Markets: Ebullient

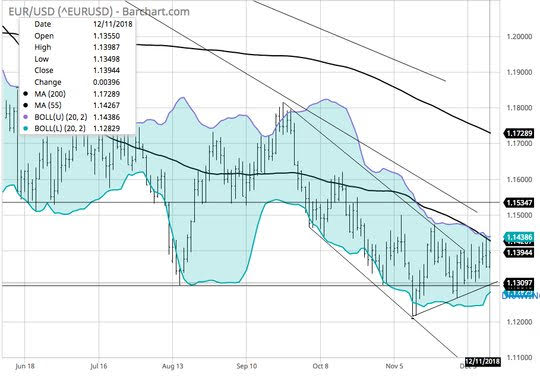

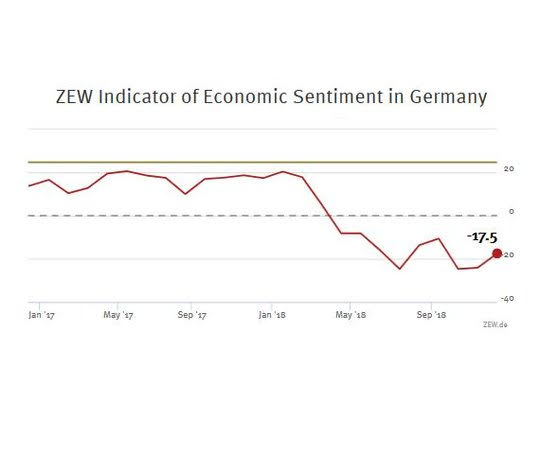

Equities are bouncing, markets are back to bargain hunting as the US/China trade talks continue, as Macron pledges tax cuts and wage hikes to placate the yellow-vest movement, as UK May delays her Brexit vote and tours Europe for a better deal. There are some uglier stories as well – as the INR drops 1.6% after another RBI Governor Urjit Patel resigns – the second in two years putting pressure on PM Modi to find a solution and to deal with his election loses in 3 key states, as Japan Topix closes at 18-month lows, as EU Juncker says there is “no room” for a Brexit renegotiation, as Italy PM pushes Europe to overcome its short-sighted rigor on fiscal policy rules. What seems clear about today is that the US/China focus is lower and the European one is higher as the UK fears are kicked down the road and the ECB meeting and ending of QE supports the EUR. Markets are in a ebullient mood even though very little good news has hit the tape – Confidence fell in Australia, house prices are lower there as well, Japan machine tool orders drop further, China M1 and M2 suggest no new credit demand even as Total Social Finance rose and the UK jobs report shows unemployment near 43-year lows and wages up to 2008 levels suggesting the BOE has less room to deal with Brexit no-deal scenarios. The bounce in the German ZEW was a surprise but the erosion of current conditions troubles and the improvement in outlooks remains below long-term averages. This puts the EUR/USD into focus today in the G10 and the INR in the EM world as politics remain in play everywhere. This mood swing won’t last unless we see a 1.1440 melt-up.

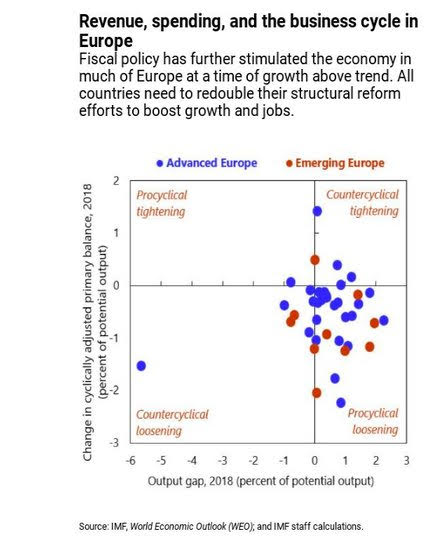

Question for the Day: Is the IMF right about the risks for 2019? There is a clear story about 2018 that many analysts are thinking through for 2019 – that the Trump tax reform and fiscal stimulus mixed with deregulation led to the 2018 US divergence and caused the FOMC to hike rates faster. What happens to Europe in 2019 is now the key focus with QE ending and rate hikes to normal the next agenda item with a new ECB President. How this mixes globally matters. The IMF speech from Lipton today is worth readling. The fund had been urging governments to “fix the roof” during a sunny last two years for the world economy, IMF First Deputy Managing Director David Lipton said. “But like many of you, I see storm clouds building, and fear the work on crisis prevention is incomplete,” he said at a banking conference hosted by Bloomberg. He also warned that strains could leave policymakers under pressure and in uncharted waters.

