Markets: Dealing

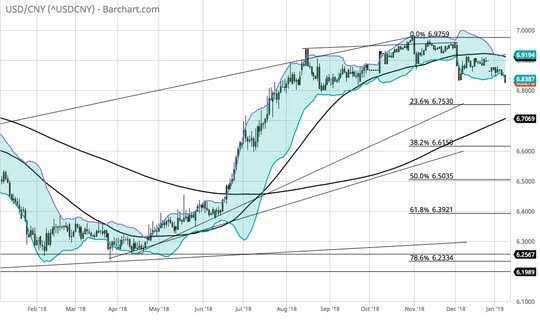

The house always wins. The deal hopes are driving the bourses globally higher with equities back in favor after 3-days of S&P 500 gains. Yet, markets are fickle like a drunken card player. Taking another card on 16 seems to be the risk on the day. There is plenty behind this drinking binge with China deal hopes high– even though intellectual property and forced technology transfers remain hot issues. The CNY trades at 3 ½ month highs even as China bond yields drop further. The recent RRR cut and the fiscal pump priming helped shares there as well. But the reasons for the China actions beyond trade are significant and they matter. The economic data overnight was gloomy at best – Australia services PMI dropped faster and harder, housing there is worse, while German trade showed less demand, French consumer confidence plummets, and UK productivity flips negative in 3Q. Markets are bid for risk nevertheless as this is about positions and fear of missing out in the 2019 rush to play. There is little room for bad news on the tape going forward which makes the agenda today important with BOC policy decisions likely on hold but with a hawkish tinge, with Fed speakers and FOMC minutes reminding everyone of the December hike and risk for another in 2019, with 10-year US bond sale pointedly making clear higher equities makes lower bond yields less attractive. Rates maybe the one area to watch for risk today as the rally up in shares hasn’t yet been confirmed by fixed income – particularly in Europe. The rate spread arguments for the USD demise are also less obvious and nowhere more clearly than in China. The near 7.0 highs of CNY in November risk a 6.7350 test on trade hopes. Dealing the cards for the next hand makes clear that such stability in CNY maybe less helpful a card for the PBOC and other officials as they struggle to see better 2019 growth.

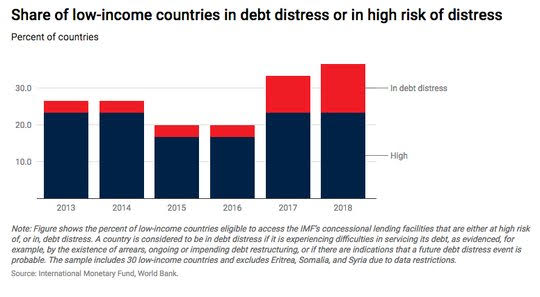

Question for the Day: Does the World Bank cuts to growth forecasts matter to markets? The World Bank released its outlook for 2019 global economies with a report: Storm clouds are brewing for the global economy. There are 3 reasons for investors to care about the World Bank forecasts – 1) they are worse than the October IMF ones; 2) they are leaders for others – with Jan-June updates - they are key for foreshadowing changes from other global organizations into the next quarter; 3) they get emerging markets better than almost anyone else with special focus on commodities - making their report important for anyone believing in the nascent EM rally.

“When you think about the engines of the global economy, they’re all going to lose momentum,” said Ayhan Kose, the lead economist behind the World Bank forecasts. The World Bank sees global growth at 2.9% after 3% in 2018 - this is down from 3.1% expected. The key point for investors is that US divergence in 2018 won’t work in 2019 as they see US GDP at 2.5% in 2019 and 1.7% in 2020 – down from 2.9% in 2018 which was a mark-up form the 2.7% June estimates.

What Happened?

