Wednesday, December 2, 2020 3:42 AM EDT

|

Markets advanced - within limits, and are defensive Tuesday evening, after a flurry of conflicting reports with regard to how they may impact markets. Most, at least on the surface, will not affect markets near-term, with next year really variable more on the 'reality' (as opposed to 'enthusiasm') about vaccines. So I will note the controversy around Washington, Attorney General Barr getting on the wrong side of his boss, and so on, but you all know about that by now.

|

|

|

I would prefer to briefly focus on the influences on the market and a couple stocks. I hasten to mention that I generally will assess or opine on various factors, with overall views of the investing or trading environment, while not seeking-out individual stocks broadly. That's especially when we are shuffling at a rather extended level for big-caps (you have people normally not investing or trading stocks in their lives increasingly doing so, and that tends to be a sign of some froth).

|

|

|

At the same time we're delighted the new generation is inclined, proving the majority are just as interested in success as always, and not socialist leaning (of course it's funny how making money and capitalism seems to supplement if not replace altruistic liberalism among some young folks as they finish their schooling and get into the real world of making money as competitive sport).

|

|

|

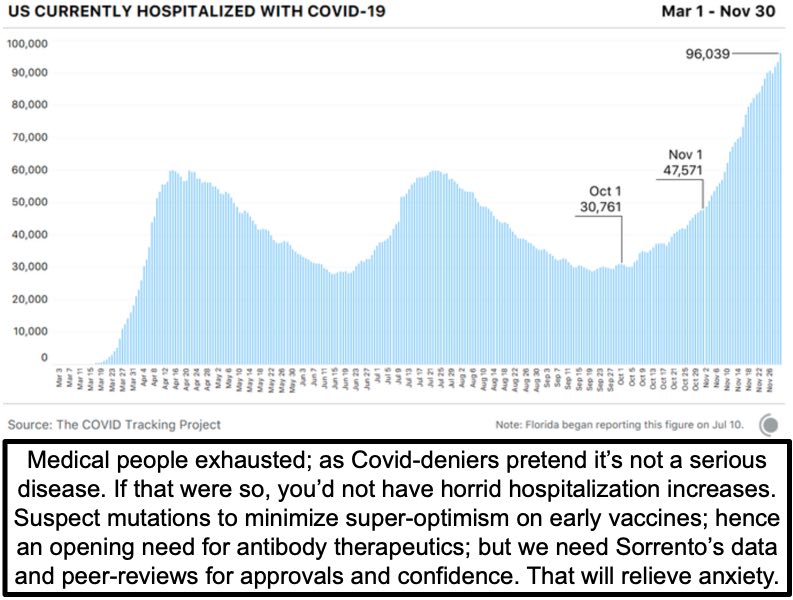

In that regard it's important that NBC News decided to focus on South Dakota, which is not alone in 'experimenting' with older positive patients now receiving 'antibody therapeutics', in this case from Lilly (LLY). That's fine, as NBC fortunately made the point that many patients testing positive or showing early symptoms of active disease, really don't have the luxury of waiting around for vaccines to arrive (not to mention the weeks to build immunity 'if' they work).

|

|

|

So this helps establish the 'space' and brings front-and-center the realization, to many who don't know, that Government money has too long focused just in the direction of big pharma and vaccines, which we all hope are very effective (as again we were told by numerous officials as shipping commences to more locations). Lilly, along with Sorrento (SRNE) are Regeneron (REGN), are prominently among the most-centered in that particular area of antibody therapeutics.

|

|

|

Executive Summary:

- Blackrock (BLK) not Goldman Sachs (GS) appear to mostly dominate President Elect Biden's financial team, though both are represented.

- A late-breaking story tries to make a mystery (and it is) about redacted Court documents related to some sort of preemptive pardoning lobbying NBC purports is going on with the White House circumventing rules.

- This 'might' relate to the President's immediate family and circle, but they would not require lobbyists, just merely a casual discussion.

