Markets: Bruised

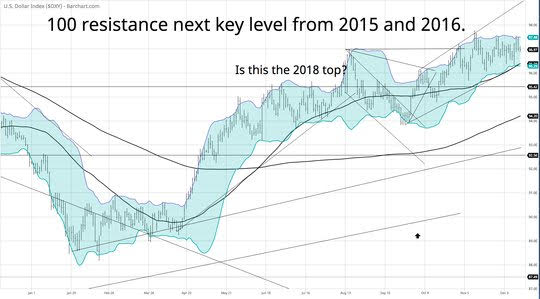

Markets are bruised and waiting for the ECB Draghi news conference. There is no expectation of anything substantial from today’s news conference other than confirmation of their end of QE and lower forecasts for growth and inflation. The ending of bond buying matters and its effects on markets will play out over the next year – just as the original QE took time to move risk appetites higher and volatility lower, so too the reverse will require months to notice. The overnight news wasn’t enough to help risk-takers in Europe ahead of the ECB – even with China’s new policy to open to foreign companies and talk of ending the 2025 Made in China plan, even with UK PM May winning her leadership challenge. But there are other negative stories like the SNB remaining steadfastly in the QE camp and cutting both growth and inflation forecasts – foreshadowing some other central bank forecast shifts; like the Chinese holding another Canadian in its diplomatic push to get the Huawei CFO release; like the rising risk of a UK Labour government. No matter, markets are on hold and waiting with the data overnight too light to matter and the price action over the last week too volatile to jump ahead of event risks. The measure of the bruising in FX remains the USD which isn’t going down despite all calls for it. There is clearly a risk around Draghi and his conference call today for a move – with 97.60 rather than 96 the issue.

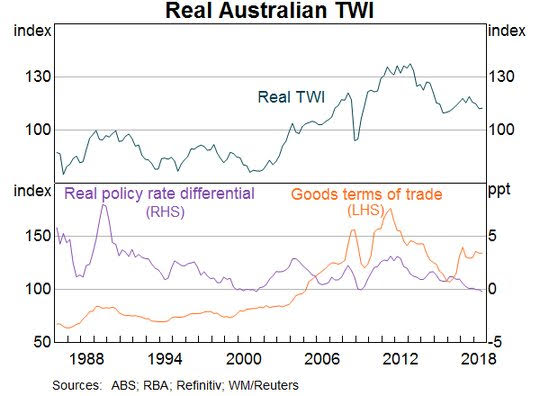

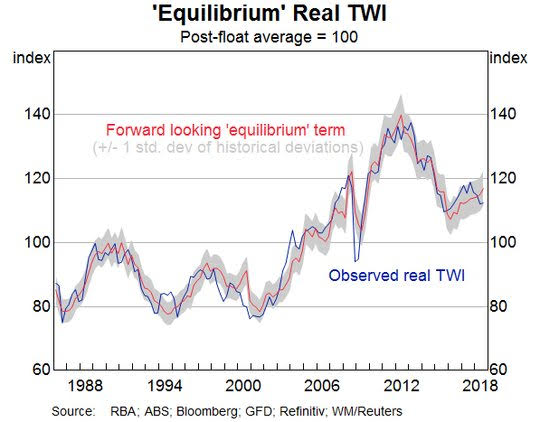

Question for the Day: Is the USD overvalued? The RBA Bulletin has a chapter on modeling the forward AUD price. Central Banks and FX markets have a difficult relationship – as Former FOMC Chair Greenspan quipped in his book The Age of Turbulence: “… I knew that because of the efficiency of Foreign Exchange (Forex) markets, forecasting exchange rates for major currencies is as accurate as forecasting the outcome of the flip of a coin.” The RBA is attempting to flip the coin here – they model FX because its so important to the economy – this is how the Bulletin puts it: These models are used to assess how consistent the level of the exchange rate is with the level that would be expected based on its historical relationship with other economic variables – or ‘determinants’. These determinants are the terms of trade – the ratio of export to import prices – and prospective investment returns on Australian assets compared with those abroad, commonly captured by real interest rate differentials.

