Market Signals For The US Stock Market And Indian Stock Market - Monday, April 8

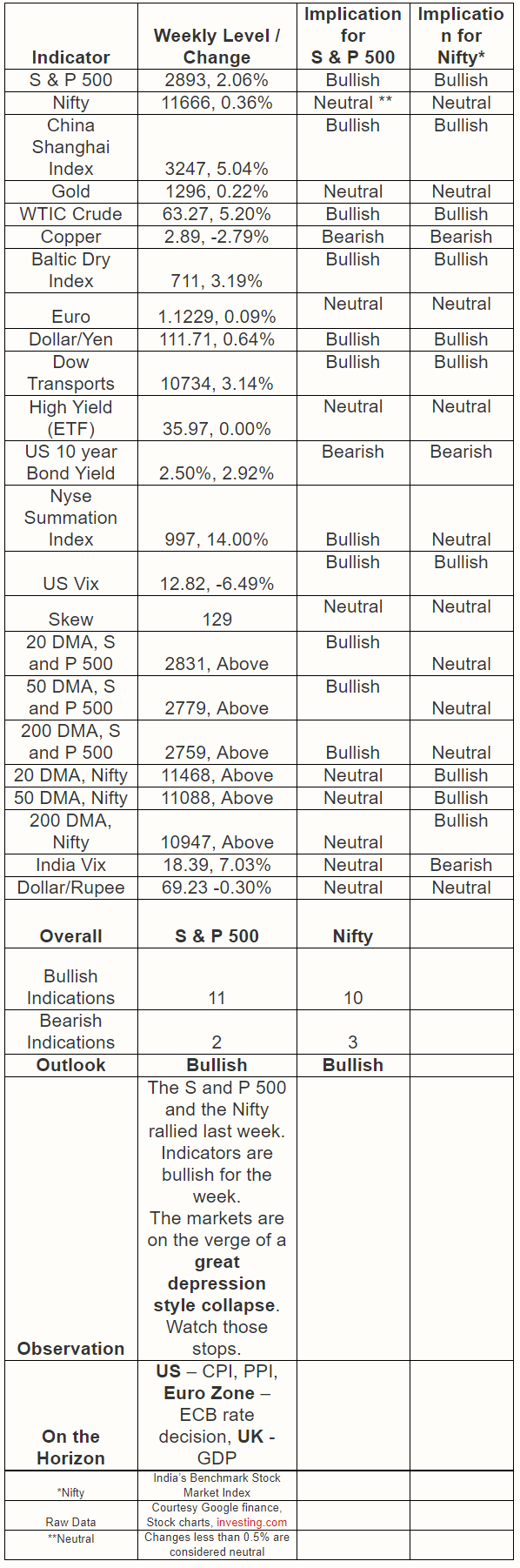

The S&P 500 and the Nifty rallied last week. Indicators are bullish for the upcoming week. QE forever from the FED is about to trigger the deflationary collapse of the century and we are very close to a major secondary top in global equity markets. The market got its oversold bounce of about 550 points but a 5-year bear market is in the making. The trend is changing from bullish to bearish. Looking for significant under performance in the Nifty going forward on rapidly deteriorating macros. The India VIX has exceeded the US VIX suggesting there may be a sudden catch up on the downside for the Indian market in 2019. A 5-year deflationary wave is about to start in key asset classes like the Euro, stocks, and commodities amidst a number of bearish divergences and Hindenburg Omens. We are on the verge of a multi-year great depression. Quantitative tightening by the FED is yet to be priced in fully. The markets are still trading well over 3 standard deviations above their long term averages from which corrections usually result. Tail risk has been very high off late as the yield curve inverts. The critical levels to watch for the week are 2905 (up) and 2880 (down) on the S&P 500 and 11750 (up) and 11600 (down) on the Nifty. A significant breach of the above levels could trigger the next big move in the above markets. You can check out last week’s report for comparison. Love your thoughts and feedback.

Disclaimer: The views expressed here are my own and must not be taken as advice to buy or sell securities.