Market Briefing For Wednesday, September 2

The propensity of intensity - is amazing in the overly-exploited super-cap stocks. I realize we've addressed this behavior frequently, and it has been a proper backdrop to 'not fight the trend' and 'not fight the Fed'. At the same time this behavior persists, it has had mixed results when it comes to the broad list, which appropriately lags.

(Not underestimating durability of trend-in-force; just keeping a skeptical eye open.)

At the same time the S&P 'worry wall' has not just been climbed, but surmounted by the handful of leaders, and that is increasingly like what upside capitulation looks like of course. However, recognizing that (I presume) would explain why analysts are at pains to discuss how well many stocks could do if the economy reopens more.

Sure; that's almost the only way to get sufficient participation to levitate the Averages which otherwise are not only stretched, but the limited correlation with the VIX tends to hint at concerns among traders that the S&P run is very long-in-the-tooth. (VIX)

Executive Summary:

- Record close for the S&P and the Nasdaq, driven by the usual suspects.

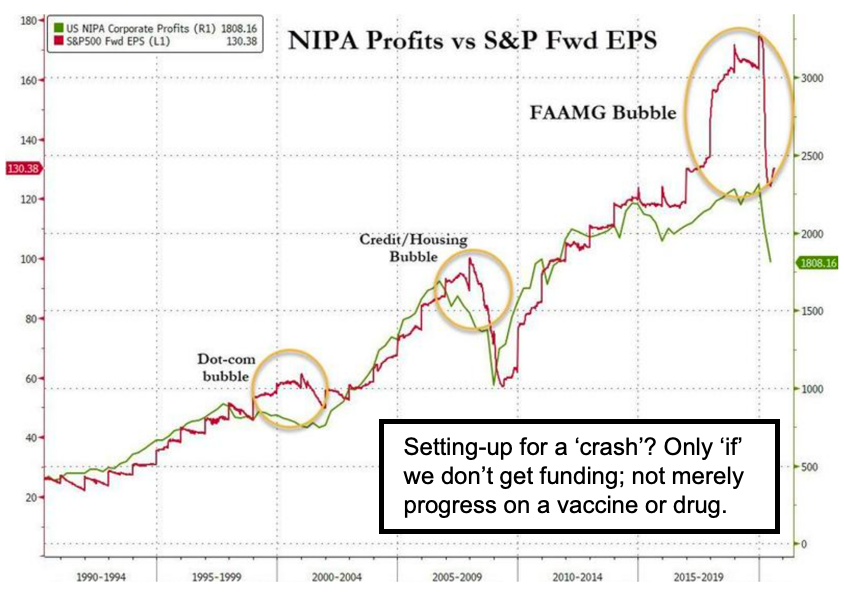

- Only a solution to Covid-19 would enable 'convincing' optimism about opening and thus broadening the participation in a serious way.

- I don't disagree with the idea that the S&P has legs, I've said that since March lows were nailed, but I do express concern that so many technicians or experts doubting the move all the way up 'now' can see how S&P works higher.

- All that means is the sensitivity to the Fed's shift to inflation targeting is key to the implications of 'stretching' the upside, but the Fed won't be oblivious to runaway inflation (although that's something to focus on down-the-road).

- The Fed has twice thrown cold-water on things, and I do agree (say it often) that slightly higher back-end rate firming would be positive not negative, as it would be affirming better business conditions, not merely surviving the pandemic.

- We'll monitor the 10-year while realizing better growth and higher rates (as I've often noted) do not automatically mean markets don't respond favorably, some commodities have also responded well to hints of slightly firmer 'real' rates.

- Oil & Bank bounces are helpful, though with Oil it's more in Crude than stocks, with the Senior Averages in an 'overshoot' posture, while many stocks lag. (BNO)

- Operating leverage can be great for growth stocks IF we surmount the morass, and I'm referring more to Covid's economic suppression than political issues.

- At the same time it will not surprise me if we have a solid shakeout, while the backdrop (if we avoid insurrection in this Country) is actually fairly good for the economy in the wake of the heart of the pandemic.

- Maybe not so great for S&P and better for lots of smaller stocks left adrift during this extended thrust, although if they can hold and the broad list chime in amidst rising skepticism; sure, that would be the ticket to ride (with eyes on exits). (AAPL)

In-sum: this market remains focused on the very big-caps with a few strategic shifts in business operations going on too; whether it be the presumed TikTok deal, or the move by WalMart (WMT) to attempt a variation of Amazon's (AMZN) achievements. Leveraging all the data from TikTok combined with their existing database would be exceptional and I suspect if the partner proves to be Microsoft (MSFT), that's going to create another 'play'.

As to President Trump saying the U.S. will 'not' join a global vaccine alliance, that I'm unsure about. Understanding corruption in China exists, as well as their relationship with the WHO is one thing, extrapolating that to individual vaccine or other candidate solutions from China or any country is unclear. The President 'presumably' is focused on China, but we already know (for-instance) there are workable saliva tests with a good accuracy level available 'in' China, India and France.

Yes there are tests here in the U.S. (probably several) coming; but like vaccines, not embracing what 'works' when available is different when human life is at stake, not merely trade relationships (or at least should be). This is a tough issue and possibly impossible to divine day-to-day since Washington already said lots will happen this month as far as new tests; but they over-emphasized the Abbott (ABT) test, which doesn't work on pre-symptomatic or asymptomatic people. So it's hard to say where they'll go next on all this, and it's frustrating for everyone, not just stockholders in a myriad of biotechs and pharmas, almost all of which have been in correction modes. (LPTH)

Bottom-line: the trend remains in-force, some profit-taking here and there in 'super caps', while generally anyone that shorts gets hit, hence late day comebacks. This is likely continuing tomorrow with a caveat about all of it being long-in-the-tooth.