Markets: Benign

How benign is solitude – William Wordsworth

Most see the low volume, low volatility world of markets as benign, not malignant, despite the scares from inverted yield curves, 4Q price action PTSD and ongoing geopolitical uncertainty from Brexit to US/China to elections from Australia to Israel to India and Spain. Anyone looking down from above would see oil at 5-month highs and China iron ore at record highs grinding against the easy money policy of central bankers moving from normalization to wait-and-see. The new fear for investors is in missing out, in the upside to growth forecasts, to realizing there is no alternative to risky assets in a world of negative real rates. The confusion over how to create inflation after years of disinflation in Japan and Europe and below target in the US leaves more extreme measures in the wings. Fiscal not monetary policy will remain the focus just about everywhere making economics political more than model driven. This doesn’t mean that there aren’t notable headlines moving markets, only that it’s not about the data but politics, to wit:

- Saudi Aramco bond orders over $75bn – with price not expected to be tighter than the sovereign debt. The company will issue 6 bonds from 3Y to 30Y.

- Libya civil war continues with forces of General Haftar carrying out airstrikes on Tripoli.

- Trump proposes new tariffs of $11bn on EU imports to offset Airbus subsidies. This comes as the EU and China start summit talks in Brussels.

- Iran puts US central command on its terror list in a tit-for-tat move after the US labels the Iran Revolutionary Guard a terror organization.

This makes the dull trading seem unsustainable, with focus on Super Wednesday and perhaps a bit more from the US on politics and forecasts with the IMF expected to lower its global growth view from 3.5% this morning. The USD is offered and remains vulnerable to a risk-on return but for now, FX and rates are in the dead calm world of benign neglect.

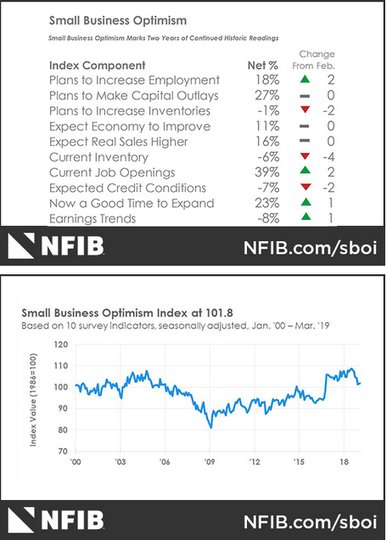

Question for the Day: Is the US confidence leading a recovery? The soft patch theory for the US 1Q dominates with the focus this weak shifting from economic data to real earnings and outlooks for 2Q. The CPI and the FOMC minutes are next stories to matter to economists but unlikely to drive markets. Today the NFIB small business optimism index rose 0.1 to 101.8 – above the longer-term averages. The uncertainty index from the NFIB fell 6 to 79 – perhaps highlighting that the US politics and policy just isn’t the concern. Five Index components improved, two were unchanged, and three fell. Labor market indicators improved, the outlook for expansion, real sales, and reports of rising earnings gained ground, and capital spending plans held steady. The major soft spot was in inventories with stocks viewed as too large and plans to invest in inventories turning slightly negative – more firms planning reductions than additions. “Small business owners continue to create jobs, expand their operations, and are enjoying strong sales,” said NFIB President and CEO Juanita Duggan. “Since Congress resolved the shutdown, uncertainty has declined as small business owners add jobs, increase sales, and invest in their businesses and employees.”

What Happened?

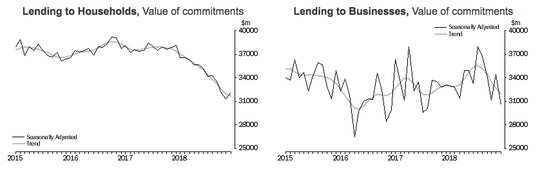

- Australia February home loans jump 2% m/m after revised -2.5% - more than the -2% drop expected – first rise since Oct 2018. The investment lending for homes also jumps to +2.6% m/m from -2.3% m/m revised – also more than the -3.6% expected. January revised from -2.6% m/m for home lending and -4.1% for investment lending to homes. The rise in lending was driven by new home commitments up 3.4% m/m, refinancing up 2.6% m/m and personal finance up 0.4% m/m. The lending for businesses fell 11.1% m/m, -76% y/y.

- Italy February retail sales up 0.1% m/m, 0.9% y/y after revised 0.6% m/m, 1.2% y/y – as expected. The January sales revised from 0.5% m/m, 1.3% y/y. The volume of goods fell 0.1% m/m, up 0.3% y/y. Large retails fell 0.1% y/y – first drop since Sep 2018 – while small retail jump 1.6% y/y. Online sales rose 17.5% y/y. By product sales rose the most in cosmetics up 3.8%, shoes 3.4% while books fell 1% and appliances -0.2% m/m.

Market Recap:

Equities: The US S&P500 futures are off 0.1% after a 0.1% loss yesterday. The Stoxx Europe 600 is up 0.35% with focus on oil and China growth, not tariffs. The MSCI Asia Pacific rose 0.2%.