The work of this research matches much of the work of the Fed on yield curves and their role in the economy. This is the key observation - In other words, forward-looking foreign exchange markets tend to incorporate expectations on inflation, the business cycle and monetary policy as embedded in the entire yield curve. However, it's not obvious which individual yield curve factor is most important for the RTWI in any given period.

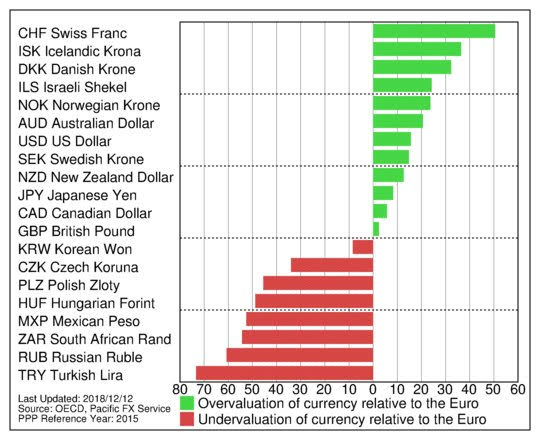

What this means for the USD? Markets are going to continue to see the US inflation risks and yield curve as key drivers for value in the USD into 2019. The bearish USD view is back in force for next year – just like it was in 2018 - on grounds that its 1) overvalued by 10-15%; 2) Fed rate hikes slow or stop; 3) US growth slows or goes into recession. The focus is on rates and the US yield curve in predicting such.

On the face of it – predictions about US rate policy shifts and US curves are difficult given the new FOMC data dependency. This means a higher band of uncertainty for the factors driving the dollar. As for valuation arguments – PPP is a slow moving metric where the USD can remain overvalued for extended periods. The EUR PPP is the best way to view the dollar story and the USD isn’t the extreme here – better to look at the CHF, NOK and AUD as having room to drop in 2019 with EM recoveries as the most likely.

What Happened?

- Australia December MI consumer inflation expectations jump to 4%from 3.6% - more than the 3.5% forecast. The MI version now matches the RBA version. The outlook returns to October levels and remains below the 4.2% June highs.

- German November final HICP unrevised at 0.1% m/m, 2.2% y/y– as expected. The National CPI also unrevised at 0.1% m/m, 2.3% y/y from 2.5% in October.

- French November final HICP unrevised at -0.2% m/m, 2.2% y/y– as expected. The national CPI also unchanged at -0.2% m/m, 1.9% y/y after 2.2% y/y.

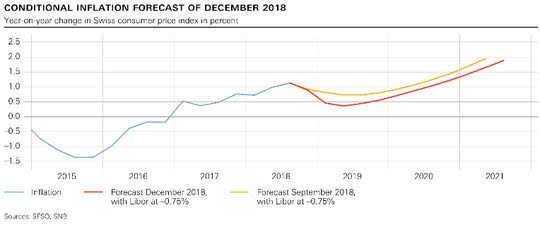

- The Swiss National Bank keeps policy unchanged with -0.75% 3M Libor target - as expected – with continued FX intervention as needed. The SNB now sees lower GDP for 2018 at 2.5% and 1.5% in 2019. They see the risks to the downside due to the global economy. Inflation is also expected lower with 4Q 2019 down to 0.6% from 0.8% in September.

Market Recap:

Equities: The S&P500 futures are up 0.25% after a 0.54% gain yesterday. The Stoxx Europe 600 flat at 350 after early gains reversed but bounce back on ECB.

- Japan Nikkei up 0.99% to 21,816.19

- Korea Kospi up 0.2% to 2,095.55

- Hong Kong Hang Seng up 1.29% to 26,524.35

- China Shanghai Composite up 1.23% to 2,634.05

- Australia ASX up 0.14% to 5,735.30

- India NSE50 up 0.50% to 10,791.55

- UK FTSE so far off 0.4% to 6,854

- German DAX so far off 0.1% to 10,916

- French CAC40 so far off 0.3% to 4,894

- Italian FTSE so far up 0.8% to 19,103

Fixed Income: Waiting game with ECB news conference and US data – mood is holding pattern with most biased to sell if risk-on returns. German 10-year Bund yields 0.28% up 1bps, France off 1bps to 0.71%, UK Gilts off 1bps to 1.27% while periphery extends on ECB with Italy off 12bps to 2.9%, Spain off 3bps to 1.41%, Portugal off 5bps to 1.69% and Greece off 4bps to 4.22%.

