Markets: Hell

The road to hell is paved with good intentions. Markets are on this path as hope for owning risk starts with the best plans from political leaders and central bankers. There are plenty of hellish stories overnight to blame for the turn of mood in equities. The first being the weaker EU commission forecasts for EU growth that hits Italian bonds pushes the EUR lower and makes everything good about easy money look suspect. The second is that EU Donald Tusk warned of a “special place in hell” for those in the UK wishing Brexit with no plan. This grabbed headlines and leaves clear that Europe and the UK both suffer with this political divorce. The other EU story is from the European data where nothing comes up better but worse than expected for German and Spanish industrial production, Italian retail sales and the list goes on supporting the cut in EU growth forecasts. The third story is that of the RBI which surprised with a rate cut from 6.5% to 6.25% which quickly turned into a doubting game about political power over the central bank independence rather than one where monetary policy supports growth. Finally, the BOE had its own surprise as it retreats from its rate hike plans and cuts its growth forecasts into the abyss of Brexit uncertainty and geopolitical doubt. The BOE cut is 2019 GDP to 1.2% from 1.7% in November. This is lowest growth outlook since the great recession. The BOE joins India, Australia, Canada, and the US in backing away for rate hike plans highlighting the economic uncertainty. The winner in all of this is the USD and that becomes the bellwether for pain in other asset classes should the present rally extend beyond 97.55.

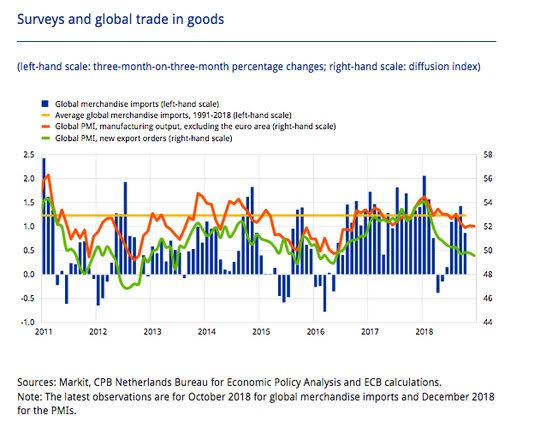

Question for the Day: Is the ECB worried about growth yet? The ECB Bulletin out today highlighted the risk to the downside for growth, blaming protectionism, Brexit, EM volatility, policy uncertainty both fiscal in the EU and monetary abroad. The charts on ESI and PMI highlight the weakness of the Eurozone economy.

Against this gloom, the message sent isn’t one of fear but expectation that the present weakness is an extended soft patch. The ECB notes the following: “Even though growth is expected to slow, which is consistent with a maturing business cycle in which labor supply shortages increase in some countries and saving ratios recover from their low levels, activity is expected to be relatively resilient owing to a number of factors, including the expected continued expansion of global activity, the accommodative monetary policy stance supporting financing conditions, improving labor markets, rising wages and some fiscal loosening.” Bottom Line – the ECB is banking on the consumer to save the day with wages expected to help. The private consumption data will be key for understanding ECB policy moves through 2019.

This puts the EU commission forecasts for Winter 2019 in the spotlight on the day as well. The sharp cuts in 2019 growth from the Autumn outlook hit markets today and much of the growth remains predicated on the uncertainties receding rather than getting worse.

What Happened?

- Japan December LEI preliminary 97.9 from 99.1 – as expected. The coincident index drops to 102.3 from 102.9. The Cabinet Office assessment of the current conditions is “weakening”

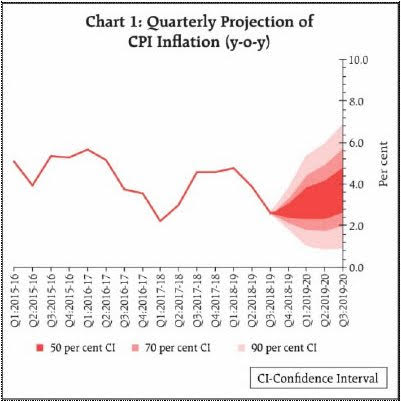

- India RBI cuts rates 25bps to 6.25%- surprising market – first easing since Aug 2017. Most expected a shift in policy stance then a rate cut in April or later. The easing action was by a 4-2 vote. Deputy Governor Viral Acharya and another MPC member, Chetan Ghate, voted for status quo in interest rates, while Das and three others voted for a cut in interest rates. The MPC also changed the policy stance to ‘neutral’ from ‘calibrated tightening’. This was first money policy review for Shaktikanta Das the former economic affairs secretary, who took over as RBI Governor in the second week of December 2018. The RBI sees FY2020 GDP at 7.4%, CPI is seen at 2.4% in 1Q2019 and 3.2%-3.4% for 2Q and 3Q. They think the FY2020 budget proposals will likely boost demand. They also raised the limit for collateral free farm loans and linked bank ratings to exposure to NBFCsDas said that shift in stance to neutral provides flexibility to meet growth challenges. "Farm output was expected to decelerate in FY19. Continuing deflation in food and crude led to decline in headline inflation,” he added. Das also emphasized on the need to strengthen private investment activity.