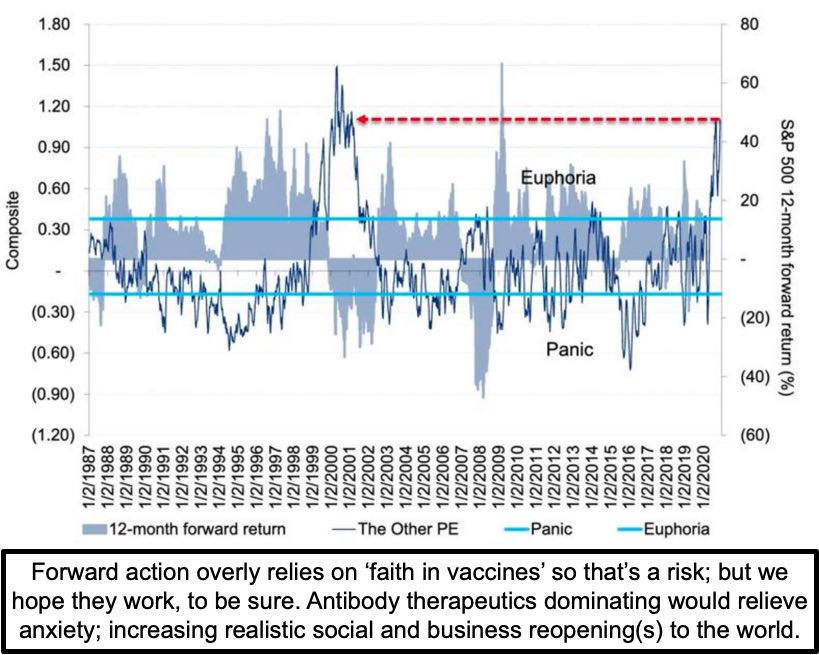

- Near-term big-picture catalysts are somewhat consumed, that's been our ongoing belief about S&P in this 'overshoot-zone' as I've termed it.

- Hedge and analyst types (yet-again) calling this the most dangerous ever seen for stocks, are the very same ones bearish for six months or more.

- Certainly that doesn't mean stocks aren't vulnerable to a shake from our 'overshoot zone' of the S&P, just means it won't be catastrophic.

- The behavior of Zoom (ZM) and others proves my point about upside excess in a small universe of stocks that have been at the helm of S&P gains.

- Most pundits calling for disaster omit the detail of narrow leadership.

- Political uncertainties are factors, but not significantly definable for stock market purposes 'yet', because both parties contemplate more spending.

- The proposed 'thin' near-term stimulus discussed today was disappointing to the market, which hoped for more during this difficult time for millions of our fellow citizens.

- Yes we are in a situation where the 'poor get poorer' due to no stimulus, in that regard it not about blame, but perhaps shame, for those struggling, it is overdue to have more than what was proposed today, but the message is getting across, and yes there can be a 'double-dip' in the interim.

- Contradictory views continuously clash about these issues, but it comes down to COVID mostly, and that's why even an interim therapy would help and we don't have that on a 'scalable' level yet, but stay tuned.

- By the way this evening the FDA gave an EUA to the Mt Sinai COVID test, although it's unclear if that's relates to one of Sorrento's tests too (one is a blood test and the other was saliva with Columbia's).

- Also, Cingularity (25% owned by Sorrento) noted progress in their multi-city trial of NK cell treatment against COVID, moving to next phase.

- In that regard Friday's Defense Department 'contract' via DARPA was the trigger to ignite a move in SRNE ahead of an institutional presentation, so it consolidated and could easily spring forward again with any impetus.

- Friction in OPEC+ is part of what's afoot, with the meeting delayed not to Thursday, giving members less visible time to have discreet talks.

- Tough 'dark winter' looms, and at some point the S&P (SPX) should shake just a bit to emphasize the nearer-term economic aspects, but again we tend to rebound every time there is positive news on treating COVID.

|

|

How did you like this article? Let us know so we can better customize your reading experience.