Markets: Grinding - Friday, November 9

There is a skate park feel to trading as the painful retreat of equities and oil feels like a trick gone bad. The oil fail today has many reasons – the FOMC hawkish tone, the Saudi OPEC doubts, China confidence crumbling (Auto sales of 12% in Oct), US politics, Italian banks, Brexit deal doubts. What is clear for markets is you don’t get off the half-pipe accident without some blood, sweat and tears. Overnight economic stories didn’t help – UK industrial production weaker, UK 3Q GDP in line but September weaker, UK trade still a drag, China PPI/CPI in line but not helpful for growth, Australian SOMP upbeat on growth but sees more risks on trade. Beyond the economic headlines – which are mixed at best – you have these tidbits to consider:

- Italian banks are moving BTP holdings to the back-book. The ability to not mark-to-market liquid sovereign bonds seems problematic for ECB and QE ending. Accounting changes don’t make the losses better as this is about collateral for other risk and hampers future loans and growth.

- China business and consumer confidence in doubt. The number of “uncertain” word counts in recent 4Q outlooks from China companies and the drop in consumer spending (which will be known more clearly next week) driving doubts about policy stimulus working.

- European growth outlooks are being marked down. Even with oil lower, the outlook for 4Q growth is lower and the EU Commission reports from yesterday are hurting.

When you mix this all together the uptrend for the USD holds as it’s the October safe-haven and perhaps still the same for November. What seems most hurt in the week isn’t the EUR or CNY but oil and that maybe the key for watching risk in equities into the weekend.

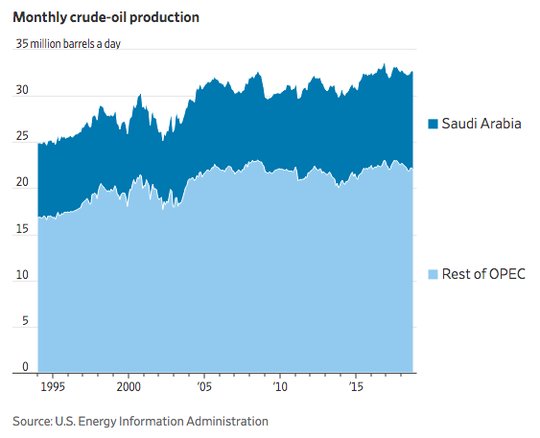

Question for the Day: Is Oil the next key for markets? The OPEC weekend meeting maybe more important for markets than the further analysis of US mid-terms and US/China trade hopes. Oil went into a bear market yesterday and today, WTI trades below $60. The risk of less price pressures from inflation has helped some nations – India being one obvious winner – but for the US this is mixed. For Saudi it’s a problem. For OPEC its worse – Saudi is 1/3 of the total output and its future is more linked to the US and Aramco IPO than others. The WSJ reports on a Saudi study about the end of OPEC. The OPEC study aims to “assess the short/medium-term consequences of a dissolution of OPEC,” according to an overview reviewed by The Wall Street Journal. It is intended to determine how the global oil market, and Saudi finances, would look “if coordination between oil producing countries disappear,” according to the overview. The overview describes two scenarios to investigate, if OPEC isn’t in the picture: 1. All big oil producers, including Saudi Arabia, act competitively—fighting each other for market share; 2. Saudi Arabia, instead, attempts to leverage its massive oil output alone to help balance global supply and demand in an attempt to keep oil prices steady—similar to the role that members say OPEC plays today.

What Happened?

- Australia September home loans -1% m/m after -2.2% -- as expected. August revised lower from -2.1% m/m. Construction loans -3.5% after -6.5%, new home purchases -3.9% after +0.1%, existing home purchases -0.5% after -1.7% m/m. The refinancing also lower -1.8% after -0.6% m/m. The investment lending fell to -2.8% from -1.1% m/m with total lending on value basis -3.8% after -3.1% m/m.

