Market Briefing For Wednesday, Oct. 9

While the domestic and global concerns rage, the market (and in some cases politicians, statesmen and central bankers) has managed to get out of purges, while all of the surges are tempered. That's a reticence, as is very understandable, for investors to come into this market given all that is not known; while there are lots of known unknowns.

Even the Fed has difficulty assessing the rapidity of change globally, as Chairman Powell himself alluded to in his speech yesterday (mentioning to a bit of surprise, the Middle East situation and he didn't mean Ohio). (I was trying to lighten-up with that reference.)

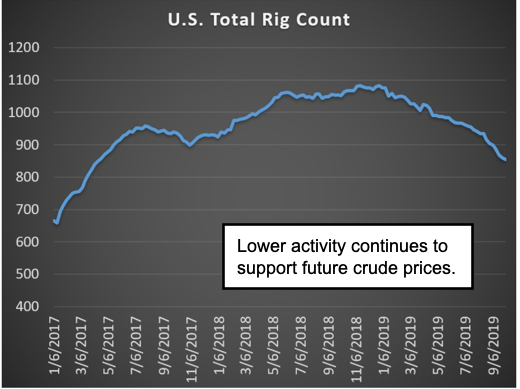

He basically reemphasized 'data dependency' and peaking my interest a bit, he notably mentioned transparency without the old historical 'lag'. I think this goes beyond the modern data-reporting technology, but Oil in-particular (remember I put more emphasis on Oil impacting markets, than most do; and generally in the opposite direction as I see firmness in Crude as a Plus, not a minus, reflecting a stronger economy and so it becomes less significant as higher prices are offset in better times).

Setting aside my thoughts on this (remarkably similar for years related to what Chairman Powell said today), he related it to measuring overall services and activities. He's talking about rapid changes that challenge the Fed; that would be my interpretation of his referencing challenging 'puzzles' that formerly triggered historical accurate and flat-out wrong conclusions.

I think Fed Chairman Powell today is saying productivity and the swirl of events may shift over time as 'society adjusts' to these challenges. I am pleased he recognized that the outcome can't yet be known. This is a form of monetary frustration, and even understated digital growth that is now ubiquitous; so if that's essentially an excuse why the Fed might be overshooting in terms of ease, well he's saying he can't answer it.

I can say there are pluses and minuses to digital development trends; that generally contribute both to 'growth' and 'contraction' in jobs, while not denying overall contributions to growth and efficiency.

He tried to explain why job gains might be revised downward; why Fed influence on 'inflation/deflation' is indirect; of course independence of the open market operations and FOMC decisions; while implementing plans to add to the supply of Reserves, which is what markets wanted to hear. He is inferring a shift from the 'temporary' Fund injections that I have emphasized needed to diminish as we got into October (they are to a degree). He said that time is upon us; at least that's my read of it.

I don't often focus so much on monetary comments or policies, but this is probably the most important backdrop to money managers aside the near-term aspects of a 'trade deal'. The Chairman also acknowledged, as he should, the risks around trade, Brexit, and what have you, as the policy cannot be on a preset course; and that's the takeaway.

Bottom-line: the Chairman sidestepped the 'systemic risk' question at least a bit; sounding like he's fairly confident about forward-looking and funding prospects. He says the 'vulnerability is moderate', focusing at least a bit on corporate debt and high asset prices (must concur).