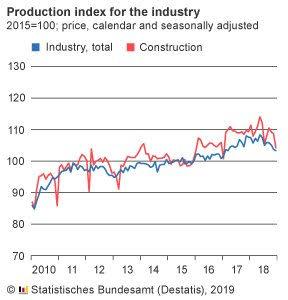

- German December industrial production -0.4% m/m, -3.9% y/y after revised -1.3% m/m (pre -1.9%), -4.0% y/y – weaker than +0.6% m/m expected. Ex-energy and construction, production rose 0.2% m/m. Within industry, capital goods rose 0.9%, intermediate goods fell 0.4%, consumer goods fell 0.5%. Outside industry, energy was flat and construction fell 4.1% m/m.

- Spain December industrial production -1.4% m/m, -6.2% y/y after revised -1.8% m/m, -3.2% y/y (pre -2.6%) – weaker than -2% y/y expected. By industry, non-durable consumer goods fell 0.1% m/m, capital goods -2.5% m/m, intermediate goods -0.3% m/m, consumer durable goods -5% m/m. Energy fell 3.4% m/m.

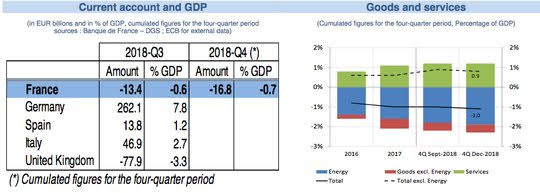

- French December trade deficit E4.7bn after revised E4.8bn (pre E5.1bn) – more than E4bn expected. Exports rose 2.2% m/m while imports rose 1.7% m/m. The French C/A deficit narrows to E1.1bn from revised E3bn (pre E2.8bn) – worse than E0.8bn expected. The services surplus rose E2.9bn from E2.0% and secondary income deficit narrowed to E3.7bn from E5bn, but the goods gap widened to E4.7bn from E4.6bn and primary income surplus fell to E4.4bn from E4.5bn.

- Italy December retail sales -0.7% m/m after revised 0.6% m/m (pre 0.7%) – weaker than +0.7% m/m expected. Sales by product shows pharmaceutical products -3.3%, sporting and toys -2.7% while furniture/textiles rose 1.9% and other products rose 2.9%. Internet sales slowed to up 0.6% y/y from +22.7% in November. Overall, sales for 2018 were up 0.2% y/y. For December, growth was 0.6% y/y in value and -0.5% y/y in quantity.

- ECB monthly bulletin: Risks to growth outlook have moved to the downside. “Overall, the risks surrounding the euro area growth outlook have moved to the downside on account of the persistence of uncertainties related to geopolitical factors and the threat of protectionism, vulnerabilities in emerging markets and financial market volatility.”

Market Recap:

Equities: The US S&P500 futures are down 0.45% after a 0.22% loss yesterday. The Stoxx Europe 600 is off 0.5% with forecast cuts driving. The MSCI Asia Pacific remains holiday thin and off 0.2% with Australia gaining at Brazil’s expense in the mining sector.

- Japan Nikkei off 0.59% to 20,751.28

- Korea Kospi flat at 2,203.42

- Hong Kong Hang Seng closed for holiday

- China Shanghai Composite closed for holiday

- Australia ASX up 1.1% to 6,159.20

- India NSE50 up 0.06% to 11,069.40

- UK FTSE so far off 0.1% to 7,167

- German DAX so far off 1.0% to 11,210

- French CAC40 so far off 0.5% to 5,054

- Italian FTSE so far off 1.1% to 19,767

Fixed Income: The blast of cold data and dovish central bank outlooks drives EU bonds sharply higher, yields are down almost everywhere except in Italy – that contrast and fear about growth matters. German 10-year bond yields off 4bps to 0.12%, French OATs off 3bps to 0.55%, UK Gilts post-BOE off 4bps to 1.17% while Italy up 9bps to 2.92%, Spain off 1bps to 1.25%, Portugal up 1bps to 1.68% and Greece up 6bps to 3.96%.

- Spain sold E1.2bn of 3Y Bonds at -0.086% with 3.88 cover - previously -0.047%

- France AFT sold E4.45bn of 10Y OATs at 0.57% with 2.15 cover - previously 0.70% and 1.92 cover.

