Market Monetarism On The March?

Back in the old days, Fed officials like Jeremy Stein suggested that there was a trade-off between growth and stability. While low interest rates promote growth, it might come at the cost of financial stability.

Market monetarists warned against reasoning from a price change. Low rates often reflect weak NGDP expectations, and in the long run the best way to avoid financial crises is to make sure that NGDP keeps growing at an adequate rate.

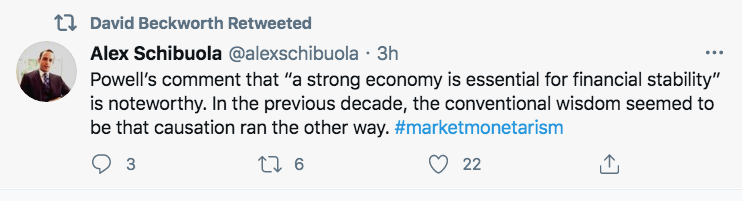

Now the Fed seems to be coming around to this view:

People sometimes tell me that Powell is better than Yellen. Here’s how I’d put it. When Yellen was chair, Powell was no better on monetary policy, maybe a tiny bit worse. But Powell has benefited by observing 4 years of market monetarist critiques of Yellen’s policies. He saw how we warned that Phillips Curve models were not reliable, and that market indicators suggested that inflation was likely to undershoot the Fed’s target. When it did, Powell was a quick learner. In 2019, the Fed didn’t make the mistake previous Fed chairs would have made, they cut rates sharply on market forecasts of a slowdown, even though Phillips curve models said 3.5% unemployment should drive inflation higher.

He learned from market monetarists that it’s not enough to target inflation at 2%, you need to catch up to the previous trend line when there’s a big undershoot, and AIT was adopted in 2020. Going forward, this should allow the Fed to avoid the mistakes of the 2010s, when there was no catch-up. Time will tell.

He learned from market monetarists that financial crises are caused by falling NGDP, and that one cannot assume that money is too easy just because interest rates are low.

So if it ends up being true that Powell’s term has been more successful than Yellen’s (and it’s too early to say) it won’t be because Powell is more talented, it will be because he came later. He had more time to benefit from market monetarist insights.

Or at least that's what I'd like to believe.

PS. The same is true of Australia. Mercatus just published a new working paper by Stephen Kirchner with the following abstract:

It’s now completely obvious that the RBA blew it in the years leading up to the Covid recession. In recent years, Stephen Kirchner, David Beckworth and I all pushed back against their policy of allowing inflation to fall below the target range because of fears that ultra low rates could lead to financial excesses. In the long run, contractionary monetary policies push interest rates even lower than what you’d get with a more expansionary policy, with no gain in financial stability.