- Japan Nikkei up 0.19% to 21,802.59

- Korea Kospi up 0.13% to 2,213.56

- Hong Kong Hang Seng up 0.27% to 30,157.49

- China Shanghai Composite off 0.16% to 3,239.66

- Australia ASX up 0.07% to 6,315.50

- India NSE50 up 0.64% to 11,678.80

- UK FTSE so far up 0.25% to 7,470

- German DAX so far up 0.15% to 11,978

- French CAC40 so far up 0.25% to 5,485

- Italian FTSE so far up 0.55% to 21,889

Fixed Income: Waiting pattern in bonds continues with politics of US/Brexit driving along with supply – German 10-year Bund yields stuck at 0%, French OATs flat at 0.36% while UK Gilts up 3bps to 1.11% with some excitement over denied headline that Merkel supports 5Y Irish backstop limit. The periphery is better with Greece continuing to rally off 5bps to 3.48% - 13Y lows, Italy off 4bps to 2.64%, Spain flat at 1.09% and Portugal off 1bps to 1.23%.

- German linker auction technically uncovered– Germany sold E750mn of 11Y 0.5% Apr 2030 Bundei at 119.13 price with 0.989 cover – after Bundesbank cover 1.32 vs. 1.88 previously.

- UK Gilt auction in line – UK DMO sold GBP2.75bn of 10Y 1.625% Oct 2028 Gilts at 104.65 price with 2.28 cover – up from 2.06 previously.

- Austria auction weaker - sold E575mn of 4Y 0% Jul 2023 RAGB at 101.68 with 1.88 cover down from 2.28 previously, also sold E575bn of 10Y 0.5% RAGB at 102.18 with 1.99 cover down from 2.10 previously.

- US Bonds are mixed with supply focus, curve flatter– 2Y flat at 2.34%, 5Y flat at 2.33%, 10Y off 1bps to 2.52%, 30Y off 1bps to 2.91%.

- Japan JGBs rally with focus on BOJ/growth – 2Y off 1bps to -0.16%, 5Y off 1bps to -0.17%, 10Y off 1bps to -0.05%, 30Y off 1bps to 0.53%. The MOF sold Y1.9trn of 5Y 0.1% JGB at -0.164% with 5.31 cover – previously -0.144% with 5.15 cover.

- Australian bonds rally back with region– 3Y off 3bps to 1.42%, 10Y off 1bps to 1.90%, NZ 10Y off 3bps to 2.04%. The AOFM sold A$150m of 10Y 2.5% Sep 2030 indexed bonds at 0.33% with 5.3 cover

- China PBOC skips open market operations for the 14th day, leaves liquidity neutral, though most see some shift given MLF maturing this month. China bonds see curve flatter – 2Y up 1bps to 2.65%, 5Y up 5bps to 3.08%, 10Y off 2bps to 3.30%.

Foreign Exchange: The US dollar index off 0.15% to 96.92. In emerging markets, the USD is weaker with ASIA: KRW up 0.2% to 1139.85, INR up 0.2% to 69.395; EMEA: RUB up 0.25% to 64.695, ZAR up 0.45% to 14.041, TRY up 0.5% to 5.659.

- EUR: 1.1275 up 0.15%. Range 1.1255-1.1281 with 1.1280-1.1320 key for momentum but tight ranges mean bigger risks.

- JPY: 111.25 off 0.2%. Range 111.24-111.58 with EUR/JPY 125.45 flat – nothing to see here – 110-112.

- GBP: 1.3085 up 0.15%. Range 1.3052-1.3122 with EUR/GBP .8615 flat. Hope for extension with deal driving. 1.30-1.33.

- AUD: .7150 up 0.3%. Range .7119-.7151 with NZD .6750 up 0.2% - commodities driving with .7130 break setting up for .7250 retest.

- CAD: 1.3300 off 0.1%. Range 1.3293-1.3320 watching 1.3250 again with oil and politics key.

- CHF: .9990 flat. Range .9980-.9994 with EUR/CHF 1.1265 up 0.15%. Less fear leaves 1.00 tent.

- CNY: 6.7095 off 0.1%. Range 6.7070-6.7190. PBOC fixed 6.7142 from 6.7201. Waiting for US/China deal and PBOC cut

Commodities: Oil up 0.35%, Gold up 0.3%, Copper up 0.1% to $2.9395.

- Oil: $64.62 up 0.35%. Range $64.33-$64.79 with $65 next key all about Libya, Iran, and Saudi with US API key tonight. Brent flat at $71.11 with focus on $70-$72.

- Gold: $1305.70 up 0.3%. Range $1300.60-$1306.90 with focus on $1301 for $1310-15 next with USD and other commodities driving. Silver up 0.2% to $15.25, Platinum off 0.7% to $906.30 and Palladium up 0.25% to $1357.

Economic Calendar:

- 0900 am Mexico Mar inflation (y/y) 3.94%p 3.94%e

- 1000 am US Apr IBD/TIPP economic optimism 55.7p 54e

- 1000 am US Feb JOLTS job openings 7.581m p 7.565m e

- 1200 pm US WASDE report

- 0100 pm US 3Y note sale

- 0430 pm US weekly API crude oil stocks 2.963mb p 1mb e

- 0645 pm FOMC vice-chair Clarida speech

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.