Lipton listed 5 key challenges:

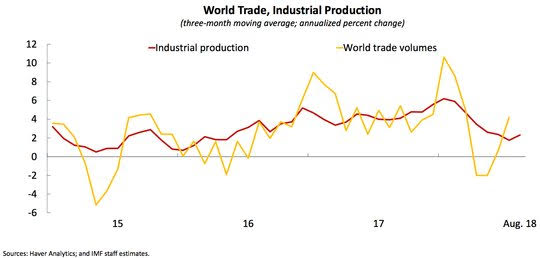

1) Trade War between US and China– The IMF estimates “that if all of the tariffs that have been threatened are put in place, as much as three-quarters of a percent of global GDP would be lost by 2020. That would be a self-inflicted wound.”

2) China global responsibility. “China now is a globally integrated $13 trillion economy whose actions have global reverberations. If China is to continue to benefit from globalization and support the aspirations of developing countries, it will need to focus on how to limit adverse spillovers from its own policies and invest in ensuring that globalization can be sustainable. Lipton suggests more Intellectual Property protections, lower trade barriers for investments and more market-oriented economic reforms for resource allocation.“

3) European challenges – Brexit and reform. The IMF forecasts “show growth in the euro area and the UK falling short of previous projections, and modest potential growth going forward. The absence of a common fiscal policy limits Europe’s ability to share risks and respond to shocks that can radiate through its financial system. And crisis response will be constrained because too much power remains vested in national regulators and supervisors at the expense of an integrated approach across the continent.”

4) Emerging Markets– need for defense against outside shocks. “For all of their extraordinary dynamism, we have seen a divergence among emerging markets over the past year: between those who have not shored up their defenses against shocks, including preparation for the normalization of interest rates in the advanced economies; and those that have taken advantage of the global recovery to address their underlying vulnerabilities.”

5) Multilateral Institutions– need more resources. “…we see a rising tide of doubt about globalization and discontent with multilateralism in some advanced economies. Just as with the IMF, it is fair for the international community to ask for modernization in its institutions and organizations, to seek reforms to ensure that institutions serve effectively their core purposes.”

What Happened?

- Australia November NAB business confidence 3 from 5 = weaker than 5 expected– while business conditions fell to 11 from 13 – as expected. Declines in business confidence to below average levels also suggest businesses’ outlook is for momentum to ease further. Indeed, forward orders (the most reliable indicator of domestic demand) fell in the month from 3 to 0 and are now below average for the first time since late 2016. While conditions across most industries remain above average, conditions in the retail industry continue to lag – with retail the only sector to report deteriorating conditions.

- Australia 3Q house price index fell 1.5% q/q after -0.7% q/q/ - as expected. Melbourne property prices recorded the third consecutive quarter of falls (-2.6 per cent) and the first annual price fall (-1.5 per cent) since the September quarter 2012, while Sydney property prices continued to fall (-1.9 per cent) in the September quarter 2018. The total value of Australia's 10.1 million residential dwellings fell by $70.1 billion to $6.8 trillion. The mean price of dwellings in Australia is now $675,000.

- Japan November machine tool orders -16.8% y/y after -0.7% y/y – weaker than the 0.5% y/y expected.

