Markets: Delays

Delays are not denials. The lesson of the day so far is that Trump’s delays on tariffs are good for markets while May’s delays on a UK vote for her deal for Brexit until March 12 is bad. What is the difference and are expectations about denials and time interlaced with politics? The Trump Tariff delays, Trump talking down North Korea denuclearization deals and China Banking and Insurance Regulatory Commission forcing increased lending to the private sector by 30%drive shares 5.6% higher in China, CNY to 7-month highs and Oil back to the highs for the year. The CBIRC declared victory on its debt control targets today. “After two years of work, various financial disorders have been effectively curbed,” Wang Zhaoxing, vice chairman of China Banking and Insurance Regulatory Commission (CBIRC), told a news conference. The lack of other big news stories leaves markets watching technicals rather than fundamentals for the next clue. The lack of supportive economic data hasn’t been the problem in 2019, rather it’s the reaction function of central bankers that on the margin drives and the all-clear from the FOMC to the PBOC to the ECB is in play this week. Delaying rate normalization has brought relief and comfort as the story reverts back to slow but steady growth everywhere without the burning inflation fears or the bears of recession. This won’t last as the business cycle can’t be denied but merely delayed. The best barometer for understanding the price action today is in the commodity linked currency world where hope for a trade deal overrides fears of deflation and housing bubble pops – with the AUD the front and center of the storm - wait for .7275 to confirm the risk breakout.

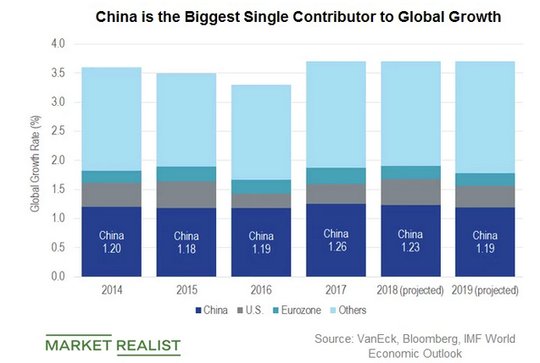

Question for the Day: Is the problem in Europe more than just China growth? The bounce back in the EUR today and the relief in the periphery of Europe are connected back to the gains in China. The hope for a Trump trade deal drives away fears about an EU car tariff and restarts the hope that Germany and Italy are going to turn their growth woes around. The standard argument is that China growth matters more to the world than the US. The US divergence in 2018 is taken as proof of this point.

The problem with this logic is that the US/China trade talks are not just about trade as the Project Syndicate piece from Feb 18 Minxin Pei clearly states. “The US is prepared to sacrifice its economic relationship with China because the risks posed by the two powers’ conflicting national interests and ideologies now overwhelm the benefits of cooperation.” The article adds: “Likewise, for China, the trade war has exposed the strategic vulnerability created by overdependence on US markets and technologies. Chinese President Xi Jinping will not make the same mistake again, nor will any other Chinese leader.” Europe is that alternative and it plays a significant role in balancing out the US push.

What Happened?

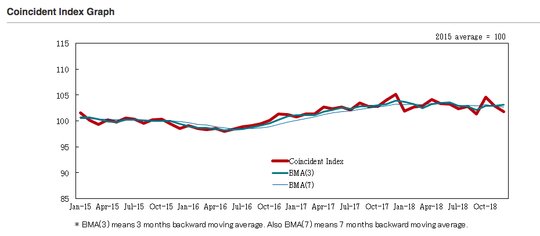

- Japan December final Leading Indicator 97.5 from 99.1 – weaker than 97.9 preliminary. The Coincident Indicator 101.8 from 102.9 – also weaker than 102.3 expected.

- Spain January PPI up 1.8% y/y after revised 1.7% y/y (prel 1.6% y/y) – more than the 1.2% y/y expected. The ex-energy PPI slowed to 0.3% y/y from 0.5% y/y. Energy added 0.214pp to headline while intermediate goods took -0.09pp and consumer goods -0.075pp

Market Recap:

Equities: The S&P 500 futures are up 0.45% after a 0.64% gain Friday. The Stoxx Europe 600 rose 0.2% to 371.90 with focus on China tariff delays.

- Japan Nikkei up 0.48% to 21,528.23

- Korea Kospi up 0.09% to 2,232.56

- Hong Kong Hang Seng up 0.50% to 28,959.30

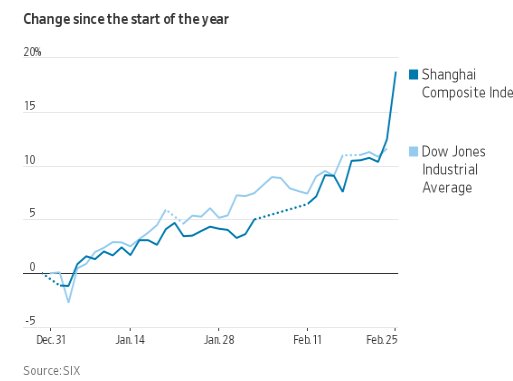

- China Shanghai Composite up 5.6% to 2,961.28

- Australia ASX up 0.35% to 6,263.60

- India NSE50 up 0.82% to 10,880.10

- UK FTSE so far up 0.2% to 7,192

- German DAX so far up 0.45% to 11,507

- French CAC40 so far up 0.45% to 5,240

- Italian FTSE so far up 0.95% to 20,453

Fixed Income: The risk-on mood in equities and supply this week clashes with month-end rolls and central bank speeches. The core bonds are lower and periphery higher – German 10-year Bund yields are up 3bps to 0.12%, French OATs are up 1bps to 0.53% and UK Gilts up 2bps to 1.18% while Italy BTPs off 9bps to 2.78%, Portugal off 1bps to 1.48%, Spain off 1bps to 1.17% and Greece off 4bpst to 3.77%.

