Markets: Curves

“Nothing ever straight grows out of the crooked timber of humanity” – Isaiah Berlin

The exponential gains in stocks have stalled, even as the USD continues a linear reversal and oil continues to rocket higher into the OPEC meeting Thursday. The curve and slope of risk continues to make for a very unpleasant ride for investors with hairpin turns, roller coaster inclines of worry, and questionable drivers.

The inversion of the US rate curve throws many into a negative growth spin. Headlines overnight didn’t help anyone forget that they are in car without a seat belt – starting with Trump naming USTR Lighthizer as the lead negotiator for a China trade deal over the next 3 months.NATO meets today to talk about Russia and the Ukraine. The UK can reverse its Brexit decision unilaterally according to the ECJ opinion– adding to the view that December 11th could be the end of UK May government but also another way out of the Brexit mess with another referendum. The French PM confirms the government is suspending fuel-tax hikes but the yellow-vest protestors balk at talks. These headlines matter but the focus is on the fragile truce of trade and growth still with the USD reflecting the doubts about US divergence being central. The EUR is breaking out of its recent downdraft with 1.15 next while the CNY grabs all the headlines as its fixed stronger and runs nearly 1% stronger – watching 6.75 and 6.50 next. For most, CNY represents a measure of China growth and Xi success at home, for others it’s a risk barometer for all of Asia as it sets the export/growth tones that drive 2019 investment plans. The break of the USD uptrend here means something more than today’s curves.

Question for the Day: What are the new worries? Markets gave up on a Goldilocks view of the world overnight, blamed on rethinking US/China trade truces, but also linked to doubts about inflation/growth dynamics into 2019.

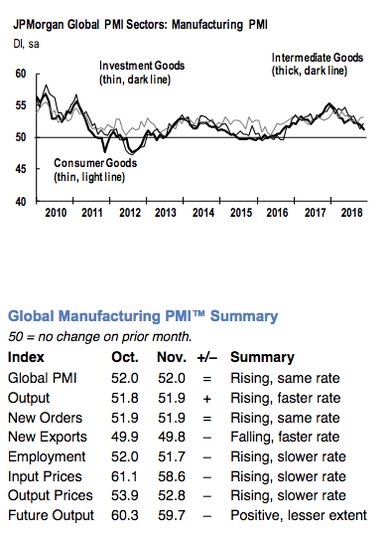

- The first consideration is growth– with the JPM global manufacturing PMI clearly in a slowing mode unchanged at 52 from the October 23-month lows. The stall in export orders particularly in emerging markets is highlighted. On the other hand, input and output costs moderated.

- The second concern is China and its ongoing battle with credit and debt as the success of shrinking the shadow banking sector hits private sector funding and directly hits growth. The trade truce isn’t enough to convince China bears about the fragility of the economic rebound. The regulators appear to be turning on the tap again as the WSJ notes the rise in wealth management products increasing from June to October by 6% to CNY22.3trn.

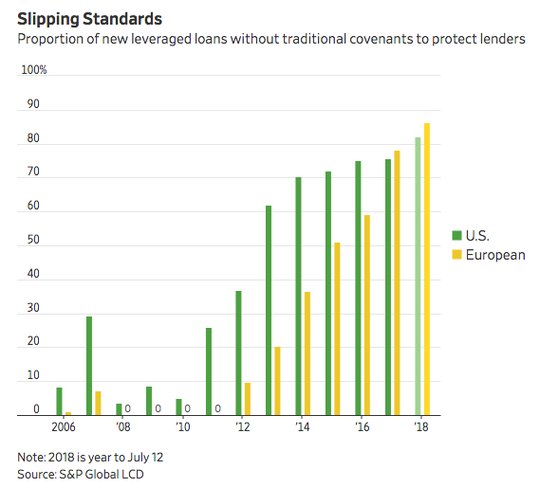

- The third concern is financial stability– as the BOE and FOMC reports highlight the holding of corporate debt by asset managers. As the WSJ reports, banks maybe better prepared but customers less so. The Fed noted that mutual fund holdings of corporate debt had grown to about $2.3 trillion in September this year, from more than $500 billion at the end of 2009 in 2018 dollars. If there is a liquidity issue in bonds and asset managers are leveraged then the stability of markets is at risk. As the Fed also noted, routs are more likely with business borrowing at historic highs and valuations of their debt also high – ie with less traditional covenants.

