Markets: Expectations

TGIF. The Friday rules for trading are in play with little but a Fed monetary policy conference to consider and more earnings. The heart and soul of the problem for markets in 2019 is that given the kitchen sink of negative interest rates and QE globally, why is inflation so tame?There is plenty to show for asset price inflation but even there a market of stocks dominates more than the stock markets. The headlines on individual stocks are interesting in the US with Kraft-Heinz suffering after the close on its earnings miss and SEC investigation. The Goldman/Apple credit card has spawned a return to payment technology ideas. Make it clear, these stories are nice but not necessary to understanding this week’s price action. The view is that China is going to get a deal with the US and that its going to win with stimulus and growth. The Chinese stock market gains this week stand out and the manipulation of that market by authorities over the last month has worked to spark global interest. The other story that matters this week is that Europe isn’t falling off the face of the earth – as German GDP highlights much of the weakness in 4Q can be explained away by car inventory drawdowns suggesting some hope for growth in 2019 – if China stabilizes. Throw in that today’s core Eurozone CPI was up to 1.1% in the revision and you have many thinking that the ECB will be able to do nothing and look smart if it all just plays out with Trump and Xi as hoped. This is the world we live in – one of expectations – where the rate of change in politics is more important than that of economics. The hangovers from too much geopolitical worry stands out most clearly in the UK where Brexit and the UK May government look like tired stories where most people in the market don’t care to trade or focus anymore until they must – like when there is another vote or deadline that really matters. The USD has managed to hold steady again overnight despite the hope-a-thon of US/China trade talks and a steady uptick in shares globally. US capital inflows are stable like expectations that all will somehow work out. Gold lower, bonds mixed, Oil higher – all point to a good day ahead. That makes it interesting to watch the USD/CHF as it’s on the cross roads of safe-haven and the EUR where 1.0050 looks like an important pivot and its telling us that the world expects .98 before 1.02 which clashes with the risk-on in equities – something that doesn’t square with gold or JPY. How the CHF plays out with the EUR and USD in the next few days may just foreshadow the real expectations for trouble ahead.

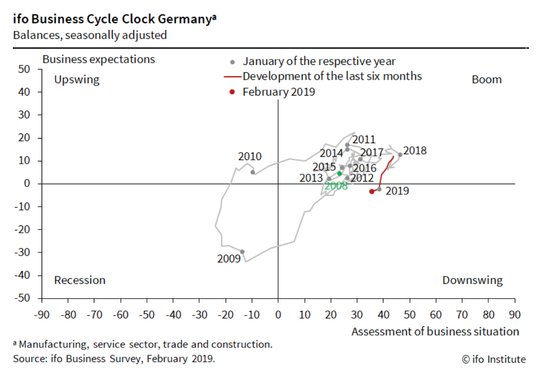

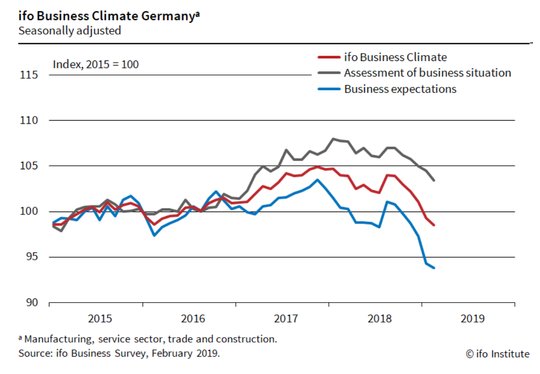

Question for the Day: Does IFO or Eurozone core inflation matter most? The EUR holds 1.1340 still and this despite the threat of US auto tariffs, ongoing weakness in surveys from PMI flashes to German ZEW to today’s German IFO. The view that Europe 1Q will stabilize and that the soft patch is just that – a return to trend growth – is the standard for much of the ECB. The hope that the ECB will do something to spark growth remains in play for the market as the data is watched. The clock is ticking against the ECB as the IFO business cycle clearly turns over.