- US Bonds are offered, waiting for data, supply and Powell– 2Y up 2bps to 2.51%, 5Y up 3bps to 2.49%, 10Y up 2bps to 2.68%, 30Y up 1bps to 3.03%.

- Japan JGBs trade lower, curve slightly steeper– 2Y up 1bps to -0.17%, 5Y flat at -0.17%, 10Y up 1bps to -0.03%, 30Y up 1bps to 0.59%.

- Australian bonds sold off on China deal hopes, commodities– 3Y up 4bps to 1.69%, 10Y up 2bps to 2.12%.

- China bonds sold off on equity move, CBIRC talk– 2Y up 9bps to 2.70%, 5Y up 1bps to 2.93%, 10Y up 3bps to 3.18%.

Foreign Exchange: The US dollar index fell 0.2% to 96.33 overnight. The emerging markets are also USD offered– EMEA: ZAR off 1% to 13.851, RUB off 0.2% to 65.231, TRY off 0.3% to 5.302; ASIA: INR off 0.05% to 70.995 and KRW off 0.5% to 1116.10.

- EUR: 1.1365 up 0.25%. Range 1.1327-1.1368 with focus on 1.1380 and 1.1420 next – risk-on helping with auto-tariff fears reduced.

- JPY: 110.75 up 0.1%. Range 110.580-110.86 with EURJPY up 0.35% to 125.85 – all about equities and China first with 110 bid and 112 offered.

- GBP: 1.3075 up 0.15%. Range 1.3050-1.3099 with EURGBP up 0.15% to .8690 – Brexit focus drags compared to EUR with 1.3150 next.

- AUD: .7180 up 0.75%. Range .7130-.7181 with commodities and China driving and .7220-50 resistance. NZD .6895 up 0.75% with .6920 key.

- CAD: 1.3110 off 0.15%. Range 1.3113-1.1346 with focus on A$ more than C$ - data this week and 1.3050 key.

- CHF: .9985 off 0.15%. Range .9983-1.0006 with EURCHF up 0.1% to 1.1350 – focus is on 1 as the pivot with .9950 and .9880 next.

- CNY: 6.6835 off 0.45%. Range 6.6720-6.7140 with focus on trade talks driving, stock inflows moving and 6.62 next key.

Commodities: Oil up, Gold up, Copper up 0.85% to $2.9620.

- Oil: $57.43 up 0.30%.Range $56.95-$57.53 with focus on China and Venezuela driving bid with $58 WTI still key. Brent up 0.1% to $67.17 with $68 same pivotal resistance.

- Gold: $1333.20 flat.Range $1329.30-$1334.10 with focus on $1325-$1345 and USD weakness vs. risk-on mood. Silver up 0.2% to $15.93. Platinum up 1% to $854.20 and Palladium up 1.8% to $1489 – all about autos and reduced tariff fears.

Conclusions: Is China share market going to help or hurt the US rally? When you consider the rally up in China shares since January, the performance looks stellar and logical given its underperformance in 2018. The knock-on effect for Europe has been more powerful than for the US even as the pressure for a Trump deal leads the headlines.

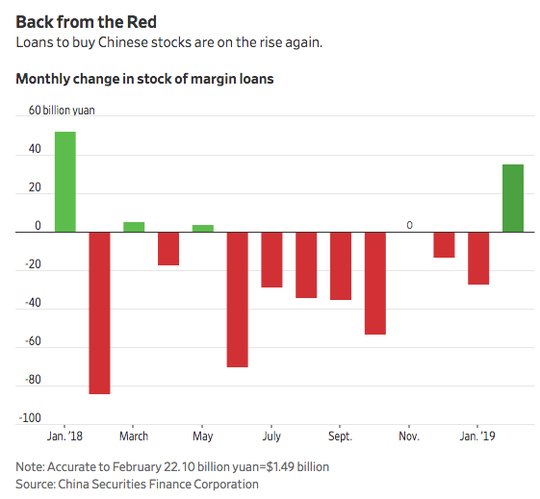

The issue behind the surging China shares is linked to debt and this is where the US and China fears combine. Margin loans in China are driving much of the rally. This is the unintended consequence of the PBOC policy push.

Economic Calendar:

- 0830 am US Jan Chicago Fed national activity 0.27p 0.11e

- 0900 am Mexico 4Q final GDP (q/q) 0.8%p 0.3%e (y/y) 2.5%p 2.6%e

- 1000 am US Dec wholesale inventories (m/m) 0.3%p 0.2%e

- 1030 am US Feb Dallas Fed manufacturing 1p 2e

- 1130 am US Treasury sells 3M and 6M bills

- 0100 pm US Treasury sells 2Y and 5Y notes

- 0400 pm UK PM May statement on Brexit

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.