What Happened?

- Australia 3Q current account deficit narrows to A$10.7bn after A$13.5bn – as expected. The goods and services balance in 3Q rose A$6.607bn with exports up 3% and imports up 1%. The net international investment was a liability of A$940.2bn down A$17.3bn from 2Q.

- Australia RBA leaves rates unchanged at 1.5%- as expected – highlights uncertainty in household consumption. The RBA still sees 3.5% GDP in 2018 and 2019 then slowing in 2020. RBA Lowe’s statement noted: “Business conditions are positive and non-mining business investment is expected to increase. Higher levels of public infrastructure investment are also supporting the economy, as is growth in resource exports. One continuing source of uncertainty is the outlook for household consumption. Growth in household income remains low, debt levels are high and some asset prices have declined. The drought has led to difficult conditions in parts of the farm sector.” Bias is for gradual policy shift later in 2019 dependent on the data: “Further progress in reducing unemployment and having inflation return to target is expected, although this progress is likely to be gradual.”

- Swiss November CPI -0.3 m/m, +-0.9% y/y after +0.2%, 1.1% y/y – less than the -0.1% m/m, 1% y/y expected. This was the first monthly decline since July and the lowest annual rate since April. The Swiss HICP fell 0.4% m/m, +1% y/y

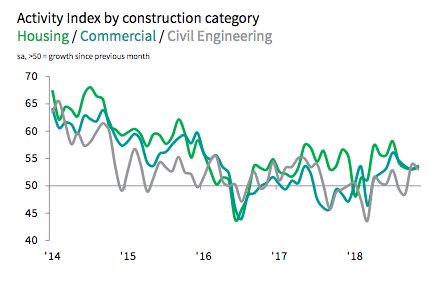

- UK November Construction PMI 53.4 from 53.2 – better than 52.6 expected – best since July. Residential building was the strongest sector, best in 3-months, while commercial and engineering activity sustained increases as well. Client demand cited with new business higher but still below 3Q average with Brexit concerns. Both input costs and employment rose – with jobs rising at the fastest rates since Dec 2015. Business confidence bounced from 6-year lows in October – to best in 3 months.

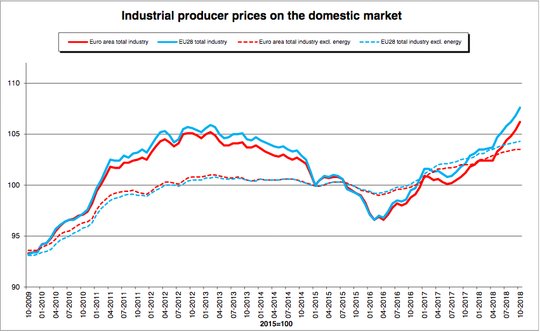

- Eurozone October PPI up 0.8% m/m, 4.9% y/y after 0.6% m/m, 4.6% y/y – more than the 0.5% m/m, 4.5% y/y expected. Energy rose 2.7% m/m, capital goods 0.2%, intermediate goods 0.1% and durable goods 0.1% m/m. The ex-energy PPI 0% m/m, 1.5% y/y. By nation, highest PPI was in Belgium up 10.4% y/y, Denmark 9.9%, Hungary 8.4% y/y and UK 7.7% y/y – Ireland was the only nation with lower PPI -2.7% y/y.

Market Recap:

Equities: The S&P500 futures are off 0.3% after at 1.09% gain yesterday – first reversal in a week. The Stoxx Europe 600 is off 0.3% - also the biggest reversal in a week. The MSCI Asia Pacific fell 0.6% - biggest drop in 2-weeks.

- Japan Nikkei off 2.39% to 22,036.05

- Korea Kospi off 0.82% to 2,114.35

- Hong Kong Hang Seng up 0.29% to 27,260.44

- China Shanghai Composite up 0.42% to 2,665.96

- Australia ASX off 1.00% to 5,797.50

- India NSE50 off 0.13% to 10,869.50

- UK FTSE so far off 0.5% to 7,027

- German DAX so far off 0.6% to 11,395

- French CAC40 so far off 0.4% to 5,031

- Italian FTSE so far off 0.6% to 19,505

Fixed Income: Supply matters as does the ongoing Italy budget tweets – markets reacting to usual Brexit headlines as well. UK 5Y sale with long 4bps tail a symptom. UK 10Y Gilt yields up 2bps to 1.33%, German Bunds are off 2bps to 0.287% while French OATs are flat at 0.69%. The periphery suffers – Italy up 1.5bps to 3.155%, Spain up 1bps to 1.495%, Portugal flat at 1.798% and Greece up 3.5bps to 4.20%.