- US Bonds are bid across the curve– 2Y off 2bps to 2.50%, 5Y off 3bps to 2.48%, 10Y off 3bps to 2.67% and 30Y off 3bps to 3.01%.

- Japan JGBs sold with focus on supply and BOJ– 2Y up 1bps to -0.15%, 5Y up 1bp to -0.15%, 10Y up 1bps to -0.01%, 30Y up 2bps to 0.62%. The MOF sold Y563.4bn of 0.7% 30Y #61 JGB at 0.589% with 4.72 cover from 0.72% previously

- Australian bonds are bid with RBA hangover continuing –3Y off 3bps to 1.64%, 10Y off 7bps to 2.10%.

Foreign Exchange: The US dollar index up 0.2% to 96.60. In EM USD also bid, Asia– KRW off 0.15% to 1122 while INR up 0.2% to 71.41; EMEA– RUB off 0.3% to 66.045, ZAR off 0.25% to 13.57 and TRY off 0.6% to 5.241

- EUR: 1.1340 off 0.25%.Range 1.1332-1.1369 with 1.13 risk of break leading to 1.1180 target getting higher on EU forecasts.

- JPY: 109.85 off 0.1%.Range 109.73-110.09 with 110.20 holding opening up 108 on equity de-risk move threat. EUR/JPY 124.50 off 0.35%.

- GBP: 1.2905 off 0.2%.Range 1.2895-1.2963 with UK May still working on the Brexit story but EUR driving today 1.2850 next key. EUR/GBP .8780 flat.

- AUD: .7105 off 0.1%. Range .7092-.7114 with .7050 back in play post RBA Lowe despite stock rally and mining focus. NZD off 0.2% to .6755

- CAD: 1.3250 up 0.3%.Range 1.3204-1.3254 with 1.3050 base now for 1.3350 again. Oil, US rates and data key.

- CHF: 1.0020 flat. Range 1.0017-1.0029 with EUR/CHF 1.1355 off 0.3%. All about Italian bonds, ECB policy and weaker growth – EUR driving.

Commodities: Oil lower, gold lower, Copper up 0.1% to $2.8215.

- Oil: $53.72 off 0.55%.Range $53.53-$54.21 with US inventory build one driver, weaker growth forecasts from Europe the other. Brent off 0.35% to $62.48 with focus on $62 as pivot.

- Gold: $1310.70 off 0.3%.Range $1306.40-$1311.60 with safe havens bid for CHF and JPY but not gold – suggests $1305 still key with $1320 bounce possible. Silver up 0.1% to $15.72, Platinum off 0.7% to $808.30, Palladium up 0.1% to $1353.60.

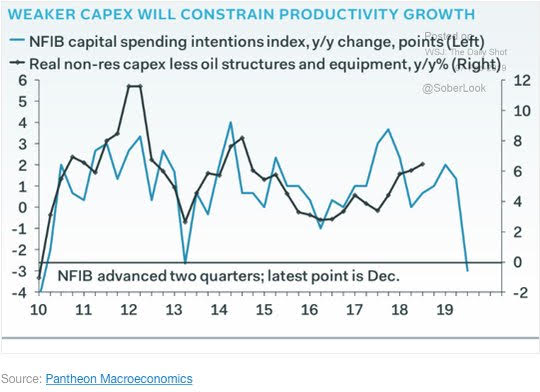

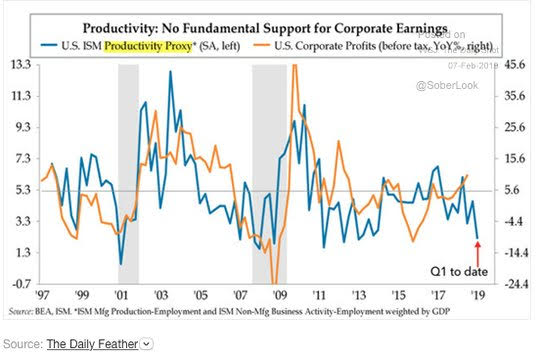

Conclusions: Is US productivity the risk to the S&P500? The US market looks relatively strong compared to Europe today. The market in equities has been bid up but the mood is changing over the last 48 hours – and some of the risks are about earnings into 2019. Linking earnings to productivity and investment is the stuff of economists and these two charts are worth considering for some of the risk reduction.

Economic Calendar:

- 0830 am US weekly jobless claims 253k p 225k e

- 0100 pm US sells $19bn 30Y bonds

- 0200 pm Mexico central bank rate decision – no change from 8.25% expected.

- 0300 pm US Dec consumer credit $22.2bn p $16bn e

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.