Markets: Almost

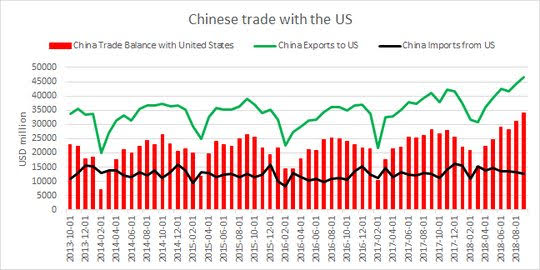

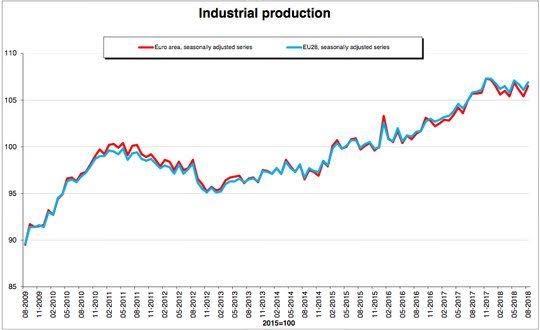

We are almost at the weekend. We almost have headlines for a EU/UK Brexit deal. We almost have a deal between US and Turkey over Pastor Brunson. We almost are sure that the US won’t list China a currency manipulator and so trigger more sanctions/tariffs. We almost have a convincing calm back in equities after a week-long rout. The phrase “almost” is in the same category as “hope” to wizened traders. This isn’t a strategy, process or something to trust. Close doesn’t count, but in a world of fake-news, or one where journalists go missing. There are a few items to support the mood swing in risk overnight that aren’t qualitative – 1) ECB Draghi still sees need for significant monetary policy stimulus. Read as easy policy despite QE tapering. This along with his concern about global headwinds supports risk. 2) China trade shows no signs of trouble from US trade war. The trade surplus grows to $31.7bn more than expected even with imports up 11.9% m/m after -3% m/m, exports up 9.8% m/m after -2.6% m/m. 3) Eurozone industrial production was better. This bounce back in August from July puts the idea of a bigger slowdown to rest. As for trading markets today – the 3Q earnings are a key focus and driver with JPM Chase out and shares higher. The hope for stability in markets helps drive today but the biggest place to watch is still in Emerging Markets. The hype around Turkey over the summer given US economic pressures is important and the recovery in the TRY significant but perhaps not sufficient. A break of 5.68 would be needed today to convince the market that inflation, bad government policy and a seemingly lost central bank can be overlooked for a test of 5.25 – where the USD uptrend should hold.

Question for the Day:Where are the bubbles? After you see a drop in equities like we have this week, the logical question to ask is where are the systemic points of pain that could add to the selling of assets. The 3Q earnings for US S&P 500 start in earnest today with bank earnings on the docket. Banks are important as they reveal the domestic credit demand and health along with the global interconnectivity. The bubbles in credit were the obvious drivers of the 2008 crash and many expect the same in the next crisis. However, focus on bubbles remains squarely on three areas globally – real estate, direct lending and private equity. Unlike 2008, the leverage in these potential bubbles seems more constrained. Banks in 2007 had up to 30 to 1 leverage. Those days are gone.

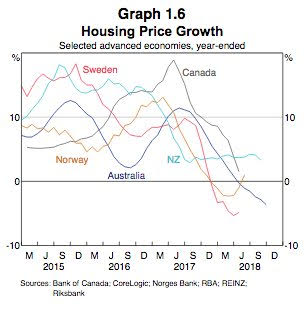

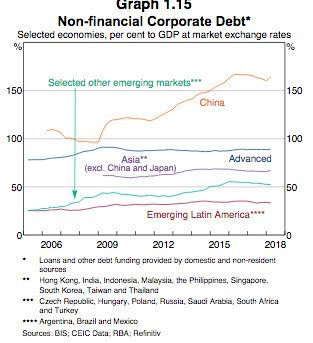

The twice a year Australian Financial Stability Review came out last night and its worth a read for those searching for bubbles. The global outlook remains positive but the RBA notes risks are increasing. The global bubble risks highlighted are corporate debt, housing prices, and emerging markets.

