Markets: Catalysts

The chemical reaction of negative news headlines mixed with the usual worries about global growth, US rate policy and trade wars drive global pessimism towards most risk assets again. The day of mourning yesterday provided no new timed reflection for buying the dip and the rest of the world responds. Markets are in a lab experiment with recognition that the beaker for a Santa Claus rally appears to be broken.

The arrest of the Huawei CFO in Canada for breaking US Iran sanctions, the BOJ Kuroda warnings on economic risks ahead, the failure of OPEC to get a deal before its meeting driving oil down over 4% and UK PM May’s ongoing search for a compromise to save her government and the Brexit deal, Italy’s League appears unwilling to shift the 2019 budget deficit below 2.2% while the 5-Star coalition might agree to 2.1% but neither seem sufficient to appease the EU budget rules – all these headlines take the blame for the new-found energy to sell after Tuesday’s collapse. The elixir to save risk will require a new mixture of a dovish Fed which requires stronger US data without inflation, more from Trump/Xi on their trade truce leading to a real deal, some solution that keeps the UK government together with some Brexit respite, and more evidence that China growth has stabilized. The catalysts for today’s selling are well known, the risks for a surprise bounce seem discounted away. The most interesting story in the price action isn’t in stocks, bonds or commodities but the lack of interest in FX. The JPY and its crosses should be on high alert for a bigger panic move for safety. The fact that 112 holds for now looks encouraging and perhaps suggests that the chemical reactions of ugly headlines and negative sentiment on positions may be nearing the end of the bear experiment into US data and the all-important US jobs report tomorrow.

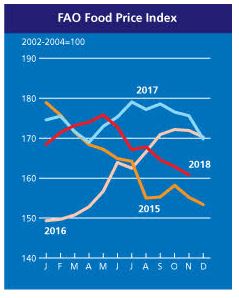

Question for the Day: Is the fall in oil and food prices a good thing for 2019? Markets are clearly in a tailspin with the faith that the truce in US/China trade fully unwound on the arrest of the Huawei founder’s daughter. There are winners in bear markets – particularly when it comes to food and energy. The drop in oil has been a notable reprieve to Turkey and India where inflation and central bank policy was at odds with the governments. The knock-on of lower energy to food shouldn’t be ignored either as it also helps emerging and frontier markets. While the world has 4 billion people that don’t worry about the money to feed themselves, it has another 1.5 billion that do and 2 billion more that are on the edge.The UN FAO food price index fell again in November to the lowest since May 2016. This allows for more policy room, less government intervention and some small support for other growth given the global consumer will have some extra cash to spend.

What Happened?

- Japan December Reuters Tankan for manufacturing 23 from 26 – with outlook for March 22. The drop in sentiment reflects weakness from car exporters and precision machinery. The index is also down from 26 in September – which suggests the 4Q growth bounce maybe less than hoped. The Reuters services index rose to 31 from 30 but is also down 2 from September and is expected to slip to 30 in March.

- Australia October retail sales rose 0.3% m/m after 0.1% m/m - better than the 0.2% m/m expected. Trend sales rose 0.2% unchanged – as expected. 5 of 6 industries saw gains led by clothing and footwear moderated by drop in cafes and restaurants. Online retail turnover contributed 5.9 per cent to total retail turnover in original terms in October 2018, a rise from 5.6 per cent in September 2018 and the highest level recorded in the series.

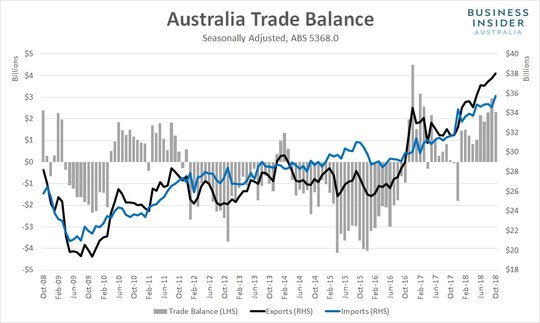

- Australia October trade surplus A$2.316bn after revised A$2.940bn – less than the A$3.1bn expected. Exports rose 1% to A$38.045bn while imports rose 3% to A$35.242bn. Coal and LNG exports rose while iron ore fell and the impact of the drought on ruralgoods rises. Imports rose on higher fuel prices and more capital goods demand.

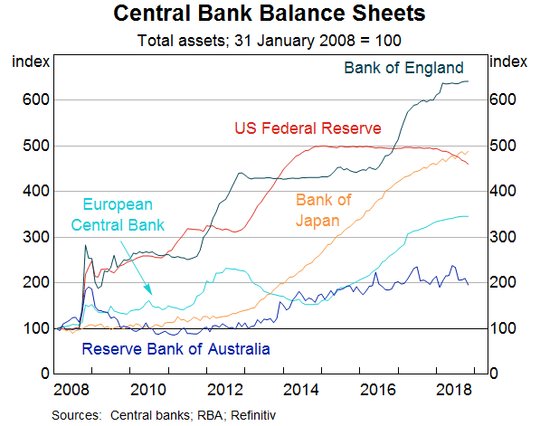

- RBA Debelle: Lessons from the Global Financial Crisis. A question worth considering about QE is: if QE was effective on the way in, then surely there must be a large degree of symmetry? Hence we should expect to see similar but opposite effects on the way out. If there were diminishing returns to QE, then it might take a little while before we see the full impact of the reduction in the Fed's balance sheet that is currently underway, but the effect should grow over time.

