Markets: Delicate

Market confidence remains delicate. Understatements about the wretched state of risk-taking collide with the upcoming central bank meetings and the horror of hope. Hungary today at 8 am – FOMC tomorrow at 2 pm – with the RBA meeting minutes last night highlighting the indecision of action and the risk of waiting it all out. There is no stability in the present market as confidence has been eroded by price action. Oil is the key focus today as it drops 4% today – too much US supply coupled with too little global demand. The doubts about US growth yesterday continued with a lack of new ideas from China’s Xi speech today. Xi pledged “unswerving” reforms but they should be in line with the overall goal of improving the socialist system with Chinese characteristics. With an emphasis on “top-level design” suggesting Xi isn’t willing to reduce the role of the state in the economy.

The command-control economy continues to be at odds with the US one and hopes for a trade détente remain delicate as well. The fragility of Xi and his leadership of the economy has risen in the press clippings today even as confidence and markets drop. Global growth fears continue to be the biggest impediment to new risk taking, with the FOMC, US/China trade, Brexit and ugly politics everywhere supporting the doubts about 2019. The focus on the day has been on oil and the failure to hold $51.50 opens $45.50 as the next big support but the ongoing bounce from the lows in early Europe matters and it’s the barometer to watch today with $49 key for WTI.

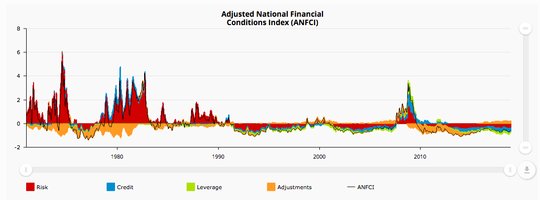

Question for the Day:Do financial conditions matter? The Powell Fed has been clear in the shift to data dependency and in their view that its not yet finished in hiking rates. The market appears frozen today in the long wait for the FOMC decision tomorrow. There have been a number of traders, economists and politicians begging for the FOMC to wait. The cost of not delivering a rate hike tomorrow maybe in ongoing inflationary pressures building to stem growth, this is the opposite of goldilocks. A Fed waiting for a better markets or higher growth risks narrowing corporate margins, killing consumer demand and reversing employment. On the other hand, sharply weaker financial conditions reflect a collapse in confidence for markets and that feeds into slower growth, lower employment as well.

The biggest problem for those hoping that the FOMC doesn’t hike tomorrow is that financial conditions aren’t that troublesome. The Chicago Fed ANFCI is worth considering here as it suggests we aren’t yet into troubled territory. The FOMC uncertainty over future policy is a natural outcome of returning to normal. It brings volatility without any reward. This maybe the new state for 2019 and investors – higher risk, lower reward. more frustration and more cracks in confidence.

What Happened?

- RBA meeting minutes: On hold for foreseeable future. Key focus was on China. Members noted that it had continued to be difficult to gauge the underlying momentum in the Chinese economy. Conditions had remained subdued in a number of sectors, including machinery & equipment production and food & clothing. By contrast, the central authorities' direction to local governments to bring forward public spending had contributed to a rebound in infrastructure investment, and the production of construction-related products had strengthened further. Infrastructure investment was expected to continue to support growth in coming months. Growth in investment in the real estate sector had continued to be driven by land purchases.

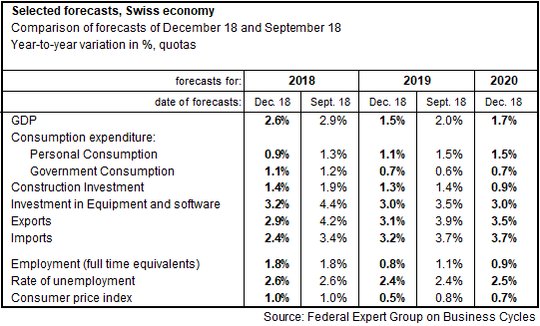

- Swiss SECO cuts 2019 growth outlook citing weak domestic demand. The State Secretariat for Economic Affairs (SECO) said it now sees growth slowing to 1.5% in 2019 down from 2% and recovering slightly to 1.7% in 2020.

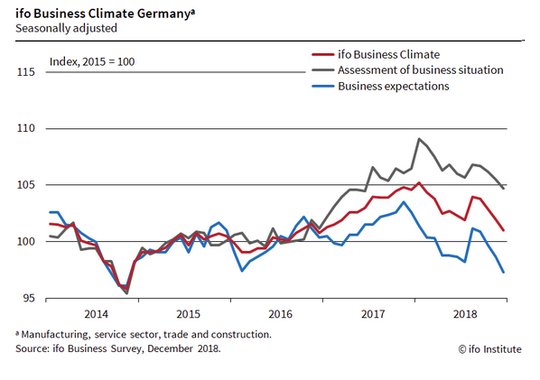

- German December IFO business climate drops to 101 from102 – weaker than 101.7 expected. The expectations index falls to 97.3 from 98.7 – also weaker than 98.3 forecasts. The current conditions lower to 104.7 from 105.4 – slightly worse than the 104.8 expected. By sector, manufacturing fell to 14.8 from 17.7, Services 26.8 from 30.7, trade 9.1 from 9.8 and construction flat at 29.6.

