Market Reacts To Powell's Dovish Comments: Stocks Surge To Record High, Yields Drops, Dollar Tumbles

In the typical "headfake" kneejerk reaction to any Fed comment, stocks initially dropped on the headline that "tapering is on the way", but immediately rebounded with spoos rising to a a new record high of 4500, suggesting the market anticipated Powell's comments and that Powell was indeed more dovish than expected.

(Click on image to enlarge)

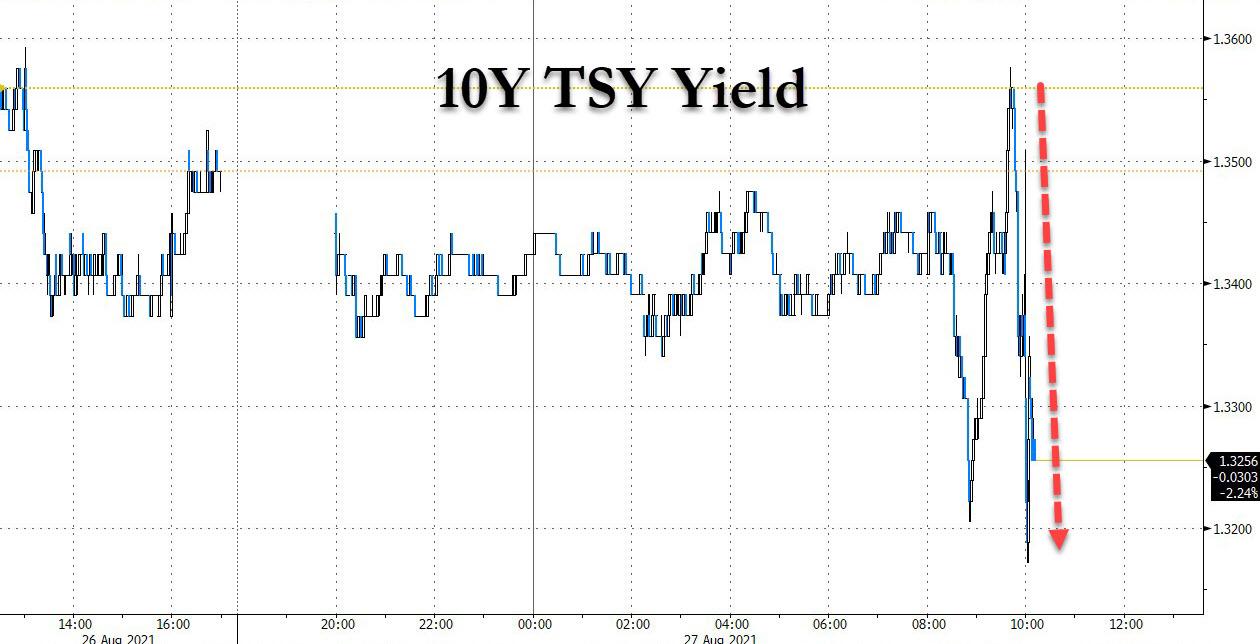

The dovish interpretation was also obvious in 10Y yields which slumped to session lows...

(Click on image to enlarge)