What Happened?

- Australia August home loans drop 2.1% m/m after 0.4% gain – worse than +0.1% expected. Investment loans fell 1.1% after -1.3% m/m – the 6th consecutive drop – while owner-occupied home loans fell -2.7% after +1.3%.

- China September trade surplus $31.7bn after $27.91bn – more than the $21bn expected. Exports rose 14.5% y/y after 9.8% y/y – more than 9.1% y/y expected. Exports for the first three quarters increased by 12.2% y/y to USD1.83 trillion. Imports rose 14.3% y/y after 20% y/y - near 15% y/y expected. Imports for the first three quarters were USD1.61 trillion, 20.0% higher than a year ago. Perhaps most surprising in the statistics - Exports to the U.S. in September expanded by 14.0% y/y to $46.69 billion. Imports from the U.S. fell 1.3% y/y to $12.56 billion. The surplus of $34.13 billion increased from $31.05 billion in August. China's exports to the EU and Japan gained 17.4% and 3.1% y/y while imports rose by 9.3% and 3.1%, respectively.

- German September final HICP unrevised at 0.4% m/m, 2.2% y/y after 0.0% m/m, 1.9% y/y – as expected. The CPI was also unrevised at 0.4% m/m, 2.0% y/y.

- Eurozone August Industrial Production +1% m/m, +0.9% y/y after -0.7% m/m, +0.3% y/y – better than +0.4% m/m, +0.3% y/y expected. The July revised higher from -0.8% m/m and -0.1% y/y. This puts the 3M average at -0.1% from 0%. The 3Q average is -0.2% after -0.1% q/q. The growth was led by energy up 1.9% m/m, durable consumer goods up 1.5%, capital goods up 1.4% and non-durable goods up 1.4% m/m while intermediate goods rose 0.4% m/m.

Market Recap:

Equities: The S&P500 futures are up 0.9% after losing 2.06% yesterday. The Stoxx Europe 600 is up 0.7% - best gain in a week – while the MSCI Asia Pacific index rose 0.6%. The MSCI all-country World index is up 0.4% and the EM index up 2.2% - biggest bounce in 2 years, first gain in over a week.

- Japan Nikkei up 0.46% to 22,694.66

- Korea Kospi up 1.51% to 2,161.85

- Hong Kong Hang Seng up 2.212% to 25,801.49

- China Shanghai Composite up 0.91% to 2,606.91

- Australia ASX up 0.22% to 6,006.60

- India NSE50 up 2.32% to 10,472.50

- UK FTSE so far up 0.65% to 7,052

- German DAX so far up 0.35% to 11,579

- French CAC40 so far up 0.5% to 5,130

- Italian FTSE so far up 0.35% to 19,423

Fixed Income: Higher equities mean lower bonds but marginally and we remain on course for a slight gain on the week. In EU, periphery remains focus with Italy and its budget but Spanish holiday keeps liquidity and spreads noisy. German 10-year Bund yields are flat at 0.52% while French OATs are up 0.5bps to 0.88%. UK Gilts are off 2bps to 1.65% with political doubts post an Brexit deal in play. Italy is off 1.5bps to 3.54% but Spain is up 3.5bps to 1.675% and Portugal up 2.5bps to 2.035% while Greece is off 7.5bps to 4.375%.

- US Bonds are lower across the curve– 2Y up 1.7bps to 2.865%, 5Y up 1.4bps to 3.018%, 10Y up 1.5bps to 3.165%, 30Y up 1.4bps to 3.337%.

- Japan JGBs slightly lower with equities bid– 2Y up 0.5bps to -0.122%, 5Y up 0.4bps to -0.073%, 10Y up 0.4bps to 0.14% and 30Y up 0.7bps to 0.90%.

- Australian bonds lower with China trade/equities– 3Y up 2bps to 2.057% and 10Y up 2bps to 2.745%.