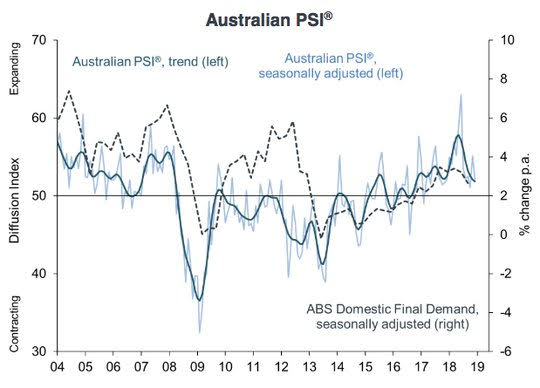

- Australia December AIG services PMI 52.1 from 55.1 – weaker than 55.0 expected. 5 of 9 sectors expanded with consumer-focused segments expanding and business contracting. Retail trade fell 1.6 to 51.8, health/education -0.9 to 55.8, wholesale trade -2.1 to 44.3, business and property -1.3 to 49.8 while personal up 2.1 to 52.9, finance/ins up 2.5 to 47.9. Overall, employment fell 7.4 to 45.5, new orders rose 1.2 to 58, sales fell 1.4 to 53.1, input prices rose 7.4 to 66.8 while selling prices rose 3.1 to 50.9.

- Australia November building permits fell 9.1% m/m after -1.5% m/m – worse than -2% expected. Private sector apartments fell 5%, overall with houses fell -0.3%. In seasonally adjusted terms, total dwellings fell by 9.1 per cent in November, driven by a 17.9 per cent decrease in private dwellings excluding houses. Private houses fell 2.6 per cent in seasonally adjusted terms.

- Korea December unemployment steady at 3.8%- better than 3.9% expected – holding 5-month lows. Unemployment fell 36,000 to 1.064mn while employment fell 77,000 to 26.889mn. Participation rate fell to 63.1% from 63.3%.

- Japan November average cash earnings rose 2% y/y after 1.5% y/y – better than 1.3% y/y expected – best in 5-months. Regular pay rose 1.6% from 1.5% y/y while bonuses rose 9.7% from 1.7%. Real wages rose 1.1% after -0.1% y/y.

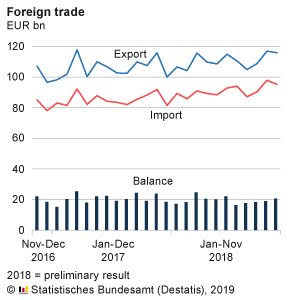

- German November trade surplus rose to E20.5bn after E18.3bn – better than the E19.5bn expected. Compared to Nov 2017 trade fell to E20.5bn from E23.8bn as imports rose 3.6% to E95.7bn while exports were near flat at E116.3bn. Exports to ex EU fell 0.4% y/y to E48.2bn while imports rose 4.3% to E41.2bn. EU exports rose 0.3% to E68.1bn while imports rose 3.1% to E54.5bn

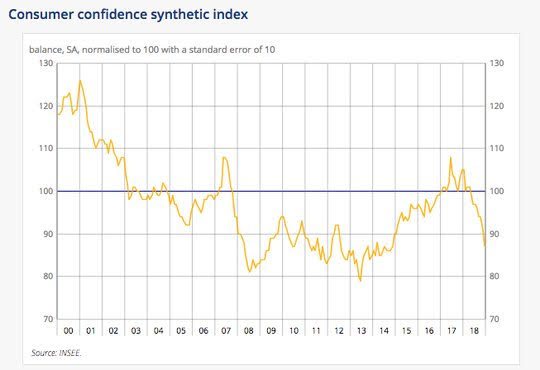

- French December consumer confidence drops to 87 from 91 – lower than 90 expected – worst since Nov 2014. By component – financial situation fell 5 to -33 and outlook for finances fell 3 to -22. Buying plans 12M fell 15 to -32, the standard of living fell 10 to -66 but outlook flat at -42, unemployment fears 12M rose 3 to 31 while consumer price outlooks fell 13 to -25.

