Market Briefing For Wednesday, Sept. 15

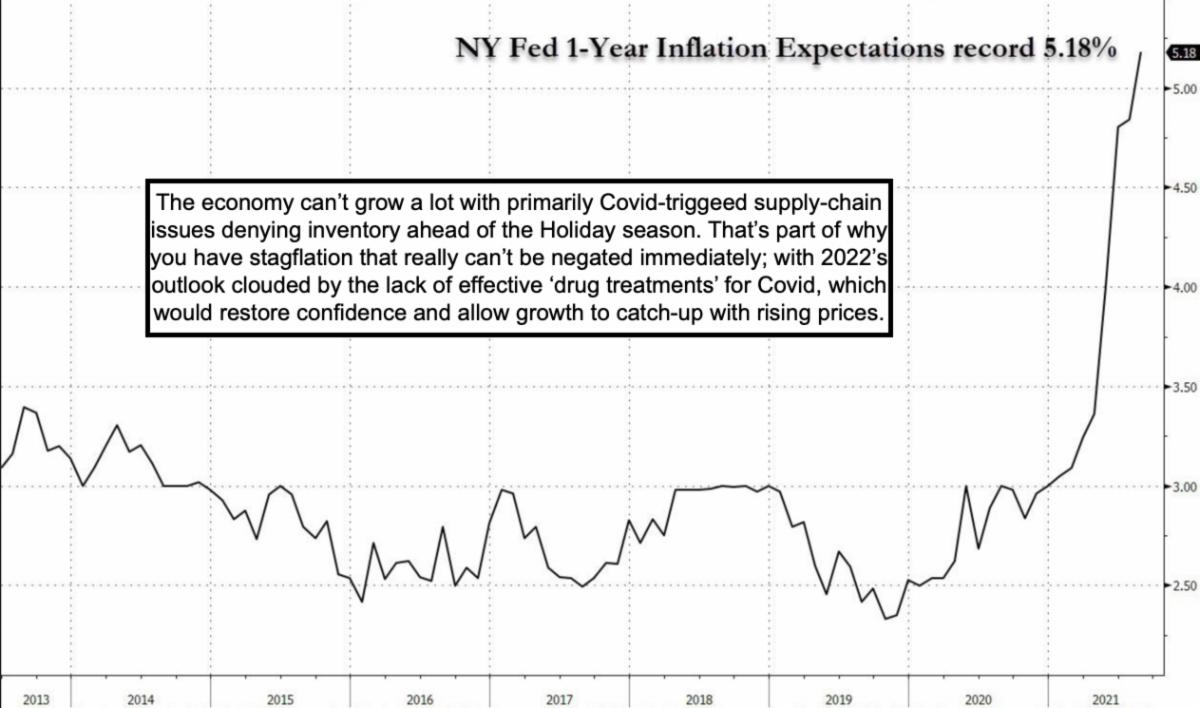

Deep thinking about productivity, impeded growth paces due to COVID, or a tougher monetary policy 'while' the COVID beast is still running rampant, has a slight impact on the willingness to get involved in this stock market, for now. It is a short-run phenomenon, but as we've discussed, supply-chain concerns as well, leaves a prospect for economic stagnation, against which the Fed ought to stay defensive, even if they moderate tapering a bit.

Shanghai Apartment Block - Unsplash

In light of today's inflation print, you have a negative real yield for mainstream debt, and that's tying into the distress in China (Evergrande again) showing a possible disruption that could cascade into other financial instruments. China is not the end of it, their funds are contributing to the low Treasury yields and if they have to liquidate, not politically but of necessity, it hits our markets. The 'tax proposals' are also weighing on the market as we discussed last week, as a lot of long-term holders in the mega-caps are realizing gains this year, with the obviously more-favorable Capital Gains taxes, if Biden's plan is approved.

That's a possibility that is facilitated by COVID's suppression of manufacturing, again proof that the pandemic did create consumption disintermediation, and now it simply makes many products more expensive or not even obtainable.

In that regard, with semiconductor ships about 20% higher, it's fairly clear that Apple (AAPL) did not think their newest iPhone would draw the usual demand without some teasing, since 13 is essentially a minor upgrade over iPhone 12 unless of course you're a professional cinematographer. It's likely one reason Apple seems to be offering a higher-than-usual trade-in allowance for this newest one because lots of people that do trade every year don't like the catch 'carriers' do tend to impose, which is a couple years without an early pay-off option (of course there are exceptions to that).

The consensus is relaxed about inflation, insufficiently outraged about COVID, and not demanding politicians 'fund' research / development of treatments or drugs to combat COVID, with the type of zeal seen for the original (and not so great) vaccines. The name 'Warp Speed' probably inhibited some people from getting it, because it implied rapid relatively minimal (and statistically skewed by the way) testing. But let's assume it was fine for what it did, not so great for what it needs to do now, which is protect against new variants.

Plus we need more affordable rapid testing that's also more accurate, actually it's imperative that we get 2nd generation vaccines to better fight variants and we need 'drugs' or monoclonal antibodies in quantity and affordable to flat-out kill the virus if there's a breakthrough. I know why they don't push it, fear that's going to cause the un-vaccinated to think they'll be fine and get that if they're unlucky and catch COVID. And they're probably right in a sense, but for over at this point 200 million Americans who are vaccinated, and children who aren't, it's essential to have a treatment and/or antiviral drug that works effectively.