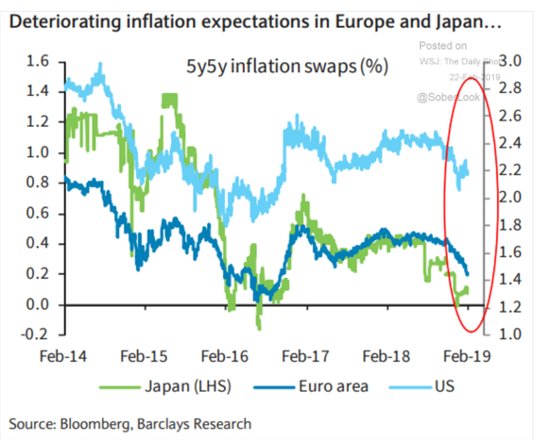

Against this is the core CPI jump from 1.0% to 1.1% today and the view that the ECB doesn’t have to do anything but wait it out. The battle for the market isn’t about growth but deflation fears. Here is where the FOMC is winning as the 30Y TIPS sale showed yesterday. The US B/E inflation expectations are higher from January moving from 1.8% to 1.95% while they are lower in Japan and Europe. The 5Y/5Y inflation expectations maybe something to watch as the markets try to square the circle of policy and data and find a direction in FX, equities and bonds going forward into next week.

What Happened?

- RBA Lowe: Repeats balanced risks for policy shift, highlights geopolitical and China growth international risks. “There are two major areas of risk globally that the Reserve Bank Board has been keeping an especially close eye on of late. The first is what I will label political risks. Here the list includes the trade and technology tensions between China and the United States, Brexit, the rise of populism, and strains in some Western European economies. It's hard to be certain about how these various issues will play out. But it is conceivable that one or more of these political risks crystallizes in a way that damages confidence and the global economy.” He added, “The second international risk that we are monitoring carefully relates to the Chinese economy. Growth there has slowed, probably by more than the authorities had been expecting. The economy is feeling the effects of tensions with the United States and the squeezing of finance to the private sector as the authorities clamp down on non-bank financing. The authorities have responded by easing policy in a number of areas, but they are walking a very fine line between supporting the economy in the near term and addressing the medium-term debt problems.”

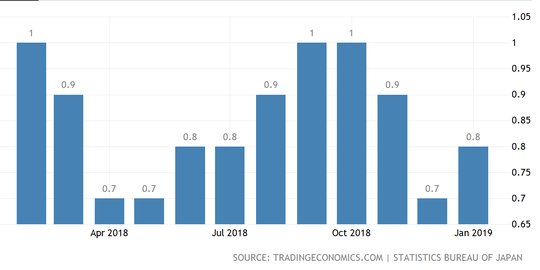

- Japan January core CPI 0.8% y/y after 0.7% y/y – as expected. The headline rate dips to 0.2% y/y from 0.3% y/y, while the core/core rate rises to 0.4% y/y from 0.3% y/y.

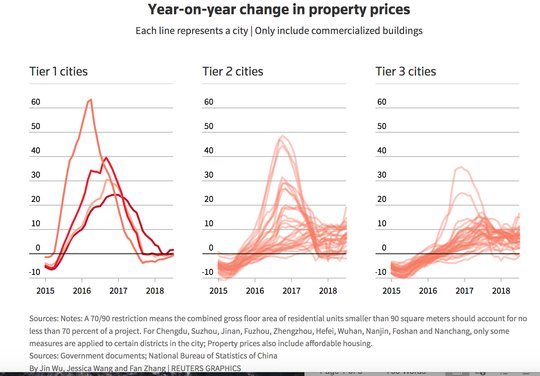

- China January house price index up 0.6% m/m, 10% y/y after 0.8% m/m, 9.7% y/y – more than 9.4% y/y expected – but weakest monthly gain in 9-months. The NBS reported price gains in 58 of 70 cities down from 59 in December. In tier-1 cities were up 0.4% m/m after 1.3% m/m while in tier-2 they rose 0.6% and in tier-3 0.7% m/m. Some smaller cities have quietly loosened property policies to stabilize sentiment. In December, Heze, a city in eastern China, reversed a rule designed to curb real estate flipping.

