Market Briefing For Wednesday, June 17

Progress on Covid-19 - definitely matters, although it was overly hyped by the Tuesday morning pundits, while some tried to temper the excess zeal. So now we have a breakthrough to reduce risk of death, low-cost and common, but only among the sickest patients, at least based on what Oxford says so far.

Executive summary:

- All schools closed in Beijing and Shanghai is barring most travelers from the capital, hence the COVID-19 cluster has become an outbreak and worsened just since yesterday.

- The BBC emphasized the 'trial' of a steroid (and perhaps not the only one to help), reducing inflammation and enhancing recovery, it is not a 'miracle drug' or cure, and steroids have been used for months, although this matters as it singles-out one having quantified benefit, and reduces mortality risks.

- So yes, the trial reduced COVID-19 mortality- for patients on ventilators, the anti-inflammatory dexamethasone steroid cut death risk from 40% to 28%.

- For patients on O2, death risk cut from 25% to 20%. Modest, but best of all: costs <$10, which isn't relevant since it's only used during hospitalization so far, as the 'hyping crowd' omitted noting no effect if taken early-on, but we're optimistic this is part of the trend toward fighting COVID-19 by preventing and/or addressing inflammation, which is known to be the issue with ADRS.

- By the way Amarin's Vascepa is also in a trial to reduce inflammation in a combination with other drugs to combat worst-case COVID-19 outcomes, these are generally the primary problem in COVID-19 (more on Amarin's settlement with one of the generics in the 'Daily Action' section below).

- It is the focus on the relationship of COVID-19 to the stock market and economic ramifications as are ongoing, that helped enable much of this year's correct market assessments, both on the way down, and the dramatic recovery, so at the moment the US 'cavalier' attitude matters, so does China's outbreak.

- COVID-19 may dominate what happens ahead as if we can't successfully reopen the economy without a massive 2nd wave, it should be evident it impacts the prospects for business and need for additional monetary and fiscal stimulus, which impacts credit markets too.

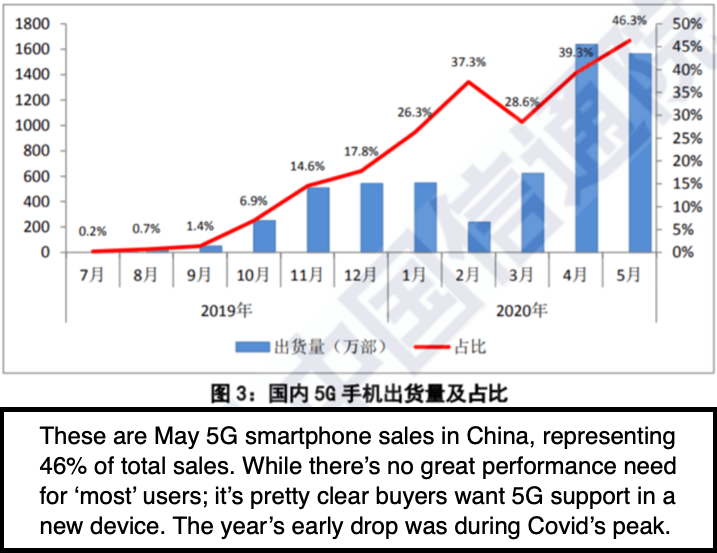

- While it may seem indirect, the death of a couple dozen Indian soldiers from an attack by China, really matters, it might even help India withdraw relying on China for many components, such as 5G systems and cellular backhaul (that's where the fairly-dormant Ceragon (CRNT) might perk-up since Vodafone (VOD) and others in India are their single biggest market, so far CRNT is boring).

- Coronavirus remains the biggest support for technology stocks, and also a consideration regarding valuations of big-techs 'if' business life normalizes, a trend that may not fully return to the past, given how 'sticky' the remote work at home regimen became.