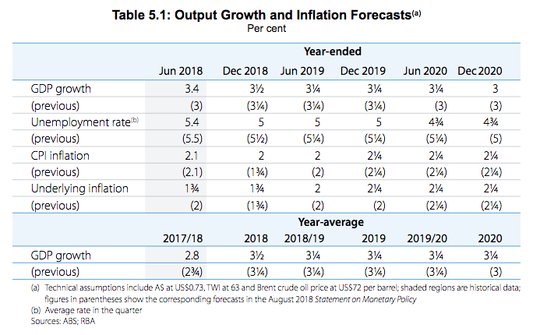

- RBA November Statement on Monetary Policy: Lifts 2018 GDP forecasts, sees higher rates longer-term, but risks to global growth. GDP forecast lifted to 3.5% from 3.25% for 2018 with domestic growth expected above trend over forecast period and with it inflation to 2.24% core by mid 2020 with unemployment at 4.25%.

- China October CPI up 0.2% m/m, 2.5% y/y after 0.7% m/m, 2.5% y/y – as expected. Food fell 0.3% m/m even with flooding and swine flu issues, while core (non-food/energy) rose 1.8% y/y from 1.7% y/y.

- China October PPI up 0.4% m/m, 3.3% y/y after 3.6% y/y – as expected. Raw material costs slowed to 6.7% from 7.3% y/y with fuel processing, chemicals slowing.

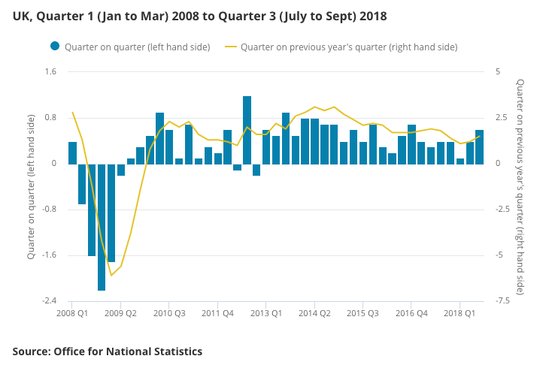

- UK 3Q GDP 0.6% q/q, 1.5% y/y after 0.4% q/q, 1.2% y/y – as expected. The September 3M rolling average slows to 0.6% q/q from 0.7% - also as expected – as the monthly GDP was 0% same as August. Business investment -1.2% q/q after -0.7% q/q – weaker than 0.2% q/q expected.

- UK September industrial production 0% m/m, 0% y/y after revised 0% m/m, 1% y/y - weaker than 0.1% m/m, 0.4% y/y expected. August revised down from 0.2% m/m. The manufacturing production up 0.2% m/m, 0.5% y/y after -0.1%, 1.3% y/y - better than 0.1% m/m expected. In a separate report construction output rose 3% y/y after 0.5% y/y – better than the 1.5% y/y expected.

Market Recap:

Equities: The S&P500 futures are off 0.5% after losing 0.25% yesterday. The Stoxx Europe 600 is off 0.7% - biggest drop in 2 weeks – while the MSCI Asia Pacific fell 1.1% and the MSCI EM fell 1.6%.

- Japan Nikkei off 1.05% to 22,250.25

- Korea Kospi off 0.31% to 2,086.09

- Hong Kong Hang Seng off 2.39% to 25,601.92

- China Shanghai Composite off 1.39% to 2,598.87

- Australia ASX off 0.08% to 6,011

- India NSE50 off 0.12% to 10,585.20

- UK FTSE so far off 0.9% to 7,077

- German DAX so far off 0.75% to 11,443

- French CAC40 so far off 1.05% to 5,077

- Italian FTSE so far off 1.45% to 19,150

Fixed Income: A hawkish twist to FOMC statement, worries about Italy and China – all that drove EU bonds bid from the start. German Bund 10-year yields off 2.5bps to 0.43%, French OATs off 1.5bps to 0.805%, UK Gilts off 3bps to 1.53% while Italy up 4bps to 3.43%, Spain off 0.5bps to 1.60%, Portugal up 0.5bps to 1.935% and Greece up 5.5bps to 4.35%.

