Market Briefing For Wednesday, February 12

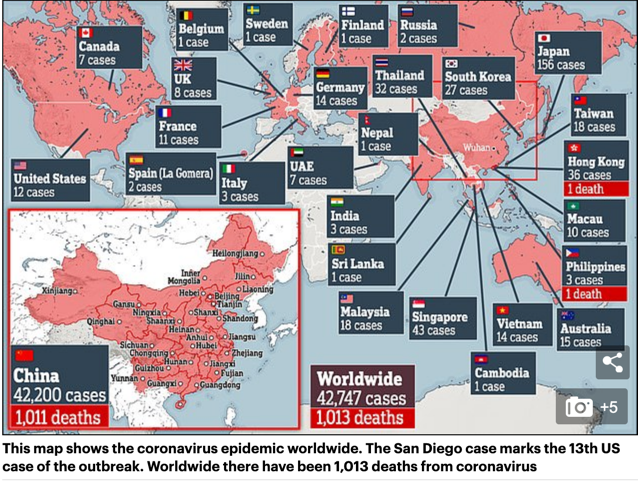

Market impact - from the coronavirus has been to thrust the S&P forward not backward, due to the fund flows from abroad, not just Fed liquidity or other funding (like buybacks, which are up for this stage of the year).

We will address the virus and numerous other factors primarily by videos tonight, given the narrow changes in the market, and focus on the New Hampshire Primary, which also sees Andrew Yang dropping-out tonight.

The impact trimming market gains earlier today was not just because the President criticized the Fed Chairman at 'Humphrey-Hawkins' (though he was quite tepid with responses to anything as Powell seeks calm policy), but related to the FTC.

As I mentioned earlier (despite a pretty neutral market after an initial thrust shifted to expected defense), it's really just an FTC request for acquisition information that rocked the market a bit, and it has nothing much to do with Chairman Powell's comments.

Daily action - doesn't intend to routinely abbreviate comments as much as tonight (although the last few reports were unusually long).

This evening it looks like Biden and Warren both get zero delegates from the New Hampshire primary, which leaves Bernie and Mayor Pete as well as Michael in the game. However, these are very early reported results.

The New York Times has an interesting story about Huawei proving the spying capacity of backdoors in their systems. More tomorrow, and we'll share come charts showing the rising mortgage and personal debt pictures.

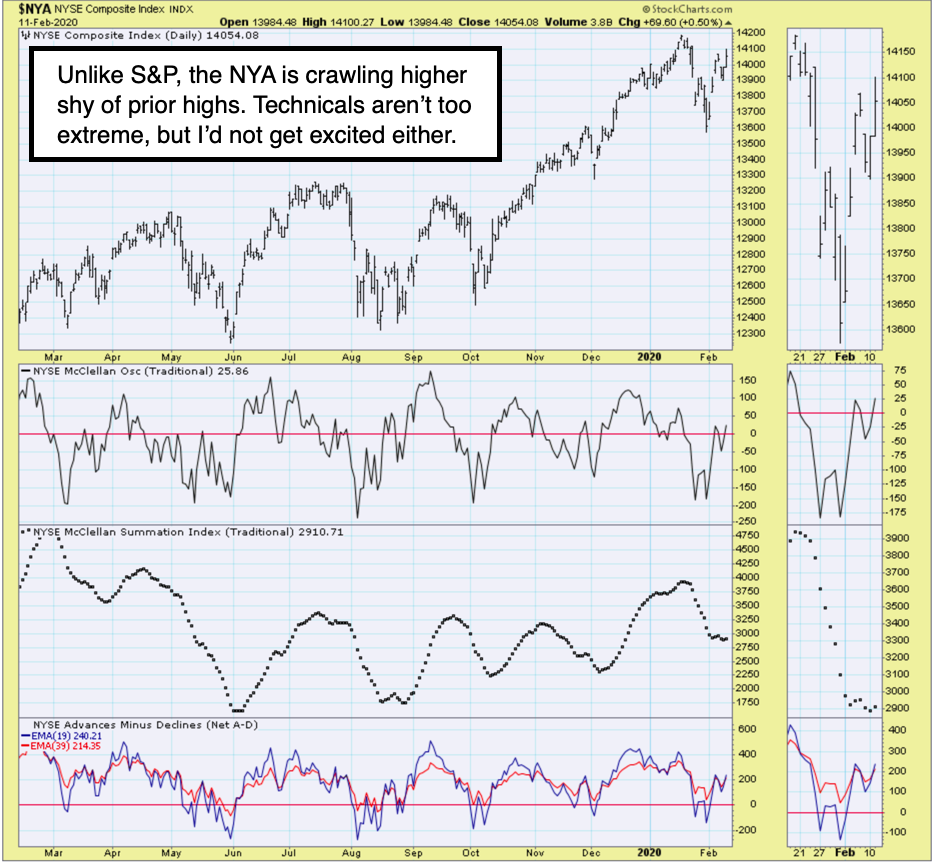

Wednesday will probably see slightly higher numbers intraday; but take notice that the NASDAQ and S&P are performing better than the NYA or DJIA, which again reflects the concentration into known suspects, while the effect of a positive nature (contrary to those who refer to 'impact from the virus') related to foreign fund flows into the U.S.

Chairman Powell alluded to less 'Repo' action (injections) going forward and to me that quelled the early morning rally a bit, before the Q&A of his testimony, and then with the FTC 'information request' regarding smaller acquisitions by many major (mostly tech) companies. Upside should be limited and increasingly struggle.