Market Briefing For Wednesday, September 9

Extremes are behind - while selling intensifies as sobriety grips most investors after the fact of the 'above trend' probe that completed at least the big-cap surge last week as you know. We pointed-out how the 'super-caps' led the move for a couple months, and how that gave an 'illusion' of strength that wasn't accompanied by the broad list.

The Apple decline, which paused, expanded as they accounted the litigation against Epic Games, and that contributed to the later-session increased selling too. Various events related to iPhone, iPad and so on are fine, but that's not what this is about as institutions feel compelled to cut back, and some of that came from excess chasing. (AAPL)

Others now see the term I used to describe the S&P thrust over 3400 to 3500, simply an 'overshoot', above the rising tops pattern. Sort of typical for an upside capitulation, it was a cap-weighted revelation of trend chasing, which is what you see as we said, at the 'end' of a trend, not the start.

Since calling the low back in late March, this was the first time we got a real blow-off (other than a couple setbacks like one in June we emphasized as a bit similar, but this one is coming from an overshoot that wasn't the case then). Also back then the participation was far better in the broad list (still coming off the 'automatic rally' from the March low), and the broad list was lagging as we got the S&P 'overshoot'.

That matters a lot, because while calling for this overall setback, against a myriad of factors and known-unknowns, we did not call for catastrophe because of the narrow 'construct' of the preceding 'overshoot' dominated by the 'super-caps'. We did expect September to be rough (still do), with intervening rallies, one of which could occur 'if' you get a reasonable stimulus deal from Congress.

Eye-opening vaccine trial halt(s). Detailed based on 'what we know so far' later. As I hear so far, the chemistry and design of the AstraZeneca / Oxford vaccine derives similarly to the Russian Sputnik vaccine. Legitimate concerns or not, misinformation or just vaccine trepidation is going to prevent quickly attaining herd immunity. (AZN)

Executive summary:

- S&P and big-cap-led Nasdaq continue cratering, not helped by the Apple hit, but particularly Nasdaq 100 (NDX), as the oft-warned about situation with Tesla unwinds(TSLA).

- We expected both Apple & Tesla to briefly lift (and help the S&P's final thrust for the phase) after their split shares began trading, then drop, rebound and drop a good bit more, Apple on a more limited basis, and Tesla more severely not just because they were skipped from S&P inclusion (I thought too volatile for the list).

- While rallies can occur anytime, this shortened trading week has seen enough damage to the Grand Dames, that it should blunt rebounds for now, and lead to working lower barring some extraordinary news.

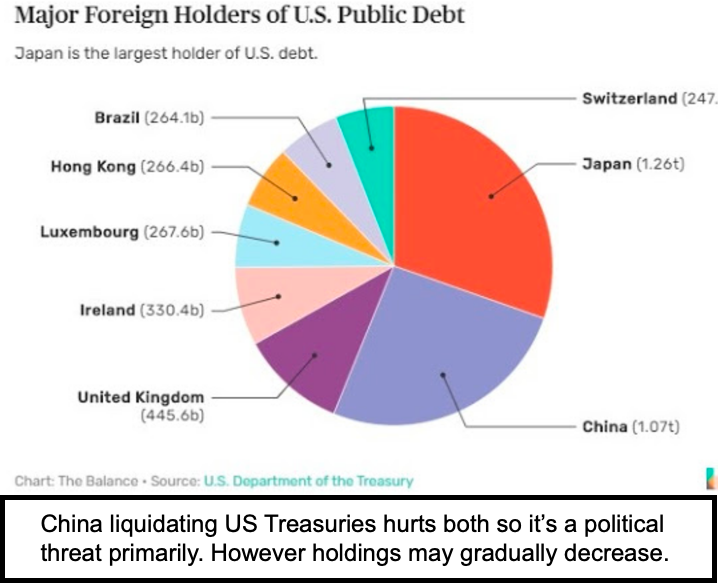

- Also, a poor 3-year Treasury Auction hints at something I mentioned, the higher yields on Chinese 10-year paper, which isn't equivalent, but if it keeps rising you don't want a competitive situation where rates firm 'here' to attract capital, that of course would defy what the Fed policy 'intends' which is 'lower for longer'.

- Aside the evolving technology landscape vs. China, the sector of 'tech' overall is going to continue outperforming more mundane sectors, but longer-term holders will have to exercise discipline as I've often warned of, not mindless chasing of an obviously extended move so many of them missed beginning in March.

- The U.S. and China need to stop the political slams and sort-out a set of 'rules' in a sense, which is what tough negotiations can achieve, if we get back to that.