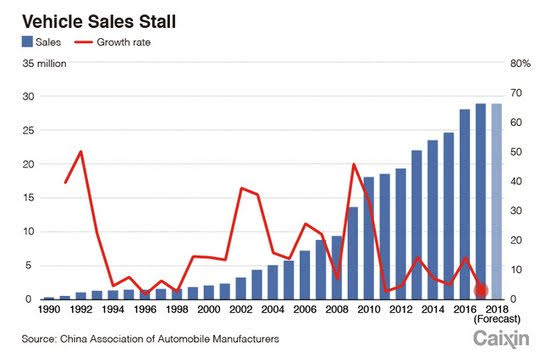

- China November vehicle sales drop 13.9% y/y after -11.7%. In November, sales of passenger cars — which include sedans, multipurpose vehicles and SUVs — dropped 18% from the same period last year to 2 million units, according to monthly figures released by the China Passenger Car Association on Monday. For the first 10 months of the year, sales in the world’s largest car market fell 1.02% to 19.3 million units, bringing it closer to a possible annual decline for the first time since 1990

- China November M2 flat at 8% y/y as expected with new loans CNY1.25trn after CNY697bn also as expected. The total social finance jumps to CNY1.520trn from CNY728.8bn – more than the CNY1.35trn expected. The M1 rose at 1.5% y/y – the weakest pace since Jan 2014.

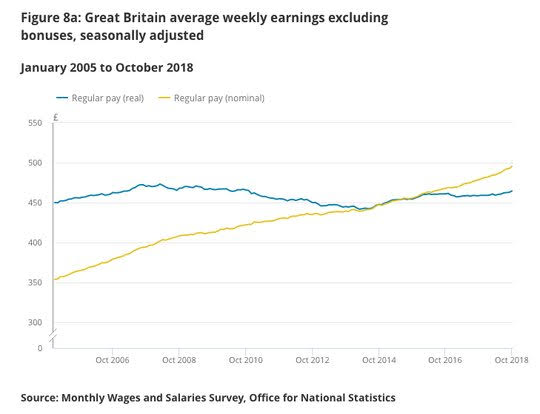

- UK November claimant count rises to 21,900 after revised 23,200 – more than the 13,000 expected. The Oct 3M ILO unemployment rate held steady at 4.1% - as expected– with the jobs up 79,000 after 23,000 – more than the 25,000 expected. Unemployment is holding near 43-year lows while wages see the best rise since July 2008. The 3M average earnings rose 3.3% after revised 3.1% - more than the 3% expected – with the ex-bonus earnings up 3.3% after 3.2% - also more than the 3.2% expected.

- German December ZEW economic sentiment –17.5 after 24.1 – better than the -25 expected- with current conditions 45.3 from 58.2 – weaker than the 55.6 expected. Despite this increase, the sentiment indicator is still clearly in negative territory and remains well below the long-term average of 22.5 points. The overall EU sentiment also improves to -21 from -22 – better than the -23.2 expected – while its conditions fell 6.1 to 12.1. “Although the rise in economic expectations is a welcome one, it should not be over-interpreted. The assessment of the economic situation has worsened dramatically for both Germany and the Eurozone. This is indicative of relatively weak economic growth in the fourth quarter. In addition, uncertainties also remain in terms of the looming international trade dispute and Brexit, which have a particularly negative impact on private investment and Germany’s exports,” ZEW President Professor Achim Wambach noted.

Market Recap:

Equities: The US S&P500 futures are up 0.7% after a 0.2% gain. The Stoxx Europe 600 is up 1.55% with technology leading. The MSCI Asia Pacific rose 0.1%.

- Japan Nikkei off 0.34% to 21,148.02

- Korea Kospi off 0.04% to 2,052.97

- Hong Kong Hang Seng up 0.07% to 25,771.67

- China Shanghai Composite up 0.37% to 2,594.09

- Australia ASX up 0.42% to 5,651.20

- India NSE50 up 0.58% to 10,549.15

- UK FTSE so far up 1.25% to 6,805

- German DAX so far up 1.55% to 10,786

- French CAC40 so far up 1.65% to 4,820

- Italian FTSE so far up 1.1% to 18,610

Fixed Income: Focus is on French/German spread after Macron concessions to yellow vests. German Bund yields are up 2bps to 0.26% while French OATs are up 3bps to 0.73%. UK Gilt 10-year yields up 2bps to 1.22% even with jobs/wages. The periphery back to suffering budget doubts - Italy up 4bps to 3.13%, Spain up 1bps to 1.46%, Portugal off 1bps to 1.78% and Greece up 2bps to 4.27%.