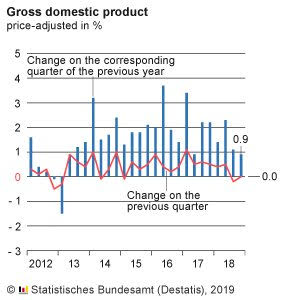

- German 4Q final GDP unrevised at 0% q/q, 0.6% y/y after -0.2% q/q, 1.1% y/y – as expected. Private consumption grew by 0.2% q/q, government consumption was up by 1.6% q/q, investments accelerated by 0.9% q/q and despite all trade war fears even net exports remained flat. Notable that inventories took 0.6% q/q from GDP – mostly due to auto issues.

- German February IFO business climate 98.5 from revised 99.3 (prev 99.1) – weaker than 98.9 expected. The current conditions dip to 103.4 from 104.5 – weaker than 103.7 expected. The future expectations fall to 93.8 from 94.3 – also weaker than 94.2 expected. These survey results, as well as other indicators, point to economic growth of 0.2 percent in the first quarter. The economic situation in Germany remains weak. In manufacturing, the index has fallen for the sixth time in succession. Companies have revised their assessment of the current situation markedly downwards. Nevertheless, a clear majority continues to report a positive business situation. However, with regard to the business outlook, pessimism is growing. In the services, the business climate has deteriorated significantly. The service providers rated their business situation somewhat less favorably. With regard to the coming months, only few companies still expect an improvement.

- Eurozone January final HICP revised at -1.0% m/m, 1.4% y/y after 0% m/m, 1.6% y/y – as more than -1.1% m/m expected. The core rises to 1.1% y/y from 1% y/y – also more than the 1% y/y expected.

- UK February CBI distributive trade orders flat same as 0% in January – weaker than 6% expected. The head of CBI economic intelligence, Anna Leach, noted: “The High Street has seen a slow start to the year, with year-on-year sales volumes unchanged again this month. Although real earnings growth is higher, consumer confidence has been ebbing away, keeping a lid on demand. Retail investment plans have taken a hit this quarter, falling to their weakest since 2012. Until politicians can agree a deal that commands a majority in parliament, is acceptable to the EU and protects our economy, business despair will deepen. A deal must be negotiated, and no-deal averted.”

Market Recap:

Equities: The S&P 500 futures are up 0.4% after losing 0.35% yesterday. The Stoxx Europe 600 is up 0.25% while the MSCI Asia Pacific rose 0.4% with China late rally.

- Japan Nikkei off 0.18% to 21,425.51

- Korea Kospi up 0.08% to 2,230.50

- Hong Kong Hang Seng up 0.65% to 28,816.30

- China Shanghai Composite up 1.91% to 2,804.23

- Australia ASX up 0.44% to 6,241.90

- India NSE50 up 0.02% to 10,791.65

- UK FTSE so far up 0.4% to 7,195

- German DAX so far up 0.6% to 11,493

- French CAC40 so far up 0.3% to 5,213

- Italian FTSE so far up 0.3% to 20,271

Fixed Income: Germany GDP components, higher core HICP, and steady hope for US/China talks led to further selling in core EU bonds. German 10-year Bund yields are up 3bps to 0.12% while French OATs off 1bps to 0.53% and UK Gilts are up 2bps to 1.18%. The periphery is mixed with Italy up 4bps to 2.87%, Spain off 2bps to 1.19%, Portugal off 3bps to 1.50% and Greece up 1bps to 3.80%.

- US Bonds are bid watching equities, waiting for FOMC speeches – 2Y flat at 2.52%, 5Y flat at 2.51%, 10Y off 1bps to 2.68%, 30Y off 1bps to 3.04%.

- Japan JGBs curve steeper post BOJ keeping buying the same – 2Y up 1bps to -0.18%, 5Y flat at -0.17%, 10Y flat at -0.04%, 30Y up 1bps to 0.58%.

- Australian bonds see curve steeper with focus on US/China – 3Y flat at 1.64%, 10Y up 2bps to 2.10%.

