Markets Fall As Senate Debates Higher Stimulus Checks

Quick Update

As a quick update to kick off today’s article, I would like to summarize my correct calls and what I profited on since beginning to publish these Driver & Diver updates. While nobody can predict the future, here are the major calls I am most proud of since producing these letters: 1) hedging or selling the U.S. Dollar; 2) selling energy; 3) switching my short-term call on small-caps from HOLD to SELL.

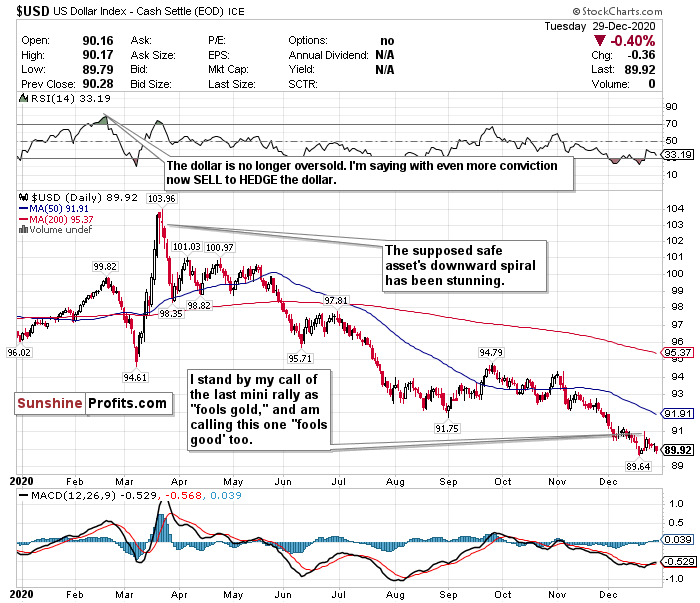

Ever since beginning these Driver & Diver updates on December 9th, I have made SELL calls for the U.S. Dollar and energy. My call on the U.S. dollar was based on the Fed’s policies, the effect of interest rates this low for this long, government stimulus, strengthening of emerging markets, and inflation. I also said that any minor rally the dollar would experience would be fool’s good. Since the dollar briefly pierced the 91-level on December 9th, it has fallen over 1%. Despite the dollar experiencing another mini-rally and nearly piercing the 91-level again on December 22, I remained steadfast in my bearish outlook of the dollar. Since the open on December 23rd, the U.S. Dollar has declined another 0.75%. I believed the dollar could drop back below 90 before the new year, and now here we are.

Since the first Driver & Diver, I also said that energy is unpredictable and volatile, and has consistently pulled back in 2020 after experiencing a hot streak. Since December 10th, the Energy Select Sector SPDR Fund (XLE) has declined over 9.5%.

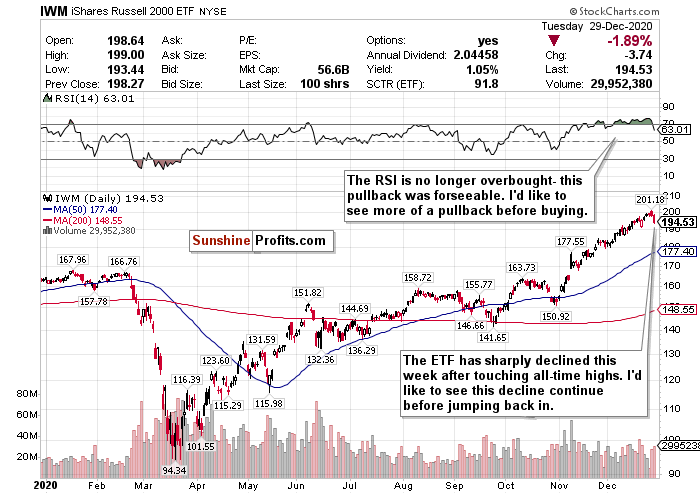

I also switched my call on small-caps, specifically the Russell 2000, to a short-term SELL from a HOLD on December 16th. Although the iShares Russell 2000 ETF (IWM) is largely flat since I switched my call, by any measurement, the index has overheated. In this week alone, the IWM has underperformed ETFs tracking the larger indices and has declined by nearly 3%. While I am still bullish on small-caps in the long run and maintain my STRONG BUY call on the Russell for the long-term, it is contingent on a pullback. I believe that pullback may have begun.