- German October Factory Orders up 0.3% m/m, -2.7% y/y after revised 0.1% m/m, -2.6% y/y – better than -0.3% m/m expected. Domestic orders decreased by 3.2% and foreign orders increased by 2.9% in October 2018 on the previous month. New orders from the euro area were up 7.3%, new orders from other countries increased 0.3% compared to September 2018. Capital goods orders rose 0.4% m/m while consumer orders fell 1.7% m/m.

Market Recap:

Equities: The US S&P500 futures are off 1.7% after losing 3.24% Tuesday. The Stoxx Europe 600 is off 2.2% - the lowest in 2 years and worst drop in 10-months – while the MSCI Asia Pacific is off 1.8% to 2-week lows with the worst drop in 6 weeks.

- Japan Nikkei off 1.921% to 21,501.62

- Korea Kospi off 1.55% to 2,068.69

- Hong Kong Hang Seng off 2.47% to 26,15638

- China Shanghai Composite off 1.68% to 2,605.18

- Australia ASX off 0.22% to 5,736.70

- India NSE50 off 1.69% to 10,601.15

- UK FTSE so far off 2.5% to 6,747

- German DAX so far off 2.6% to 10,908

- French CAC40 so far off 2.5% to 4,822

- Italian FTSE so far off 2.6% to 18,827

Fixed Income: Risk-off leads with supply absorbed. Focus is on US/China trade truce unraveling and oil price drop. The ongoing Brexit worries and the French yellow-vest crisis were not in play. UK Gilt 10Y yields off 4bps to 1.275%, French OATs off 1.5bps to 0.66%, German Bunds off 2.5bps to 0.25% while periphery suffers on Italy budget – BTPs up 8bps to 3.135%, Spain off 0.5bps to 1.45%, Portugal flat at 1.785% and Greece up 6bps to 4.18%.

- UK sold GBP 1.75bn of 30Y 1.75% 2049 bonds at 1.909% with 2.40 cover – previously 1.826% with 1.76 cover.

- France sold E1.1bn of 7Y 0.25% OATs at 0.38% with 2.14 cover – previously 0.54% with 2.05 cover. France also sold E0.935bn of 1.75% 5Y bond s at -0.185% with 2.77 cover – previously +0.06% with 2.37 cover.

- US Bonds rally further – curve slightly steeper – 2Y off 3.1bps to 2.764%, 3Y off 2.8bps to 2.777%, 5Y off 2.2bps to 2.765%, 10Y off 1.8bp to 2.895% and 30Y off 2bps to 3.152%.

- Japan JGBs rally further on risk-off mood – 10Y off 1bps to 0.05%. The MOF enhanced liquitidy auction for 15.5-39Y bonds saw bid/cover rise to 2.09 from 1.84.

- Australian bonds rally sharply on trade and stock worries – 3Y off 4.5bps to 1.915%, 10Y off 5bps to 2.447%.

- China PBOC skips open market operations but adds CNY187.5bn in 1Y MLF offsetting MLF maturing today. China bonds see curve steeper – 2Y off 1bps to 2.62%, 5Y off 3bps to 3% while 10Y up 4bps to 3.28%.

Foreign Exchange: The US dollar index flat at 97.05 with 96.96-97.20 range. USD is bid in EM – EMEA: ZAR off 1.55% to 14.06, TRY off 0.8% to 5.365, RUB off 0.65% to 66.95; ASIA: TWD off 0.15% to 30.832, KRW off 0.6% to 1120.75, INR off 0.6% to 70.90.

- EUR: 1.1345 flat. Range 1.1321-1.1353 – nothing to t see here? 1.13-1.14 still.

- JPY: 112.80 off 0.35%. Range 112.58-113.21 with EUR/JPY 128 off 0.35% - no panic with 112.50 holding and 110.80 target still in play.

- GBP: 1.2750 up 0.1%. Range 1.2700-1.2759 with EUR/GBP .8900 off 0.1% - Brexit less driver with Italy/France and US/China – market set for Dec 11? 1.2650-1.2950 keys

- AUD: .7210 off 0.8%. Range .7192-.7274 with China trade and commodities all hitting and .7350 now cap for .7150 retest. NZD off 0.4% to .6870 with .6950 top for .6750 again.

- CAD: 1.3415 up 0.45%. Range 1.3355-1.3445 with China relations, Oil and a dovish BOC the drivers and risk for 1.3750 next as 1.3380 base building.

- CHF: .9970 off 0.1%. Range .9957-.9990 with EUR/CHF 1.1310 off 0.1% - Italy and stocks driving with 1.000 still key for $.

- CNY: 6.8599 fixed 0.2% weaker from 6.8476, trades off 0.65% to 6.8925 with 6.9004-6.8568 lows.

Commodities: Oil lower, gold lower, copper lower – off 1.45% to $2.7785

- Oil: $51.53 off 2.7%. Range $50.23-$53.30. Now watching $49.41 WTI for retest of 2018 lows and Brent $57.50 same. Brent is off 2.2% to $60.17.

- Gold: $1236 off 0.1%. Range $1234.50-$1241. Risk off and gold lower = all commodities pain and $1245-$1250 cap with USD driver. Silver off 0.95% to $14.36 with $14.20 next. Platinum off 1.1% to $791.40 and Palladium off 1.65% to $1221.85.

Economic Calendar:

- 0830 am US Oct trade deficit $54bn p $54.9bn e

- 0830 am US weekly jobless claims 234k p 220k e

- 0830 am Canada Oct trade deficit C$420mn p C$720mn e

- 0850 am BOC Poloz speech

- 1000 am US Oct factory orders (m/m) 0.7%p -2%e

- 1000 am Canada Nov Ivey PMI 61.8p 60.3e

- 1215 pm Atlanta Fed Bostic speech

- 0645 pm Fed Powell Speech

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.