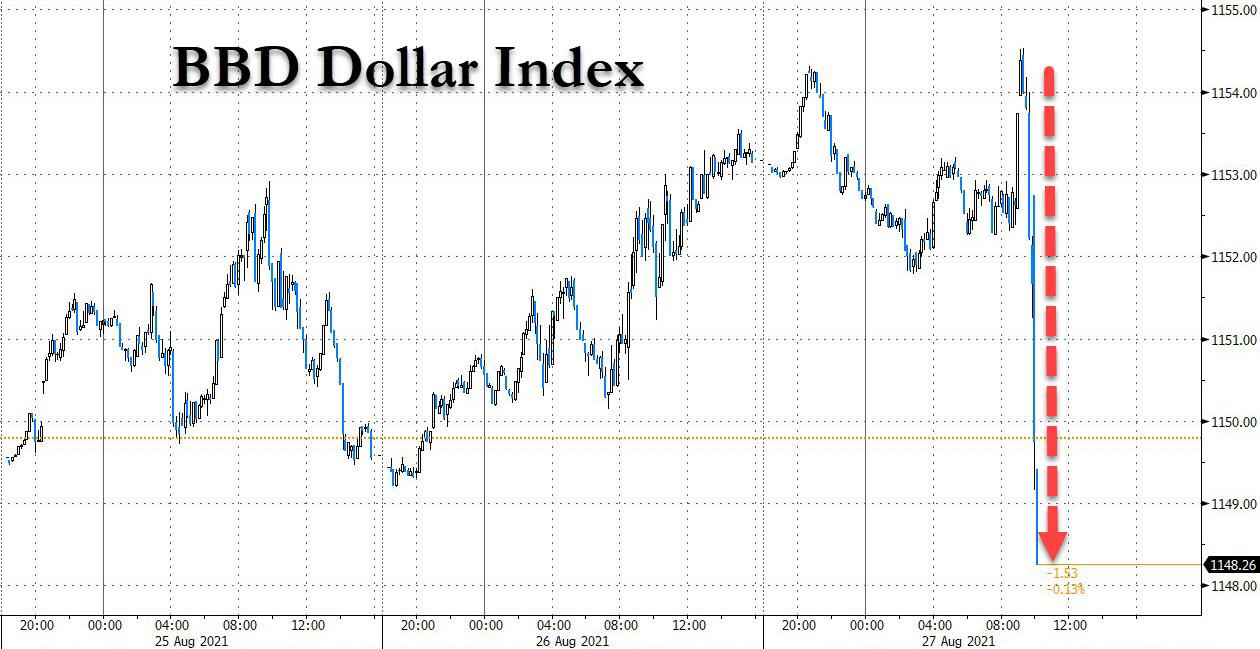

...and the dollar, which likewise slide to Friday's lows, with Powell refusing to give a firm timeline to the taper.

(Click on image to enlarge)

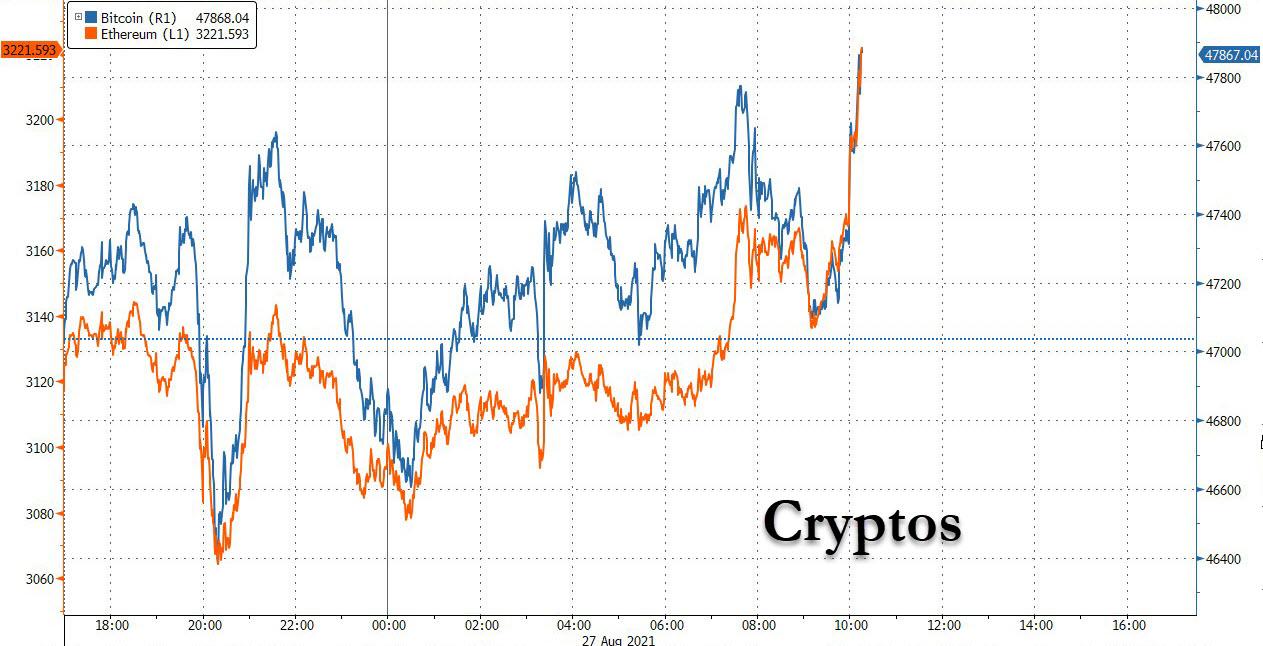

And with the dollar sliding, gold is surging pushing the yellow metal above $1,800, while bitcoin and cryptos have spiked to new session highs.

(Click on image to enlarge)

Overall, Powell's remarks were just what the market wanted - nothing too hawkish, or too dovish. Indeed, with stocks hitting all time high, they were just right.

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more