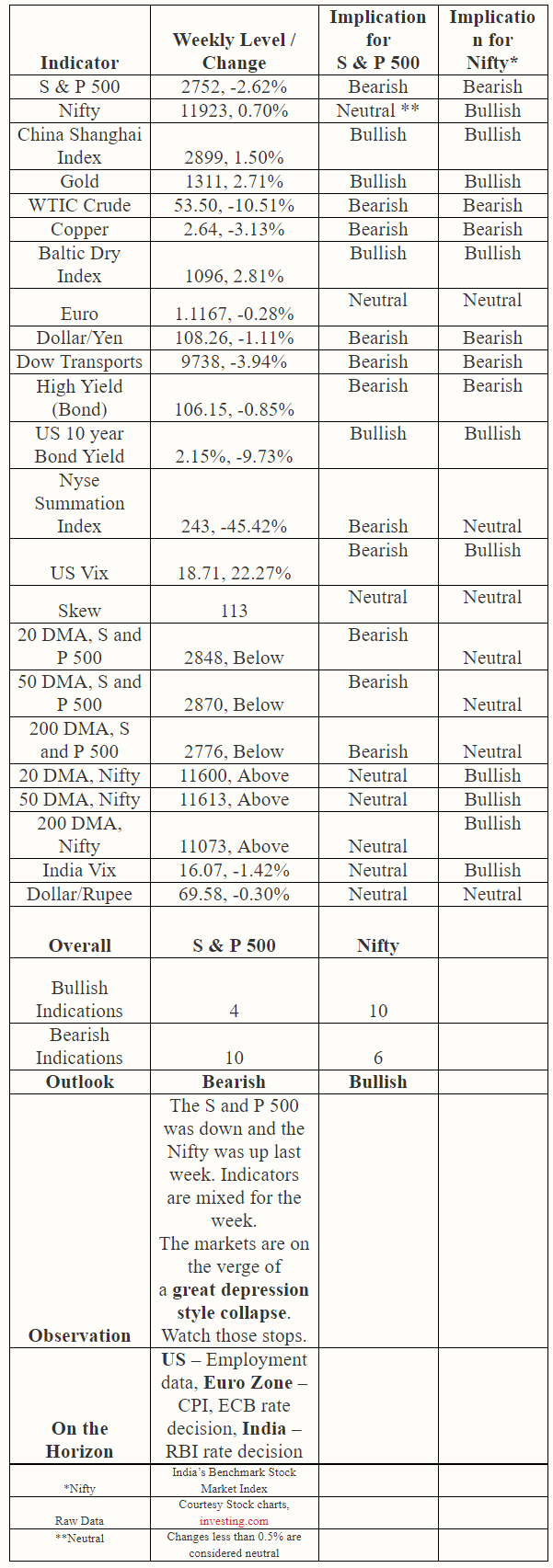

Market Signals For The US Stock Market And Indian Stock Market - Monday, June 3

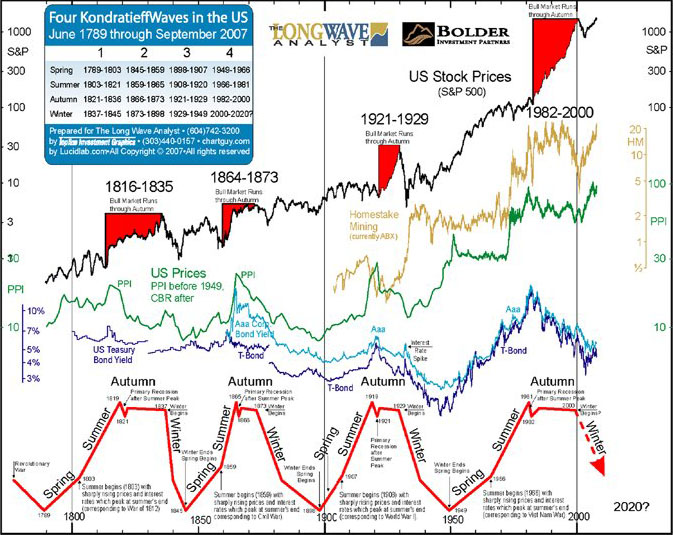

The S&P 500 fell and the Nifty was up last week. Indicators are mixed for the upcoming week. QE forever from the FED is about to trigger the deflationary collapse of the century and we are very close to another top in global equity markets. The market has rallied 600 points from the December lows but a 5-year bear market is in the making with a secondary top in place. The trend is changing from bullish to bearish. Looking for significant underperformance in the Nifty going forward on rapidly deteriorating macros. The India VIX has exceeded the US VIX suggesting there may be a sudden catch up on the downside for the Indian market in 2019. A 5-year deflationary wave is about to start in key asset classes like the Euro, stocks, and commodities amidst a number of bearish divergences and Hindenburg Omens. We are on the verge of a multi-year great depression. The markets are still trading well over 3 standard deviations above their long term averages from which corrections usually result. Tail risk has been very high off late as the yield curve inverts. The critical levels to watch for the week are 2760 (up) and 2740 (down) on the S & P 500 and 12000 (up) and 11850 (down) on the Nifty. A significant breach of the above levels could trigger the next big move in the above markets. You can check out last week’s report for a comparison. Love your thoughts and feedback.

Disclaimer: The views expressed here are my own and must not be taken as advice to buy or sell securities.