- US Bonds see bull flattening with risk-off mood swing– 2Y off 1.6bps to 2.949%, 5Y off 2.2bps to 3.07%, 10Y off 2.6bps to 3.211%, 30Y off 2.6bps to 3.408%.

- Japan JGBs steady, BOJ kept buying unchanged – 30Y sale next week next focus. 10Y flat holding 0.12%, 20Y off 0.5bps to 0.66%.

- Australian bonds lower with SOMP key– 3Y up 0.5bps to 2.108%, 10Y up 0.2bps to 2.755%.

- China PBOC skips open market operations, leaves liquidity neutral. China rates mixed – 2Y up 1bps to 2.89%, 5Y off 2bps to 3.26%, 10Y off 1bps to 3.46%.

Foreign Exchange: The US dollar index up 0.15% to 96.77 with focus on 97.20 and 96.50 as pivot. In Emerging Markets – USD is bid except for India – EMEA: ZAR off 1.05% to 14.285, TRY off 0.6% to 5.495, RUB off 0.6% to 67.31; ASIA: TWD off 0.35% to 30.768, INR up 0.7% to 72.495, KRW off 1.05% to 1128.

- EUR: 1.1350 off 0.1%.Range 1.1327-1.1389 with 1.13 back in play and focus on Italy, rates.

- JPY: 113.85 off 0.2%.Range 113.76-114.09 with 114.20 key and 112.80 base – EUR/JPY 129.20 off 0.3% - all about equities and rates still

- GBP: 1.3025 off 0.3%. Range 1.2995-1.3072 with Brexit and politics beating GDP and trade as 1.30 pivot for 1.2880 again.

- AUD: .7245 off 0.2%.Range .7235-.7271 with SOMP not enough and home loans flashing bubble pop – NZD .6750 off 0.1%.

- CAD: 1.3195 up 0.3%.Range 1.3141-1.3198 with 1.3250 next but risk of BOC mistake higher – oil focus with 1.34 target risk

- CHF: 1.0060 flat. Range 1.0049-1.0086 with EUR/CHF 1.1415 off 0.15% - all about Italy and 1.02 risk for USD.

- CNY: 6.9329 fixed 0.24% weaker from 6.9163. Now off 0.2% to 6.9485 with range 6.9351-6.9523 with focus on 6.97 and 7.00 still.

Commodities: Oil lower, Gold lower, Copper off 1.35% to $2.7725

- Oil: $59.83 off 1.35%,Range $59.28-$60.79 with focus on $60 pivot and OPEC weekend. Brent off 1.25% to $69.76 with $70 pivot and $68 base.

- Gold: $1218.90 off 0.4%.Range $1218-$1223 tracking USD again with $1215 and $1206 key. Silver off 0.75% to $14.33 with $14.28 next key. Platinum off 0.4% to $860.50 and Palladium off 1% to $1116.55.

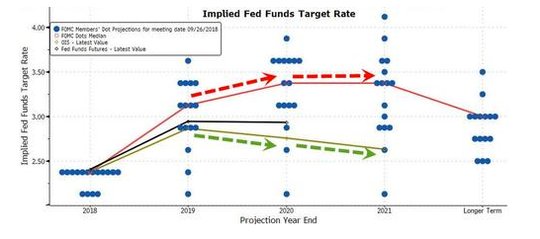

Conclusions: Is the Fed right that better jobs makes up for weaker housing and capex? The markets took the FOMC as hawkish yesterday.While most everyone sees a December hike, its more about the reaction function into 2019 that seems less obvious and the statement yesterday makes clear that tighter labor markets are the issue – putting the weekly jobless claims and job surveys from PMIs and Fed regional reports as key for trading until December.

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.

cheap oil=tax break...doing the Fed's dirty work..no rate hike Dec. if oil stays low

Don't go crying because oil prices are not climbing higher and higher, because high oil prices hurt everybody else. So get the profit someplace that does not damage the economy and hurt everybody else.