Market Briefing For Wednesday, Nov. 27

Neither domestic politics nor some 'public consumption' rhetoric out of China shook the markets on Tuesday; as it consolidated reasonably whether looking at the broad list, or the S&P as the core focus.

The reality was (as we suspected over the weekend and Monday too), not a China backing away from a trade deal due to Hong Kong's victory by pro-democracy candidates; but a China (sincere or not) indicating a 'blink' by respecting American Intellectual Property 'better'.

That surely refers to heavier fines for theft (when caught); but that's the cost of doing business for some of them. However it provides 'cover' to make a deal, or go forward to close-the-gap needed for 'Phase One' to get done. I've contended consistently that both sides want this moving forward, and would utter comments that are for 'domestic consumption' on both sides (such as being tough regarding China's Taiwan threats or so on), while the goal is to 'somewhat' find trade stabilization for now.

The world needs this; and the anti-deal crowd should try to consider it's really impossible for them to be bullish on the stock market and bearish on prospects for a deal to occur. Sure, if it falls apart things will tank for sure; but we're not at that point, and it's unlikely to actually collapse.

Meanwhile the primary summary is this:

a) central bank 'friendliness' is really the heart of driving the market;

b) we've had an internal correction for a year and a half not; even though it is generally unrecognized as having occurred;

c) this has been accompanied by often-denied economic sluggishness masquerading as serious growth; when in reality it's been more like a recession, with consumers trying to maintain lifestyles with more credit;

d) Democrats are softening their stance on Impeachment, even as the process moves to the Judiciary next week;

e) though this hasn't been the factor for investors that so many thought it would be (all along I've called it noise, and viewed both China and Fed policy as the real determinants);

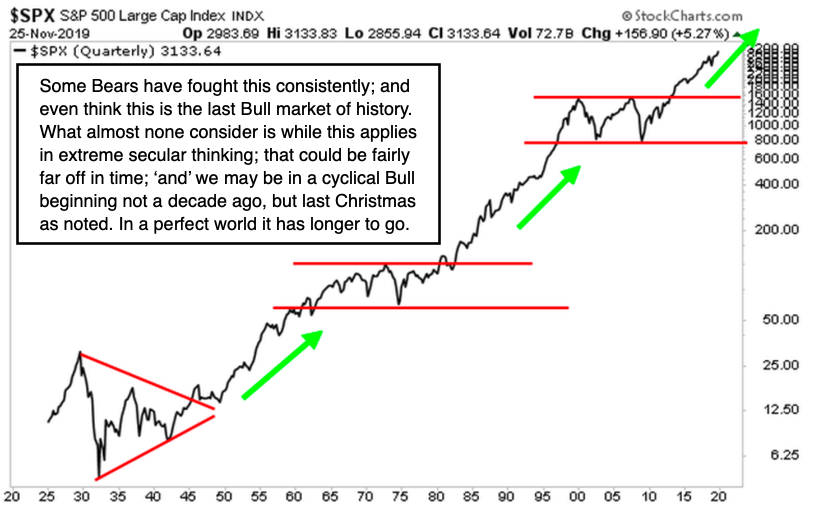

f) technically the S&P is extended, but the market is not so overbought as the majority seem to think;

g) finally more stocks that lagged are participating, even though there is some year-end tax-related selling already likely involved as well;

h) while China and (ratification of) USMCA matter most just now; let us not forget the upcoming December vote in the U.K., which indirectly is a Brexit referendum, and matters;

i) overall the pattern continues and our approach of 'not' shorting has of course been correct for months; even if there's not that much drama.

In sum: the S&P continues to 'grind out' gains; though today mostly as a summary was a slightly upward consolidation, helped by optimism on China; but otherwise not that much changed.