +6% while sales were +2.3% domestic and +4.5% foreign.

- Eurozone February final HICP unrevised at 0.3% m/m, +1.5% y/y after -1% m/m, 1.4% y/y - as expected. The core price drops to 1% y/y from 1.1%. With energy up 0.6% m/m, 3.6% y/y and Food up 0.3% m/m, 2.3% y/y. Services rose 0.4% m/m, 1.4% y/y.

Market Recap:

Equities: The US S&P500 futures are up 0.3% after losing 0.1% yesterday. The Stoxx Europe 600 is up 0.3% while the MSCI Asia Pacific rose 0.8%.

- Japan Nikkei up 0.77% to 21,450.85

- Korea Kospi up 0.95% to 2,176.11

- Hong Kong Hang Seng up 0.56% to 29,01.26

- China Shanghai Composite up 1.04% to 3,021.75

- Australia ASX off 0.03% to 6,265.10

- India NSE50 up 0.74% to 11,426.85

- UK FTSE so far up 0.5% to 7,222

- German DAX so far up 0.3% to 11,626

- French CAC40 so far up 0.5% to 5,375

- Italian FTSE so far up 0.4% to 20,966

Fixed Income: Risk on helping drive bonds from edge of Japanification in Europe. German 10Y yields up 2bps to 0.09%, France up 1bps to 0.47%, UK Gilts up 4bps to 1.23% while periphery rallies - Italy off 6bps to 2.50%, Greece off 1bps to 3.81%, Spain flat at 1.21% and Portugal off 2bps to 1.33%.

Foreign Exchange: The US dollar index 96.66 off 0.15%.

- EUR: 1.1325 up 0.15%. Range 1.1298-1.1329 with focus on 1.1250-1.1380 still - US data and stocks driving.

- JPY: 111.70 flat. Range 111.49-111.90 with EUR/JPY 126.45 up 0.15%.

- GBP:1.3270 up 0.1%. Range 1.3203-1.3278 with EUR/GBP .8530 up 0.1%. Nothing has changed?

- AUD:.7075 up 0.2%. Range .7062-.7093 with NZD up 0.15% to .6845

- CAD: 1.3315 off 0.15%. Range 1.3289-1.3334 with data and oil driving again - 1.3250-1.3350 keys.

- CHF 1.0045 up 0.1%. Range 1.0019-1.0047 with:EUR/CHF 1.1370 up 0.2% risk on and 1.00-1.0080 thinking.

- CNY: 6.7135 off 0.1%. Range 6.7060-6.7290 - all about trade talks still.

Commodities: Oil down, Gold up, Copper up 0.3% to $2.9195.

- Oil: $58.52 off 0.15%. Range $58.46-$58.95 with yesterday's break out driving $58-$60 thinking. Brent $67.08 off 0.2% with $68 pivot holding.

- Gold: $1302.20 up 0.5%. Range $1293.70-$1304.20 with focus on USD and rates still. Silver $15.36 up 1.25%, Platinum up 1% to $835.50 and Palladium up 0.4% to $1520.70.

Economic Calendar:

- 0830 am Canada Jan manufacturing sales (m/m) -1.3%p 0.5%e

- 0830 am US Mar NY Empire State Manufacturing 8.8p 10e

- 0915 am US Feb industrial production (m/m) -0.6%p 0.4%e

- 1000 am US Jan JOLTS job openings 7.335m p 6.9mn e

- 1000 am US Mar Michigan preliminary consumer sentiment 93.8p 95.5e

- 0400 pm US Jan net long-term TIC flows -$48.3bn p

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.