- China PBOC skips open market operations, leaves liquidity unchanged. Money market rates were mixed with the 7-day rate flat at 2.594% and the O/N up 8bps to 2.425%. 10Y bond yields were flat at 3.58%.

Foreign Exchange: The US dollar index is up 0.1% to 95.09 with 94.95-95.14 range. In EM FX, USD is sharply lower– EMEA: ZAR up 1.1% to 14.46, RBU up 0.5% to 65.95 and TRY up 0.5% to 5.89. ASIA: TWD up 0.8% to 30.85, KRW up 1.15% to 1131 and INR up 0.8% to 73.54

- EUR: 1.1585 off 0.1%.Range 1.1572-1.1610 with focus on US rates and stocks – 1.1620-50 resistance holding against 1.15 base.

- JPY: 112.25 up 0.1%.Range 112.01-112.50 with 112-114 back in play. EUR/JPY 130 flat – key for consolidation is 129-132.

- GBP: 1.3210 off 0.15%.Range 1.3207-1.3258 with EUR/GBP .8770 up 0.1% - focus is on what happens to May post Brexit deal 1.3250-1.33 key resistance for 1.30 again.

- AUD: .7120 flat.Range .7112-.7131 with nothing going on – focus is on China and NZD off 0.1% to .6515 with .6440 base.

- CAD: 1.3010 off 0.15%.Range 1.3003-1.3040 with risk for 1.32 still in play.

- CHF: .9910 up 0.15%.Range .9882-.9920 with EUR/CHF 1.1475 flat – no fears mean 1.00 USD resistance back in play.

- CNY: 6.9120 fixed 0.05% weaker from 6.9098 – 11th day of weaker fixings. Trades better into London at 6.9150 from 6.9268 official close Thursday. Trades 6.9165 off 0.1% now with 6.8974-6.9324 range.

Commodities: Oil up, Gold down, Copper up 1.25% to $2.86.

- Oil: $71.47 up 0.7%.Range $70.94-$72.01 with WTI focus on $70 base and $72.50 resistance. Brent $80.60 up 0.45% with focus on $80 base and $83 resistance

- Gold: $1221 off 0.25%.Range $1220.50-$1225. Tested resistance but USD holding and risk mood turning with $1215 key support. Silver up 0.5% to $14.65 with $14.50 back as pivotal support and $14.77 resistance. Platinum up 0.2% to $842.60 and Palladium up 0.9% to $1090.

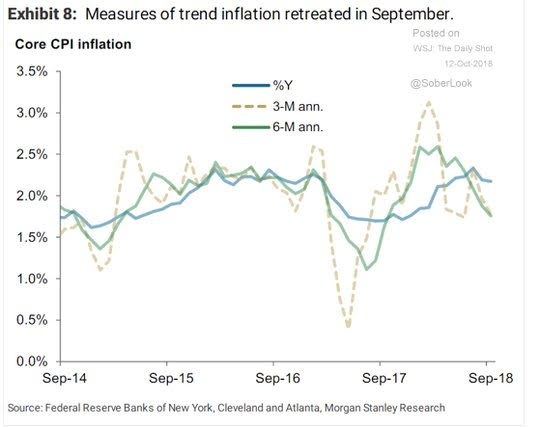

Conclusions: Was the CPI a game changer? If you had to point to one story that might have changed the dynamic of selling this week – it’s the US CPI. Fears of an FOMC being behind the curve proved false. If the Fed isn’t going to raise rates faster, and if growth holds, 3Q earnings prove positive as expected – then buying the dip returns as a process that works. The data suggest trend inflation is turning.

Economic Calendar:

- 0800 am India Aug Inflation (y/y) 7%p 3.5%e

- 0800 am India Aug Industrial Production (y/y) 6.6%p 4%e

- 0830 am US Sep export prices (m/m) -0.1%p 0.2%e / import -0.6%p +0.2%e

- 0930 am Chicago Fed Evans speech

- 1000 am US Oct preliminary Univ.Michigan Consumer Sentiment 100.1p 100.5e

- 1230 pm Atlanta Fed Bostic speech

- 0200 pm US Sep monthly budget deficits $214bn p $47.3bn e

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.