- I believe Chinese companies want to play in the U.S. and Europe too, so finding a solution to this must follow, though this won't get sorted before the Election.

- Meanwhile the United States must assist Taiwan in maintaining independence (acknowledged or not), because otherwise it risks an untenable situation such as you're now getting (different scale) with Hong Kong.

- We presume (everyone does) that China doesn't actually want a 'war' outside of intellectual policy theft and subversion in our universities, but look at India, which has not only banned Huawei for-instance, but the de-escalation talks failed over the weekend and shots were exchanged between the two sides.

- The Oil decline, fostered by Saudi Arabia cutting prices due to slacker demand over the weekend, set-the-stage for more than the normal pause this morning.

- Crude Price plummeted in the U.S. unnecessarily, recalling OPEC customers are basically everywhere but North America.

- Shutdown refineries on the Gulf Coast are temporary impediments on WTI, as for the moment there is diminished demand for crude domestically, which picks-up as the power-grids are restored from hurricane damage (fortunately the hurricane missed a direct hit of the eye-wall on the facilities or a longer-term outage would of course loom, as the Gulf refineries provide nearly half of US capacity). (BNO)

- AstraZeneca / Oxford has a safety-issue that came up in reviewing participants in the 'trial'. A look at 'other' vaccines is being made, though nobody yet revealed as far as we know 'what' the safety issue was* (see note below).

- Just hearing such concerns dissuades even more Americans about vaccinating with the early (1st Generation) vaccines,

- This 'possibly' heightens not just the skepticism about vaccines, but requires the 'experts' to focus on therapeutic drugs, that directly (ideally) infuse antibodies by a Pill or a shot, and not trying to coax the body to produce its own antibodies,

- Stocks like Heat Biologics (HTBX) and Sorrento Therapeutics (SRNE) have the idea we speak of regarding therapeutics, however they don't have approved tests/treatments as of yet, if those are perceived as forthcoming, such stocks 'might' benefit.

- This is all complex, but if this market cannot rotate to post-Covid expectations, a more 'grim' prospect looms that we've noted for months 'if' we don't have drugs.

- Vaccines that people would be willing to use are a pipe-dream for this year, but not for next, for this Fall even if one or two get approved, few will use them and I suspect most parents will revolt if being compelled to have their kids inoculated before the parents are confident of the vaccine.

- We don't have either vaccine or treatment as of yet, therapeutic is more urgent.

* Late-breaking . . re: the AstraZeneca adverse reaction report 'may' have halted a number of other Trials. Suspicious and unclear 'what' is happening as of now. So let us merely note which have '1st Generation' trials underway, while reminding that all along we've been concerned about the initial vaccines, with interest in later 'products and especially therapeutics'.

There are currently nine COVID-19 vaccine candidates in Phase 3 trials including of course AstraZeneca. Other players: Moderna (MRNA), Novavax (NVAX), Sanofi (SNYNF), Merck (MRK), Pfizer (PFE), J&J (JNJ) and GlaxoSmithKline (GSK). All these may give some ground pending clarification, while those taking a different approach make actually rally a bit.

In-sum: the names that are declining the most are generally the best recognized of all stocks. These are often great companies that got insane valuations, and some of these benefited significantly from the tax-and-capital-repatriation issues mentioned as likely to 'take the S&P to the Moon', 'if Trump won', back in 2016. This isn't 2016.

We did that, we topped in 2018, bottomed late in 2018 (our Christmas Eve 'got to get in moment'), and in my view topped (aside trading swings) in January-February 2020 for a 'crunch' which I elevated to 'crash alert' on recognizing WuFlu was a real risk (a time before they came-up with the Covid-19 designation).

Because the ensuing drop was so dramatic to define a Bear Market, we evolved to a 'full selling-climax' with our 'Max-Fear' bearish-to-bullish flat-out on-a-dime reversal on March 23rd. Most 'average' stocks exhausted their depression-midstream efforts at rebounds by July, and then hibernated until now, while the 'super-cap' (FAANG+ if you prefer, but it really came down to variance of that list.. add Tesla) leaders... they gave the illusion of strength which was dominated by managers chasing strength, at the same time as only novice investors would have chased splits, as forewarned.

Bottom-line: you got to an 'all-in' moment with was insane for the 'super-caps' as we outlined, but recognize that stocks can decline 'even if' there's nothing wrong with the particular stock. That might apply to several of them, most are in technology.

Thanks for the interesting and educational article. Being reminded of who holds so much of the US debt is not happy. The big problem with debt is that it must eventually be paid.