Stocks fell on Tuesday (Dec. 29) after the major indices all hit record highs on Monday (Dec. 28). Investors monitored the Senate’s talks on higher stimulus checks.

News Recap

- The Dow Jones snapped a 3-day winning streak and declined 68.30 points lower, or 0.2%, to close at 30,335.67. At its session high, the Dow was up more than 100 points. The S&P 500 also snapped a 3-day winning streak and declined 0.2%, and the Nasdaq fell 0.4%. The small-cap Russell 2000 index continued its decline this week and fell 1.92%.

- The Democrat-led House voted late Monday to increase stimulus payments to $2,000 from $600. Although Senate Majority Leader Mitch McConnell blocked fast-tracking unanimous Senate approval on Tuesday (Dec. 29), many GOP Senators have expressed support for the stimulus increase. Time will tell what happens.

- Apple (AAPL) and Home Depot (HD) fell more than 1% each to lead the Dow lower.

- Intel (INTC) shares rose nearly 5% due to news of exploring “strategic alternatives.” Intel shares have lost nearly 18% this year, and the chipmaker has lost significant market share to many other semiconductor competitors.

- Amidst fears of a COVID-19 “surge on top of a surge” after the Christmas holiday, more than 2.1 million people in the U.S. have now been vaccinated. However, the U.S. is likely to fall far short of its goal to vaccinate 20 million people by the end of the year. Meanwhile, the U.S. has averaged at least 184,000 new infections per day.

- The U.K. became the first country to approve a COVID-19 vaccine by AstraZeneca and Oxford. This is the third emergency-use approval vaccine, but is not yet approved in the U.S.

Investors on Monday (Dec. 28) cheered President Trump’s signing of the stimulus bill. However, some of those gains were lost on Tuesday (Dec. 29) as eyes turned to the Senate’s decision on raising direct stimulus payments from $600 to $2,000.

While some of these declines can be attributed to the end of the year consolidation, profit-taking, and rebalancing, a lot of this can also be chalked up to an overheating market.

Some of these declines can also be due to a pandemic that is still not under control. The market has surged since March 23rd and has largely ignored the reality on the ground. But in the near term, a tug of war between good news and bad news is inevitable. Although vaccine distribution has officially begun, it has been a slower and choppier roll-out process than anticipated. The level of infection and death has also reached unprecedented levels.

“The viral resurgence has induced lockdown measures throughout the country, stunting economic reopening efforts. If the viral spread is not brought under control by year’s end, it will likely be a key initiative to do so in early 2021, before a vaccine has become widely distributed,” Jason Pride, CIO of private wealth at Glenmede said.

Despite the declines on Tuesday (Dec. 29), the general focus of both investors and analysts has appeared to be the long-term potential of 2021.

As Tom Essaye, founder of The Sevens Report said:

“The five pillars of the rally (Federal stimulus, FOMC stimulus, vaccine rollout, divided government and no double dip-recession) remain largely in place, and until that changes, the medium and longer-term outlook for stocks will be positive.”

While I still believe that this tug of war between good news and bad news will lead into the beginning of the new year, I am now convinced that these moves are manic and based on sentiment. There has not been a sharp pullback to end the year as I anticipated, however, I do believe that markets have overheated and that between now and the end of Q1 2020, a correction could happen.

There is optimistic potential, but the road towards normalcy will hit inevitable speed bumps.

I do believe, though, that a correction is healthy and could be a good thing. Corrections happen way more often than people realize. Only twice in the last 38 years have we had years WITHOUT a correction (1995 and 2017). I believe we are overdue for one since there has not been one since the lows of March. This is healthy market behavior and could be a very good buying opportunity for what I believe will be a great second half of the year.

The mid-term and long-term optimism are very real, despite the near-term risks. The passage of the stimulus package only solidifies the robust vaccine-induced tailwinds entering 2021.