- UK sold GBP2.5bn of 5Y 1% 2024 Gilts at 0.966% with 1.86 cover and 4bps tail.

- ESM sold E2bn of 3M bills at -0.5757% with 3.5 cover.

- Spain sold E410mn of 6M bills at -0.401% with 7.65 cover and E3.676bn of 12M bills at -0.318% with 2 cover.

- US Bonds see bull curve flattening extend with equities weaker– 2Y off 0.2bps to 2.819%, 5Y flat at 2.817%, 10Y off 1.1bps to 2.959% and 30Y off 2.7bps to 3.227%. The MOF sold Y1.793trn of 10Y bond at 0.074% with 3.82 cover and 0.03 tail– previously 0.135% with 4.33 cover and 0.02bps tail.

- Australian bonds see flattening trade after RBA on hold, US moves– 3Y off 4bps to 1.98%, 10Y off 8bps to 2.53%.

- China PBOC skips open market operations for 28th day. China bond rally extends – 2Y off 9bps to 2.66%, 5Y off 6.7bps to 3.05%, 10Y off 5.6bps to 3.30%.

Foreign Exchange: The US dollar index off 0.5% to 96.54 with 96.37-96.96 range. USD weaker in Emerging Markets – EMEA: ZAR up 0.8% to 13.579 – better GDP noted, TRY off 1.1% to 5.31 – oil hit, RBU up 0.25% to 66.33 – NATO worries; ASIA: TWD up 0.1% to 30.68, KRW up 0.45% to 1105.50 and INR off 0.1% to 70.50 – oil hits.

- EUR: 1.1400 up 0.4%. Range 1.1350-1.1419 with 1.14 breakout opening 1.15 and 1.1750 calls. USD rates and curve key

- JPY: 112.80 off 0.75%. Range 112.73-113.66 with EUR/JPY 128.55 off 0.4% - risk off and 112.50 pivotal for 110.80 again. US rates/growth key.

- GBP: 1.2805 up 0.65%. Range 1.2720-1.2840 with EUR/GBP .8900 off 0.25% - all about Brexit still despite better data – 1.27-1.2950 keys.

- AUD: .7385 up 0.35%. Range .7349-.7394 with focus on USD weakness and commodity gains - .7450 key. NZD .6955 up 0.4% - milk auction key.

- CAD: 1.3175 off 0.15%. Range 1.3164-1.3202 with BOC tomorrow key, oil helping 1.3150 for 1.30 retest.

- CHF: .9950 off 0.25%. Range .9931-.9985 with EUR/CHF 1.1345 up 0.15% - even with Italy doubts, its about weaker CHF and SNB policy - .9880-1.00 keys.

- CNY: 6.8939 fixed 0.71% stronger– most since June 2017 – now up 0.7% to 6.8340 with 6.8323-6.8896 range.

Commodities: Oil up, Gold up, Copper off 0.55% to $2.8560.

- Oil: $53.93 up 1.9%.Range $53.03-$54.55 with OPEC talks key then US inventories. WTI watching $55 again. Brent up 2.1% to $62.99 with $65 back in play.

- Gold: $1239.30 up 0.7%.Range $1230-$1240. The focus is on the USD first, rates second, risk mood third – watching $1250 and $1268 next. Silver up 1.2% to $14.56 with $14.75 and $14.92 next. Platinum off 0.2% to $806.16 and Palladium up 2% to $1229.50 – watching WSJ on auto and gold story.

Conclusions: Does the US yield curve kinky inversion mean the end of the USD rally? The number of analysts that are commenting on the US yield curve inversion and the USD weakness is significant. The flattening curve from yesterday’s price action returns the focus to 2019 and a pause or mistake from the FOMC. The spread between 3- and 5-year yields fell to negative 1.4 basis points Monday, dropping below zero for the first time since 2007, and the 2- to 5-year gap soon followed.

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.