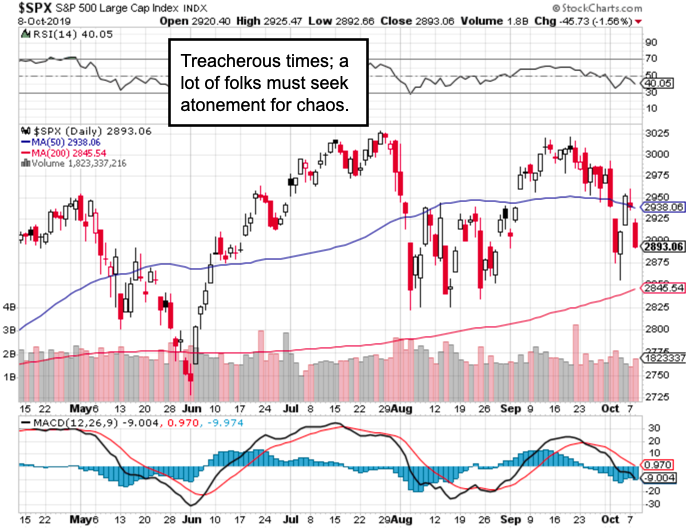

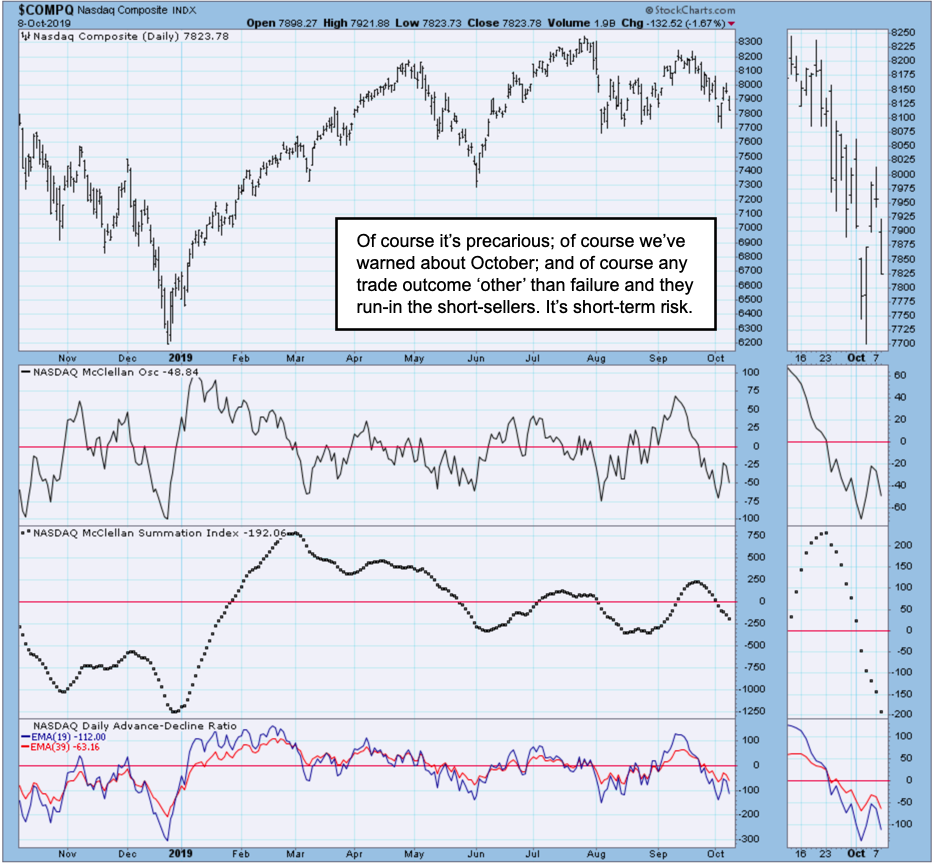

As we go into a semi-holiday Yom Kippur (and FOMC Minutes) session it was evident that the S&P rallies on Chairman Powell's remarks until he references the 'moderate systemic vulnerability' issue. When a Fed Chairman says that; it may mean he's more concern than revealing.

(Click on image to enlarge)

Certainly the Chairman focused on the Fed's expanded 'toolkit', and he considers its use as aggressive as needed in the future.

By the way; it wasn't just the Fed. As the spoke those words, reports of initial sanctions being put on Chinese for 'Human Rights abuses' also hit the wires; so it's impossible to cull-out which impacted S&P more.(So I'd say a bit of both; with all kinds of issues swirling around.)

Just at the moment it appears that Visa restrictions are being applied to Chinese officials that Washington considers violating human rights (is that most of them; or have they actually shown restraint by not moving into Hong Kong .. 'yet'.. and that could happen at any moment based a bit on the Administrator Lam comments earlier today). It's complicated, for sure, but seems to apply -for now- to the Muslim restrictions (that's an area alone sure to stimulate controversial talk-show chat-fests).

Conclusion: trade prospects were never great; and now everyone has been groomed for disappointment or minimal deals, which also means a more favorable response, should, by any miracle, a substantive deal emerge. The dis-inflationary pressures are there, and prevail as Powell noted, which is why he wants higher prices (how he relates it to better serve the 'aging population' is strange; unless he means asset prices).

Most elderly that are financially challenged aren't benefiting from stock market gains, and generally, prefer lower prices (and wish it was so for healthcare). However I know why he wants it; so with debt huge, likely most central bankers want inflation gains mostly so debt can be repaid by depreciated currencies. Against this, the Dollar remains firm as I've called for consistently (with intervening pauses but not major blow-off).