- Stories about COVID-19 in recirculating air & ventilation are issues I mentioned, oh months ago (such as cruise ships), and seem to only now get attention, and part of why holding large indoor gatherings plays Russian Roulette with people's health, thus folly, although I understand motivation (politics should not be a factor at all, scientists and doctors simply say 'just wear masks'), as too many (young & old) are cavalier about this, there has to be concern.

- Perhaps worth noting: Google (GOOGL) trying to deny advertising revenue to websites they don't agree with, or being attacked by NBC, CNN or others, reflects an awful trend of conformity that is 'not journalism', not democratic, and danger to what is called 'the 4th Estate', or the 1st Amendment right to an opinion.

- So I may disagree (and do) with lots of what passes as news will say, but I defend their right to say it, my gosh, any liberal who opposes that is actually not liberal, and that's another example of intolerant egalitarianism, which in-reality is anything but open-minded to diverging opinions.

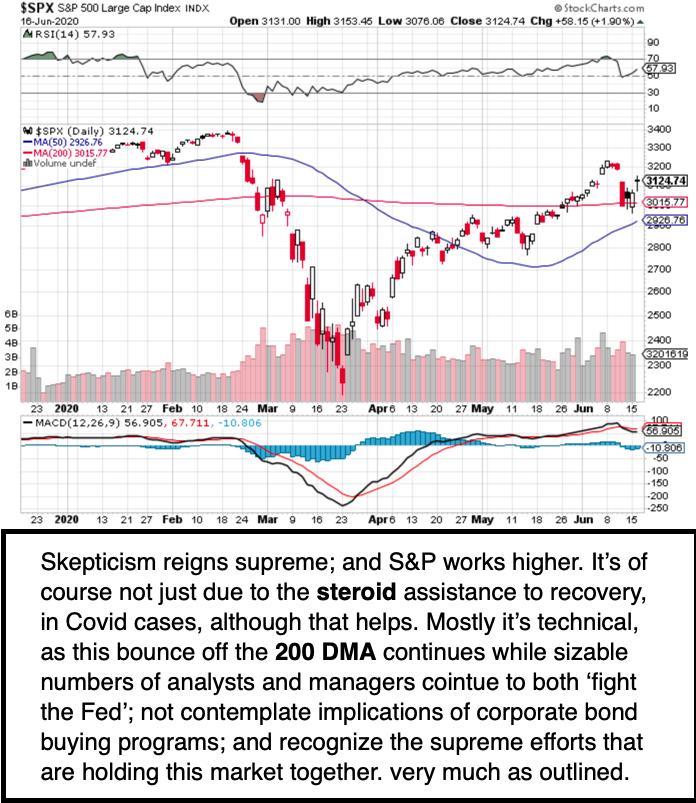

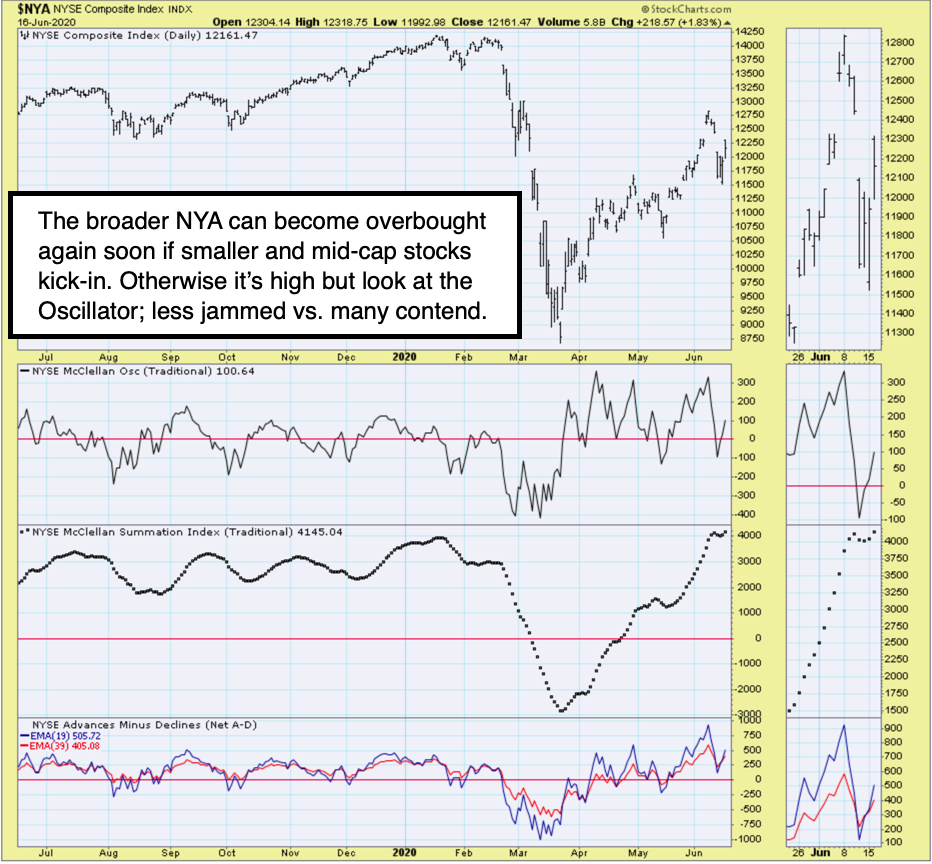

- The S&P pattern remains intact as we've outlined, with some risk returning in the later part of the week, and that may correlate if hospitalizations jump, although there is now (thankfully) a drug to prevent the worst, it's not at all a pleasant disease, and we know that survivors have secondary problems.

- Some of this risk may be offset by Apple's (AAPL) WWDC, which will likely focus on Education, Artificial and Augmented Reality, and Healthcare in general, that might well shoot Apple's stock even higher, and is a major help for S&P.

- Also (hoping) Apple announces a new iMac design as well as Apple TV 6th Generation (to support Dolby Atmos better with HDMI 2.1) and hints of new software, including maps, which really is part of business and personal lives, which is even more important as the private car preference returns.

In-sum: excessive optimism about an effective (thankfully) inflammation-drug of common availability for many years, helped what would be upside anyway early Tuesday (futures were strong overnight too).