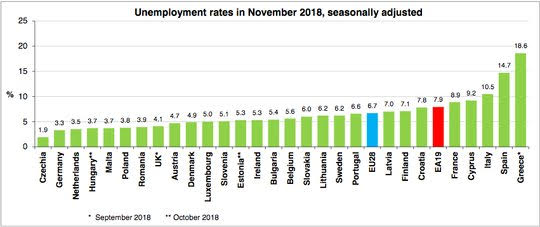

- Eurozone November unemployment drops to 7.9% from 8.0% - better than 8.1% expected – best since Oct 2008. October revised from 8.1%. Unemployment fell to 90,000 m/m to 13.04mn. Lowest unemployment was in Czech 1.9%, Germany 3.3%, and Netherlands 3.5% while worst was Greece at 18.6% and Spain at 14.7%.

- Italy November unemployment drops 25,000 to 10.5% from 10.6% - worse than 10.1% expected. Youth unemployment fell to 31.6% from 32.2%. Employment was flat with rate at 58.6%. Inactive people rose 26,000 up 0.1% to 34.3%.

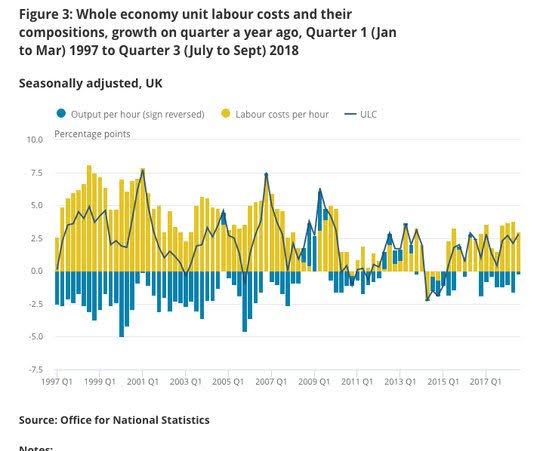

- UK 3Q final labor productivity -0.4% q/q, up 0.2% y/y after +0.5% q/q, 1.6% y/y - as expected. This was the weakest productivity growth since 3Q 2016. Productivity in manufacturing rose 1.7% y/y while services rose 0.1% y/y. Unit labor costs rose 2.8% after 2.1% y/y.

Market Recap:

Equities: The US S&P500 futures are up 0.2% after a 0.97% gain yesterday. The Stoxx Europe 600 is up 0.85% while the MSCI Asia Pacific rose 1.2%.

- Japan Nikkei up 1.10% to 20,427.06

- Korea Kospi up 1.95% to 2,064.71

- Hong Kong Hang Seng up 2.27% to 26,462.32

- China Shanghai Composite up 0.71% to 2,544.34

- Australia ASX up 0.95% to 5,838.40

- India NSE50 up 0.49% to 10,855.15

- UK FTSE so far up 1% to 6,930

- German DAX so far up 0.9% to 10,904

- French CAC40 so far up 1.1% to 4,827

- Italian FTSE so far up 1.2% to 19,235.18

Fixed Income: Supply, Fed speeches, weaker data and another up day for equities – all driving safe-haven bonds lower – Germany flat with 10-year Bund yields at 0.23%, French OATs flat at 0.73%, UK Gilts up 2bps to 1.29% while periphery better with Italy off 4bps to 2.93%, Portugal off 2bps to 1.81%, Spain flat at 1.52% and Greece off 2bps to 4.33%.

- Germany sold E4bn of 10Y 0.25% Bunds at 0.29% with 1.62 cover(after Bundesbank holding). The previous auction in Nov 28 had 0.34% yields and 1.64 cover.

- US Bonds sold on equities with supply focus– 2Y up 1bps to 2.60%, 5Y up 2bps to 2.59%, 10Y up 2bps to 2.74%, 30Y up 2bps to 3.02%.

- Japan JGBs sold with curve steeper after BOJ– 2Y flat at -0.14%, 5Y up 1bps to -0.14%, 10Y up 3bps to 0.04%, 30Y up 2bps to 0.71%. BOJ bought Y4.3trn of 5-10Y and Y252bn of TIPS – unchanged amounts but with more cover – suggesting banks happy to take profits.

- Australian bonds sold with risk-rally ignore weaker data– 3Y up 3bps to 1.84%, 10Y up 3bps to 2.34%.