- US Bonds waiting game with curve focus– 2Y flat at 2.77%, 5Y off 1bps to 2.76%, 10Y flat at 2.91%, 30Y flat at 3.15%

- Japan JGBs curve steeper– 2Y off 1bps to -0.14%, 5Y up 1bps to -0.11%, 10Y up 1bps to 0.06%, 30Y up 1bps to 0.80%.

- Australian bonds sold off with risk-stabilizing– 3Y up 4bps to 1.99%, 10Y up 3bps to 2.48%.

- China bonds see curve steeper on equity stability, trade deal hopes– 2Y off 2bps to 2.76%, 5Y up 4bps to 3.04%, 10Y up 4bps to 3.34%.

Foreign Exchange: The US dollar index flat at 96.95.

- EUR: 1.1370 flat. Watching 1.13-1.1420 still – market stuck with ECB.

- JPY: 113.50 up 0.15%.Watching 114 for a breakout but see crosses and rates as hampering.

- GBP: 1.2660 up 0.3%.Bouncing on May surviving but hardly enough with 1.25-1.2750 now keys.

- AUD: .7230 up 0.15% and NZD up 0.1% - nothing special here despite China hopes – market watching commodities.

- CAD: 1.3365 up 0.1%- Oil and data driving with 1.33-1.3450 keys.

- CHF: .9925 up 0.1%- stuck with SNB not doing enough and watching stocks/Brexit/Italy and ECB dovish tone risks.

- CNY: 6.8745 up 0.1%- with deal hopes higher – 6.83-6.92 keys.

Commodities: Oil lower, gold lower, Copper up 1% to $2.8095.

- Oil: $50.64 off 1%.Range $50.35-$51.57 with Brent off 0.95% to $59.58 – breaking $60 in Brent opens $58 test again and watching $50 in WTI again for more pain.

- Gold: $1243.50 off 0.1%.Range $1243-$1250 – still a dollar and rate story with ECB light driver today - $1255 key. Silver flat at $14.73.

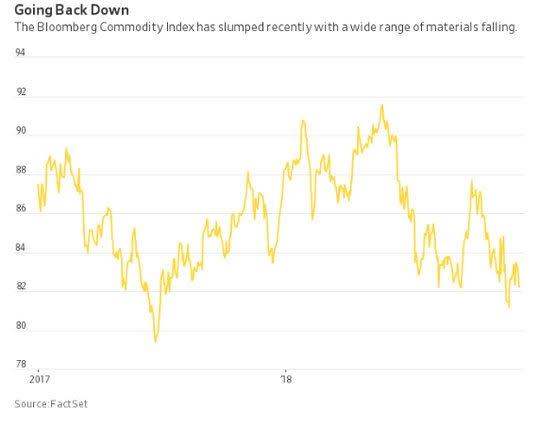

Conclusions: Are the CFO’s wrong? The WSJ story that came out yesterday – almost half of all US CFOs believe a recession comes by end of 2019– hangs over markets as growth concerns dominate this year-end. The market reflects these doubts in bonds and commodities first. The drop in the commodity indices stands out from October. The drop reflects doubts about China growth and about the US as well. The stronger USD also plays a role.

The logical inconsistency is that most analysts see 1) a weaker USD – so that supports commodities; 2) a Fed pause – which helps risk and growth; 3) some modest trade détente. This makes oil and other industrial commodities the key for judging when the mood begins to shift.

Economic Calendar:

- 0745 am ECB interest rate decision – no change from 0% and -0.4% policy expected

- 0830 am ECB Draghi news conference

- 0830 am US weekly jobless claims 231k p 230k e

- 0830 am US Nov import prices (m/m) 0.5%p -0.5%e / exports 0.4%p 0.2%e

- 0830 am Canada Nov ADP employment change -23k p +75k e

- 0830 am Canada Oct new housing prices (m/m) 0%p 0%e

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.