The market's pattern may not be sustainable, but persists as outlined for now.

Daily action - was satisfactory, and would have been higher even without the news about using a cortisone drug to inhibit inflammatory responses. It could be used in combination, but is not a new drug as such, but rather eliminates what I have called the 'prospect of death from the equation', hence it is clearly a plus.

Meanwhile, AT&T (T) has announced more layoffs, Amarin (AMRN) settled with one of the remaining 3 generics, which probably puts pressure on the remaining generic interlopers, but it's not clear cut as to how favorable today's settlement is.

So I'd think it helps AMRN's share-price firm a bit, but not enough to throw it into the 'teens. But if the bar is set, and the others come around, then the Appellate Court pending decision on possibly reversing the Federal Patent Judge's Ruling, becomes moot. Amarin should never have litigated against them in my view, but if they also win the appeal, it should be solid for some time to come. And yes it's Vascepa drug (which continues to deliver excellent results), may also show the world the broader capabilities when the results of the Evaporate Trial are out, which would suggest some benefit related to arterial plaque more directly.

Later this month LightPath's CEO will be one of dozens presenting individually, in a day-long virtual convention in the optics industry, which can be favorable as most firms and viewers will be global (the organization is in Belgium). I plan to monitor the presentation. LightPath (LPTH) stock consolidates on light volume, and then after a time tends to firm on higher volume, and I suspect we'll see another sort of phase like that, if there continues to be institutional interest, which I attribute most likely behind the higher volume, but can't know with any specificity.

Tomorrow (Wednesday) ideally will be another higher session. Stay tuned over a day or two for possible information relating to North & South Korean tension, that could impact currency and equity markets, depending what happens. Also the clampdown in China is notable, and may be 'why' the foreign currency dash seen again as the Yuan (CYB) weakens a bit. Or relates to the China/India conflict.