Markets Defend Moving Averages; Good Buying Opportunities

It was not particularly pretty but it was effective. There was no further drive lower but traders were happy to step in to defend moving averages; those who made the leap were rewarded with an attractive risk:reward opportunity.

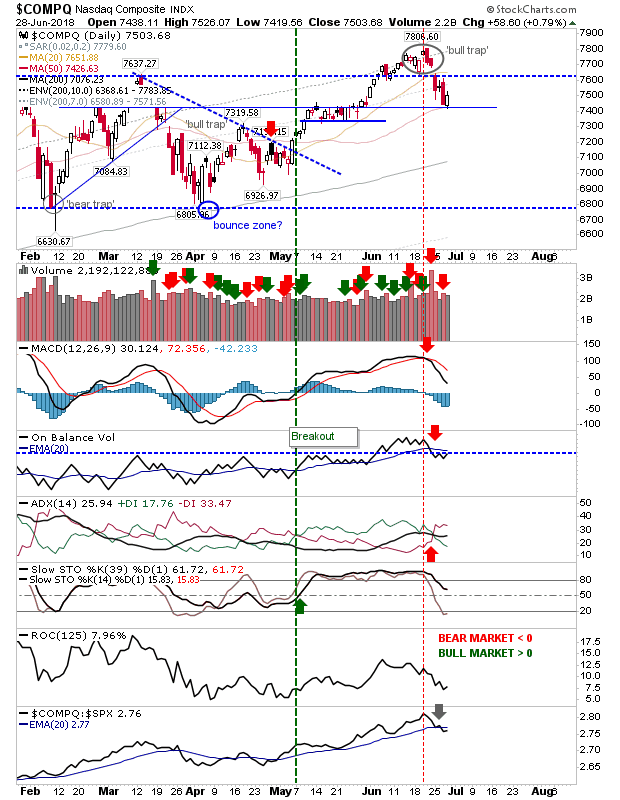

The Nasdaq had its moment as it tagged its 50-day MA. There was no significant technical change but underperformance against the Russell 2000 is still a factor.

Small Caps also had a positive text as it left a 'bullish hammer' right on its 50-day MA. For those who saw the opportunity, it was another good chance to buy the pullback.

Even the Dow Jones managed to mount a defense of the rising channel.

Finally, even the beleaguered Semiconductor Index found support at the 200-day MA - offering itself as a buying opportunity. The only real ugly thing was the sharp underperformance against the Nasdaq 100.

It was not a spectacular day but it was a reliable one for those watching support levels. The lack of morning downside meant those who took advantage of the opportunity were presented with good risk:reward long plays. If you are one of the lucky ones then sit on it and see what happens.