The consensus is that 2021 could be a strong year for stocks, despite short-term headwinds. According to a new CNBC survey which polled more than 100 chief investment officers and portfolio managers, two-thirds of respondents said the Dow Jones will most likely finish 2021 at 35,000- a roughly 16% gain from last Thursday’s (Dec. 24) close of 30,199.87. Five percent also said that the index could climb to 40,000 by the end of 2021.

Therefore, to sum it up:

While there is long-term optimism, there are short-term concerns. A short-term correction between now and Q1 2021 is very possible. But I do not believe, with conviction, that a correction above ~20% leading to a bear market will happen.

The premium analysis this morning will showcase a “Drivers and Divers” section that will break down some sectors that are in and out of favor. As a token of my appreciation for your patronage, I decided to give you a free sample of a “driver” and “diver” sector. Please do me a favor and let me know what you think of this segment! I’m always happy to hear from you.

Driving

Small-Caps (IWM)

Figure 1 - iShares Russell 2000 ETF (IWM)

The Russell 2000 small-cap index has now officially underperformed the larger-cap indices for two consecutive days. I can’t remember the last time that I’ve typed that. The index has outperformed since the start of November and has been on a scorching hot record run. However, when it comes to stocks the law of gravity applies: “what goes up must come down.”

I love small-cap stocks in the long-term, especially as the world reopens. But ever since I switched my call on the iShares Russell 2000 ETF (IWM) from a short-term HOLD to a short-term SELL on December 16th, I saw this pullback coming.

Although the RSI for the IWM ETF is no longer overbought, I still believe that the index has overheated. I would like to see a bit more of a decline before jumping right back in.

I believed a short-term pullback for small-caps would eventually happen, and I feel that this could be the start. Truthfully, I hope the IWM declines another 7% or so because I am quite bullish on small-caps for 2021. The IWM has declined nearly 3% this week. If it drops another 7% or so as I said, then jump in for the long-term buying opportunities. I sure will.

SELL and take short-term profits if you can - but do not fully exit positions.

If this pullback extends further, this could be a STRONG BUY for the long-term recovery.

Diving

US Dollar ($USD)

Figure 2 - U.S. Dollar ($USD)

The U.S. Dollar on Tuesday (Dec. 29) dropped below the 90-level yet again and declined 0.40%. Despite the dollar experiencing a mini-rally and nearly piercing the 91-level again on December 22, I remained steadfast in my bearishness of the dollar. I also stated that I believed the dollar could drop below 90 again before the new year. Well, here we are.

I am not a fan of the dollar and am not fooled by any mini-rallies. I called its rally past the 91-level three weeks ago “fool’s gold,” and I called any subsequent rally afterward “fool’s gold” as well. Since the open on December 23rd, the U.S. Dollar has declined another 0.75%.

I still am calling out the dollar’s weakness after several weeks, despite its low levels. I expect the decline to continue as well thanks to a dovish Fed.

Since hitting nearly a three-year high on March 20th, the dollar has plunged around 13% while emerging markets and other currencies have continued to strengthen.

On days when COVID-19 fears outweigh any other positive sentiments, dollar exposure might be good to have since it is a safe haven. Especially if there is a short-term correction coming in the markets. But in my view, you can do a whole lot better than the U.S. dollar for safety.

The dollar is still hovering around its lowest levels since April 2018. Despite this low level, I have too many doubts on the effect of interest rates this low for this long, government stimulus, strengthening of emerging markets, and inflation to be remotely bullish on this as a value play or the dollar’s prospects over the next 1-3 years.

Meanwhile, the US has $27 trillion of debt, and it’s not going down anytime soon.

Additionally, according to The Sevens Report, if the dollar falls below 89.13, this could potentially raise the prospect of a further 10.5% decline to the next support level of 79.78 reached in April 2014. I believe this is more likely to happen than the dollar piercing 91 again.

The dollar’s RSI is now back above 37 somehow as well despite significantly trading below both its 50-day and 200-day moving averages.

For now, where possible, HEDGE OR SELL USD exposure.