- China bonds see curve steeper with focus on PBOC policy – 2Y off 5pbs to 2.59%, 5Y up 3bps to 2.94%, 10Y up 1bps to 3.15%.

Foreign Exchange: The US dollar index up 0.05% to 96.63 – still down 0.3% on the week – but holding in range. In EM – USD mixed – ASIA: INR flat at 71.169, KRW up 0.1% to 1124.50; EMEA: ZAR of 0.2% to 14.045, RUB flat at 65.624, TRY off 0.35% to 5.336.

- EUR: 1.1345 up 0.1%. Range 1.1331-1.1352 with German GDP and core HICP higher EUR holds bid but barely. Stuck watching 1.1280-1.1380.

- JPY: 110.85 up 0.2%. Range 110.62-110.91 with EUR/JPY up 0.2% to 125.75 – Risk-on BOJ support and US/China trade deal hopes driving with 110-112 key

- GBP: 1.3015 off 0.15%. Range 1.3009-1.3021 with EUR/GBP .8715 up 0.2%. Modest hope for Brexit deal continues with 1.30 the pivot and 1.3250 key resistance.

- AUD: .7105 up 0.15%. Range .7082-.7118 with NZD .6800 off 0.15%. Mixed with commodities up, RBA Lowe speech balanced .7050-.7250 still.

- CAD: 1.3215 off 0.15%. Range 1.3210-1.3242 with BOC speech hawkish enough and oil up, tacking A$.

- CHF: 1.0005 off 0.05%. Range .9997-1.0015 with EUR/CHF 1.1350 flat. Nothing going on here look at EUR.

- CNY: 6.7195 flat. Range 6.7130-6.7340. Stocks reflect hopes about quick fixes with 6.70-6.78 keys.

Commodities: Oil up, Gold down, Copper up 1.3% to $2.91

- Oil: $57.12 up 0.3%. Range $56.21-$57.27 with US EIA and API showing US production, counter is the build in Venezuela showing sanctions working – leaves Brent up 0.3% to $67.26 – market is focused on growth hopes from trade deal/OPEC production

- Gold: $1324.80 off 0.25%. Range $1323.80-$1329.40 with risk that $1320 breaks and we return to $1305 before another rally to $1345. Silver flat at $15.80. Platinum up 0.55% to $831.20 and Palladium up 0.7% to $1455.

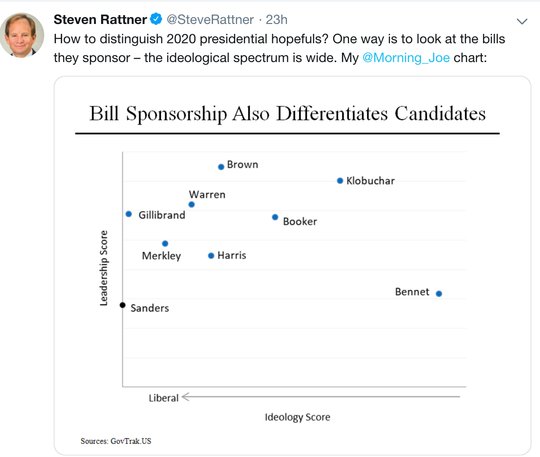

Conclusions: Is the USD reflecting less about rates and growth and more about politics? The 2020 race for the US Presidency is on and the problem many analysts are seeing is that the divide in the country between left and right, democrat and republican is wide. The chart that caught my eye and that highlights the lack of a stronger middle ground for consensus political hope came from Steve Rattner. Worth considering as we all begin to make the odds on Trump vs. the Democrat candidate in 2020.

Economic Calendar:

- 0830 am Canada Dec retail sales (m/m) -0.9%p +0.3%e / ex autos -0.6%p -0.3%e

- 1015 am NY Fed Williams speech

- 1030 am ECB Draghi speech

- 1100 am Canada Dec budget deficit C$2.2bn p C$0.3bn e

- 1200 pm FOMC Vice Chair Clarida speech

- 0130 pm FOMC Quarles speech

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.