- Germany sold E3bn of 2Y 0% Schatz at -0.58% unchanged from previous with cover 1.89.

- US Bonds trade lower, focus on risk-mood, data and auctions ahead– 2Y up 2bps to 2.75%, 5Y up 3bps to 2.75%, 10Y up 3bps to 2.89% and 30Y up 2bps to 3.14%.

- Japan JGBs lower even with focus on equities, weaker GDP– 2Y up 1bps to -0.14%, 5Y up 1bps to -0.13%, 10Y up 1bps to 0.05%, 30Y flat at 0.80%

- Australian bonds sell off with China hopes, better confidence– 3Y up 4bps to 1.97%, 10Y up 2bps to 1.48%.

- China bonds continue to rally with flatteners– 2Y up 2bps to 2.79%, 5Y off 3bps to 3.01%, 10Y off 2bps to 3.30%.

Foreign Exchange: The US dollar index off 0.15% to 96.88.

- EUR: 1.1395 up 0.35%.Still watching 1.13-1.15 with focus on ECB Thursday, US rates and data today.

- JPY: 113.15 off 0.15%.Watching 112.80 and 113.50 on the narrow – Japan equity weakness not sufficient to move USD.

- GBP: 1.2605 up 0.35%.Bouncing with Brexit vote delay and better jobs – but UK May and government risks seen rising.

- AUD: .7220 up 0.45%.Better China hopes, weaker USD - .7280 and .7350 next. NZD up 0.2% to .6880.

- CAD: 1.3385 flat. Canada still suffering with China/Oil negatives and US rates the driver.

- CHF: .9875 off 0.3%.Watching EUR first, SNB second with .9820-.9950 keys.

- CNY: 6.8990 up 0.2%. Watching 6.86-6.95 with PBOC easing still expected.

Commodities: Oil up, Gold up, Copper up 0.6% to $2.7805.

- Oil: $51.52 up 1.0%.Range $50.70-$51.63 with Libya production shut and OPEC talk helping after another ugly Monday – with $50-$52 in WTI still key, Brent up 0.9% to $60.49 with $60 pivotal still.

- Gold: $1248.75 up 0.25%.Range $1245-$1249 with focus still on $1255-$1268 resistance and USD as driver. Silver up 0.7% to $14.67.

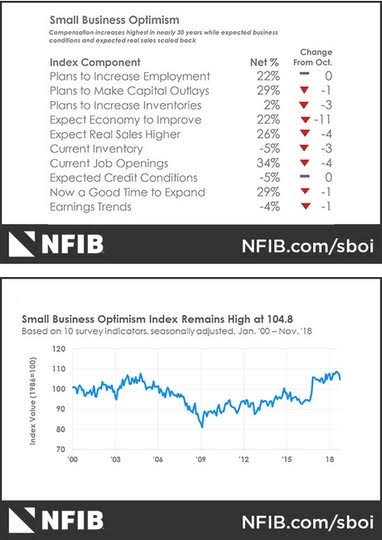

Conclusions: US business confidence holds. The mood matters argument for trading today may fall apart after the PPI and US 3-10Y sales go but the early report from the NFIB highlights some key points– 1) that small business optimism remains at historic highs, that compensation is the best in 30 years, even as business conditions and expected sales scale back. The index fell back to 104.8 from 107.4 – weaker than the 107.3 expected.

Economic Calendar:

- 0830 am US Nov PPI (m/m) 0.6%p 0%e (y/y) 2.9%p 2.6%e / core 2.6%p 2.5%e

- 1200 pm US WASDE report

- 0100 pm US 3Y $38bn and 10Y $24bn note sales

- 0200 pm UK Brexit vote expected

- 0430 pm US weekly API oil inventory 5.36mb p 2.1mb e

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.