- China bonds extend rally– 2Y off 5bps to 2.63%, 5Y off 4bps to 2.89%, 10Y off 2bps to 3.13%.

Foreign Exchange: The US dollar index is off 0.1% to 95.85. The USD is mixed in EM with Asia – KRW up 0.25% to 1119.10 and INR off 0.5% to 70.466 with oil. EMEA is USD bid – RUB off 0.2% to 67.02. ZAR off 0.1% to 13.976 and TRY off 0.5% to 5.515.

- EUR: 1.1450 up 0.1%.Range 1.1436-1.1479 with 1.13-1.15 prison holding but focus is on FOMC/rates again.

- JPY: 108.85 up 0.15%. Range 108.68-109.00 with EUR/JPY 124.65 up 0.1%. Focus is on equities/risk mood and US rates.

- GBP: 1.2735 up 0.15%.Range 1.2708-1.2777 with EUR/GBP.8990 off 0.05% - Brexit chatter changing with Jan 15 vote seen as less scary.

- AUD: .7165 up 0.35%.Range .7134-.7171 with copper up, China deal hopes with US rising. NZD .6775 up 0.75%

- CAD: 1.3235 off 0.3%. Range 1.3223-1.3279 with BOC expected to sound a bit more hawkish than FOMC. Oil and rates driving. 1.32 break opens 1.3050 risk.

- CHF: .9805 off 0.1%.Range .9791-.9818 with EURCHF 1.1235 flat. Tracking EUR and watching risk mood with .9680 target for $.

- CNY: 6.8325 off 0.3%.Range 6.8260-6.8520 with deal hopes driving – rate spread to US not a factor yet.

Commodities: Oil up, Gold down, Copper up 1.7% to $2.7010.

- Oil: $50.83 up 1%. Range $49.71-$51.09 with $50 break opening $52 next. Brent up 1.8% to $59.77 with $60 focus (traded $60.05 highs overnight). US inventories key along with equities.

- Gold: $1281.60 off 0.3%.Range $1280.90-$1288.10 – watching USD and risk mood for direction – risk is $1265 before $1305. Silver $15.67 off 0.25%, Platinum $826 up 0.5%, Palladium $1278 up 1.3%.

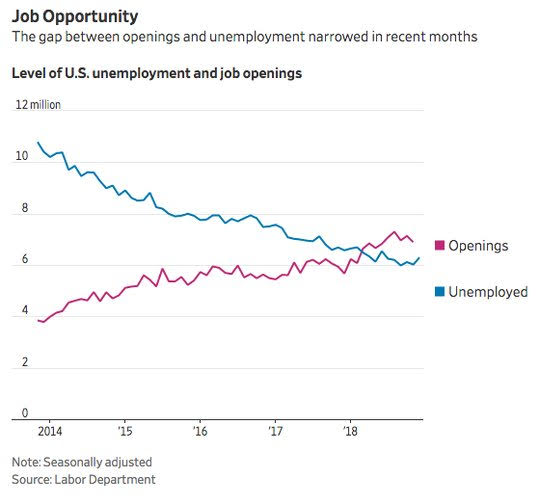

Conclusions: Is weaker data good? The Fed reaction function to markets and economic data is still the most important driver for risk-taking today. The lack of hard economic data releases today makes this all about FOMC speakers and FOMC minutes for data watching. However, the JOLTS report yesterday merits some though. Even as opening exceeds the total unemployed, the number of openings went down in November. The US jobs market is losing some momentum and it puts the weekly claims on the docket Thursday as something to watch for a larger turn in the US cycle.

Economic Calendar:

- 0800 am Poland interest rate decision – no change from 1.5% expected

- 0815 am Canada Dec housing starts 215.9k p 204k e

- 0820 am Atlanta Fed Bostic speech

- 0900 am Chicago Fed Evans speech

- 1000 am Bank of Canada rate decision – no change from 1.75% expected.

- 1030 am US weekly EIA oil inventories 0.007mb p

- 1100 am BOC news conference

- 1130 am Boston Fed Rosengren speech

- 0100 pm US 10Y note $24bn sale

- 0200 pm US FOMC minutes

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.