Market Recap:

Equities: The US S&P500 futures are up 0.35% after losing 2.1% yesterday. The Stoxx Europe 600 is off 0.15% after being down over 0.8% - oil a key driver. The MSCI Asia Pacific fell 0.9% with Japan leading losses.

- Japan Nikkei off 1.82% to 21,115.45

- Korea Kospi off 0.43% o 2,062.11

- Hong Kong Hang Seng off 1.05% to 25,814.25

- China Shanghai Composite off 0.82% to 2,576.65

- Australia ASX off 1.24% to 5,661.80

- India NSE50 up 0.19% to 10,908.70

- UK FTSE so far off 0.4% to 6,745

- German DAX so far up 0.45% to 10,819.55

- French CAC40 so far flat at 4,798

- Italian FTSE so far up 0.3% to 18,746

Fixed Income: The odds of the FOMC not hiking tomorrow went up yesterday and remain in play today (now 65% from 75%). This matters and sets the tone for bonds everywhere. Oil price weakness adds another layer of support. German 10-year Bund yields are off 2bps to 0.24%, French OATs off 3bps to 0.71%, UK Gilts flat at 1.26% while periphery mixed Italy flat at 2.96%, Spain off 2bps to 1.39%, Portugal off 3bps to 1.63% and Greece up 4bps to 4.38%.

- US Bonds are bid with focus on data and equities– 2Y off 3bps to 2.67%, 5Y off 3bps to 2.67%, 10Y off 2bps to 2.84%, 30y off 3bps to 3.09%.

- Japan JGBs hold bid with equities key– 2Y off 1bps to -0.16%, 5Y off 1bps to -0.14%, 10Y off 1bps to 0.03 and 30Y off 1bps to 0.76%.

- Australian bonds rally with China/RBA on hold minutes– 3Y off 4bps to 1.92%, 10Y off 4bps to 2.41%.

- China bonds mixed with curve flatter –focus is on Xi and conference – 2Y up 2bps to 2.81%, 5Y up 2bps to 3.10%, 10Y off 1bps to 3.41%.

Foreign Exchange:The US dollar index off 0.3% to 96.80. In EM, USD weaker as well – EMEA:TRY up 0.4% to 5.345, RUB off 0.3% to 66.91, ZAR up 0.6% to 14.30; ASIA:INR up 1.2% to 70.757, KRW up 0.15% to 1126.90,

- EUR: 1.1385 up 0.35%. Range 1.1337-1.1402 with 1.1420-50 pivotal resistance into US data.

- JPY: 112.35 off 0.45%. Range 112.25-112.86 with 110.80 target and risk off driving but 112 sticky still. EUR/JPY 127.95 off 0.1%.

- GBP: 1.2685 up 0.5%. Range 1.2610-1.2706 with EUR still most of the story today – Corbyn postpones no confidence vote on May. EUR/GBP .8975 off 0.15%.

- AUD: .7195 up 0.25%. Range .7173-.7203 with USD on ropes the support .7050-.7300 still key and commodities still a problem – RBA minutes non-event. NZD up 0.95% to .6865.

- CAD: 1.3400 flat. Range 1.3391-1.3420 with oil driving and data ahead key.

- CHF: .9915 off 0.15%. Range .9900-.9937 with growth doubts, EUR still main story .9880-1.00 keys. EUR/CHF 1.1290 up 0.2%.

- CNY: 6.8900 off 0.15%. CNY gains with EUR more than anything new on trade – 6.88-6.92 still key.

Commodities: Oil lower but bouncing from lows, Gold up but other metals lower, Copper off 1.1% to $2.7480.

- Oil: $48.75 off 2.9%.Range $47.84-$49.59. Brent off 2.6% to $58.08. More technical pain after yesterday. Focus is on $46.80 and $45.50 next in WTI. US API tonight and supply from Libya key.

- Gold: $1252.40 up 0.05%.Range $1248-$1253. Watching USD and $1255-$1260 resistance. Silver off 0.3% to $14.72 with focus on $14.50 base for $14.92 again. Platinum off 0.5% to $792.10 and Palladium up 0.1% to $1183.

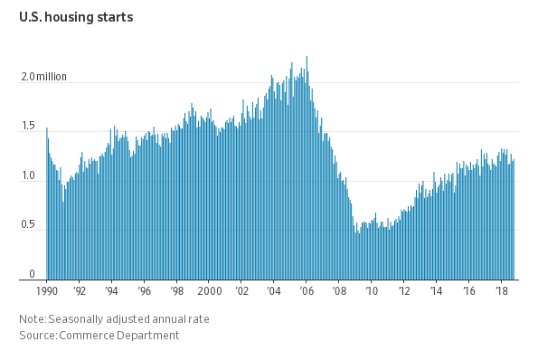

Conclusions: Will housing starts matter to the FOMC? In the midst of the great recession, the level of starts dipped below 500,000. Today’s report is expected to retreat to 1.22 million, well below the 2.2 million highs back in 2006 but still in line with the longer-term average. The weakness in housing prices has been blamed on supply – with starts reflecting labor, material and property tightness - inflation by any other word. The ability for the FOMC to slow but not stop the economy by raising rates remains in play.

Economic Calendar:

- 0830 am Canada Oct manufacturing sales (m/m) 0.2%p -0.2%e

- 0830 am US Nov housing starts 1.5%p -0.7%e / 1.228m p 1.225m e

- 0430 pm US weekly API crude oil inventory -10.18mb p +1mb e

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.