Executive summary:

- Global dislocations and general disruptive media provide a backdrop for a COVID-and-inflation-driven shakeout, which periodically rebounds.

- The 'selective' easing of the pace of inflation is virtually irrelevant, the fast pace was not sustainable, and some commodities were expected to drop, at least where there is the domestic capability to adjust supply to demand.

- Ideally the seasonality of it all, and the near-unanimous 'correction fear' of the pundits and analysts, contributes to an absence-of-bids, so downside.

- 'If' we get a penetration and algo-driven selling, it may be closer to an end of the decline, rather than the 'pivotal inflection' point some suggest.

- There is no pivotal point, the record high was a couple weeks back, while the internal market high (such as an A/D Line gives a clue of) was earlier.

- New COVID outbreaks in China and Southeast Asia are indicative of global concerns and restrictions, which relate to health, not geopolitics directly.

- Don't forget the continuing reversal of the Japan 'carry trade', which they may even expand as they require funds for recovery, China has picked up the slack but that may end.

- I could make a very bearish case in some instances, because it's again all due to COVID, resolve the pandemic and we'll resume 'Roaring '20's', fail to 'fix it' with treatments drugs and better vaccines, and it delays that type of robust recovery, as well as resumption of normal supply chains.

- So approval of next-gen COVID vaccines and drugs is a bullish cases for the future, failure to get those is an intermediate bearish case, and sadly not a good sign for the population overall (and globally), not just the US.

- Speaking of global issues, there's no known succession plan in Russia.

- As you likely heard, members of Putin's inner circle tested positive, so he took the Sputnik 5 vaccine, since it's not very good, most think, it's a bit more likely that Putin himself could test positive (if not already).

- No kidding if this pandemic doesn't wind-down everything's more risky, and we even hear that Gen. Miley had to warn Commands that Trump was acting crazy after the January 6th Insurrection failed, and threatened to launch missiles (so concerned that he called his counterpart in Beijing).

- I suppose some will say he overstepped, but maybe not, now I really don't know if that happened, but it's in the General's new book he wants to sell well of course, nevertheless if he called China and told Commanders not to do anything the President says 'unless' he's in the loop, well..

- Casino stocks 'cashing out' is a sign of the problems in Asia more than in the U.S., but as they crack a lot of related stocks suffer too, most travel related stocks are also vulnerable to further decline pending COVID.

- China has locked-up millions of people ahead of their Golden Week, and that would normally be a time for resorts and casinos to 'cash in', not now.

- I don't agree with pundits saying the Chinese Communists want to close gambling (one of their highest revenue makers), and think that's mostly a spin by those who were too optimistic on casino stocks (however the CCP indeed is in a tizzy of regulatory changes that is unclear even to them).

- I don't concur with managers who say these stocks are buys even as they for sure have already declined a lot, they can suffer still more pain.

- Finally it's possible that damming criticism of Instagram (FB) as 'toxic to youth' might catch-hold and unleash a torrent of online discipline, not on kids in a direct sense, but on Facebook etc., that's how Government would do it, not that we endorse China-like torrents of regulations, but it's possible.

- More likely, the 'toxicity' can be reduced by Facebook & Instagram trying to expand in areas Government should commend, like uplifting topics and accurate (not critical revisionism) history for example.

- You know my market view and the dangers anticipated for awhile now. So there's no reason to eagerly look for bullish rationales at this time.

This is not about maximum seasonal pain, because it's an ongoing evolution of a decline. There are many avenues to keep an eye on, but if there were a 'navigational system' (there sort of is, technicals) that was reliable, we'd know the destination. But the destination is ultimately south of here, but it's unclear if it's going to indeed be short-term in duration, and quality as far as mega-cap stocks which will have less impact on the already-corrected majority. Above all remember it's Quadruple Expiration with anticipated volatility.

S&P (SPX) is close to its 50-Day Moving Average, as denotes a level which has seen brief skirmishes and then rebounds every time it was 'fiddled' with. It's been filled with rotational sell-offs, but it gets more unhinged as the managers get unhedged.. which is a process especially if this breaks the 50-DMA.

So if it does slide and turn in the vicinity of the 50-DMA, it will look like a 'bear trap', and regardless any such rally will initially appear iffy. Many who still say they are positioning for a sell-off, can only be talking about the mega-caps. At the time as I've mentioned most stocks being down for many months or mere trading ranges, the analysts calling for a 'pivotal inflection' break miss or omit what has already happened. That doesn't mean things can't be bleak for a bit, and there again it relates to yields, inflation, liquidity issues (Chinese mostly), and of course all though are indirect outcomes of the persisting pandemic.

The prospect of ending the slide exists temporarily, based on prior visits to the level. But it could go deeper for these various reasons I've noted, especially in lieu of a COVID solution, the concentration of interest in the mega-cap stocks, and realization that low interest rates alone will not deliver the goods, when the goods physically can't be delivered.

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as more charts and analyses. You can subscribe for more

Indeed the future is uncertain, and that also applies to stocks and the whole financial realm. The next two variations ofthis virus will be far nastier than what we have seen so far, as the ruling generals of the Chinese army try out the next versions of the death weapon. The official government would have none of it, but the generals did it anyway.

Of course the evidence for this is purely circumstancial, it would not stand in a USA court, BUT.....